Honda Motor: Pivoting To The EV Market

Honda is slowly establishing a stronger presence in the EV market, as it plans to become a manufacturer of environmentally friendly cars.

While the pandemic hurt the company’s profitability in Q1, there’s an indication that Honda’s business is recovering.

I believe that, at the current price, Honda is a bargain.

By extending its partnership deal with GM (GM) and announcing its retirement from Formula 1, Honda Motor (HMC) is signaling to investors that it wants to establish a stronger presence in the EV market and become a manufacturer of environmentally friendly cars in the next few decades. While the pandemic hurt the company's profitability in Q1, there's an indication that Honda's business is recovering and is on track to achieve¥200 billion in operating profit in this fiscal year. As the company's stock trades below Wall Street consensus price target, I decided to open a long position in it, as I believe that at the current price Honda is a bargain.

Path to an All-Electric Future

For decades, Honda has been one of the most well-known cars and motorcycle manufacturers in the world, thanks to the popularity of its core car products from the Civic, Accord, CRV, and Acura lines. Earlier this year, the company has been disrupted by COVID-19, which brought some of its operations to a complete halt and brought its revenues to record low levels. In Q1, Honda's total sales declined by 46.9% Y/Y to¥2.12 trillion, while its operating loss for the period was¥113.6 billion, which is a decrease of¥366.1 billion from a year before. In addition, its net loss from April to June was¥80.8 billion, which is also a decrease of¥253.1 billion in comparison to the same period last year.

Despite the decline in sales, there's now an indication that the company is slowly recovering from the pandemic, and it has all the chances to return to profitability in the following months. In September, its total sales were up 11.5% Y/Y, as the company managed to sell ~12,7000 vehicles. In addition, sales of Honda's Acura line-up were up 16.6% Y/Y, while the company's truck sales were up 19.9% Y/Y.

Going forward, Honda will greatly benefit from the restructuring that occurred earlier this year. While the pandemic disrupted the company's operations at the beginning of the year, it also acted as a catalyst for change. As Honda's factories were shut down for a while, the company finally decided to centralize all of its R&D, sales, and engineering activities under one structure. In the past, the company's different divisions were working as decentralized silos, which decreased Honda's overall efficiency. Now, with a centralized structure, Honda hopes to improve its overall business performance and thrive in a post-pandemic world.

In addition, Honda plans to play a bigger role in the ever-growing EV market. In April, Honda signed a partnership agreement with General Motors to create two new electric vehicles on Ultium batteries, using GM's EV platform. A few months later, both companies strengthened their partnership deal by creating a North American Alliance, the goal of which would be to decrease the cost of developing EVs and unlock synergies by cooperating tighter in North America. Such a move shows that Honda is committed to becoming a manufacturer of environmentally friendly vehicles. Its recent decision to exit the Formula 1 Championship as a provider of combustion engines to Red Bull Racing and AlphaTauri shows that the company is serious about the development of clean energy cars. As the world goes carbon-neutral and environmental regulations become stricter with every year, such a decision to pivot into the EV market makes sense.

The biggest risk to Honda at this stage comes from its own management team. Due to the conservative Japanese corporate culture, it takes a long time for companies to implement radical changes from within. The latest example with Nintendo (OTCPK:NTDOY), which took too long to enter the mobile gaming market, and after two years after entering, it decided to abandon it, shows that the Japanese corporate culture is resistant to change, and often, this leads to the destruction of shareholder value. That's one of the main reasons why it took a while for Honda to abandon its silo structure and centralize its business processes to become more efficient. Considering this, there's still a risk that Honda might return to the old way of doing things or decides to slow down on its EV expansion if the restructuring will be too fast.

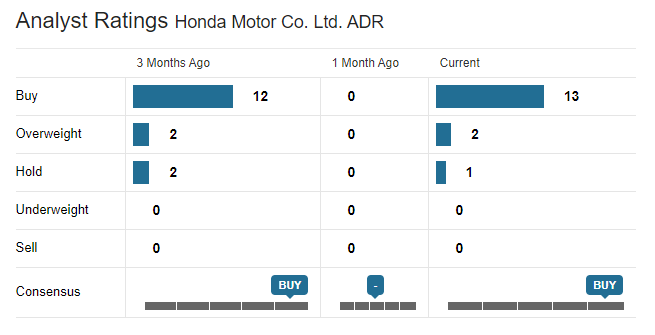

Despite this, the good news is that Honda has ¥2.61 trillion in cash reserves, which will help it to create shareholder value in the following years. By having 13 'Buy' ratings and a consensus price target of $31.54, Honda should be considered undervalued at the current price, as its downside as of today is limited.

Source: WSJ

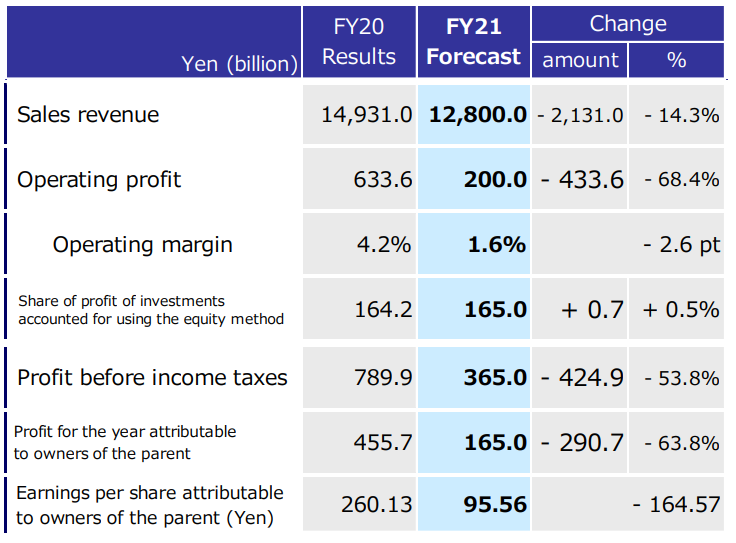

Going forward, Honda sees a gradual recovery of its business by the end of the fiscal year, and the growth of its sales in September shows that that will indeed be the case. For FY21, Honda expects its revenues to be¥12.8 trillion, which is a decline of 14.3% Y/Y, and it also forecasts its profit before income taxes to be¥365 billion, a decline of 53.8% Y/Y. Considering the company's performance in Q1 and in September, it's safe to say that Honda will be able to achieve those goals and later return to growth in the next few years, as it could be considered one of the unexpected winners of the EV market in the next couple of decades due to its commitment to go carbon-neutral. For that reason, I'm long Honda.

Source: Honda

Disclosure: I am/we are long HMC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.