Elections and rising corona cases are causes for worry for most investors.

Digital transformation is a long-term secular trend that will define this decade.

We highlight two niche markets (pools and generators) that are experiencing unprecedented demand.

There is a lot to unpack these days. So far, 315 companies in the S&P 500 have reported earnings so we have a substantial number of companies that have already reported. On a positive note, the week the US economy bounced back in Q3 as expected with a 7.4% growth (Vs a -9% and a-1.3% decline in Q1 and Q2 respectively). If you have been following our weekly column, this bounceback should not come as a surprise.

On a worrying note, the resurgence of Covid-19 cases in Europe is causing concern. At the top of investor's minds is concern about the elections next week in the US. This might have triggered the sell-off in equities this week and even some companies have been increasing the pace of doing M&A. Our approach, though, is not to invest in or divest from companies merely because elections are coming up. Let us examine a few trends we have noted so far.

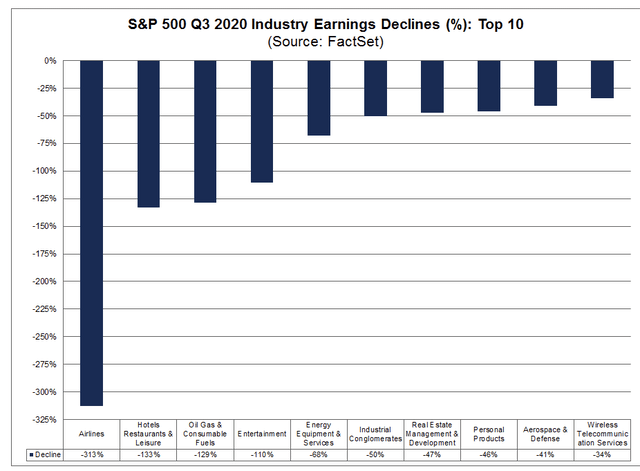

Earnings performance across industries as of 26th October (Source: FactSet)

Worried over Shipping and shipping charges

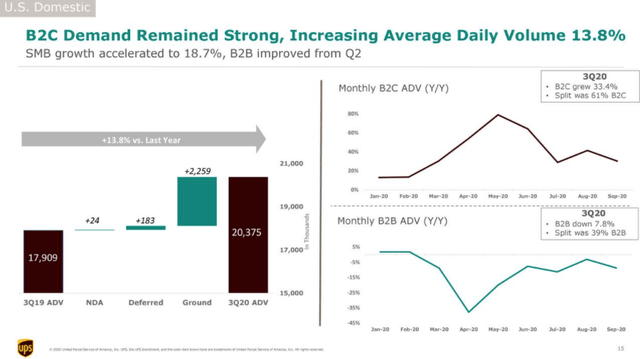

This is going to be a busy shopping season and one of the main worries has been the capacity constraints in shipping. Those fears have been allayed a bit by listening to UPS's (NYSE:UPS) CEO. They experienced a 23% rise in packages handled per day in Q2. In total, they handled an average of ~21.1 million packages per day in the US in that quarter. In Q3, they handled 20.4 million packages per day (13.8% year-over-year increase). Contrast these to the last holiday season where they handled 23.1 million packages per day. They do have the capacity to handle the shipping that is coming through. They are ready for the peak season. It is obvious though that this will be a different season with more customers than ever shopping online. This will place some capacity constraints on companies like UPS. This gives them room to increase prices and surcharges which UPS is already considering:

There is a capacity constraint in the industry...And if we took all the volume that was available to us we would end up with a customer experience that wouldn’t be good for us or our customers and...with what we call chaos costs. - UPS (UPS) CEO Carol Tome

Looking ahead our peak plans, volume management, and surcharge approach will also help promote a more optimized volume mix - UPS CFO Brian Newman

Source: Q3 Slides

The main worry for many companies and consumers is that there might be an increase in shipping charges and surcharges. Add to that the other issue of your orders not arriving on time. To remedy this, some companies have negotiated for lower fees to their customers as here told by eBay CEO Jamie Iannone:

so on carrier capacity, part of why we did the UPS deal this year was to open up more flexibility and more options for our sellers. So not only are they going to save a bunch on the rate that they're going to have on there, but the integration is going to make it really easy for sellers and provide all that tracking for buyers. So, now you have multiple options even as a small consumer seller between USPS UPS and FedEx, one of the things we have worked on is deals that actually protect them from peak shipping charges or surcharges over the holiday

