Healthpeak Properties: A Covered 5.4% Yield With Upside Potential

Healthpeak Properties has seen some challenges in its SHOP segment.

However, it has relatively low exposure to SHOP compared to its peers, and has a growing life sciences business segment.

The dividend remains covered, and I see upside potential for the share price.

The healthcare REIT sector remains largely beaten down since the start of the pandemic. While some names deserve to be trading lower, I see others that have been unfairly punished. In this article, I’m focused on Healthpeak Properties (PEAK), which I believe is one such stock that deserves a higher valuation. Since the start of the year, the shares have traded down by 23%. I evaluate what makes this stock an attractive investment at the current price; so let’s get started.

A Look Into Healthpeak

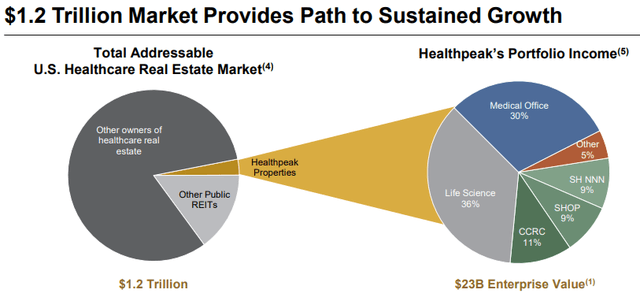

Healthpeak Properties is one of the “Big 3” diversified healthcare REITs, with the other two being Welltower (WELL) and Ventas (VTR). Its portfolio consists of 633 properties in the segments of life sciences, medical office, CCRC (continuing care retirement communities) and senior housing (both operating and triple-net).

(Source: September Investor Presentation)

The most challenging segment for healthcare REITs during the current pandemic has been senior housing, as infections tend to spread quickly in the communities, and the elderly are the demographic that is the most at risk. These challenges were reflected in Q2 results, in which FFO declined by 9% YoY, driven by a 21% decrease in same-store NOI in the senior housing segment.

Looking forward to Q3 results, I expect to see continued weakness in the senior housing segment, as average daily occupancy declined by 110 basis points in July, versus June 30th. On the bright side, I see Healthpeak as being better positioned than both of its peers Welltower and Ventas, due to Healthpeak’s relatively lower exposure to SHOP (seniors housing operating portfolio), as a percentage of its portfolio.

For comparison, Welltower derived 38% of its Q3’20 NOI from SHOP, and Ventas derived 26% of its Q2’20 NOI from SHOP. Healthpeak compares favorably to its peers, as it derived just 9% of its Q2’20 NOI from the challenging SHOP segment. Meanwhile, the senior housing triple-net segment, which represents 9% of portfolio NOI, appears to be stable, as 97% of the tenants paid rent in July, with the remaining 3% on a deferred payment plan.

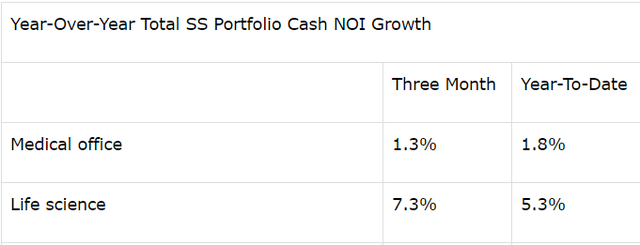

In addition, two-thirds of Healthpeak’s NOI from life sciences and medical office appear to be resilient and growing. As seen below, NOI for these two segments grew in the low to high single-digit during the second quarter. Looking forward to Q3 results and the rest of the year, I expect the life sciences segment to continue to exhibit strong growth. This is supported by the additional 100,000 sq. feet of leases that the company signed in early Q3, including 20K sq. feet of renewals at a 22% cash mark-to-market, and 60K sq. feet of new leases in Boston.

(Source: Company Earnings Press Release)

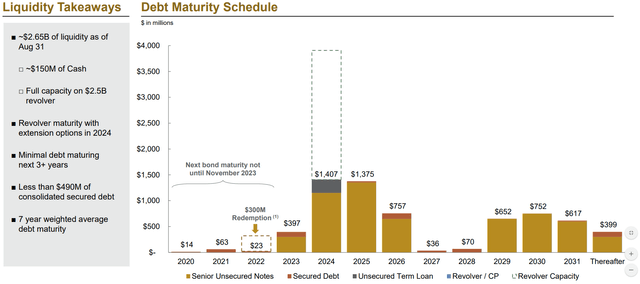

Healthpeak maintains a strong balance sheet with a BBB+ and equivalent rating from S&P and Moody’s. It has a net debt to adjusted EBITDAre ratio of 5.4x, which is below the 6.0x ratio that I generally consider to be safe for REITs, and a 7-year weighted average debt maturity with no material debt maturities until 2023. Healthpeak also maintains plenty of liquidity. As seen below, as of Aug 31st, it had $150M of cash, and full capacity on its $2.5B revolving line of credit.

(Source: September Investor Presentation)

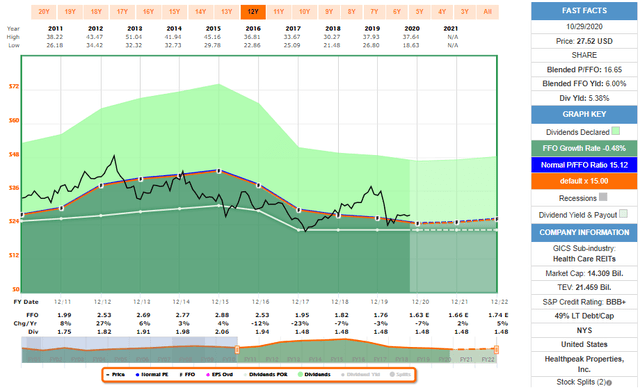

Lastly, due to its relatively low exposure to SHOP, Healthpeak did not cut its dividend like its peers, Welltower and Ventas. Currently, the dividend yield is 5.4%, and is covered at a 92.5% payout ratio based on Q2’20 FFO. I expect dividend coverage to remain tight for the remainder of the year, and expect better coverage by the middle of next year. This assumes an eventual easing of the pandemic, with the anticipation of a vaccine, and the continued expansion of the fast-growing life sciences segment.

Investor Takeaway

Healthpeak has a relatively high-quality portfolio, and due to its lower exposure to SHOP, it has weathered the current pandemic better than its two diversified healthcare REIT peers. I find the life-sciences segment to be the most promising, and expect it to be a continued growth driver for the company. Meanwhile, Healthpeak maintains a strong balance sheet and has a covered 5.4% dividend yield, which I find to be attractive in this low-yield environment.

The shares are currently trading well below where they were at the start of the year. Analysts have a consensus Buy rating, with an average price target of $30. For the reasons stated above, I see upside potential for the shares at the current valuation.

(Source: F.A.S.T. Graphs)

Thanks for reading! If you enjoyed this piece, then please click "Follow" next to my name at the top to receive my future articles. All the best.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.