GW Pharmaceuticals Q3 Earnings May Provide Clarity On Many Issues

Investors should study the various revenue streams for "epidiolex".

Level of cash reserves important to judge likelihood of future share dilution.

Comments at analyst call on future product developments probably the most important look-out.

Earnings may give indication of ability of company to move to next level.

GW Pharmaceuticals (NASDAQ:GWPH) posted solid results for Q2, but its stock price did not respond very favourably. My article in August went through the details on this.

Q3 results are due to be released on 3rd November. Investors should first and foremost look at earnings growth for the company's signature drug product epidiolex. Secondly, they should study the balance sheet to see how cash reserves are looking. This may determine whether future share dilution is likely from stock issuances.

Most importantly, they should study product development at the analyst call. Management tends to be quite conservative. What they say, however, about "nabiximols" could be key. This will provide indicators on the next big ramp-up on earnings the company needs if it is to move to the next stage. The current epidiolex earnings roll-out has been good. However, "orphan" drugs for childhood epilepsies only have limited upside by definition.

Epidiolex

The key indicators to watch for can be summarised.

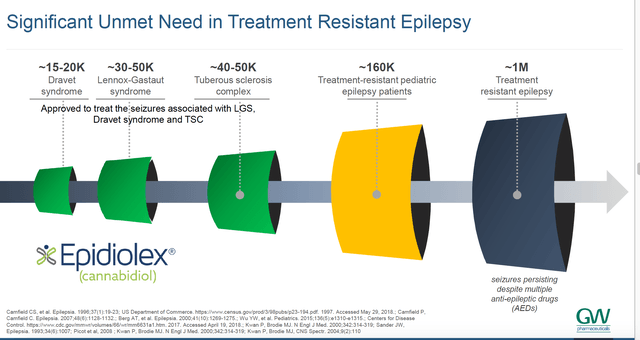

- The growth potential that remains for treatment of DS (Dravet Syndrome) and LGS (Lennox-Gastaut Syndrome) in the USA. The company had previously said they were about 50% market penetrated for these childhood epilepsy conditions. Apart from number of patients, dosages per patient will still be increasing as physicians get confident the product is well tolerated.

- The progress of the ramp-up for TSC (tuberous sclerosis complex) in the USA. Revenues for TSC should at least match those for DS and LGS in the long run. There are about 50,000 sufferers of TSC in the USA and up to 1 million worldwide. Of that number, about 85% suffer from epileptic seizures. This is a similar number to those suffering form DS and LGS combined.

- Progress in Europe, where the drug is known as "epidyolex". This relates both to revenues for treatment of DS and LGS and to approval for treatment of TSC. The size of the addressable market for patients in Europe is similar to that of the USA. Potential revenues are lower due to the more equitable pricing of medicines in Europe. News of interest will include how the roll-out has gone in the first 5 country target markets for the company in Europe. Investors should also look out for when the company expects positive news on the next 10 country target markets on the continent. At the Q2 earnings, it was reported that Europe contributed only US$6.6 million to revenues. That is about 5% of total revenues. So, this is an area where substantial revenue increases should be forthcoming in the next few quarters.

Progress elsewhere in the world might also be touched upon at the call. For instance, epidyolex for DS and LGS was approved in Australia in September. A few other Asian markets such as South Korea may now be seeing sales. - News on whether there are substantial off-label revenues coming in for epidiolex for adult epilepsy. At the recent Morgan Stanley Annual Global Healthcare Conference, CEO Justin Gover stated:

"We only promote on-label but there is, as we all know significant unmet need in a broader refractory epilepsy population."

The company illustrates this potential as follows:

GW Pharma

Thus, off-label opportunities are something investors should be keen to hear further news about.

There may also be news on how trials for the use of epidiolex in Rett Syndrome, although these are not expected to be completed until August 2021. Rett Syndrome is a very distressing degenerative condition affecting mainly girls for which there is really no approved treatment at present.

Nabiximols

My previous article detailed the tremendous potential for this product (known as "sativex" overseas). Drug testing and approval is of course an uncertain process. However, comments at the analyst call should shed some light on when nabiximols could join the revenue stream of the company if all goes according to plan.

At the recent Morgan Stanley Conference, Gover was very positive:

"I think it has a potentially transformative effect on the investment proposition for GW Pharma as a whole."

