SGOL Weekly: Positioning Set To Remain Bullish In Near Term

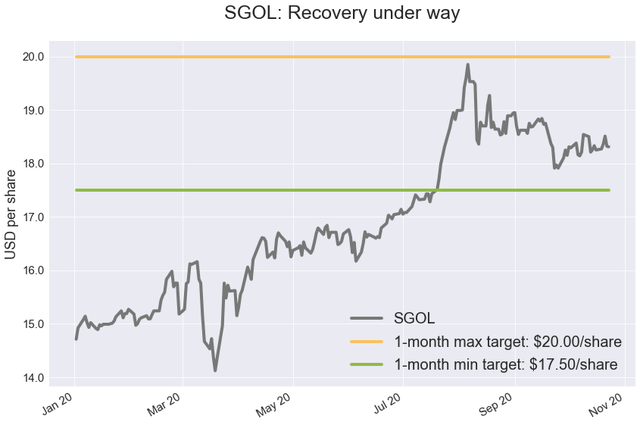

SGOL is in recovery mode since mid-October, boosted by an increase in safe-haven demand ahead of the US elections.

Speculators are not excessively bullish toward CME gold, suggesting plenty of dry powder to deploy on the long side.

In contrast, retail investors look excessively bullish toward the yellow metal, creating a risk of profit-taking. We view this risk as small given the friendly macro sentiment for gold.

We are willing to reassert tactical upside exposure to SGOL, expecting $19 per share over the next month.

Investment thesis

Welcome to Orchid's Gold Weekly report. We discuss gold prices through the lenses of the Aberdeen Standard Physical Gold Shares ETF (SGOL).

SGOL is in recovery mode, having bottomed out at roughly $18 per share in mid-September.

We expect the macro backdrop for gold to remain bullish in the near term, reflecting persisting macro uncertainty due to the COVID-19 and political uncertainty due to the US elections.

In this context, we think that demand for hedges will remain strong in the near term, benefiting gold prices and SGOL.

While the speculative community is not excessively bullish, ETF investors and other small traders are.

Although the risk of profit-taking cannot be ruled out, we think that the macro environment will remain sufficiently shiny for the yellow metal to induce ETF investors and small traders to maintain a very long positioning toward SGOL.

Our trading range forecast for SGOL over a 1-month view is $17.50-$20.00/share.

Source: Bloomberg, Orchid Research

About SGOL

For investors seeking exposure to the fluctuations of gold prices, the Aberdeen Standard Physical Gold Shares ETF is, in our view, a great long-term investment vehicle, with a small expense ratio of 0.17%.

The average spread over the past 2 months is at 0.07%, suggesting that the ETF is also well suited from investors with a short-term horizon.

Further, the legal structure of the fund prevents trustees from lending the precious metal held in the Fund.

The fund physically holds gold bars in vaults based in London (UK) and Zurich (Switzerland) custodied by JPMorgan.

SGOL’s assets total $1.75 billion.

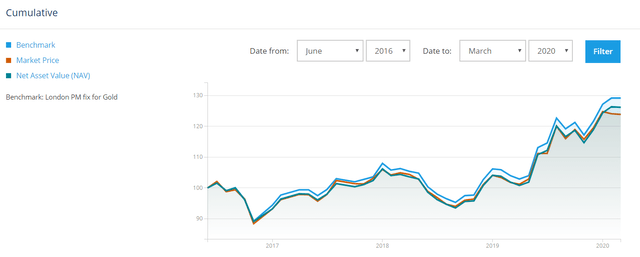

Importantly, SGOL, which was launched in September 2009, tracks closely its benchmark - the London PM fix for gold, as the chart below shows.

Source: SGOL

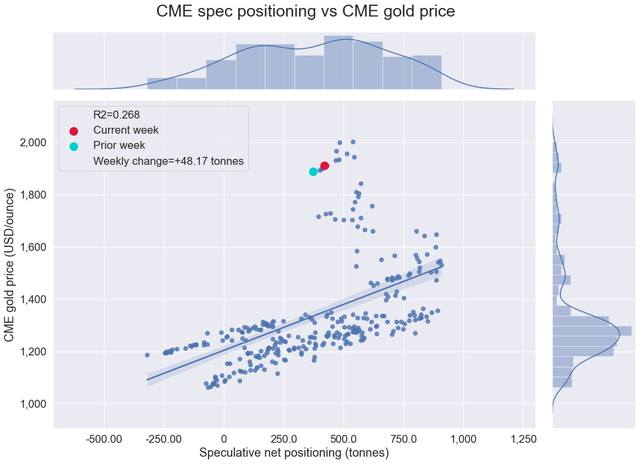

Speculative positioning

Source: CFTC, Orchid Research

The speculative community increased by the equivalent of 48 tonnes its net long position in COMEX gold in the week to October 20, according to the CFTC.

Although gold’s spec positioning is not stretched on the long side, the COMEX gold spot price looks a bit expensive based on the relationship between prices and speculative positioning since 2015.

Implications for SGOL: We expect speculators to increase their net long exposure to COMEX gold in the near term due to 1) growing uncertainty ahead of the US elections, and 2) the massive monetary and fiscal stimulus to fight the COVID-19. This should push the COMEX gold spot price, which should, in turn, boost SGOL.

