International Seaways: Either A Bargain Or A Value Trap

International Seaways is seen as one of the top shipping stocks for Q4 2020.

The company reported a net income of $64.4 million in Q2 2020, compared to a net loss of $16.5 million in Q2 2019.

Undervalued stock with a trailing P/E ratio of 4x, with analyst upside of 103.9%.

Stocks aren't cheap and popular at the same time.

- Unknown

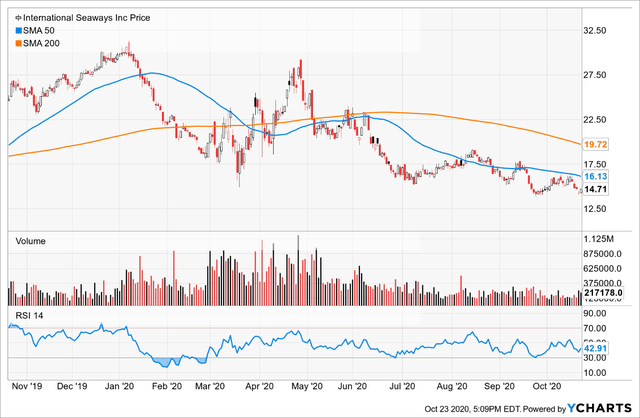

Stocks involved in petroleum have been hit hard since March. Whether the company is directly involved in oil refining, exploration, or transportation, these stocks are largely dependent on crude oil prices and demand. Clearly, if 2020 has shown us anything, it is that these are largely dependent on forces beyond anyone's control. While oil prices have recovered, they are nowhere near pre-pandemic levels and are continuing to slog. As long as COVID-19 is around, stocks involved in oil could have a long, choppy recovery.

While certain stocks and industries have experienced robust returns since the bottoms of March, other stocks have not. Many of these stocks, especially in the oil and gas sector, are extraordinarily undervalued and at attractive entry points. They generally have better financials than overvalued tech names, and are also managing to grow their net income. Certain stocks, such as International Seaways Inc. (INSW), offer investors attractive multiples and attractive financials. While many analysts and investors want to avoid any stock with remote association to energy, others are just starting to notice the upside potential.

Opportunities In The Shipping Space

International Seaways, Inc. owns and operates a fleet of crude oil and petroleum transportation vessels. While stocks involved with oil still pose significant risks, the upside potential for stocks such as International Seaways is immense. Although the company primarily transports crude oil and petroleum products, the shipping industry includes companies that transport any sort of cargo around the world. Shipping stocks were some of the hardest hit when the coronavirus began ravaging the world. In fact, the Invesco Shipping ETF stopped trading after plummeting so much. However, individual stocks such as International Seaways, with strong financials and low valuations, are prime to be bought low right now and could be at the forefront of a recovery rally once the world begins to return to normal.

International Seaways Net Income Actually Grew Despite the Energy and Shipping Rout

While the energy and the broader shipping sectors were crushed in Q1 and Q2 2020, International Seaways managed to grow its bottom line. While these sectors are still trying to dig themselves out of the mud in Q3 2020, International Seaways actually managed to post its highest quarterly net income in Q2 2020 since going public. This is staggering considering the headwinds that these industries are up against. International Seaways reported net income of $64.4 million in Q2 2020, compared to negative $16.5 million in Q2 2019. This is an astounding growth rate and year-on-year improvement.

Analysts See Significant Upside

While many analysts are continuing to avoid shipping and energy, there is a noticeable trend of analysts believing that this sector has bottomed out with upside. International Seaways certainly falls into this category. In fact, Investopedia rated International Seaways as its top undervalued shipping stock for Q4 2020. As of now, the stock is trading at $14.13 a share. Based on 7 analyst upside price targets, International Seaways has an average upside potential of 103.9%, with one price target as high as $40. Major investment firms such as Jefferies and Stifel also reinitiated "Buy" ratings in the last week. Jefferies, especially, is bullish on the company and believes that the stock is going to recover with a $26 price target.

