OGIG is up ~88% over the past year and has outperformed many of its larger peers, including QQQ, IGV, and FTEC.

The primary reason appears to be a larger allocation to China-based companies.

China's e-commerce market is estimated to be larger than the next 10 markets combined, 2.5x the U.S. market, and the fastest growing market.

Meantime, China has largely got COVID-19 under control. As a result, its economy is growing faster than the U.S. economy.

The O’Shares Global Internet Giants ETF (OGIG) is brought to you by Shark Tank's Kevin O'Leary (Chairman of O'Shares) and Connor O'Brien (CEO/President). OGIG is advertised to be a "rules-based" ETF designed to give investors exposure to the largest and highest quality global companies that derive most of their revenue growth from the internet and e-commerce sectors. O'Brien appears to be the day-to-day manager and brings 15 years of experience at Lehman Brothers and Merrill Lynch to the party. O’Brien has an MBA from Dartmouth and a BA in Physics and Economics from Middlebury College - a private liberal arts school in Vermont.

I was curious about the "rules based" aspect of the ETF's description and the target index OGIG is designed to track: the O’Shares Global Internet Giants Index, or OGIGX. Searching through the prospectus, I found this:

"The Target Index is constructed using a proprietary, rules-based methodology designed to select equity securities from the FTSE USA Small Cap Index that have exposure to the following three factors: 1) quality, 2) low volatility and 3) yield. The “quality” factor is calculated by combining measures of profitability (return on assets, asset turnover ratio and accruals) and leverage (operating cash flow divided by total debt). The “low volatility” factor is calculated using the standard deviation of five years of weekly local total returns. The “yield” factor is calculated using the company’s twelve month trailing dividend yield(the total dividends paid by the company over the previous twelve months divided by its stock price as of the index calculation date)."

It was not clear to me how the FTSE USA Small Cap Index could have "internet giants" in it, but I was never able to find an explanation.

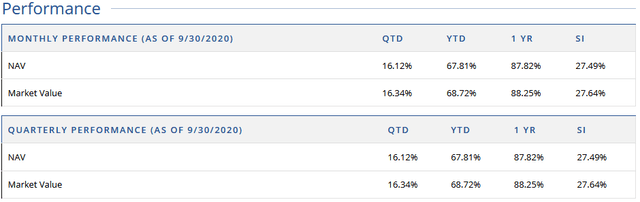

The OGIG ETF is relatively new (since mid-2018), but the returns (so far) have been very impressive:

Source: O'Shares

Source: O'Shares

However, I did notice that the "monthly" and "quarterly" performance results in the table above are identical. Maybe O'Shares needs to hire an O'Shea to more closely keep track of performance... and it shouldn't be too hard to track returns on a daily basis, too. Regardless, see the charts below for returns based on Seeking Alpha's charting tool (YCharts).

As of 10/20/2020, the fund said it has $498,515,594 under management, so just under a half-a-billion dollars. Very small in comparison to many of its competitors like the iShares Expanded Tech-Software Sector ETF (IGV) or the Fidelity MSCI Information Technology Index ETF (FTEC) which have assets under management of $5.5 billion and $4.7 billion, respectively.

OGIG's expense ratio is a reasonable 0.48%.

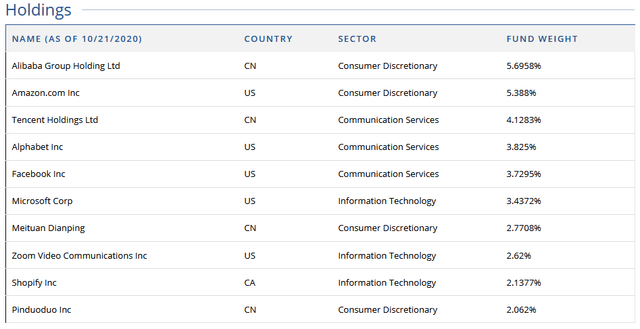

Top-10 Holdings

The top-10 holding in OGIG are shown below (as of 10/21/20):

Source: Oshares.com

Source: Oshares.com

The first thing I noticed was the preponderance of Chinese companies in the top-10 holdings. Alibaba (BABA) is the top-holding with a 5.7% weight, while Tencent (OTCPK:TCEHY) holds the #3 slot with a 4.1% weighting. In total, of the top-10 stocks represent ~35.5% of the total portfolio and roughly half the top-10 is devoted to Chinese companies.

