The Quiet Before The Storm - Reviewing My 3rd Quarter Performance

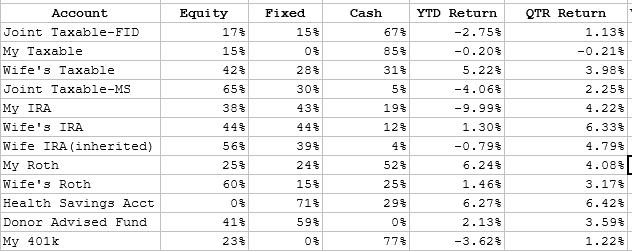

Asset selection resulted in performance trailing a simple 40%/60% CORP/VTI ETF benchmark for the quarter and YTD. I did better against my custom benchmark.

My trading focus this quarter was offsetting the income loss from early in the year when my 2.5% CDs matured and became cash holdings earning 1bps.

I will cover performance, trades, and plans for the last quarter of the year in this article.

Source: photo

Introduction

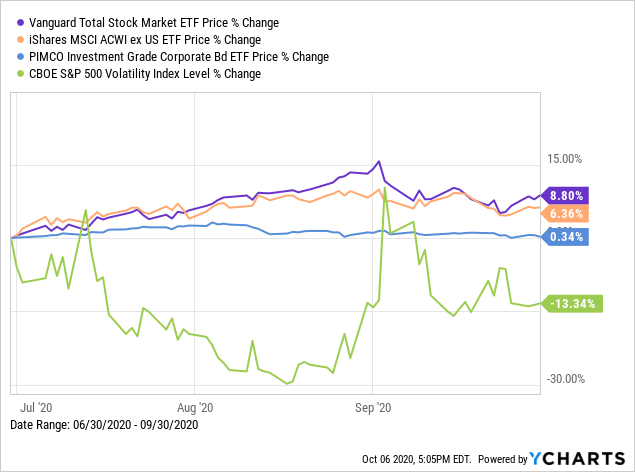

Data by YCharts

Data by YCharts

I picked selected ETFs to represent 3rd quarter returns. Stocks continued their advance off the March bottoms, with US stocks hitting all-time highs. With interest rates near zero, there wasn't much return for investment grade bonds. Junk bonds did much better returning 4.46% as investors looked for Fixed Income investments that yielded more than the 1% available on AAA-rated bonds.

I included the VIX, a measure of risk, as selling options is my secondary means of generating income. That strategy is covered in detail here: Writing options for income. Those trades netted an annualized ROI close to 16% on the covering cash.

Benchmarking

As my regular readers know, I compare my results to a custom benchmark built using ETFs. That gives me an idea if my time spent picking stocks, ETFs and CEFs is adding value. As you will see, being retired, I have chosen to be conservative in my asset allocation. One could argue, since our SS checks and my pension cover our expenses, I should actually be more aggressive compared to the average retired investor. I pondered that concept in my article about setting one's allocation based on age and net worth:

Source: PortfolioVisualizer

Most of what the CASHX component represents is my 401(k) Stable Value Fund, which is still yielding a minimal-risk 2%.

Performance results

My weighted ROI for the 3rd quarter was 2.36% versus the above benchmark's ROI of 3.42%. So I trailed the benchmark for the quarter but YTD, our accounts lost only 1.54% versus the benchmark's 3% loss. Again, the benchmark is only a guide and is based on my approximate start-of-year allocations to the asset classes represented by each ETF used.

One thing that really sticks out is the lack of correlation of ROI and asset allocation between accounts. My Health Savings Account, with no equity exposure, had the best performance, whereas the Morgan-Stanley account, with the highest equity exposure, had the second-worst. Both accounts went under major overalls this year and that will be covered after the trade history.

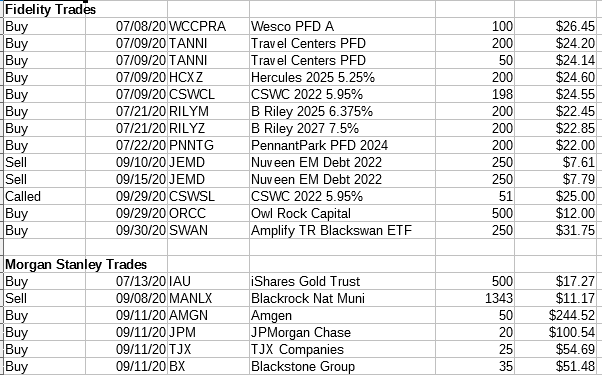

Trade History and Review

At Fidelity, there was the desire to increase yield for the Fixed Income allocation in my IRAs and Roth accounts. All the July buys were focused on Baby Bonds that will mature before 2029. All were bought below Par with an average YTM of over 7%. The Wesco PFD has a coupon of 10.625% so while it does not mature, I fully expect it to be called in 2025. I believe the YTC is just under 8% currently. By focusing on this slice of the Fixed Income market, having set maturity dates minimizes price drops caused by rising interest rates (Article).

