Old National Bancorp: Revenue Initiatives To Support Earnings In A Low Rate Environment

Management’s efforts to expand the team and cut costs elsewhere through the ONB Way initiatives will likely support earnings in the coming quarters.

Earnings will most probably face downward pressure from lower asset yields.

ONB’s credit risk is currently fairly low as active deferrals made up just 1% of total loans at the end of September.

The target price for the mid of next year suggests a high upside from the current market price; hence, I’m maintaining a bullish rating on ONB.

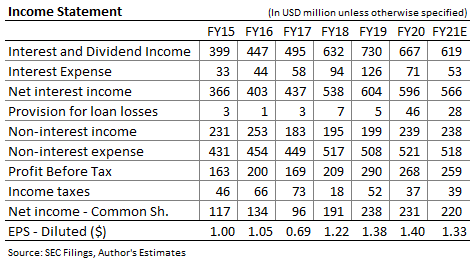

Earnings of Old National Bancorp (NASDAQ: ONB) surged to $0.47 per share in the last quarter from $0.32 per share in the second quarter of 2020. Unusually high gain on sales of securities and nil provision expense drove the increase in earnings. The management is currently in the process of expanding ONB’s team, which will support earnings in the coming quarters. Further, the cost-cutting initiatives announced earlier under the ONB Way program will support earnings. On the other hand, pressure on asset yields in a low interest rate environment will hurt the bottom-line. Overall, I’m expecting ONB to report earnings of $0.48 per share in the fourth quarter, which will take full-year earnings to $1.40 per share. For 2021, I’m expecting ONB to report earnings of around $1.33 per share due to lower asset yields and normalization of gains on sales of securities. The June 2021 target price suggests a high upside from the current market price; hence, I’m maintaining a bullish rating on ONB.

Expansion Efforts to Compensate for Paycheck Protection Program Loan Forgiveness

ONB’s loans grew at a decent rate of 2.0% in the September-ending quarter, on a linked-quarter basis. Loans will likely continue to grow in the coming quarters because of the management’s expansionary efforts. As mentioned in the third quarter’s conference call, the management expects to hire team members in the Private and Commercial banking segments, which will likely drive loan growth in the coming quarters. Further, the management mentioned in the conference call that ONB ended the September-ending quarter with a record $2.9 billion commercial pipeline, which will drive the loan portfolio.

On the other hand, the forgiveness of the Paycheck Protection Program (“PPP”) loans will pressurize loan growth. As mentioned in the third quarter’s investor presentation, ONB had $1.5 billion of PPP loans outstanding at the end of the last quarter. I had previously expected most of the PPP loans to get forgiven in the fourth quarter of 2020. However, I’m now pushing forward the expected timeframe because the management mentioned in the presentation that it expects the PPP runoff to begin in the fourth quarter but the majority of the forgiveness to happen in 2021.

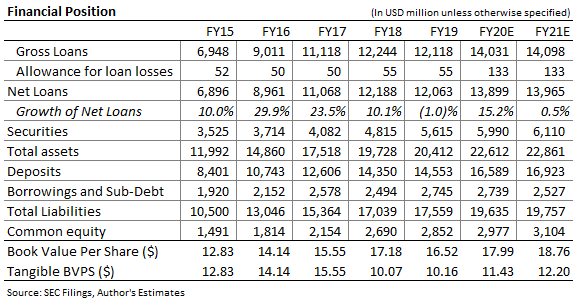

The slowdown in the economic activity amid the COVID-19 pandemic will also most probably hurt loan growth. Overall, I’m expecting ONB’s loans to grow by 1% quarter-over-quarter in the fourth quarter of 2020, followed by 0.5% year-over-year in 2021. The following table shows my estimates for loans and other balance sheet items.

ONB Way Savings to Offset Higher Expenses from Team Expansion

As mentioned in the conference call, ONB is ahead of schedule in achieving expense savings through initiatives under the ONB Way program. Under the program, the company consolidated its branch network earlier this year, which will keep the non-interest expense low in the coming quarters.

