Oracle: High Quality Businesses Are Not Necessarily Expensive

In the cloud services space, profitability does not seem to matter anymore, while higher expected growth means everything.

Oracle has taken a very different and more long-term oriented approach, which could easily make the company a superior investment.

Oracle is still dominating in the enterprise applications segment and is moving fast to the cloud while not compromising profitability and increasing investments.

Valuation remains very conservative, and the risk of downward multiple repricing is extremely low.

Source: gsmarena

So far, Oracle (NYSE:ORCL) seems to have been playing catch up with the high flying and exciting names in the cloud space. Oracle is considered a niche player in the Cloud Infrastructure (IaaS) space and Customer Relationship Management (CRM) and Human Capital Management (HCM) applications as well. However, ORCL is dominating the enterprise applications and database segments while also developing its cloud infrastructure, which will offer an important competitive advantage.

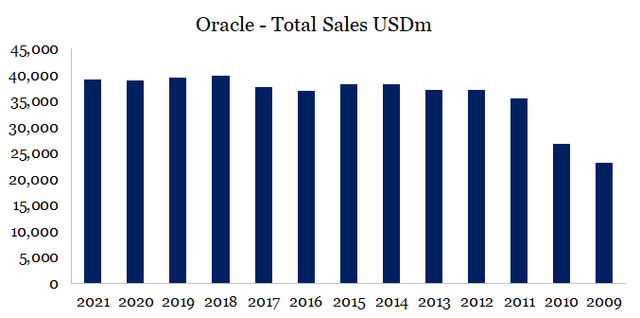

Due to its legacy business, the company's topline revenue does not appear to be growing at all. This is rather striking for most investors in an industry where, as we will see later, topline growth at whatever the price means everything.

Source: prepared by the author using data from Oracle annual and quarterly reports

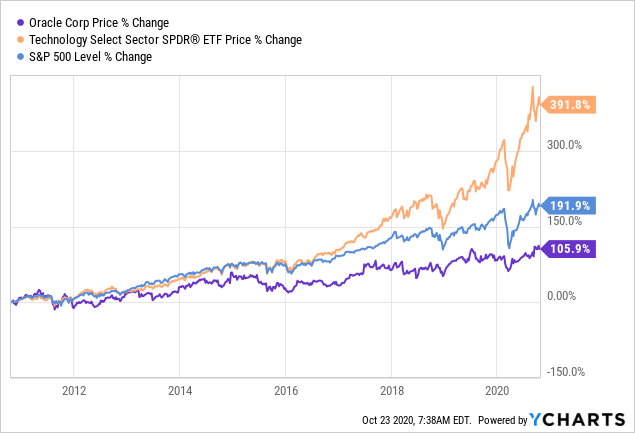

This has led to a decade of disappointing performance relative to the overall market, the technology sector, and to the current leaders in the cloud infrastructure, platform, and software space.

Data by YCharts

Data by YCharts

After all, who wants to hold an old legacy business that has been late to the exciting cloud space, that has had flat revenues over the past decade and disappointing share price returns. Whether you are a small retail investor or a professional, it is very hard to justify buying a company with such a track record at times when share prices of high-growth companies are skyrocketing.

Although this statement is enough for most people to simply disregard Oracle, for me, it is a sign to look further as attractive long-term opportunities are usually born out of extreme pessimism. Especially in a fast-evolving industry and a field where almost everyone feels so competent and confident in forecasting the future based on past performance. At the same time, people such as Warren Buffett proclaim:

I don't think I understand where the cloud is going.

Such a disparity in understanding the field is almost always a solid reason to take a step back from the mainstream thinking.

