The Most Underrated ARK ETF Is ARK Genomic Revolution Multi-Sector ETF

ARK Genomic Revolution Multi-Sector ETF captures innovation in an industry that is severely under-covered relative to other ARK focused industries.

Existing treatments for severe diseases are very expensive and slow to develop and are not very effective.

ARK and Cathie Wood are confident that the genomics revolution will produce far better treatments and capture a huge healthcare market.

Readers may find it helpful to read my article on the ARK Innovation ETF (ARKK) which introduces ARK Invest and portfolio manager Cathie Wood.

An Underrated Innovation Sector

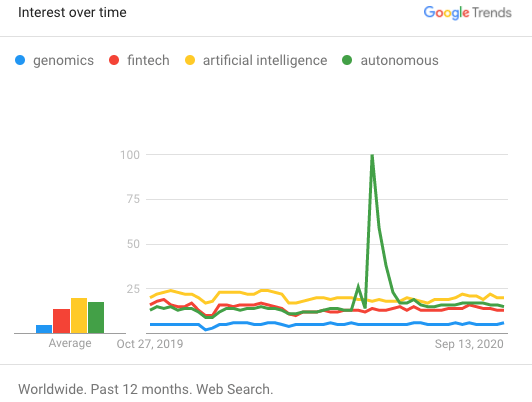

Out of the four innovation sectors, genomic revolution seems to be the most underrated and least understood. The other three sectors are more prevalent in everyday life. The ARK Autonomous Technology & Robotics ETF (ARKQ) has heavy holdings in autonomous vehicle companies which has been a popular discussion topic, especially with the recent rise of Tesla (TSLA). The ARK Next Generation Internet ETF (ARKW) contains very recognizable companies such as Facebook (FB) that are innovating in artificial intelligence which many consumers and investors are exposed to. The ARK Fintech Innovation ETF (ARKF) also contains recognizable names such as PayPal (PYPL) and Square (SQ) that have made very popular fintech consumer and business products.

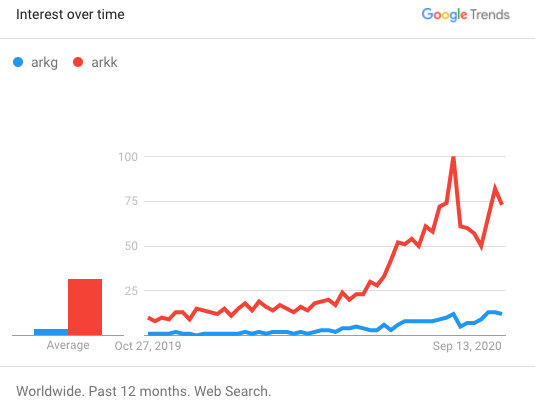

However, for the ARK Genomic Revolution Multi-Sector ETF (ARKG), it would be a large surprise if someone recognized any of the top ten holdings. ARKG also has not benefited from the same rise in Google search interest as ARK's main ETF, ARKK. Similarly, the term "genomics" has consistently been less searched than common terms related to the other ARK ETFs such as "fintech", "artificial intelligence", and "autonomous".

Source: Google Trends, Accessed 10/26/2020

Source: Google Trends, Accessed 10/26/2020

Cathie Wood, the portfolio manager for all ARK ETFs including ARKG, chose the genomic revolution sector as the most under-appreciated by the market in a 2019 interview. It's definitely worth watching that section of her interview as she puts it best. Some excerpts:

We are unlocking the secrets to life and death and that science and knowledge is going to enter into healthcare decision making for the first time...

More than half of the spending on healthcare is wasted...

The reason [genomic revolution] is so inefficiently priced is [that] the traditional healthcare analysts... have not been in labs recently and experimenting with gene editing and watching gene editing correct mutations or change the dynamics of how a plant is going to grow...

[The genomic revolution] seems too "sciency" and too complicated, that's where you know you have some real opportunity...

- Cathie Wood, Big Ideas Summit 2019

The Genomic Revolution

Consistent with ARK's transparent research philosophy, they have released a white paper detailing their reasons for investing in the genomic revolution. Their main thesis is that the cost to sequence a human genome has exponentially decreased in the last few years which eliminates the huge cost barrier to genomic research. This has led to major discoveries in gene based therapies, including CRISPR which can edit and correct mistakes in genes that cause genetic diseases and living therapies that harness the bodies natural immune systems to fight cancer.

