FXC: Looking For Status As A Safe Haven

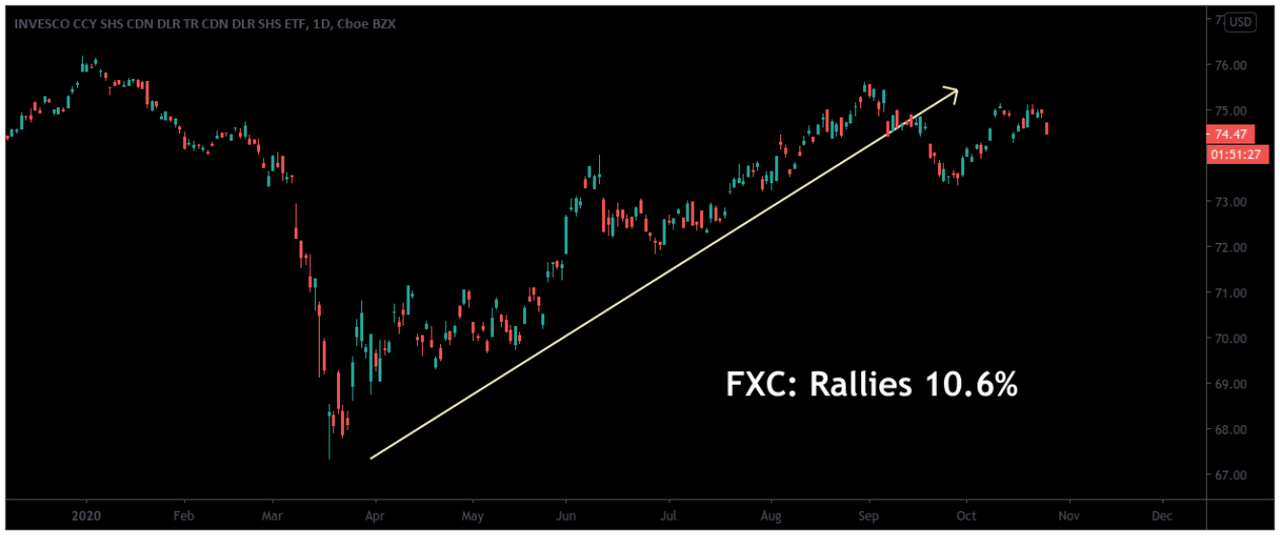

Invesco CurrencyShares Canadian Dollar Trust ETF has rallied by over 10% since March 18th, 2020.

However, market buying activity in FXC has resumed as coronavirus cases have increased and we think this is the type of bullish trend activity that is most likely to continue.

Primary resistance levels for FXC have developed near $81.49 (which marks the price low from September 2017 and an upside break here would suggest that the long-term downtrend has finished.

Once again, market uncertainty seems to be growing and the Invesco CurrencyShares Canadian Dollar Trust ETF (NYSEARCA: FXC) has gained by 10.6% while this negative momentum in sentiment has been building. In forex markets, this might be leading some investors to argue that instruments denominated in Canadian dollars are likely to be viewed as a dominant safe haven asset. However, it will be important for foreign exchange investors to continue to monitor trends in these areas because another surge in global coronavirus cases could change the dynamic in ways that push FXC from its recent highs.