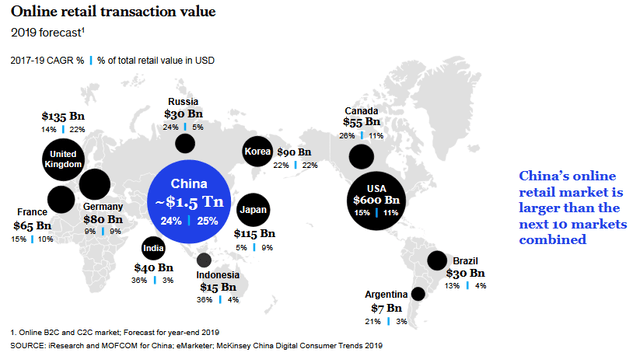

That makes total sense considering - according to McKinsey - the Chinese online e-commerce market is estimated to be 2.5x the size of the US market, larger than the next 10 markets combined, and grew at a 24% CAGR between 2017 and 2019:

Source: McKinsey

Source: McKinsey

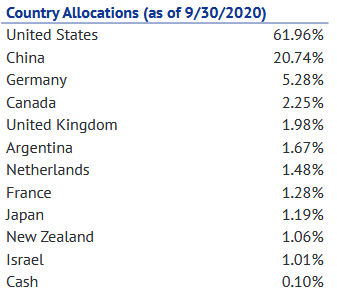

The point is that OGIG lives up to its description and searches the globe for the best internet and e-commerce stocks. That being the case, the ETF is fairly well diversified on a geographic basis, although the U.S. still represents 62% of the ETF's total allocation:

Source: OGIG Fact Sheet

Source: OGIG Fact Sheet

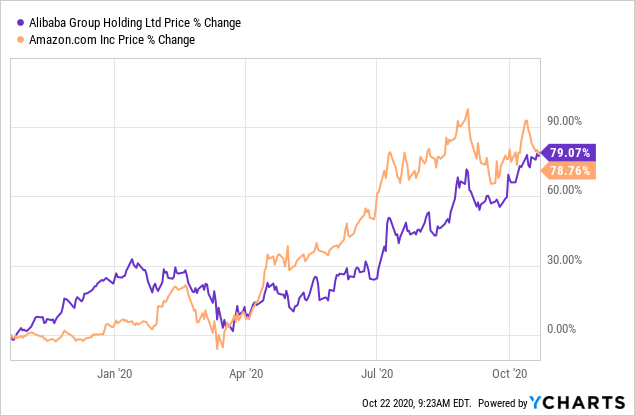

Interestingly enough, BABA, the biggest online retailer in China, and Amazon (AMZN), the largest American online retailer and #2 holding with a 5.4% weight, have both appreciated about the same amount over the past year:

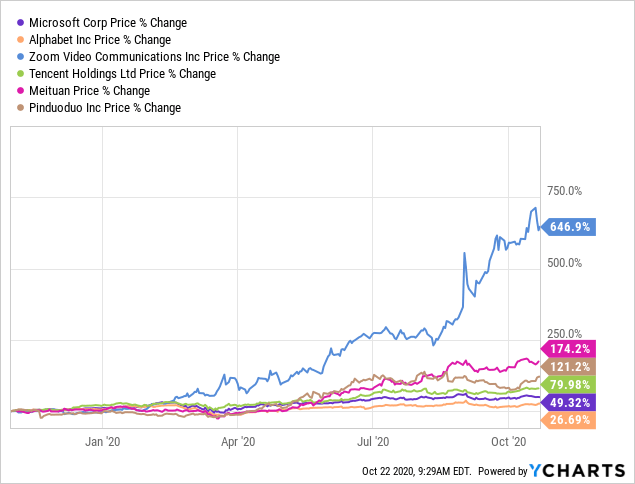

The chart below compares the performance of the other Chinese companies in the top-10 list with a random selection of three of the US based companies. As can be seen, Zoom (ZM) has been an outsized contributor to the fund's success over the past year and is now a household name. Alphabet (GOOG) (NASDAQ:GOOGL) has been a clear underperformer but has actually been trading quite well lately despite recent anti-trust suit filed by the U.S. Department of Justice. Analysts cite consumers' preference for Google Search, the case could take many years, and that a break-up of Google may actually unleash additional shareholder value (see Google: FAANNG's Red-Headed Stepchild).