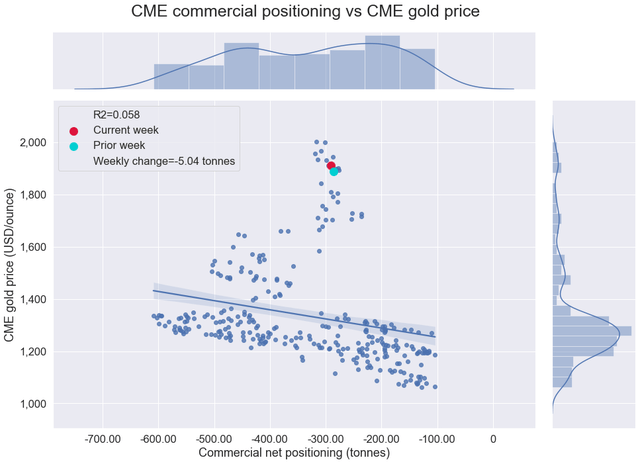

Commercial positioning

Source: CFTC, Orchid Research

Producers reduced by the equivalent of 5 tonnes their net short position in CME gold in the week to October 20, according to the CFTC.

The relationship between commercial positioning and gold prices is unclear based on data from 2015.

Implications for SGOL: We do not think that near-term changes in commercial positioning will materially impact gold prices and thus SGOL.

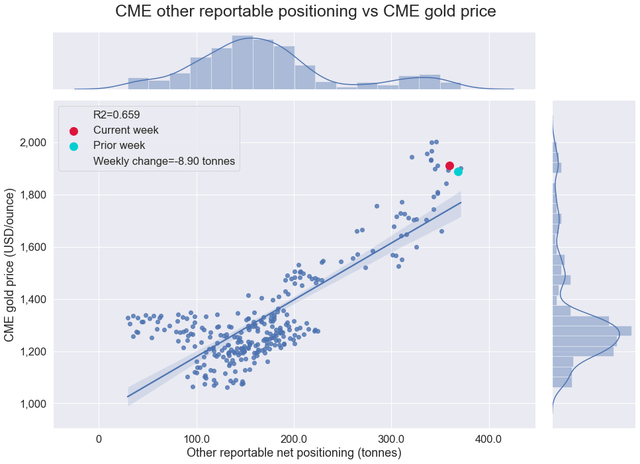

Other reportable positioning

Source: CFTC, Orchid Research

Other reportable traders, which correspond to market participants who are neither speculators (money managers), nor producers, nor swap dealers, reduced their net long positions in CME gold by 8.9 tonnes in the week to October 20.

Although these traders tend to deploy momentum-based strategies, their activity is smaller than money managers. Interestingly, the relationship between their positioning and gold prices is stronger than for money managers.

They appear to be excessively bullish toward CME gold, which is consistent with the strong bullish retail investor sentiment. Given the stretched positioning among this category, gold prices look vulnerable to some profit-taking.

Implications for SGOL: Other reportable traders are vulnerable to take profit given their very long positioning, which could be negative for gold prices and SGOL. But as long as the positive momentum in the gold price is maintained and that the macro backdrop remains bullish for the yellow metal, the risk of significant profit-taking is small.

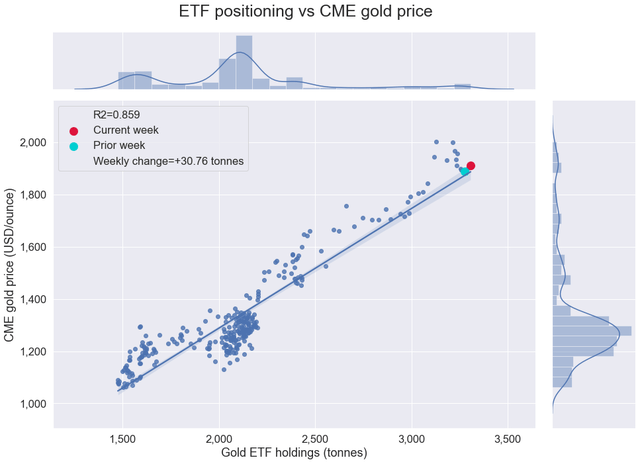

ETF positioning

Source: Orchid Research

ETF investors increased markedly their gold holdings by 30.76 tonnes in the week to October 23, according to our estimates.

Gold ETF holdings are at a record high, highlighting a very bullish sentiment among ETF investors.

Based on the relationship between ETF positioning and gold prices, the CME gold price looks fairly valued.

Implications for SGOL: Given the positive macro environment, we expect ETF investors to continue to accumulate gold, which should be supportive of gold prices and SGOL.

Closing thoughts

We think that SGOL is in recovery mode, boosted by an increase in safe-haven demand ahead of the US elections, in a context of heightened macro uncertainty owing to the COVID-19.

Although retail investors look already excessively bullish toward SGOL, we do not think that a negative swing in sentiment is imminent yet.

In addition, speculative positioning is not stretched, suggesting some room for additional buying interest in the near term.

We expect SGOL to trade between $17.50 and $20.00/share over the next month.

Did you like this?

Click the "Follow" button at the top of the article to receive notifications.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Our research has not been prepared in accordance with the legal requirements designed to promote the independence of investment research. Therefore, this material cannot be considered as investment research, a research recommendation, nor a personal recommendation or advice, for regulatory purposes.