Existing treatments are much more expensive and time consuming to develop. They also aren't as effective. For example, many chronic cancer treatments just treat symptoms and not the root cause which is expensive and does not extend life expectancy by much. Chemotherapy treatments attempt to kill the cancerous cells but has severe side effects and is not guaranteed to succeed. Radical surgery to remove malignant tumors is highly invasive and not possible for certain population segments.

In contrast, gene based living therapies are one-time administrated therapies that can significantly extend life-years of patients, making the value of the therapy extremely high relative to existing treatments. One such example on the market is Novartis' (NYSE:NVS) Kymriah, which, according to ARK's research, could extend life-years of patients with blood cancer by up to 3x over chronic cancer treatments.

Finally, a relevant example to current events is Moderna's (MRNA) mRNA based vaccine for COVID-19 which is one the leading vaccine candidates and is in phase 3 trials. This is a new method of vaccination that relies on mimicking viral genomes to produce an antigen immune response rather than using traditional live viruses. It would be the first vaccine of its kind to be approved if it passes phase 3. Moderna claims that the mRNA based vaccine can be manufactured much more quickly and efficiently than traditional vaccines which have product specific requirements.

Market Opportunity

According to ARK, CRISPR’s addressable market in the monogenic disease space could scale to $75B annually with nearly $2T in latent demand from unaddressed populations. In the oncology space, living therapies could be used in an addressable market of over $200B. Early detection of diseases via DNA sequencing could have a market in the tens of billions.

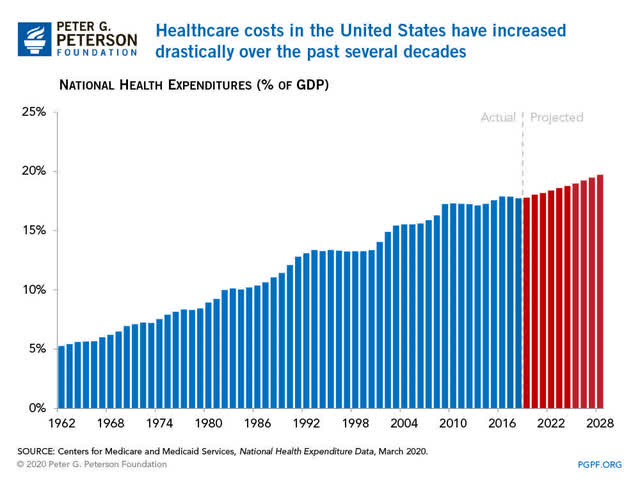

The genomic revolution hasn't even been fully realized yet and many healthcare applications not even yet been discovered. The U.S. is projected to spend over $4T on healthcare in 2020. As a percent of GDP, healthcare spending is projected to continue to grow to nearly one-fifth of GDP by 2030. The genomic revolution has a huge market opportunity to capture.

Source: Peter G. Peterson Foundation

Source: Peter G. Peterson Foundation

Top Ten Holdings

| Company (Ticker) | Focus | Weight | P/E |

| Invitae Corp. (NVTA) | Genetic testing and screening | 9.68% | N/A* |

| CRISPR Therapeutics AG (CRSP) | Gene-based medicines using CRISPR | 8.12% | 293.21 |

| Pacific Biosciences Of California (PACB) | DNA sequencing | 7.23% | N/A |

| Arcturus Therapeutics Holdings (ARCT) | mRNA based therapeutics | 4.93% | N/A |

| Twist Bioscience Corp. (TWST) | Synthetic DNA products, SARS-CoV-2 | 4.86% | N/A |

| Iovance Biotherapeutics Inc. (IOVA) | Cancer immunotherapy (living therapies) | 3.88% | N/A |

| CareDx Inc. (CDNA) | Organ transplants and genetic screening | 3.73% | N/A |

| Personalis Inc. (PSNL) | DNA sequencing and data analysis for cancer therapies | 3.46% | N/A |

| Seres Therapeutics Inc. (MCRB) | Microbiome therapeutics | 3.43% | N/A |

| Compugen Ltd. (CGEN) | Immuno-oncology (living therapies) | 2.97% | N/A |

| Total/Average | 52.29% | 293.21 |

Source: ARK Invest (accessed 10/26/2020), Seekingalpha.com ticker pages.