He saw an annual market worth US$450 million in the USA for nabiximols for MS (multiple sclerosis). That is just one condition they want to treat. (It should be noted in comparison that Q2 saw company revenues in total of US$121.3 million). There are about 1 million MS sufferers worldwide according to company figures.

Phase 3 clinical trials carried out were reported on in September. They showed very promising efficacy and safety profiles. The company has instituted a Phase 3 development programme. A recent survey on which the company reported indicated that over one-third of MS sufferers in the USA currently use THC-containing cannabis to treat their symptoms. Nabiximols could offer a scientifically tested and regulated alternative.

After MS, the next priorities are for use with SCI (spinal cord injury) spasticity and PTSD (post traumatic stress disorder). PTSD alone has about 8 million sufferers in the USA.

Again, according to the company figures, there are about 250,000 to 500,000 cases per annum worldwide of SCI, of which about 12,000 are in the USA. The company sees SCI as a US$400 million opportunity.

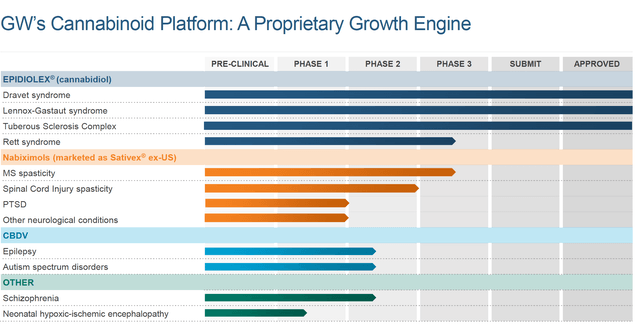

Further Pipeline

The company has a broad range of further pipeline drug candidates. This is summarised below from the company website:

GW Pharma

There may well be interesting news of developments for Rett Syndrome, for autism and for schizophrenia. From Phase 1 and 2 to a revenue producing product is a long and winding road. The targeted schedule does, however, give some visibility for how the long term could look for the company. Thus, any update from the company on these further products and conditions would provide useful information for long-term revenue potential.

Stock Price Movements

As I have detailed previously, the company's stock price can be adversely affected by two factors.

- The pattern of stock ownership in the company lays it open to unwanted speculation. Several hedge funds and private equity funds hold substantial holdings. They can manipulate the pricing for their own good but not for the common good of the ordinary stockholder. For instance, as detailed by Fintel, in one 10-day period in October the percentage of stock shorted fluctuated for no apparent newsworthy reason. It started at 9.27%, went up to 27.9%, fell to 5.8% and rose to 11.9%.

- The stock is quite widely held in various cannabis ETFs. For instance, it is the largest holding in the ETFMG Alternative Harvest ETF (MJ). The other large holdings are Canopy Growth (TSE:WEED) (OTC:CGC), Cronos (OTC:CRON), Aurora Cannabis (OTC:ACB) and Tilray (NASDAQ:TLRY). These recreational cannabis stocks have been through a very negative period. This has adversely affected GW Pharma's stock price. The company otherwise has no reason to rise or fall in tandem with such recreational cannabis stocks.

Analysts reckon that a Democratic sweep in the upcoming election would usher in a more liberal attitude to marijuana legalisation and financing. This would be beneficial for the sector as a whole and for this stock. In Europe, there are problems with listings as Euronext does not allow listing of cannabis stocks. Listing is allowed on London's secondary market, AIM. GW Pharma used to be listed on AIM but moved to NASDAQ in 2016.

Cash Reserves

The cash reserves held by small drug development companies are always a matter of keen interest for investors.

At the end of Q2, the company's cash and cash equivalents came to US$477.6 million. R&D costs stood at US$45.7 million and SG&A costs stood at US$75.9 million. This cash is down somewhat from previous numbers, as my article here detailed. For instance, as of Q4 2019, the company reported US$536 million in cash and cash equivalents. Debt repayment is quite manageable and mostly quite long term.

Investors need to look at the cash and spending figures for Q3 and calculate how likely further stock issuance might be.

Conclusion

GW Pharma stands on the cusp of a transformation in its revenue potential. The company has an opportunity to move from being a successful supplier of orphan status drugs to being a mass market producer. The Q3 analyst call may give some important clues as to this. If such a transformation seems imminent, then the stock price is currently substantially undervalued.

Disclosure: I am/we are long GWPH. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.