Genworth Primed To Gap $1 Higher

The current stock price of Genworth reflects a reverse head and shoulder pattern, the most powerful pattern for higher prices.

The stock price is now breaking over 7 month highs and imminent news is expected in the next 10 business days.

I expect to see rumors from Deal Reporter/Bloomberg or an incredible funding update from Genworth in the next ten business days.

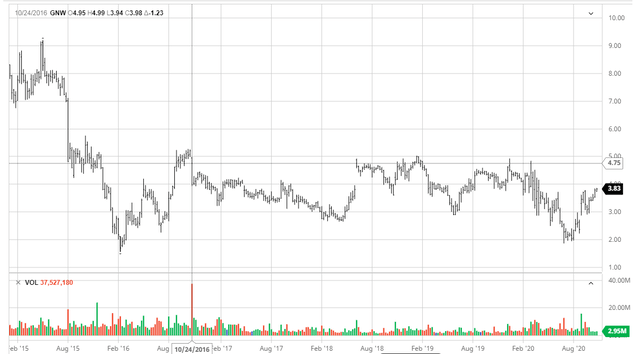

On October 23, 2016, China Oceanwide (OTC:HHRBF) and Genworth Financial (GNW) entered into an acquisition transaction whereby China Oceanwide will pay $5.43 per share all cash to buy Genworth from current shareholders at the time of the closing. If you look at the chart of the stock GNW since then, it has been a rough go for shareholders. More recently the chart is completing a reversal head and shoulders pattern:

You'll notice that Genworth just set new 7 month highs of $3.87. This is still a far cry from the buyout price of $5.43. Most importantly, people seem to be forgetting that Genworth comparables Radian Group (RDN) and MGIC Investment Corp. (MTG) are doing well. In theory, the worst case estimated value of acquisition failure should have an increasing share price estimate, raising the estimated value of Genworth even with low merger probability completions. Meanwhile, here I am estimating that the merger completion probability is closer to 100%.

Investment Thesis: The stock market seems to be overdiscounting Genworth Financial. It took far longer than expected for the companies to get all the governmental blessings required to make this deal happen. That said, at this point in time, with the merger set to close next month, I think that all it takes is an announcement from China Oceanwide and Genworth that there is a finalized agreement with Hony to provide the offshore financing and that the onshore money is pending SAFE approval to send Genworth over $4.75. In theory, the deal could then subsequently close within a week or two, a solid subsequent 14% return in the following two weeks for those who want to get paid a few years of normal market returns these days to wait. If you do the math on the email from Genworth's CEO, we are now past the end of the Chinese Mid-Autumn festival plus a mandatory 14-day quarantine which China Oceanwide said it would need to get through to finalize the funding because it wants to meet Hony Capital in person to finalize the funding. Further, by this Saturday, October 31, China "Oceanwide needs to provide satisfactory evidence that the necessary funding will be available to close the transaction by November 30." The CEO closed that email by saying

Thank you again for your patience as we await Oceanwide's completion of the transaction funding process. We're very close, and I'll be back with an update when I can.

The current stock valuation seems to place literally no value on what the CEO of Genworth is saying to Genworth's employees. The current stock valuation seems to suggest that this transaction has no chance of closing this year, much less this next month. The purpose of this article is to go through the time frame here to explain the market's perspective and why I think it's wrong.

Explaining Historical Prices Above $4.75

If you look at the GNW price chart, back when the deal was announced in October of 2016, the stock price was over $4.75:

Secondly, in June of 2018 when the Committee on Foreign Investment in the United States completed its review of the acquisition, the stock jumped over $4.75.

Thirdly, at the end of 2018, when Genworth announced that Delaware, Fannie Mae and Freddie Mac approved the proposed acquisition, the stock jumped over $4.75.

Fourthly, in early 2019, when Virginia and New York regulators approved the acquisition, the stock jumped over $4.75.

Fifth, in late 2019 because Genworth was struggling to get Canadian regulators to approve the transaction, the stock jumped over $4.75 when Genworth sold its stake in Genworth MI Canada Inc. to Brookfield Business Partners.

Last but not least, earlier this year, when an agreement was reached with the New York regulator, the stock price jumped over $4.75.

So what you have here is a history of news based price spikes, where the news breaks and people get excited that the deal will close imminently and those hopes and dreams are crushed. Not one of these times played out. More had to be done. Genworth was expecting that after this last update, the deal would close very quickly. Genworth said in their press release optimistically:

Once these items are resolved, Oceanwide will be in a position to request clearance in China for the currency conversion and transfer of funds in order to complete the transaction.

Unfortunately, after receiving all of the regulatory approvals necessary to complete the acquisition, COVID-19 caused a funding crisis. The COVID-19 crisis crashed the stock down to $2 as the funding was jeopardized.

Funding Progressing Nicely

In April of 2020 China Oceanwide ran into issues funding the transaction which brought on delays:

Genworth and Oceanwide remain committed to the transaction and are still targeting closing towards the end of May, if feasible. However, given the unprecedented market disruptions due to the coronavirus pandemic, Oceanwide and Genworth previously extended the deadline to no later than June 30, 2020 to provide the parties with additional time if needed to close the transaction.