* N/A P/E implies negative or zero earnings.

Risks

With great opportunity comes risk. There are four main risks I see with investing in ARKG that were not discussed in the white paper. It's important to determine if the risks are acceptable with your own investment risk profile.

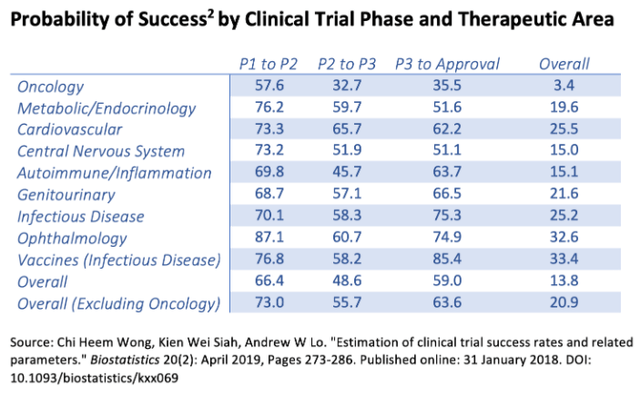

Risk 1: High Failure Rate Of Therapeutics

In the U.S., drug therapeutics must go through three phases of clinical trials before being approved by the FDA. It is estimated that overall only 13.8% of drugs pass clinical trials which makes for a very high failure rate. Pharmaceuticals spend an average of $1B per drug to bring it to market which may go down the drain if the drug therapeutic fails clinical trials.

Per their white paper, ARK is confident that the genomic revolution will increase the overall success rates of therapeutics in the pipeline. However, there is still risk that genomic revolution itself fails to materialize in any FDA approved therapeutic.

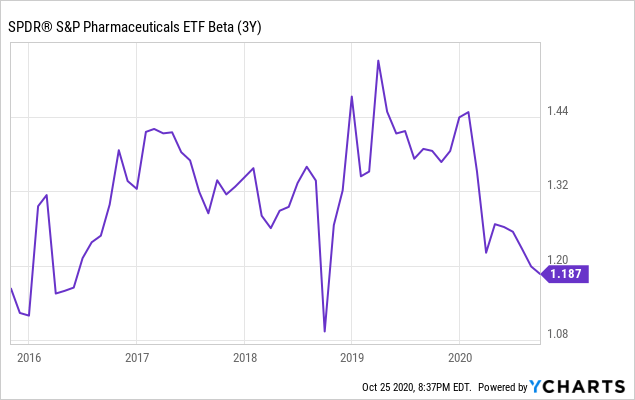

This known high failure rate is the reason pharmaceutical companies are often high risk stocks to invest in. These companies often pilot only one or few therapeutics at a time. A single piece of good or bad news about its clinical trials can skyrocket or crash the stock price instantly. It is no wonder that the S&P Pharmaceuticals ETF has much higher historical Beta than the S&P 500 (anchored at 1.0 Beta).

Data by YCharts

Data by YCharts

Despite this high failure rate risk, investing in a broad basket of companies targeting different angles of genomic revolution will mitigate an investor from overexposing to individual company failure risk. ARKG does that for you as it typically holds between 30 and 50 different genomic revolution companies at once.

The genomic and therapeutic industry is one that is difficult for the ordinary investor to grasp at a deep level, including myself. I believe that the industry as a whole is primed for innovation, but I would unlikely be able to choose the best companies for it. I would rather trust Wood, her team of research analysts, ARK's genomic industry contacts, and their successful track record to select companies with the best chance of succeeding in disruptive genomic revolution.

Risk 2: Long Time To Market

Even if a drug therapeutic successfully passed clinical trials, the average drug therapeutic takes six to seven years to pass. This isn't even counting the additional three to six year lead time to develop, research, and run tests on animals. While ARK believes genomics research will result in advanced machine learning and diagnostic techniques that will dramatically speed up development, products will still take years to develop.