Summarizing the financials and valuation level

For a stock that is trading near its 52-week lows, International Seaways sure has a lot of things to like about its finances. Management has been aggressively buying back shares, and the company has maintained its dividend payments with a yield of 1.6%.

International Seaways has a forecasted revenue growth of 38.5% in 2020, and as previously mentioned, saw its Q2 2020 net income hit an all-time quarterly high as a publicly traded company.

The stock also has a perfect Piotroski Score of 9, indicating healthy, liquid balance sheets, profitability, and operating efficiency. The Piotroski Score scores companies highly when they have a positive ROA, positive Operating Cash Flow, positive Gross Profit, low leverage, and high levels of positive change. With an ROA of 5.6%, asset turnover of 0.3x, operating cash flow margin of 37.2%, gross profit margin of 58.3%, current ratio of 4.0x, and quick ratio of 1.8x, it is no wonder why International Seaways’ Piotroski Score is perfect. While the Piotroski Score does not take ROE into consideration, International Seaways’ ROE of 9.9% is quite solid as well. The company is clearly resilient and profiting effectively from assets and operations, while being able to meet all of its short-term obligations.

With strong financials able to withstand the COVID-19 downturn in its sector, combined with analyst upside and low multiples, International Seaways is at an attractive entry point. With a trailing P/E ratio of 4x, forward P/E ratio of 2.8x, and a 0.4x P/B ratio, the company looks quite undervalued.

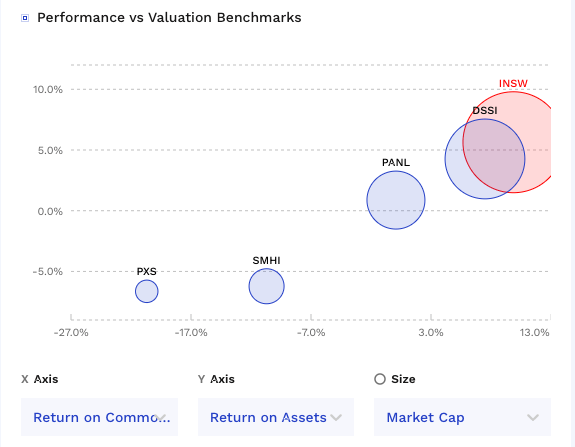

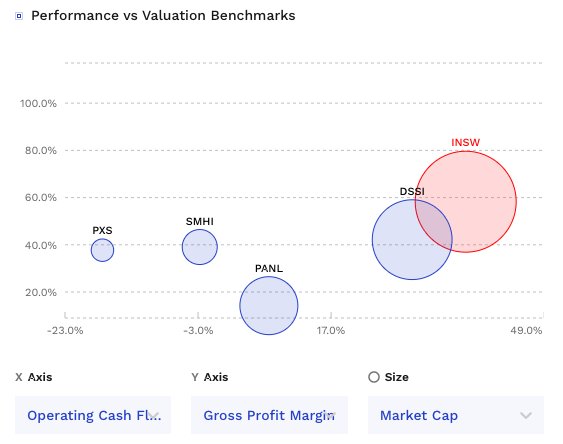

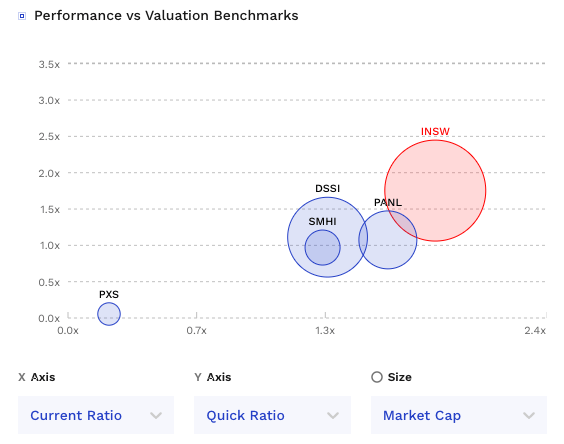

Let’s compare International Seaways to its main competitors according to Finbox: SEACOR Marine Holdings (SMHI), Pangaea Logistics Solutions, Ltd. (PANL), Pyxis Tankers Inc. (PXS), and Diamond S. Shipping Inc. (DSSI)

First and foremost, International Seaways’ ROE and ROA are considerably higher than those of its competitors. The only company whose ROA and ROE can remotely compare to International Seaways’ is Diamond S. Shipping, with an ROA 4.3% and ROE of 7.5%.

