Rolls-Royce has secured support to tap investors for £2bn and guarantee a hefty war chest to ride out the coronavirus crisis.

The aerospace firm - hit by a pandemic plunge in revenue - asked shareholders to back the heavily-discounted rights issue on the basis it would unlock £3bn in additional debt options to navigate the COVID-19 disruption.

Rolls, which is paid based on the number of hours its engines fly, had said that having the additional £5bn at its disposal would take "any liquidity questions off the table through this crisis".

The company reported that 99.5% of shareholders supported the rights issue vote.

The cash call sees existing investors offered 10 new shares for every three they own at 32p each - a discount of more than 40%.

Chief executive Warren East had placed shoring up the company's finances at the top of his agenda following a "sharp deterioration" that culminated in a record half-year loss of £5.4bn.

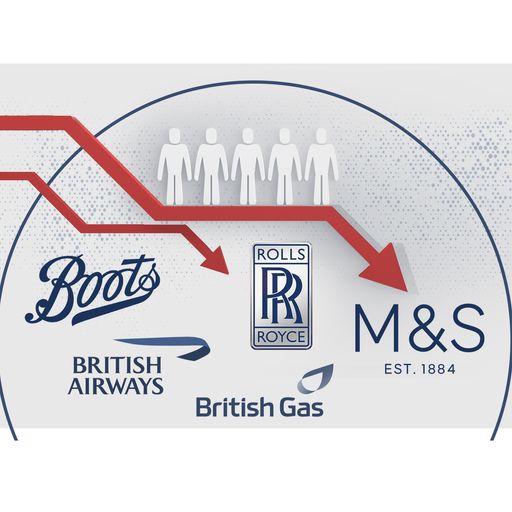

Rolls launched a £1.3bn cost-cutting plan, including 9,000 job losses, as it adjusted to the collapse in demand for international travel.

It has confirmed a development, first reported by the Financial Times, that staff have been informed of the possibility of temporary factory closures and reductions to working hours and benefits as the crisis evolves.

Rolls-Royce has signalled that no decisions have been taken on any additional cost-saving measures.

Mr East told investors ahead of the rights issue vote: "We didn't want to put the business and our shareholders' interests at risk by gambling on what the situation might look like in the middle of next year."

Shares, which remain two-thirds down in the year to date, were trading 2.4% lower on Tuesday.