I started reducing my holdings in JEMD, an Emerging Markets debt CEF, after taking an updated deep drive (Article) and determining its termination value will be closer to $8.00, not the desired $9.85 that is mentioned in the Prospectus. The goal is to sell another 500 shares if the price again moves above $7.75.

One risk in a low interest rate world is companies replacing high-yielding debt with lower-yielding ones or using cash to retire HY debt. Capital Southwest called about 25% of their 2022 5.95% baby bond in September. This wasn't unexpected since they planned on calling 50% last spring but delayed the call because of COVID-19. I did okay as I purchased below Par, something becoming very difficult recently.

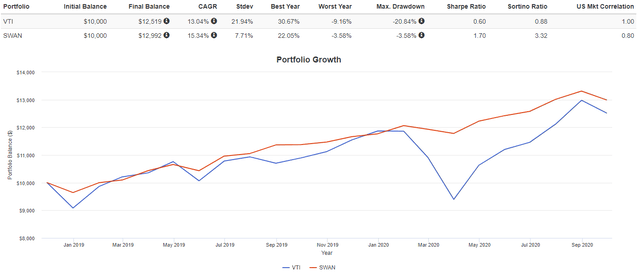

At the end of the quarter, I added two securities discussed often by SA Contributors. Owl Rock (NYSE:ORCC) is a BDC with minimal exposure to COVID-19 sectors, yielding 13% (Article). Amplify Blackswan ETF (NYSEARCA:SWAN) is designed to provide market-like returns with risk-reduction components (Article). As the next chart shows, since its launch in December 2018, SWAN has both outperformed VTI and did so with less volatility.

Source: portfoliovisualizer.com

Morgan Stanley Account

For the Morgan Stanley account, I added to the stocks suggested to me last spring plus bought my first exposure to gold, IAU. With minimal exposure to Health Care, at MS's recommendation, I add Amgen (AMGN). Each has about $10k in exposure. Since purchases, these represent some of the better performers in this account, up an average of 5%. Overall, the MS account is not one of the better performers but that isn't why it was opened. Its main purpose is to provide hands-on guidance if my wife passes second or I lose the ability to manage my portfolios (Article). This account represents under 10% of our net worth.

Health Savings Account

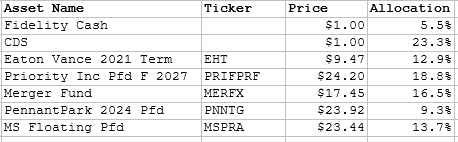

The biggest shakeup has been to this account. This account was funded while I was employed to help cover medical costs in retirement (Article) and due to using it incorrectly at first, the balance is small. That fact has led me to be conservative and not include equities (so far).

When the CD matures this month, I will either buy more PNNTG, add WCC.PRA, or some equity exposure using SWAN. I view MERFX as a cash substitute based on its benchmark and CAGR since inception (Article). At the end of 2019, this account was 100% cash.

Donor Advisor Fund

A Donor Advisor Fund allows a person to accumulate funds for charitable giving in advance of actually distributing the funds to your favorite charities. You get the tax deduction in the year contributions are made, not at disbursement. Having accumulated a nice-sized DAF, 2020 will be my first with no contributions and all my charitable support will come from my DAF. This will allow us to use the high Standard Deduction for the first time in years. This was part of my retirement planning, pre-funding my charity giving (Article).

Portfolio Strategy

Source: Photo

Source: Photo

As I am writing this, the market is reacting to the President calling off any stimulus talks until after the election - the DJIA is down 300 points. It was up in the morning after Trump flew home, and then again when he would sign a "skinny" stimulus bill. Such uncertainty isn't what the markets, nor investors, want. With the polls showing Biden with an increasing lead, including most swing states, maybe by the time I submit this article, we will have a better idea what the rest of the fourth quarter will have in stock (pun intended) for us investors.

I continued converting my 401(k) assets to the Roth option to reduce my RMDs when they start in 2027. Based on current rates and adjusting brackets for some inflation, I expect my marginal rate to be up 6%. This quarter I converted $30,000. Such conversions do not change what the overall account holds. I plan on converting the same amount in the 4th quarter (Article).

My plan is to sit tight until after November 3rd or later depending on the election's outcome, both for president and control of the Senate, the more important outcome in many pundits' opinions. Part of that "on hold" strategy is not writing many Puts expiring in November. I'm also looking to add more baby bonds if I can find some below Par and providing diversification away from BDCs and Fund advisors which account for the majority of those currently held. My preference is to stay below $20K exposure to any one issuer.

If the Democrats control all three houses (White, House, Senate), keeping up-to-date on investment/taxing policy changes will be critical, although most income/wealth starting points are far beyond where we are financially.

If you appreciate articles of this nature, please mark it 'liked' and click the 'Follow' button above to be notified of my next submission. Thanks for reading.

Disclosure: I am/we are long SWAN, MERFX, IAU, AMGN. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I own every security mentioned in this article but will refrain from trading any over the 72 hours post-publishing. Results and any security mentioned is for informational purposes and not an endorsement to buy. All investors have the responsibility to do their own due diligence.