Source: Author via Tradingview

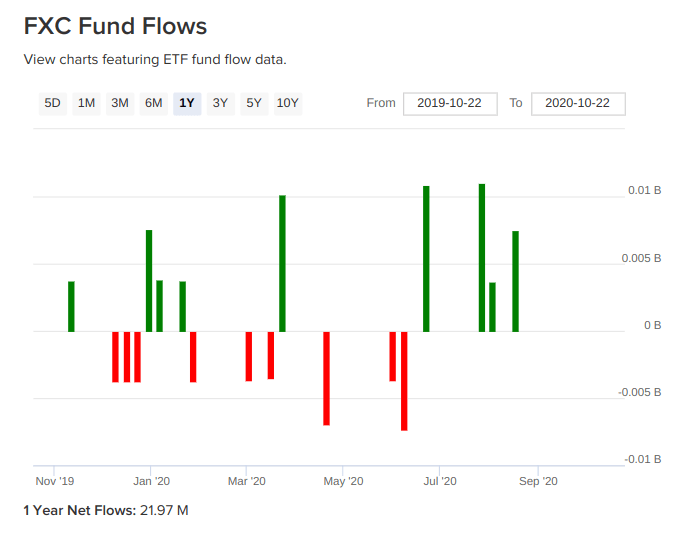

If we break down this rally, we can see that most of the recent buying activity in the Invesco CurrencyShares Canadian Dollar Trust ETF has been weighted toward certain periods that could be characterized as possessing higher-than-normal levels of volatility throughout the financial markets. Specifically, trends pointed in the negative direction with the Invesco CurrencyShares Canadian Dollar Trust ETF posting negative net flows to close the year 2019, but these bearish trends have largely reversed in the trading periods that have followed.

Source: ETFdb

Over the last one-year trading period, the Invesco CurrencyShares Canadian Dollar Trust ETF has generated positive net flows of 21.97 million. An analysis of this activity shows that FXC initially thrived in an environment of increased uncertainty as we start to see a surge in buying activity into the end of March 2020. Following this period, we see a few rounds of selling pressure, but this activity might have resulted, in part, from the initial easing of lowdown measures and new opportunities to take profits.

However, the market’s buying activity in FXC quickly resumed as coronavirus cases started to increase once again and we think this is the type of trend activity that is most likely to continue into the end of 2020. Of course, this outlook is largely based on the negative expectations for rising coronavirus cases during the winter seasonal period and this is why we might revise the outlook to contain a more bearish thesis in the event that true progress is made in delivering an effective COVID-19 vaccine to the North American public at large.

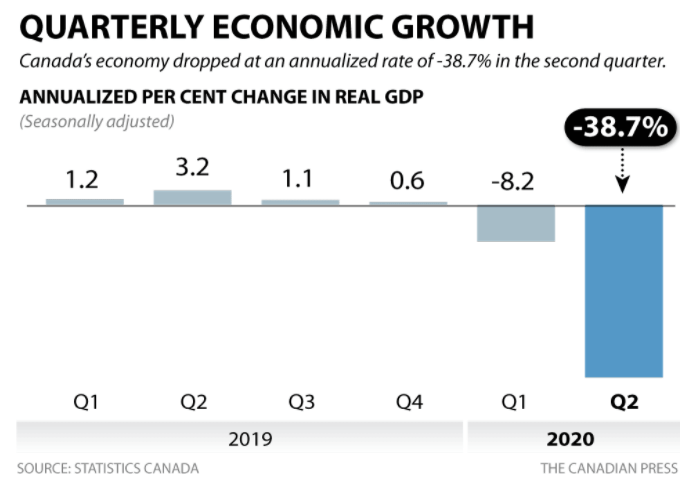

Source: Statistics Canada, The Canada Press

Additionally, forex investors that are focused on the bullish prospects for the Invesco CurrencyShares Canadian Dollar Trust ETF must also consider certain weaknesses in Canadian economic data which suggest that the economy could still face a difficult recovery period. Recent figures show that Canada’s economy contracted by -38.7% (seasonally adjusted) and this was the worst output figure on record. Since this period marks the second straight quarter of decline and this confirms that Canada has officially entered into recessionary territory.

On the plus side, monthly GDP figures have shown some improvements (with positive growth rates visible in both July and August). If this bullish trend continues, we could see another round of buying activity supporting net flows in the Invesco CurrencyShares Canadian Dollar Trust ETF and this would likely take the fund even further in terms of its ability to attract safe haven buying during periods of continued economic uncertainty.