The Hamster Wheel of Growth

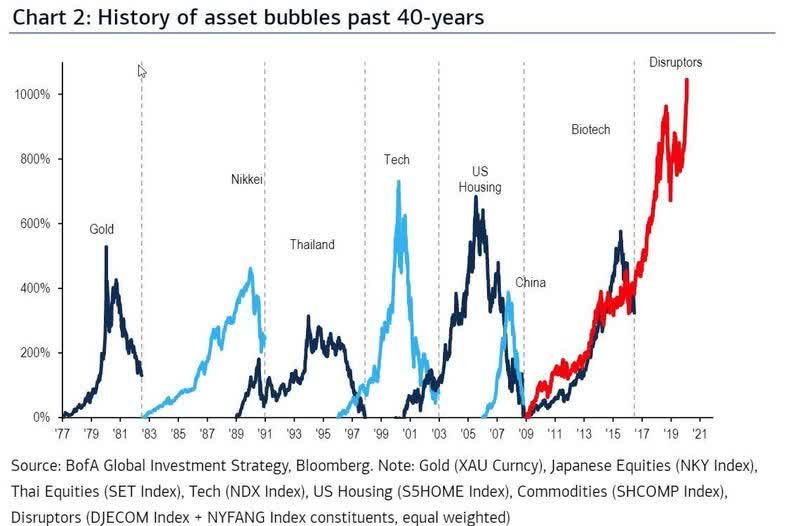

Whether it is electric vehicles, e-commerce or anything to do with the cloud, there is one buzz word uniting all these sectors - disruption.

As connectivity and many other disruptive technologies scaled up in a more meaningful way over the course of the last decade and abundance of cheap capital only added fuel to the fire, sticking with the disruptors of our day has been the only way to achieve superior returns. Naturally, this led to massive growth in certain industries which some may even call a bubble.

Source: flowbank.com

The distinctive feature of each industry classified with the term above is usually the following: profitability and high-quality business models are not as relevant for investors as high short-term sales growth is.

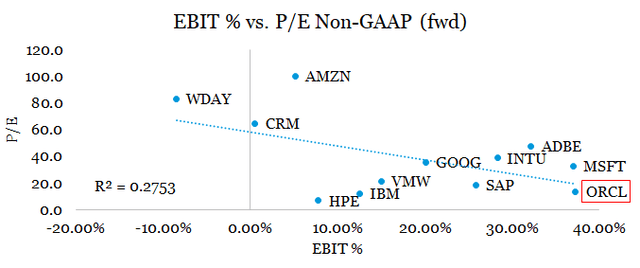

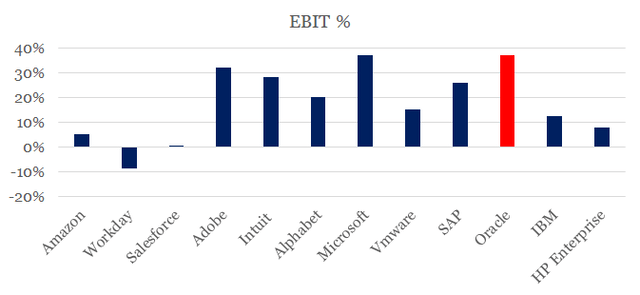

That is why valuations in the cloud space do not exhibit a strong relationship with profitability. Quite surprisingly even, on a cross-sectional basis, forward P/E ratios exhibit a negative relationship with achieved operating profitability. In simple terms - the less profitable a company is, assuming it is growing fast, the more likely it is to achieve a higher valuation.

Source: prepared by the author using data from Seeking Alpha

The high flyers such as Amazon (AMZN), Salesforce (CRM) and Workday (WDAY) seem to be the main reason for this distortion. Their extremely high valuations are also heavily dependent on years of further growth and, perhaps, one day - increased profitability.

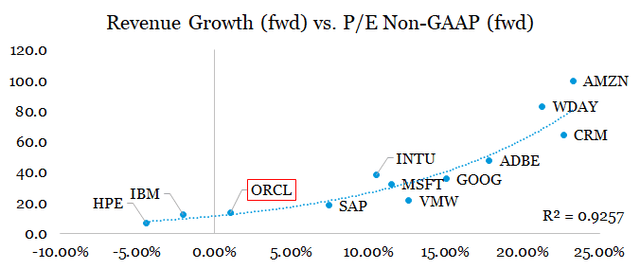

So, if profits and return on capital are not relevant for valuations, then there is only one thing left - hopes about future sales growth. And of course, this appears to be the case as forward P/E ratios and forecasted revenue growth numbers are in a very strong relationship. One major problem with this relationship is that the market is usually very accurate in forecasting growth over the short run, but not over the long term.

