DeltaShares S&P 500 Managed Risk ETF Not Best Choice In This ETF Arena

Over the last few years, investors have been deluged with funds that want reduced risk without forfeiting too much return.

These funds, depending on their exact objective, deploy various strategies to accomplish the task they set out. I will briefly highlight three of these funds.

DMRL is not my choice for retirees looking for return with less risk. I will explain why.

Introduction

Over the last few years, investors have been deluged with funds that want reduced risk without forfeiting too much return. These funds, depending on their exact objective, deploy various strategies to accomplish the task they set out. Here are three others covered regularly on Seeking Alpha:

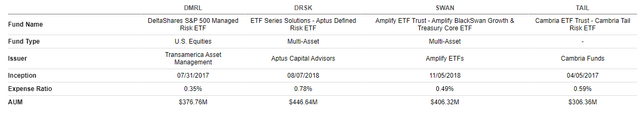

Source: Seeking Alpha Peers

With some adjustments, the above were provided using SA Peers screen.

Aptus Defined Risk ETF (DRSK) uses Corporate Bond Term funds and individual stock options (Article).

Amplify BlackSwan Growth & Treasury Core ETF (SWAN) uses UST issues and LEAP options on the S&P 500 index (Article).

Cambria Tail Risk ETF (TAIL) uses UST issues and both Calls and Puts on the S&P 500 index (Article).

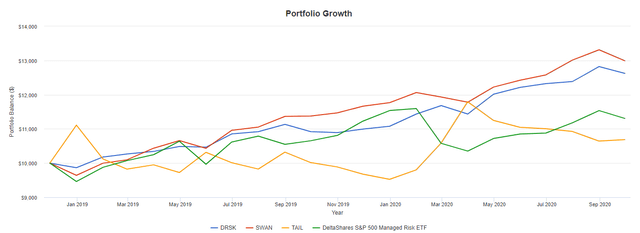

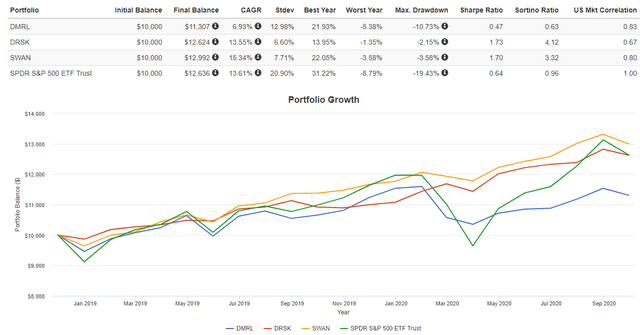

Source: www.portfoliovisualizer.com

As you can see, the different approaches for the same goal, returns with less risk, have results that differ over time, with DRSK and SWAN being the most consistent in their returns. Another approach in the return versus risk universe are ETFs that use covered calls to generate return via higher income streams and hopefully less price movement, while giving up any large upward price movement. These ETFs are covered in many SA articles.

Exploring DeltaShares S&P 500 Managed Risk ETF (NYSEARCA:DMRL)

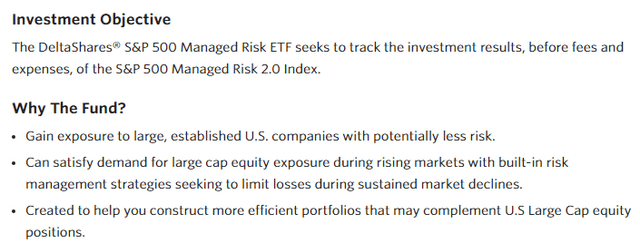

This is how Transamerica explains DMRL:

Source: www.transamerica.com

Source: www.transamerica.com

The sub-advisor is Milliman Financial Risk Management LLC, a global provider of risk management products. DMRL basics are $371m AUM, with an expense ratio of .35% and yield under 1%. The ETF is managed against the S&P 500 Managed Risk 2.0 Index, which has the following description:

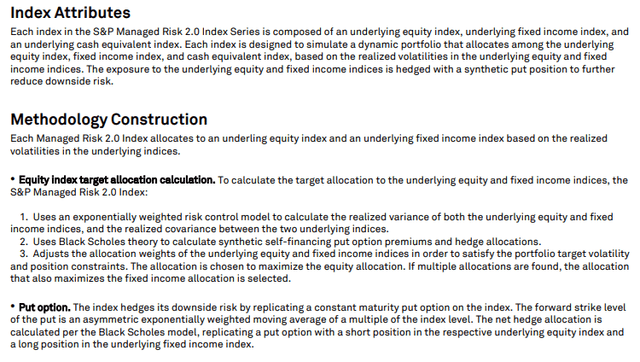

The S&P 500 Managed Risk 2.0 Index is designed to simulate a downside-protected portfolio that utilizes a framework that includes a targeted volatility and a synthetic option overlay to hedge the portfolio's downside risk. The framework allocates the index weights between the equity and reserve asset and then the volatility of the combined allocation is hedged using a synthetic put option. This framework provides for lower drawdowns and a stable volatility profile for the index while allowing for a higher participation in the upside of the components.