(Source: Finbox)

International Seaways’ operating cash flow margin of 37.2% and gross profit margin of 58.3% easily trumps its competitors as well. Once again, the only company that really competes with International Seaways is Diamond S. Shipping, as it has an operating cash flow margin of 29.2% and gross profit margin of 42.2%. Many of International Seaways’ competitors actually have negative figures as well.

(Source: Finbox)

With a current ratio of 4.0x and quick ratio of 1.8x, the company is also considerably better-positioned than its competitors to fulfill its short-term obligations.

(Source: Finbox)

It’s also worth mentioning that while International Seaways has a perfect Piotroski Score, none of its competitors do. While Diamond S. Shipping has a comparable score of 8, Pangaea Logistics has a score of 6, Pyxis Tankers has a score of 5, and SEACOR Marine Holdings has a score of 4.

Risks involved in INSW

Could it be further off from a rebound than we think? Based on revised earnings forecasts, and EPS misses in 3 of the last 4 quarters, there are definitely things to be concerned about. 90 days ago, International Seaways had a forecasted EPS of $1.82 for Q3. That estimate has been slashed by nearly 2/3rd to only $.65 EPS. While analysts have largely increased their earnings estimates for companies in Q3 throughout the quarter, International Seaways has not followed this trend. This does not bode well for its recovery prospects. The company's forecasted revenue also has a negative 5-year CAGR of -6.7%.

Low Altman Z-Score indicates bankruptcy risk: Ideally, stocks want an Altman Z-Score of 3 or higher. This indicates solid financial positioning. While Z-Scores between 1.8-3 indicate moderate bankruptcy risk, they are still acceptable scores. Anything below 1.8, let alone 1.0, is serious cause for concern. International Seaways has an Altman Z-Score of 0.9. That is extremely unsettling. Although the company has a perfect Piotroski Score, and the Altman Z-Score is not always a perfect indicator of impending bankruptcy, this low score is still something to be very concerned about.

Energy and shipping still pose significant risks: Energy prices and demand, while somewhat recovering from April lows, are nowhere even close to pre-pandemic levels. Everything ranging from geopolitical issues to slowing demand in air travel, to less cars on the road, affects oil demand. This, in turn, affects stocks involved in shipping the commodity. In fact, the broader shipping industry has been arguably impacted as heavily by COVID-19 as energy. A stock involved in both, such as International Seaways, could see even more pain in the future if things don’t start improving soon.

Takeaway for investors

Investing in companies heavily involved in shipping oil poses significant risks. Nobody knows when life will start returning to normal, and nobody knows when oil demand will approach pre-pandemic levels, if it ever does. While International Seaways offers a rare trifecta with an enticing valuation, strong financials, and upside potential, it certainly offers significant risks as well. There are both asset-specific risks and macro sector-level risks.

While the company is resilient, and its Q2 bottom line and perfect Piotroski Score reflect that, this could easily change if the COVID-19 world becomes the new normal. The company has significant bankruptcy risk, according to its Z-Score, and investing in underpriced oil tanking stocks could be a classic value trap. The stock offers significant upside with significant risks. Before taking the plunge and buying this stock, be sure to self-evaluate your risk tolerance. The financials are strong and the upside is enticing; however, no investor ever wants to catch a falling knife.

*Like this article? Don't forget to click the Follow button above!

Subscribers told of melt-up March 31. Now what?

Subscribers told of melt-up March 31. Now what?

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you'll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.