Source: prepared by the author using data from Seeking Alpha

The relationship above creates an extremely aggressive environment, where managers of these companies are often forced to favor short-term behavior that will allow them to take market share now and worry about competitive advantages and profitability later.

Although such an aggressive environment does inevitably create an enormous value for the society in terms of overall innovation and technological progress, it does not mean that these conditions would last forever. Growth will inevitably slow down, and when exactly is anybody's guess. Moreover, transitions from extremely high growth to a bit slower one rarely happen gradually and are almost always violent events.

Another thing worth considering is that the relationship above is also exponential, meaning that only a small change in expected growth rates could be followed by massive movements in share prices of the companies at the very top. At the same time, the companies at the very bottom face a very limited risk of a downward multiple repricing due to changes in topline growth.

The companies at the bottom face other risks too, such as slowly becoming irrelevant and lacking the funds needed to invest and innovate in future technologies. This, however, is where Oracle stands out from the other underperformers:

- as one of the most profitable businesses in the peer group, Oracle has more than enough resources to allocate to future investments, in spite of its low valuation multiple;

- it is the only company at the very bottom, led and owned by a visionary who is more long-term oriented and could afford the comfort of not chasing short-term stock price performance;

* sorted by forward P/E ratio - highest to lowest

Source: prepared by the author using data from Seeking Alpha

Being a long-term investor myself and not interested in chasing short-term performance, especially when it's based on expectations about the near future revenue growth rates, I find the opportunity behind Oracle a compelling investment case.

Trends that can't go on forever

Business fundamentals and valuations in the sector have been set on a trajectory of widening gaps between the current leaders and laggards. Usually, there is nothing wrong with that, and in fact, it is quite normal.

When taken to the extreme, however, this trend is not sustainable. Especially when it relies on ever-increasing share prices, acquisitions, dilution etc.

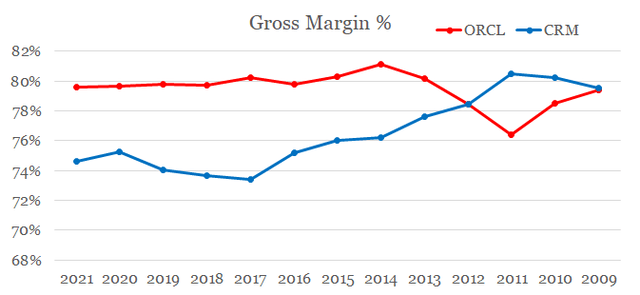

As an illustration, I would use Oracle and Salesforce as two companies competing in the CRM applications space and two companies standing on the two opposite ends of the growth-valuation matrix shown above.

Trend 1 - dilution

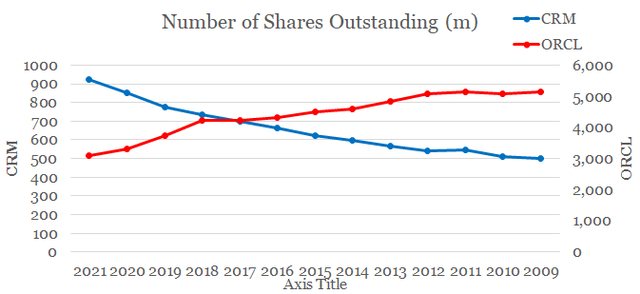

To capitalize on the ever-increasing equity markets, cheap capital, and sales growth at any price trend, Salesforce has been issuing shares at an increasing rate, while ORCL has been doing exactly the opposite - buying back shares and thus investing in itself.