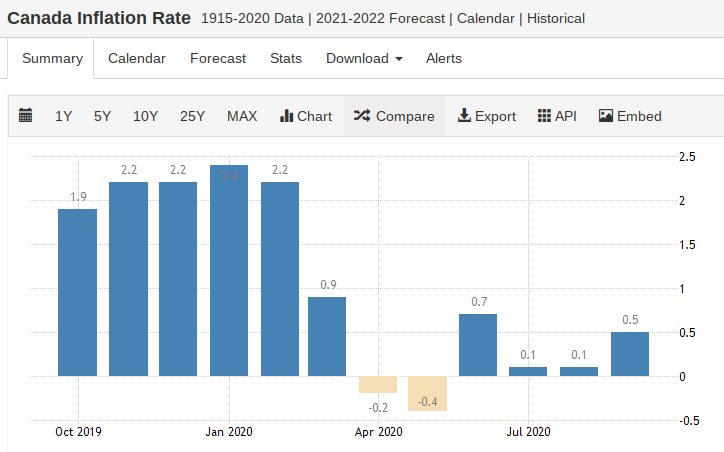

Source: Trading Economics

Another area of the underlying economy that could start to weaken prior rallies in the Invesco CurrencyShares Canadian Dollar Trust ETF might be found in the long-term inflation rate. Limited evidence of inflation tends to be an area of concern for investors focused on assets in the foreign exchange markets and the post-coronavirus economy in Canada is showing evidence that this might be the case. Regional inflation figures for September showed some improvements but gains in pricing pressures were muted at just 0.5% and these are levels that are unlikely to excite bullish investors.

Source: Author via Tradingview

Going forward, Canada’s inflation rate might be one of the best indicators when defining an outlook for currency assets like the Invesco CurrencyShares Canadian Dollar Trust ETF. Evidence of rising inflation should bring additional buying in the underlying value of the Canadian dollar itself. If this occurs, foreign exchange investors will need to define certain technical resistance levels that might be able to contain prices into the end of 2020.

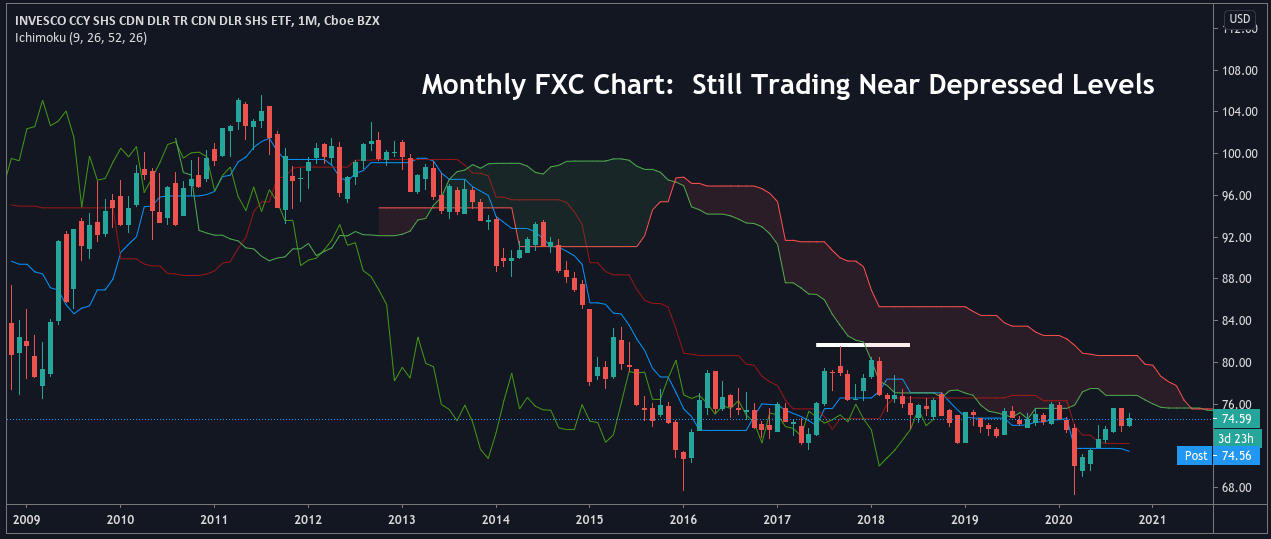

Monthly charts for the Invesco CurrencyShares Canadian Dollar Trust ETF show that FXC is still holding near long-term lows. Recent rallies have done little to send the Invesco CurrencyShares Canadian Dollar Trust ETF back toward its longer-term averages and we think these trends work in favor of long positions. Primary resistance levels have developed near 81.49 (which marks the price low from September 2017.

An upside break here would suggest that the long-term downtrend has finished and this would be an encouraging sign for investors holding long positions in the Invesco CurrencyShares Canadian Dollar Trust ETF. On balance, technical signs suggest that FXC might be on the verge of breaking above its Ichimoku Cloud resistance zone but a failure to successfully complete this move could be an area of concern going forward.

Thank you for reading. Now, it's time to make your voice heard.

Reader interaction is the most important part of the investment learning process. Comments are highly encouraged! We look forward to reading your viewpoints.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.