On the other hand, ONB’s initiatives to increase revenue under the ONB Way program will likely lift non-interest expenses. The management mentioned in the conference call that it has already hired some personnel to increase revenues. Further, the management expects to hire more personnel in Wealth Management, Private Banking, Commercial, Treasury Management, IT, and digital marketing. The management expects these hires to put near-term pressure on personnel costs over the next few quarters but ultimately lead to higher revenue from these growth initiatives. The management estimates an impact of $5 million on expenses in 2021, as mentioned in the conference call.

I’m expecting the management’s revenue-based initiatives to counter the expense-saving initiatives in the coming quarters, leading to mostly stable non-interest expenses next year.

Expecting Full-Year Earnings of $1.40 per Share

Low loan growth and expense savings from branch consolidations will likely support earnings in the quarters ahead. Further, as mentioned in the conference call, costs will likely move marginally lower as borrowings and certificates of deposits will reprice at maturity. However, the management does not expect the funding cost reduction to be sufficient to offset declines in asset yields. Considering these factors, I’m expecting ONB to report earnings of $0.48 per share in the fourth quarter, which will take full-year earnings to $1.40 per share. For 2021, I’m expecting ONB to post earnings of around $1.33 per share. The following table shows my income statement estimates.

There is a chance of an earnings surprise because of the uncertainties related to the COVID-19 pandemic.

Improvement in Loans Requiring Payment Accommodations Shows Credit Risk is Low

Loans requiring payment deferrals made up just 1% of total loans at the end of the last quarter, as mentioned in the presentation. This is a substantial improvement from the June-ending quarter when ONB allowed payment deferrals on 11% of total loans, as mentioned in the second quarter’s presentation. The sharp reduction in the portion of loans requiring payment accommodations shows that the credit risk is now at a manageable level. Further, hotels made up just 0.7% of total loans at the end of the last quarter, as mentioned in the third quarter’s presentation. The hotel industry is the only segment that I expect will continue to suffer through the mid of 2021.

Maintaining a Bullish Rating Due to High Upside, Low Risk

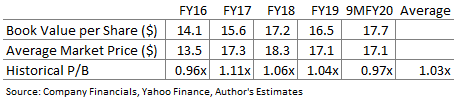

I'm using the average price to book ratio, P/B, to value ONB. As shown in the following table, ONB has traded at an average P/B multiple of 1.03 in the past.

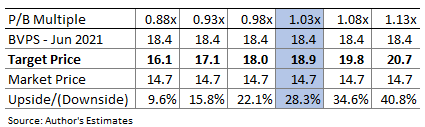

Multiplying this average P/B ratio with the forecast June 2021 book value per share of $18.4 gives a target price of $18.9 for the mid of next year. This price target implies an upside of 28% from ONB's October 23 closing price. The following table shows the sensitivity of the target price to the P/B ratio.

ONB is also offering a modest dividend yield of 3.80%, assuming the company maintains its quarterly dividend at the current level of $0.14 per share. I’m not expecting a dividend cut because the earnings and dividend estimates suggest a payout ratio of 42% for 2021, which is sustainable. Further, the common equity tier I ratio stood at 11.84% at the end of the last quarter, as reported in the amendment to the earnings release. This ratio is comfortably above the minimum regulatory requirement of 7.0%; therefore, there is little pressure of a dividend cut from regulatory requirements. Moreover, the management mentioned in the conference call that it expects to maintain the current dividend.

As discussed above, ONB is currently facing a low level of credit risk due to the limited amount of loans requiring payment accommodations. Considering the high upside, modest dividend yield, and low credit risk, I’m adopting a bullish rating on ONB.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: This article is not financial advice. Investors are expected to consider their investment objectives and constraints before investing in the stock(s) mentioned in the article.