Meanwhile Meituan (MEIT) and Tencent have significantly outperformed the ETF's ~88% return over the past year:

Data by YCharts

Data by YCharts

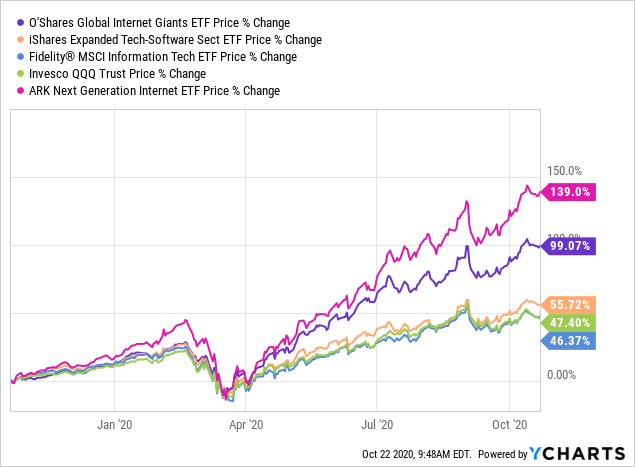

It's clear that OGIG's ability and tendency to invest in China-based companies has been a key ingredient in delivering returns for the ETF. That is likely the primary reason that OGIG has outperformed some of the other familiar high-tech/software/internet related ETFs like IGV, FTEC, and the Invesco QQQ ETF (QQQ). In fact, the only fund peer I have covered over the past few months that has beaten OGIG over the past year is the ARK Next Generation Internet ETF (ARKW):

Data by YCharts

Data by YCharts

I was surprised that MercadoLibre (MELI) was not in OGIG's top-10 holdings. It is generally regarded as the fastest growing online retailer in South America and has done very well at holding Amazon at bay in the region (see MELI: A Must Own For Growth Investors). MELI was the #12 holding in the fund with only a 1.9% weight.

Risks

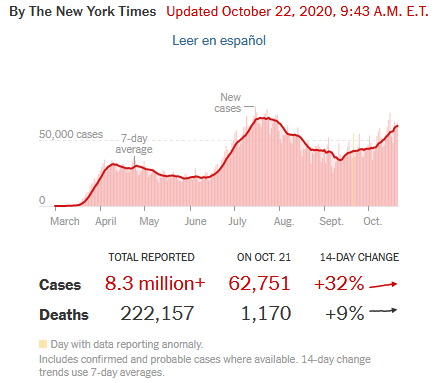

The primary risk with the OGIG is similar to the other funds discussed in the article: a market near all-time highs, high stock valuations, and a Wall Street that seems totally disconnected from Main Street. That is, unemployment is still high (7.9%), thousands of small businesses have closed the door and turned off the lights, and the COVID-19 new case count (60,000+/day) has surged higher as America heads into the Fall/Winter flu/holiday season:

Source: NY Times

Source: NY Times

The good news is that China - with COVID-19 largely under control - has seen its economy come back strong (+4.9% in Q3) and, as mentioned earlier, 20%+ of OGIG is invested in China-based companies.

Summary & Conclusion

I like the OGIG fund primarily because of its exposure to China. The fund doesn't have a long-term track record, but its relatively small size could prove to be an advantage as compared to its bigger peers who may find it harder to move the needle. That is, OGIG small size gives it the ability to be a bit more nimble. OGIG is an attractive compromise between the ARKW ETF, which some view as way too aggressive and very high on the risk/reward scale, and many of the more familiar ETFs like the triple-Qs, FTEC, and IGV.

Disclosure: I am/we are long FTEC IGV QQQ. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am an engineer, not a CFA. The information and data presented in this article were obtained from company documents and/or sources believed to be reliable, but have not been independently verified. Therefore, the author cannot guarantee their accuracy. Please do your own research and contact a qualified investment advisor. I am not responsible for the investment decisions you make.