This means that a lot of market events can happen as you wait for the companies in ARKG to succeed. This is par for the course for ARK ETFs as ARK focuses on the future long term potential of their holdings. If you are not comfortable with long-term uncertainty over a market cycle (5-7 years), you should not be investing in ARKG or other ARK ETFs.

Risk 3: Medicare For All

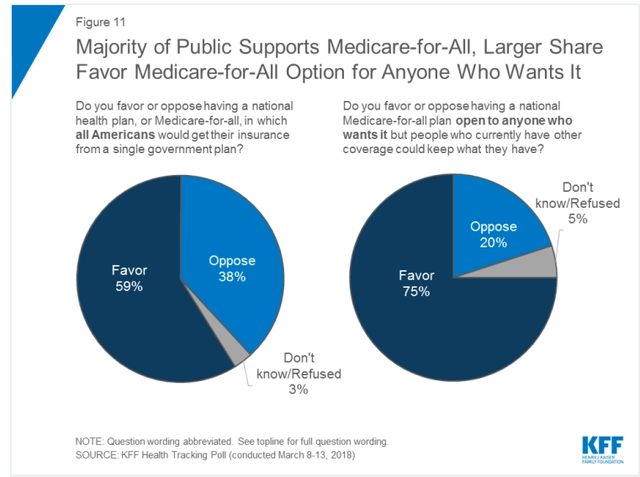

Medicare For All has been a big topic of discussion recently as the U.S. grapples with increasingly unaffordable health care costs. Most recently in the Democratic primaries, Bernie Sanders has made Medicare For All a big mantra on his platform. Though he did not win the nomination, it's worthwhile to discuss the impact of Medicare For All if it ever becomes a widely supported policy in the future.

Medicare For All would transform the U.S. health insurance industry into a single-payer system run by the government and funded through taxes. It would eliminate or significantly reduce the role of private insurance. There is some evidence that Medicare is able to reduce health costs with better bargaining power over that of private insurance.

If Medicare For All becomes the only payer, it would have significant leverage in negotiating drug prices as pharmaceuticals would be forced to accept whatever payment offered. This would significantly impact profitability of genomic revolution.

There is certainly significant support for Medicare For All from the public.

Source: Kaiser Health Tracking Poll

Source: Kaiser Health Tracking Poll

However, none of the Democratic presidential primary candidates other than Sanders supported a Medicare For All platform. The primary winner, Joe Biden, prefers to expand on the Affordable Care Act, which would not eliminate private insurers but simply expand access to Medicare.

Even if Medicare For All were to become policy in the distant future, ARK's research into the costs of genomic revolution shows that it would be orders of magnitude cheaper to produce therapeutics than existing methods, which creates a significant buffer against the pricing pressure from a Medicare For All policy.

Risk 4: Valuation

It is not possible to value companies in ARKG in the traditional sense. If you look at the top ten holdings, only one company has positive earnings and thus a legitimate P/E ratio. Very few of them have consistent historical revenue. This makes it very difficult to determine if you're getting good value when investing. This is very common for this industry as pharmaceutical companies often spend the bulk of their time investing in R&D and do not have significant products in market.

This is also par for the course for Wood's investment philosophy and ARK ETFs. You cannot value genomic revolution based on current revenues or profitability due to the inherent nature of the industry. Instead, you must look at future probability of success and the market size available for disruption. I trust Wood's team to make the best judgement call in selecting the best companies for that case.

Conclusion

I find the market opportunity for genomic revolution to be convincingly large and the promise of the technology to disrupt the existing industry is believable. The fact that genomic revolution currently flies under the radar in the realm of disruptive innovation makes it even more attractive for an investor.

I am long ARKG and will continue to add to the position unless I no longer believe ARK and Wood are heading in the correct direction with the fund based on their transparent research. If ARKG fits in your investment risk profile, this is a great opportunity to get in before the rest of the market understands genomic revolution.

Disclosure: I am/we are long ARKG, ARKK. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not a financial advisor. All recommendations here are purely my own opinion and is intended for a general audience. Please perform your own due diligence and research for your specific financial circumstances before making an investment decision.