Source: www.spglobal.com

The index history goes back beyond the three years the ETF has been available and is the basis of why I am not a fan - more on that later.

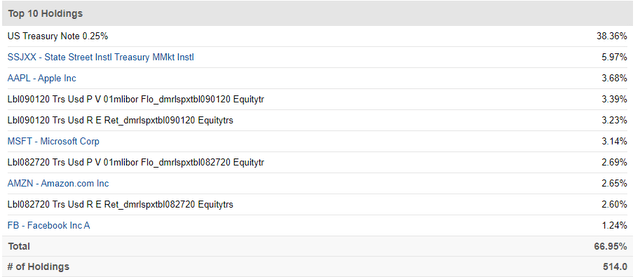

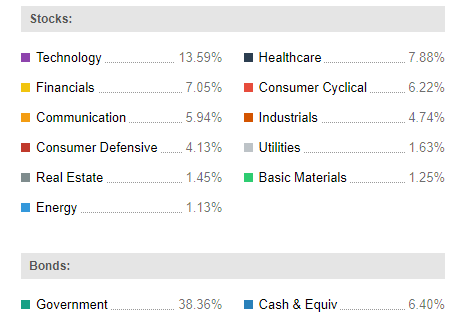

As of September 30, Seeking Alpha shows the following information for DMRL:

Source: Holdings

Reviewing data on Fidelity.com shows options make up 55% of the portfolio, UST issues the rest. Glancing at the complete list of holdings, it appears the ETF has options on most of the stocks in the S&P 500 index.

S&P 500 Managed Risk 2.0 Index - A deeper look

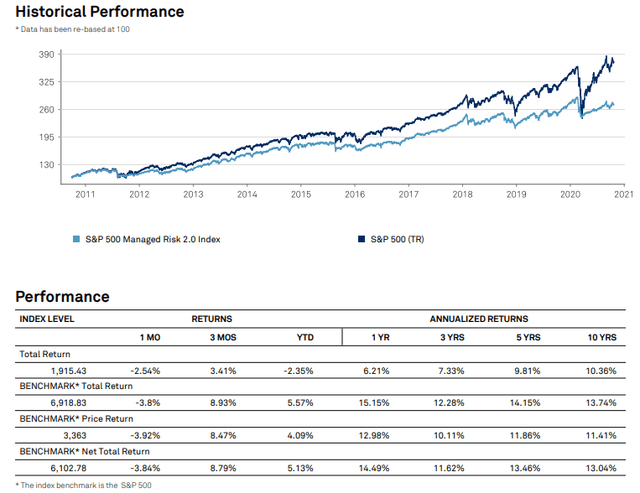

Source: Index PDF

Unlike some risk-managed funds, DMRL is allowed to use Put options to limit downside risk as explained above. Another difference is the underlying index actually combines two indices, one for each major component, equity and fixed income. The important fact is that the index predates the ETF by 27 years, allowing us to get a possible glimpse into how the ETF might have performed. I found S&P provided data back to 2010.

Source: Index PDF

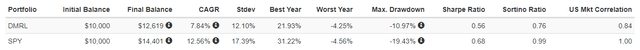

While you can see that the ETF Index provided less return over the past 10 years (10.36% vs. 13.04% net), I couldn't find risk statistics from S&P, so I went to Portfolio Visualizer to see how DMRL has done versus SPY since inception:

Source: www.portfoliovisualizer.com

So again, we see that DMRL underperformed SPY over the past three years, not unexpected for a risk-managed ETF. Both the Sharpe ratio and Sortino ratio say an investor wasn't compensated for the risk taken. How important that is depends on the goals of each investor as DMRL fulfilled its goal of having lower risk than the S&P 500 index, represented here by SPY.

Portfolio Strategy

For investors with a long-term horizon or retirees who are cash-flow positive, risk-managed funds probably have less interest. As a retiree having to take RMDs, they play a part of my IRA investment allocation. I chose to use SWAN over DRSK because of DRSK's use of TERM ETFs for the fixed income component (which I don't view as good investments in today's low interest rate world) and a personal preference for using LEAPS over individual stock options and over DMRL as there was no comparison in either CAGR or risk measurements.

Source: www.portfoliovisualizer.com

The above data does lose the first year of DMRL as SWAN launched in December 2018. Since then, SWAN and DRSK have provided the best CAGR and lowest risk. So while DMRL has done well, I'm bearish only because there are better choices in the risk-managed ETF universe. So for a subset of retired investors or others who are willing to give up some return for a good night's rest, risk-managed funds can play a part (keyword) in their portfolio.

Author's note: For those readers who disagree with my analysis or are looking for risk-managed ETFs in other asset classes, the same manager has MC (DMRM), SC (DMRS) and EM (DMRE) versions too.

If you appreciate articles of this nature, please mark it 'liked' and click the 'Follow' button above to be notified of my next submission. Thanks for reading.

Disclosure: I am/we are long SWAN. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.