AT&T: Ignore The Debt, One Quarter Of FCF Overwhelms Any Year's Debt

Investors should ignore AT&T debt, as its FCF has remained incredibly strong.

The company's fiber and HBO Max businesses have continued to perform well and have significant growth potential.

The company has a 7.5% dividend yield at a high-50%'s payout ratio. That cash flow points to strong long-term shareholder returns.

AT&T (NYSE: T) recently announced its earnings today, watching its share price increase by more than 5%, pushing its market capitalization back over $200 billion. The company has since come slightly back to Earth, however, it's worth highlighting the quality of its earnings. As we'll see throughout this article, AT&T's continued cash flow and financial strength make it a strong long-term investment opportunity.

Company 3Q 2020 Earnings Overview

The company has focused on maintaining strength in its earnings despite the difficulties it has continued to face from COVID-19.

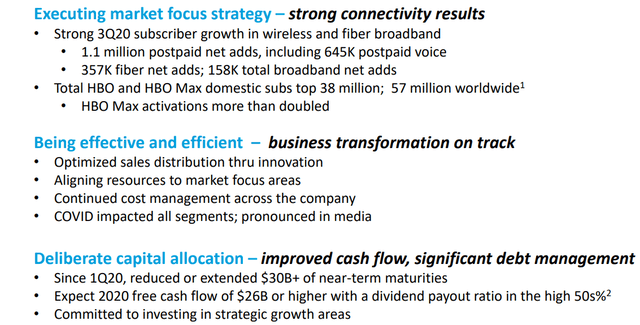

(AT&T 3Q 2020 - AT&T Investor Presentation)

It has continued to see its wireless and fiber businesses expand significantly. The company saw 1.1 million postpaid net ads and 645 thousand postpaid voice ads. This is before the release of the iPhone 12, and the company is in a business where it has seen new struggles from the combination of T-Mobile (TMUS) with Sprint.

AT&T has also seen 357 thousand fiber net ads and 158 thousand broadband net ads. The company's total HBO and HBO Max domestic subscribers top 38 million domestically and 57 million worldwide, as HBO Max activations have more than doubled. The company is continuing to be increasingly efficient and profitable despite the effects of COVID-19.

We will discuss all of these segments of AT&T's business in more detail in subsequent sections. However, its financial position also remains incredibly strong. The company has reduced or extended $30+ billion in near-term maturities and expanded its FCF priorities, while decreasing its payout ratio. It is committed to investing in strategic growth.

Business Financial Strength

AT&T has continued to generate strong earnings from its exciting portfolio of businesses.

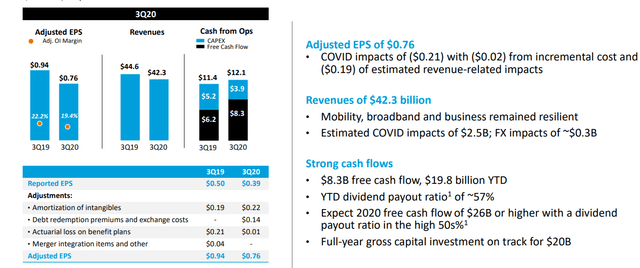

(AT&T Business Results - AT&T Investor Presentation)

AT&T's reported EPS for the quarter came in at $0.39 versus $0.50 a year ago. Accounting for adjustments, its adjusted EPS was $0.76 versus $0.94 a year ago. The company saw $0.21 in COVID-19 related impacts to adjusted EPS, meaning its adjusted EPS would have been $0.97 in a non-COVID-19 world.

That's a great quarterly EPS from a company in a non-cyclical business at a share price of less than $30. AT&T's revenues were $42.3 billion with COVID-19 impacts of $2.5 billion, meaning most of the COVID-19 impacts were from profit. Excitingly, the company expects $8.3 billion in FCF and $19.8 billion in YTD FCF.

AT&T now expects $26 billion in 2020 FCF with a dividend payout ratio in the high-50%'s. That means a 7.5% dividend yield with a high-50%'s payout ratio. Additionally, the company's capital investment remains on track for $20 billion. This means it is continuing to invest in its business and maintaining strong FCF despite COVID-19.

AT&T's Rapidly Growing Businesses

At the same time, the company has several rapidly growing businesses worth paying close attention to.

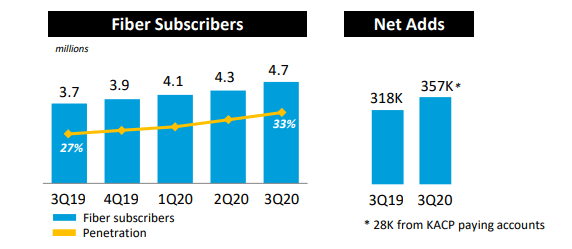

(AT&T Fiber - AT&T Investor Presentation)

AT&T is simultaneously increasing its number of potential fiber subscribers and penetration in its current market. From 3Q 2019 to 3Q 2020, its potential total number of subscribers increased from 13.7 million to 14.2 million. At the same time, the company's penetration in its target markets increased by 6%.

