Yum China: Firmly On The Recovery Path

Yum China continues to outperform in FQ3, despite ongoing COVID-19 headwinds.

The outlook also appears to be promising, as a path to recovery is taking shape.

The company is also accelerating its store buildout, which adds to the upside potential.

Valuations (ex-cash) are undemanding, and therefore, I am bullish.

Yum China (NYSE:YUMC) remains a standout in the restaurant space, even through the COVID-19 pandemic, highlighting the extent of its competitive advantages and resilience. Looking ahead, I see continued margin expansion at its Pizza Hut franchise, along with growth from its delivery and membership initiatives, as key earnings growth drivers. Over the long term, I believe YUMC remains a compelling proxy to the Chinese consumption story at undemanding valuations.

FQ3 Outperformance Defies COVID-19 Headwinds

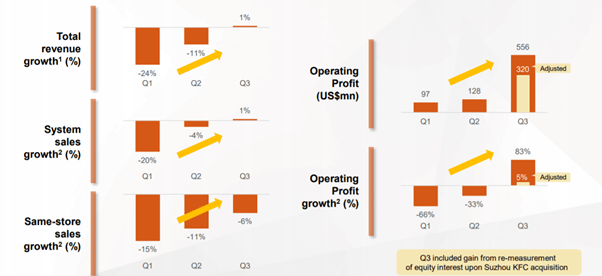

YUMC posted strong FQ3 results, as overall revenue growth returned at +1% Y/Y (improving from the -11% Y/Y in FQ2 and the -24% Y/Y in FQ1). Similarly, same-store sales improved to -6% Y/Y, which is still a decline but has narrowed considerably from the -11% Y/Y in FQ2 and -15% Y/Y in FQ1. For the quarter, 312 gross new stores were added, bringing the total network to 10,150.

The bottom-line improvement was also commendable, with the c. 0.9%pts Y/Y restaurant margin improvement to 18.6%, a major positive, considering the macro backdrop. The fact that YUMC has been able to expand margins also highlights the business's resilience in navigating the pandemic-affected period unscathed. Pizza Hut was the primary driver of the margin expansion, with improved efficiency and fewer promotions, along with moderating wage and commodity inflation boosting the bottom line.

Source: Yum China FQ3 Presentation Slides

Pizza Hut Leads the FQ3 Strength

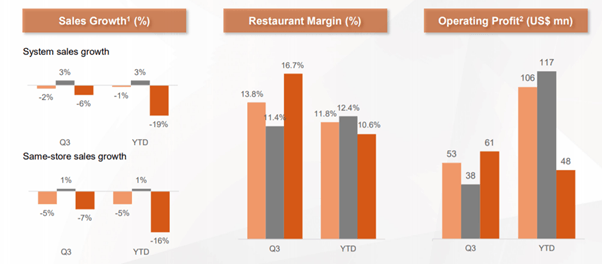

The Pizza Hut performance was the highlight of FQ3 - while improvements across same-store sales and traffic were solid, the fact that operating profits increased 59% Y/Y in a COVID-19 impacted year was no mean feat. Restaurant margins expanded c. 5.3%pts, reaching a new multi-year high at 16.7% on the back of improved labor, food & paper, along with rental expenses relative to sales.

The FQ3 performance also shows that Pizza Hut's initiatives are bearing fruit, from menu innovation, value campaigns, and delivery, to loyalty programs. On deliveries, for instance, orders are up 34% Y/Y, while loyalty members now contribute a significant c. 53% of sales. However, the margins do also benefit from COVID-19-related cost savings such as labor, rents, and social insurance waivers, all of which are likely non-recurring. While I am not sure the 16.7% restaurant margin is sustainable in a post-pandemic environment, I do think some of the cost-cutting will stick, with a c. 15% margin looking well within reach.

Source: Yum China FQ3 Presentation Slides

KFC Also Shows Improvement But Lags Pizza Hut

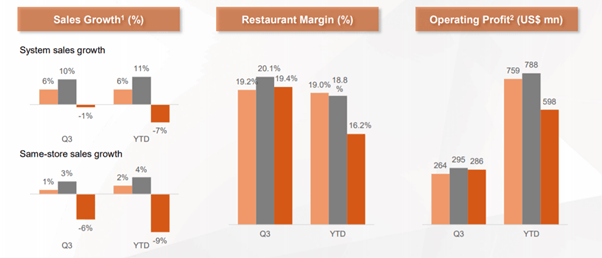

There were also signs of improvement at KFC - same-store sales and traffic were down 6% and 10% Y/Y, respectively, but this was still an improvement from prior quarters. However, with pricing up 4% Y/Y and benefits from cost saving initiatives, operating profits only fell c. 3% Y/Y for the quarter. As a result, KFC restaurant margins only contracted c. 70bps, reaching 19.4% - the upper-end of the 13-20% five-year range.