Source: prepared by the author using data from annual and quarterly reports

At first sight, there's nothing wrong with all that, but:

- it is worrisome that, in the case of CRM's dilution, this is also followed by a heavy insider selling activity;

- buying back shares when your company is trading at very low multiples is more likely to create value for long-term shareholders;

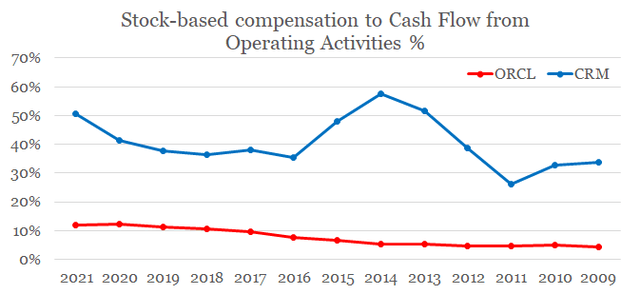

To make matters even more extreme, the share of stock-based compensation from cash flow from operations is also increasing at a much faster rate for CRM than it is for ORCL, while it also reached 50% over the last twelve months for the former.

Source: prepared by the author using data from annual and quarterly reports

Sooner or later, this trend will have to reverse, and an ever-increased reliance on stock-based compensation could potentially have a devastating effect on cash flow for CRM. Moreover, companies relying heavily on stock-based compensation will have a harder time retaining talent, if stock price returns are no longer as appealing.

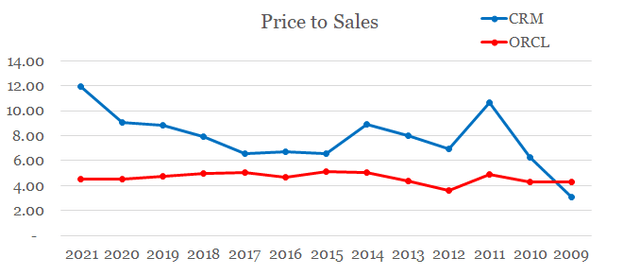

Trend 2 - valuation and profitability gap

Even though a gap in P/S multiples of the two companies makes sense, given their different growth profiles so far, the gap is already reaching extreme levels.

Source: prepared by the author using data from annual and quarterly reports

Especially when the gap in profitability is going in the other direction.

Source: prepared by the author using data from annual and quarterly reports

Once again, these gaps can't widen forever, and the more they go in their current direction, the more painful a potential repricing is going to be once topline growth slows down.

Oracle - Let's see what this 'laggard' is all about

In the field of cloud infrastructure, Oracle is indeed not a meaningful player as the company had neither the resources available nor the commitment to build data centers infrastructure around the world at a comparable rate to the behemoths in the space - Google (NASDAQ:GOOG) (NASDAQ:GOOGL), Amazon, and Microsoft (NASDAQ:MSFT). However, ORCL is still a niche player in the space and is ranked fifth as it benefits from the company's dominant position in the enterprise applications space.

Source: Oracle Financial Analyst Meeting 2019 Presentation

In addition to its future IaaS aspirations, ORCL is still an absolute leader in the enterprise applications space and seems to be the only player offering both services. This on itself could be seen as a competitive advantage that ORCL has and could result in significant cross-selling capabilities.

Although Oracle's topline growth has been flat due to the company's legacy operations, its NetSuite and Fusion ERP solutions are growing at around 30% organically. Finally, Oracle's database is an asset that is extremely hard to replicate, and in spite of the stiff competition, Oracle would likely remain the dominant player in this space for the foreseeable future.

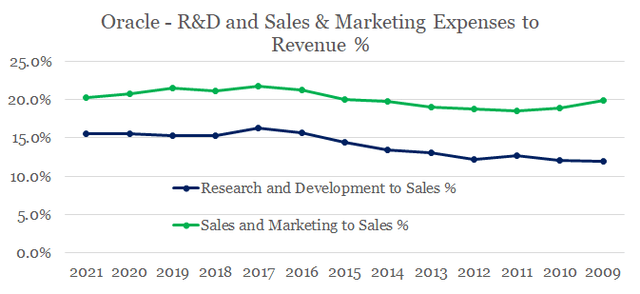

With all that in mind, Oracle appears to be very well positioned in the cloud space but is also the most profitable player in the space, while at the same, it has dialed up its Research & Development and Sales & Marketing expenses as a share of sales.