Unrelated to shipping, some companies have been discussing increasing prices for some goods. Subscriber growth has slowed down at Netflix (NASDAQ:NFLX) and Spotify (NYSE:SPOT) and they are having to explore other ways to boost revenue. One of these is by raising prices. Netflix did just that on Thursday this week with its standard and premium plans have been raised from $12.99 and $15.99 to $13.99 and $17.99 respectively. Spotify is considering doing the same as subscriber growth slowed down in Q3. They have done some research that shows that there is a high correlation between the hours people spend on Spotify and their ability to raise prices. The consumers who spend the most time on Spotify are less price-sensitive and this leaves room for Spotify to then raise prices. Here's CEO Daniel Ek:

initial results indicate that in the markets where we’ve tested increasing prices, our users believe that Spotify remains an exceptional value and they’ve shown a willingness to pay more for our service. So as a result, you’ll see us further expand price increases, especially in places where we’re well positioned against the competition, and our value per hour is high. I would however, throw in one big caveat; we will continue to tread carefully in these COVID times to ensure that we don’t get ahead of the market.

Another company considering price increases is Chipotle (NYSE:CMG). With these many companies considering price increases, could we be having inflation rising soon? Here is Chipotle Mexican Grill CFO Jack Hartung:

Delivery expenses were elevated year-over-year, given the significant growth we’ve experienced in our digital business, a trend we expect to continue. Therefore, to help improve economics on this important access point, we’re currently testing delivery menu price increases

Digital transformation to define this decade

To begin with, we are well aware that the pandemic has impacted many sectors negatively. What is also not in doubt is that, amidst the gloom, the pace of digital transformation has accelerated. Management teams have changed their views about the need for it and have warmed up to make it the center of their focus going forward. The question though is how long will this wave last? If you thought digital transformation will be over soon, we're here to tell you that it seems we are only in the early innings of this transformation. It is still not too late to board the digital transformation train. Microsoft (MSFT) CEO Satya Nadella had this to say:

We’re off to a strong start in fiscal 2021, driven by the continued strength of our commercial cloud, which surpassed $15 billion in revenue, up 31% year-over-year. The next decade of economic performance for every business will be defined by the speed of their digital transformation. We’re innovating across the full modern tech stack to help customers in every industry improve time to value, increase agility and reduce costs

In short, this is the decade of digital transformation even as digital shopping continues to gather pace in various companies:

The pandemic continues to accelerate via consumer trend from bricks to clicks – Helen of Troy (HELE) CEO Julien Mininberg

There was a trend toward digital ordering pre-pandemic, and that significantly accelerated during the pandemic. I don’t expect customers to go back to calling on the phone. I expect digital ordering to continue to grow post-pandemic – Domino’s Pizza (DPZ) CEO Ritch Allison

We’re going to see e-commerce continue to grow. We’re profitable a year ahead of schedule, despite all of the accelerated investments that we’ve made – Levi Strauss (LEVI) CEO Chip Bergh

Niche markets experiencing a buzz

Something else we have noticed is that some niche markets have been experiencing unprecedented demand. There is value to be found in these niche areas that not everyone is talking about. Two examples of these are pools and generators whose demand is at unprecedented levels. Generator demand has surged leading to Generac (GNRC), a major producer, to raise its full-year outlook and guidance:

The extreme level of power outages, combined with the continuation of the home as a sanctuary trend led to unprecedented levels of demand for home standby generators during the quarter that was broadly based across the entire U.S. We are aggressively ramping production levels for home standby generators, and there is a substantial backlog for these products that continues to grow during the fourth quarter - Generac CEO Aaron Jagdfeld

We are in the golden age of housing as per Whirlpool (NYSE:WHR) CEO Peter Arvan. The home construction market is booming. Some of the companies benefiting from this boom are pool construction as they are faced with such high demand for pools. The backlog is huge leading such that some builders have decided to just build the pools themselves:

I mean I was speaking to dealers in the seasonal markets in the last few weeks and their backlogs are huge, and they’re hoping to get as many of those pools as they can in the ground before the snow flies...What I would say is, anecdotally, we’ve heard from several large homebuilders that are starting to build their own pools, simply because they can’t wait for the pool builders to catch up - Pool (NASDAQ:POOL) CEO Peter Arvan

We’re hearing from members that have contracts booked out to late 2021 and even into early 2022 - Pool & Hot Tub Alliance president Sabeena Hickman

Conclusion

By this time next week, we will have clearly known who the winner of the US general elections. We also hope that the corona cases will start subsiding and that we will be a step closer to a vaccine. In the meantime, stay safe and keep investing in niche markets.

Disclosure: I am/we are long MSFT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.