With traffic at transportation hub stores yet to fully recover, I think there is plenty of upside ahead. Alongside a sales recovery, KFC should also benefit from continued margin expansion on the back of the operating leverage inherent in the business model. Also encouraging was the fact that digital orders and sales increased by 17% Y/Y and 8% Y/Y, respectively. As of FQ3, YUMC's digital orders contributed c. 83% of the total.

Source: Yum China FQ3 Presentation Slides

A Brighter FQ4/Fiscal 2021 Outlook

Despite store traffic still being weighed down by the lingering COVID-19 impact, management sees sequential sales improvement in the upcoming quarters. However, some store impairment is expected from the pandemic, and with FQ4 typically a low season for sales, it makes sense that management is opting to remodel existing stores. The latest guidance calls for gross new units to be increased to above 900, up considerably from the prior guidance for 800-850 new units. Additionally, the positive commentary on lower-tier cities and Pizza Hut suggests upside to future store expansions will be focused on the aforementioned areas.

Interestingly, the company plans to adopt a small-store format and customized menus, especially in upper-tier cities, for takeaway and delivery. This makes sense economically, as it should help reduce rent and other costs. Meanwhile, investment costs in lower-tier cities are getting lower, which also facilitates the accelerated store buildout. Pizza Hut margins should also benefit from increased use of a satellite store format with limited items on the menu, as it also entails a significant reduction in the kitchen size.

As expected, however, wages are guided to increase moderately by low to mid-single-digits in fiscal 2020 and could catch up to pre-pandemic levels as soon as fiscal 2021. Commodity prices remain a concern, but for now, are expected to be largely stable. Lastly, while management's base case calls for a recovery in fiscal 2021, the path is expected to be uneven, and therefore, investors should stay focused on the long-term potential (as opposed to Q/Q fluctuations).

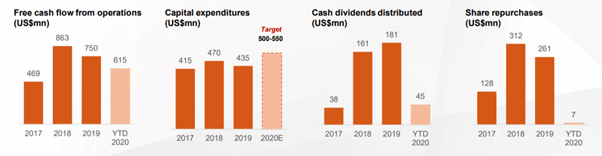

Shareholder Return Potential Backed by a Fortress Balance Sheet

Over the last two fiscal years, YUMC has returned $426 million in cash to shareholders through share repurchases and dividends since the spinoff. Considering YUMC's $4.2 billion cash position and potential for steady cash generation through the cycles, I see upside to shareholder returns in future years.

Source: Yum China FQ3 Presentation Slides

In the near term, however, the company is focused on reinvestments by building new stores and remodeling existing stores, as well as other digital investments. As YUMC has historically generated above-average ROICs from reinvestments, I am supportive of management's plans and expect the spending to pay off in future years.

Firmly on the Recovery Path

As YUMC's latest quarter showed, things are moving in the right direction. While management is calling for a near-term recovery path for the restaurant industry to be uneven, I think YUMC is firmly on track for a return to same-store sales growth early next year. Even if my base case turns out wrong, however, YUMC's resilience through COVID-19 should offer investors plenty of comfort. And backed by an industry-leading supply chain and growth initiatives such as digital membership and delivery, along with an accelerated store expansion, I see plenty of upside for YUMC.

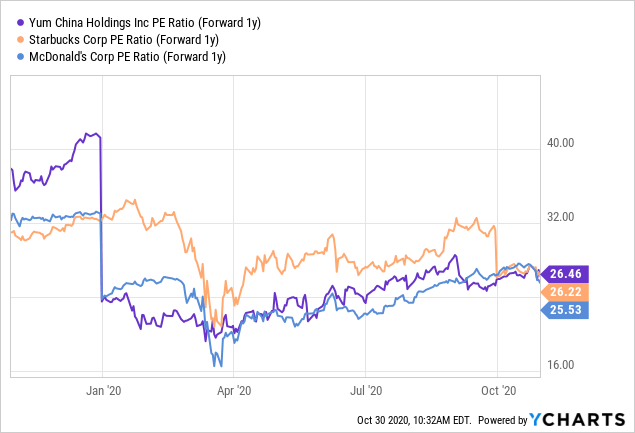

YUMC shares are trading at c. 26x forward 1-year P/E, in line with restaurants with a similar profile such as McDonald's (MCD) at 26x and Starbucks (SBUX) at 26x. However, if we were to adjust for YUMC's projected net cash position, the implied forward 1-year 2021 PE is closer to c. 21x. Considering the undemanding valuations, I believe YUMC shares are compelling at these levels.

Data by YCharts

Data by YCharts

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.