DBS is one of the rare ETFs which gives exposure to silver futures rather than the physical commodity.

The ETF attempts to minimize roll yield through its dynamic rolling strategy, but the benefits aren't that substantial for investors.

DBS is likely going to rally over the next year due to the fear levels seen in the market.

Over the past year, the Invesco DB Silver ETF (DBS) has performed quite well with shareholders receiving over 35% on a year-to-date basis.

My current view is that DBS is likely going to head higher over the coming year. However, depending on your desired approach and holding structure, this ETF may or may not be for you.

About DBS

When it comes to gaining exposure to the silver markets, investors typically have one of three choices.

- First off, they can hold a fund which holds and tracks physical storage. This option is perceived by many to be the most secure option and this approach tends to attract the most capital in the silver ETP space.

- The second option would be that investors could hold a fund which tracks silver miners. Under this approach investors are really just making focused equity investments based on their larger macro view of the direction of silver markets.

- And thirdly, investors can choose a fund which offers exposure to the futures markets. DBS is one of such fund.

When it comes to holding exposure to the futures market in commodities ETFs, investors need to ask two key things: how does the fund roll exposure and how does the futures curve typically behave. The reason why these are critical questions to ask is that methodology matters - small differences in holding strategies can result in very large differences in performance depending on the commodity.

In the case of the silver markets, investors are generally in luck because the futures curve is actually pretty efficiently priced. In many futures markets, the futures curve is a function of supply and demand for the commodity with shortages or surpluses resulting in (sometimes dramatic) fluctuations in the forward curve.

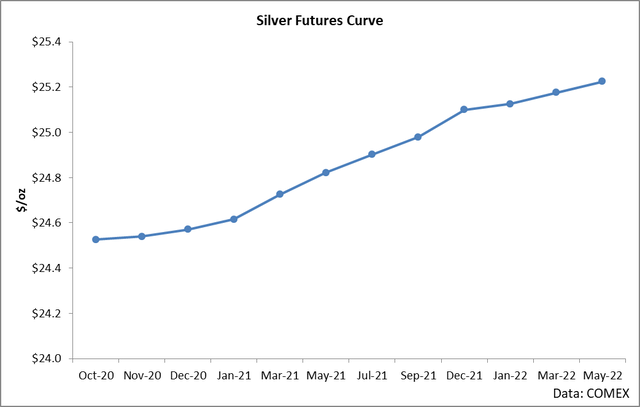

The silver futures curve is fairly efficient and it reflects what is called the "cost of carry". A futures curve reflecting the cost of carry is generally pretty efficient in that you can almost solve for what a futures price should be worth based on the current spot rate and the borrowing costs available to investors.

If you were to get out a calculator and compute the annualized rate of return reflected from each point in the above curve back to the spot rate of silver, you'd find that most of the data points in the above chart are basically equal to the spot price of silver compounded at around 2% per year. This 2% per year figure is the cost of borrowing and the average market storage fee. If the futures curve were to trade too far beyond this roughly 2% annualized figure, traders could engage in arbitrage through buying the physical on borrowed capital while entering into a futures contract to deliver at a later date.

What the above relationship means for silver futures holders is that through time, you will see your futures holdings steadily march in value towards the spot price in relation to the time until expiry. Since the curve is basically priced at a 2% annualized compounded figure from the spot price, as time until expiry declines, so does interest and therefore so does price. This means that investors in silver futures are currently seeing declines in value to their holdings of about 2% per year - they are holding futures which are converging towards spot at this rate.

And here's where DBS's methodology comes into play. It is an ETF which is aware of the above convergence and is attempting to mitigate it through dynamically shifting along the curve. I actually greatly admire this approach of exposure in commodities markets, however when it comes to the silver market, I don't think the clear win is really there. For example, regardless of where you hold along the futures curve, you are still going to converge towards the spot price at a rate which is very close to the cost of borrowing.

At present, I don't believe that DBS is delivering too much value to shareholders above and beyond a standard futures holding approach. However, I still am bullish the ETF due to its underlying holdings. I believe that silver is likely going to head higher from here and in the following section I detail a strategy for retail investors to apply to DBS.

Silver Markets

At the time of writing, silver is actually taking a bit of a tumble as most markets seem to be in freefall this morning in light of spreading coronavirus cases.