Source: prepared by the author using data from annual and quarterly reports

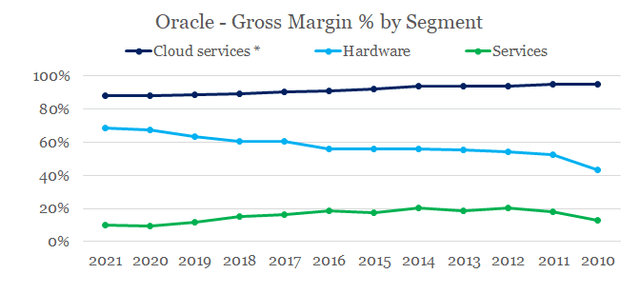

Furthermore, as share of legacy business continues to decline giving way to higher margin Cloud Services, ORCL's total gross profitability will continue to experience tailwinds.

* Cloud services and license support and Cloud license and on-premise license

Source: prepared by the author using data from annual and quarterly reports

With its stable and more profitable business model, Oracle could also continue invest heavily into R&D and its data centers even if profitability deteriorates in the future.

Cumulatively, over the 2009-2020 period, Oracle spent around $122bn on common stock repurchases and $24bn on dividends, while also not compromising its R&D investments, which amounted to $61bn over the same period. Thus, ORCL has the ability to significantly expand its R&D, marketing, or capital spend budgets, if it sees the opportunity to do so.

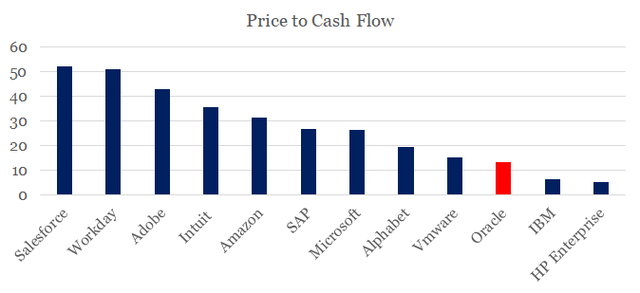

At the same time, ORCL still trades at ridiculously low price to cash flow levels when compared to its peers.

Source: prepared by the author using data from Seeking Alpha

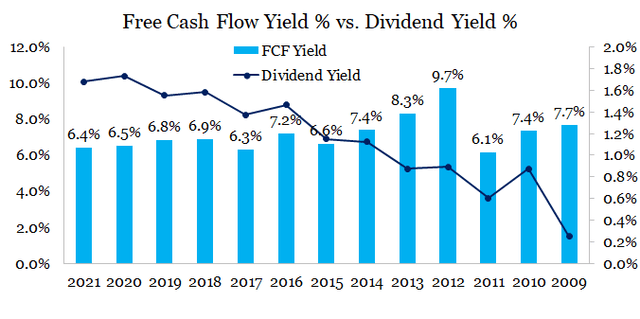

Finally, the well-covered dividend has been increasing on a per share basis both due to absolute dividend spend increases and lower share count as a result of Oracle's ambitious share buyback program. Free cash flow yield on the other hand remains significantly higher than the average of any of the S&P 500 sectors.

Source: prepared by the author using data from annual and quarterly reports

Thus, Oracle appears to be very well-positioned for the future with significant competitive advantages and highly profitable business model, while at the same time trading at levels that suggest otherwise.

Conclusion

Oracle is definitely not among the high flyers of any of the cloud sub-categories of the cloud space. The company does not seem to play the game of higher topline growth no matter the costs and its sustainability. Perhaps, counterintuitively, to many, the company appears to be focused on the long-term profitability and improving its competitive advantages in the enterprise applications and database space. On top of that, the company is making a move into the cloud platform and infrastructure space that could eventually translate into another important competitive advantage.

Contrary to all that, Oracle is trading as if the company is becoming irrelevant. Whether it's free cash flow yield, price to cash flow, price to earnings or even price to sales, Oracle is trading at extremely low levels compared to almost all of its peers. All that does not guarantee anything for the future. However, low valuation, combined with a strong business model, offers a significantly higher probability for future outperformance.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in ORCL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication, and are subject to change without notice.