Overall, over the past year, AT&T's number of subscribers has increased by 1 million adding $600 million in annual revenue. Increasing market penetration and size is immensely important, and it's the path to a growing business. The business currently provides $2.8 billion in annual revenue or ~1.7% of the company's annual revenue.

As a user of AT&T Fiber, I'm a big fan of the business. It's the potential for the company to increase its size and value. We would like to see AT&T expanding its infrastructure more, in order to increase available customers, but with a market leading valuation, the company is very valuable.

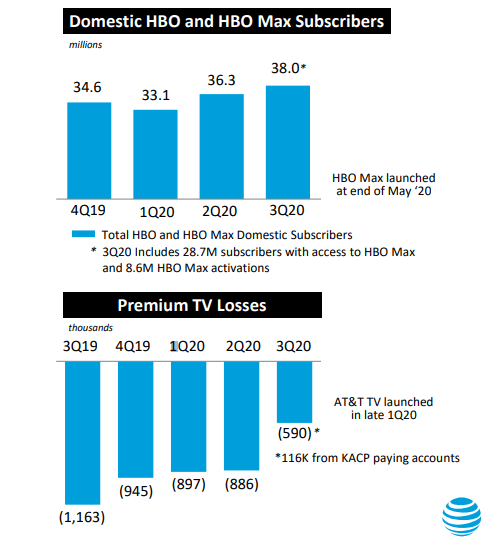

(AT&T HBO Max vs. Premium TV Losses - AT&T Investor Presentation)

The company's other major business is its HBO and HBO Max subscription business. The recent growth of the business has more than made up for Premium TV Losses. At the same time, its domestic subscriber count, at 38 million, means near $7 billion in annual revenue. With 50 million subscribers, that would be $9 billion in annual revenue.

The HBO Max segment of that would be near pure cash flow. The company has an impressive portfolio of assets here, and its new HBO Max business will more than make up for the struggles that DirecTV is facing. That, combined with decreasing rates of slowdown, mean higher potential for AT&T. The company is passing its HBO Max targets, which is incredibly exciting.

Capital Allocation and Liquidity

Putting this all together, we get AT&T's capital allocation and liquidity profiles.

(AT&T Capital Allocation and Liquidity - AT&T Investor Presentation)

AT&T has significantly improved its net debt. Since its Time Warner acquisition, the company decreased its net debt from $180 billion to $171 billion by YE 2018. By YE 2019, the company hit $151 billion, and by 3Q 2020, it hit $149 billion. The drop in adjusted EBITDA due to COVID-19 has hurt AT&T, but financially, it has remained strong.

At the same time, it has reduced maturities over the next 5 years by 50%. That provides flexibility and manageable near-term debt towers for the company. AT&T's largest debt tower is $7.8 billion in 2024, and the company's FCF for the most recent quarter's FCF was $8.3 billion. That means one quarter of FCF overwhelms any quarter's debt.

AT&T has an overall weighted average maturity of 17 years at 4.1%, improved from 13 years at 4.3% at 1Q 2020. That's on top of a $10 billion cash balance. The company's annual interest expenditures at $6.1 billion are incredibly manageable. It has focused on new asset sales to improve its debt profile.

Overall, AT&T has focused heavily on maintaining a strong and exciting profile of assets. It's selling extra assets as available, $3 billion expected to close in 4Q 2020. The company is continuing to have a safe financial profile, pay down debt, and increase shareholder rewards. It's doing it all with the chance to invest and a double-digit FCF ratio.

Risk

AT&T's largest risk is the chance of new competition in its core cellular businesses. T-Mobil and Sprint have recently merged, making a much more powerful cellular competitor. There's the target to make Dish also into a cellular competitor. Both of these companies could put significant pressure on AT&T and its business.

However, we expect the risk to be minimal, the company has continued to perform.

Conclusion

AT&T has continued to perform incredibly well, especially in the most recent quarter. The company has an impressive portfolio of assets and continued strength in its FCF. It has recently adjusted its FCF forecasts upwards and now expects a 2020 payout ratio in the high-50%'s. The company's most recent quarter's FCF is more than any of its debt towers in the coming years.

AT&T has continued to focus on asset sales to improve its portfolio. Its annual interest expenditures are incredibly manageable. The company has a number of exciting growth opportunities, especially through HBO Max and AT&T Fiber. AT&T is a valuable long-term investment at this time.

Create a High Yield Energy Portfolio - 2 Week Free Trial!

The Energy Forum can help you generate high-yield income from a portfolio of quality energy companies. Worldwide energy demand is growing and you can be a part of this exciting trend.

Also read about our newly launched "Income Portfolio", a non sector specific income portfolio.

The Energy Forum provides:

- Managed model portfolios to generate high-yield returns.

- Deep-dive research reports about quality investment opportunities.

- Macroeconomic market overviews.

Disclosure: I am/we are long T. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.