While it is understandable that investors would want to get into cash as soon as possible when there is fear on the streets, I actually believe that it is times like these that make for solid silver purchase. The reason for this makes intuitive sense: during a crisis, the initial response by many investors is to pull capital from all but the safest of assets. However, through time, investors will get their feet under them once again and look to strike a balance between risk and return and park assets into safer havens like silver.

A way of gauging investor fear in the market is to look at the VIX. The VIX is an index which is calculated from a basket of S&P 500 options and it tends to rise when the market tends to fall. As you can see, at the time of writing, the VIX is making a sizable move to the upside.

What this chart essentially shows is that it is a very fearful time for many investors - volatility is rising and markets are falling. However, for silver investors, it is actually times like this that make for excellent buying opportunities.

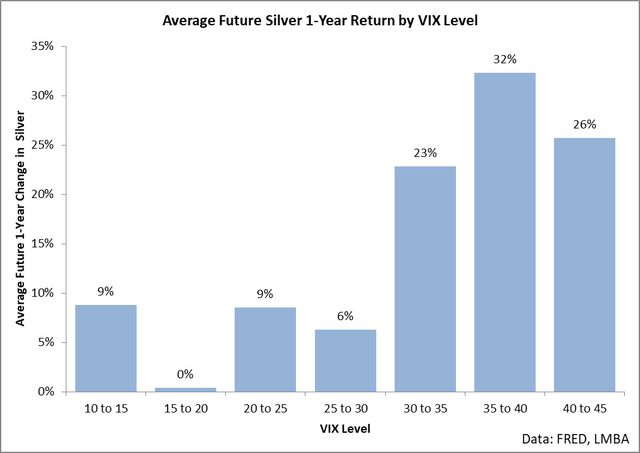

In the above chart, I have calculated the average return seen to silver holders in the 12-months following VIX readings of a certain magnitude. As of this morning, this VIX is currently sitting at 37. Historically speaking, when the VIX is around this level, silver increases by an average of 32% over the next year.

What is interesting here is also the consistency of the underlying data. When we discuss an average, we are talking about a data point which has figures above and beneath the figure. Since 1991, the VIX has fairly consistently rallied to the upside following a VIX reading of this level with 80% of all occasions seeing an increase. Additionally, when silver has rallied it has done so by an average of 41% while declines were only in the low single digits.

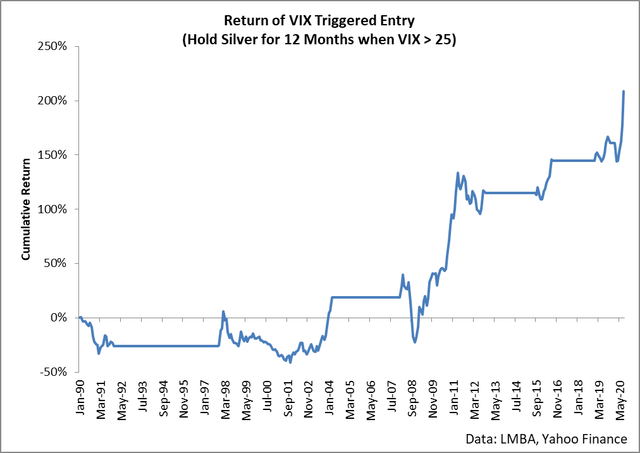

Put simply, I believe that silver is going to rally and that today's selloff in the commodity makes for a solid buying point. For a rules-based approach, here is a backtest showing the return of buying silver every time the VIX hits 25 or more and then holding for 1-year.

This strategy strongly outperforms the buy and hold approach of silver on a risk adjusted basis. On average, silver rallies by 0.72% per month, but under this strategy the average monthly return increases to 1.13%. Also, silver's standard deviation of monthly returns is 8.19% while holding under this approach reduces it to 5.26%. In other words, holding silver only after the markets have exhibited fear is a stronger method than simply buy and hold in risk-adjusted terms.

To apply this strategy to DBS, all you would need to do is buy today and look the VIX 1-year from now. If the VIX is above 25 in 1-year, then the markets are still fearful and investors should look to hold for another year. This simple strategy allows you to be in silver precisely when investors tend to flock to the commodity as a safe haven.

Conclusion

DBS is one of the rare ETFs which gives exposure to silver futures rather than the physical commodity. The ETF attempts to minimize roll yield through its dynamic rolling strategy, but the benefits aren't that substantial for investors. Silver is likely going to rally over the next year due to the fear levels seen in the market.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.