Loews Corporation: We Expect Shares To Eventually Breakout

Company reports a net loss of $835 million in Q2.

We see the company bouncing back.

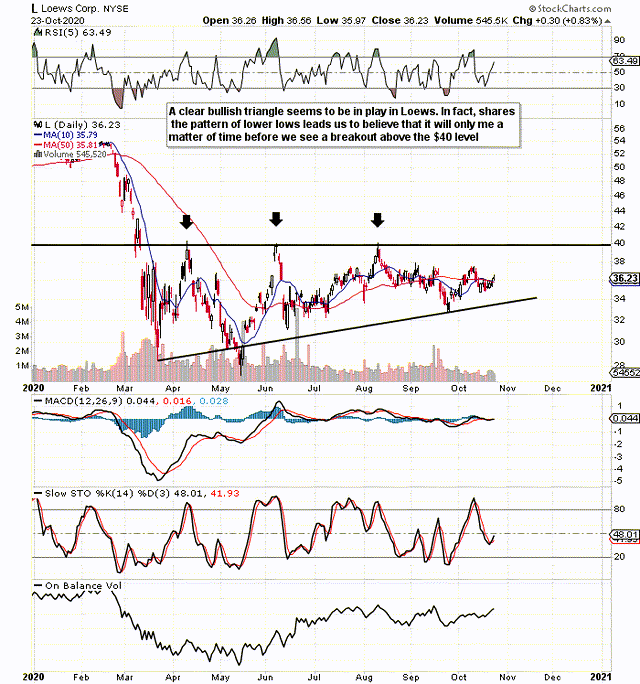

Shares at present seem to be undergoing an ascending triangle (bullish).

Loews Corporation (L) looks like it is undergoing an ascending triangle which obviously has bullish connotations. Although these types of triangles usually form as continuous patterns, they can also appear as reversal patterns which is exactly what we are eyeing up in Loews at present. The important thing to remember however is that no matter where these patterns appear, they invariably are bullish patterns. In fact, as we can see below, shares have tried to break through the $40 level with conviction since April of this year but each time have failed to do so. If we can get a breakout however and considering the height of the pattern, our minimum target price would be at least $50 a share. We first though have to see whether the risk/reward setup in attractive in Loews at present.

From a valuation standpoint, although Loews is not profitable at present (from a net earnings standpoint), its assets (p/b of 0.6), sales (p/s of 0.8) and cash/flow (p/c of 6.2) are all trading on the cheap compared both to the sector as well as the company´s 5-year averages. This obviously is a good starting point and gives the ascending triangle some degree of probability of playing itself out especially if we get some type of reversion to the mean with respect to the company's valuation.

In terms of profitability, net margin was on the rise as the firm closed out 2019 (6.24%). Furthermore, return on equity (ROI) was also increasing (4.95% at 2019 close) and net income hit $932 million in the firm's latest fiscal year or $3.07 per share. The EPS number due to really aggressive share-buybacks was the best bottom-line number the firm had seen since 2010.

Monitoring previous trends coming into 2020 is important because they provide insights into how structurally sound Loews is at present. A company doesn't become a bad company overnight. The trailing bottom-line EPS number of -$4.18 for example is the first bottom-line number (over a twelve-month period) we have witnessed for more than a decade.

There are a few things worth noting when it comes to the company's second quarter earnings. Although we normally favour companies which are turning a profit, we do not see the present down-turn being permanent for Loews. Why? Well straight off the bat, the company is pretty well diversified across both private and public subsidiaries in insurance, hotels, natural gas & liquid pipelines and packaging.

The company reported a $900+ million net investment loss in Q2 as a result of the deconsolidation of Diamond Offshore. All of the other segments were down on Q2 in 2019 but the principal segment investors would have been focused on would have been CNA financial due to it being the biggest segment by far in the company.

The reason being is that this segment due to its much higher revenues brought in the full $249 million of net profit in the second quarter of last year. However, $135 million was the earnings number in CNA Financial in Q2 this year. Catastrophe losses were well up in this segment this year due to COVID-19, weather related losses as well as civil unrest losses. However, revenues grew by 11% to hit $2.77 billion and really confirmed the management team´s strong underlying performance in this segment.

Despite the high catastrophe losses ($300+ million), CEO Jim Tisch came out on the earnings call and stated that the commercial property and casualty insurance industry remains heavily undervalued by the market. As value investors, what we liked about Tisch's words was that he put his money where his mouth was as Loews initiated more buybacks of this subsidiary in the second quarter.

Therefore, when one includes the expected downturn in Loews' Hotels (-$72 million) in Q2 along with the $900+ million charge in Diamond Offshore, it should not be long before Loews is back to reporting positive earnings before long. Boardwalk Pipelines remains profitable and CNA Financial holds excellent potential due to how low this industry as a whole is priced at present by the market. The play here may be to start with a small position and double down on it if indeed we can get a breakout above the upper trendline of the triangle. Let's see what the third quarter brings.

----------------------

Elevation Code's blueprint is simple. To relentlessly be on the hunt for attractive setups through value plays, swing plays or volatility plays. Trading a wide range of strategies gives us massive diversification, which is key. We started with $100k. The portfolio will not not stop until it reaches $1 million.

-----------------------

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in L over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.