In June 2020, China Oceanwide still needed more time:

The extension gives Oceanwide additional time to finalize the financing for the transaction purchase price of $5.43 per share, which may include debt funding of up to $1.8 billion through Hony Capital and/or other third parties. Oceanwide has indicated that the financing has been delayed due to the COVID-19 pandemic and uncertain macroeconomic conditions.

That said, by August 31, Genworth now demanded that China Oceanwide provide proof of funding progress:

Genworth and Oceanwide have also agreed to additional interim milestones. Specifically, the 15th waiver contemplates the submission by Oceanwide to Genworth of evidence by August 31, 2020 confirming that:

Approximately $1.0 billion is available to Oceanwide from sources in Mainland China to fund the acquisition of Genworth; and

Hony Capital and/or other acceptable third-parties have committed to provide Oceanwide $1.0 billion or more from sources outside of China to fund the transaction.

Most recently, Genworth announced that China Oceanwide and Hony Capital had come to a general agreement on the key commercial terms and conditions of its $1.8B offshore financing plan. The deal close was extended to November 30th with an interim checkpoint step of October 31, "by which time Oceanwide needs to provide Genworth with satisfactory evidence that the necessary funding will be available to close the transaction by November 30."

What This All Means Right Now

For Hony Capital to reach a general agreement on the key commercial terms and conditions with China Oceanwide, they would have had to extend an offer to China Oceanwide, which China Oceanwide would have had to have accepted. As is customary in Asian culture, in order to finalize the deal, China Oceanwide and Hony Capital want to meet in person, according to the CEO of Genworth's email to staff. If you study the timeline, it is now more than 14 days after the holiday and as such it is reasonable to suspect that China Oceanwide is now meeting face to face with Hony Capital working to finalize the funding part of the transaction, which is really the only piece left. This could take a couple days once they get the pieces in place.

The stock valuation of $3.83 is significantly less than $5.43 which seems to suggest that the finalization of the acquisition is nowhere near as close as what it seems to be to me. Although they could close this week, I doubt that they do. It will be interesting to see if they race to complete this before the election. An update is due to Genworth this weekend. I expect that Deal Reporter and other news sources that make it their business to cover stuff like this will report some sort of update later this week.

Latest Updates And What They Mean

Brookfield Business Partners announced it would buy the rest of Genworth MI Canada for $1.2B. This is good news as it reflects that Brookfield wants to buy out the rest of shareholders before everyone realizes that Mortgage Insurance companies are undervalued. Genworth's intrinsic value is tied to the mortgage insurance industry and the better the industry is doing the stronger Genworth's valuation should be in a non-acquisition scenario. If business trends continue to improve, it would seem to me that by this time next year Genworth would be subsequently worth more than their buyout price of $5.43. I am confident that this notion is not lost on China Oceanwide which stands to make billions of dollars on this acquisition in the coming years.

China Oceanwide also owns a portion of Ant Financial. Ant Financial is set to be the world's largest IPO. China Oceanwide's stake is worth around $1.4B USD.

China Oceanwide owns a portion of Playtika. Playtika filed for U.S. IPO this month. China Oceanwide's stake is worth around $1B USD.

- China Oceanwide just raised 4.2B RMB ($630M USD equivalent) by selling 27% of Minsheng Securities Co., Ltd.

- China Oceanwide is looking for 2.7B RMB ($400M USD equivalent) line of credit from China Minsheng Bank Co., Ltd.

Note that the onshore portion of the financing for the Genworth acquisition is $1B USD, so the two cash raising financing operations above look great from an acquisition standpoint.

China Oceanwide extended its agreement to sell Oceanwide Center to Hony Capital to December 31, 2020. Hony Capital is the related firm funding the debt based portion of this LBO to buy Genworth.

The country China is now looking to ramp up offshore investments with $10B issuance of new quotas. China Oceanwide sending $1B to buy Genworth would be a step in this direction. I have long argued that the SAFE approval to remove the funds from China is perfunctory and this news supports that notion.

These are all good updates that show the power and value of Genworth's business as well as illustrate the power and size of China Oceanwide as well as how the country of China is looking to encourage more of these sorts of deals.

Summary and Conclusion

I expect that the next deal financing update will be worth around $1 of upside to Genworth stockholders because of how imminent $5.43 is with funding in place and that is the last step and it is already pending and agreed to. It is just a matter of finishing it up and sending the money.

With a deal nearly done, it is amazing to me that the upside to the deal close price isn't 0-10%. Instead it is 41%. As such, I expect this gap to close in the very near future as the price skyrockets on news and market acceptance that the deal is getting done instead of the apathy right now that seems to suggest that it's not missing out on anything major. The difference is about a billion dollars between a done deal and right now in market capitalization and that ought to be worth someone's time but the way the market is structured these days is pretty crazy and I've seen worse.

Given that the price historically has tended to spike over $4.75 on deal news, I expect that to happen this time, except this time I expect the deal to close. At this time, quarantines have theoretically ended and Hony is working on finalizing and signing the deal with China Oceanwide. I am curious to see if deal news leaks near the end of this week.

Disclosure: I am/we are long GNW. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.