Soligenix: One Approvable Drug And Another With Phase 3 Read Out Soon - $55M Valuation Won't Last

Positive Phase 3 data reported on Oct. 22, solidifies the approvability of SGX301 for CTCL treatment, an estimated $250M annual revenue opportunity, yet SNGX’s valuation is only ~$55M.

SGX942 for oral mucositis (“OM”) remains on track for Phase 3 results in December, and is now a call option that is not priced into the stock.

Once capitalized, we estimate SNGX could be worth several hundred million dollars for SGX301, and with positive SGX942 results in OM, the company could be valued in the billions.

Additional stock catalysts include potential non-dilutive or less-dilutive funding to support SGX301’s commercialization or partnerships, and new non-dilutive government funding for SNGX’s vaccine programs.

Soligenix (NASDAQ:SNGX) reported positive and final Phase 3 clinical data for one of its lead late-stage drug candidates SGX301 for the treatment of cutaneous T-cell lymphoma (“CTCL”). These results have now de-risked this development program and the stock, with Soligenix now in possession of an approvable drug. As we cited in our initial article on SNGX, SGX301 met and continued to improve upon its primary endpoint in Cycles 1 and 2 of the FLASH Phase 3 clinical trial, respectively, and the recently reported results for Cycle 3 demonstrate the exceptional safety and tolerability of the therapy, as well as the potential to improve patient outcomes with longer-term use.

These results solidify the strong efficacy, safety, and tolerability results for SGX301, hence the likelihood of FDA approval, for which the company expects to submit a new drug application (“NDA”) in the first half of 2021. Our peak revenue estimate for SGX301 remains at $235M million, which is derived from the 47,000 diagnosed CTCL patients in both the U.S. and EU multiplied by our pricing assumption of $10,000 per year and 50% market penetration.

This suggests that SGX301 alone could be worth several hundred million dollars, significantly higher than the company’s entire valuation of ~$55 million. For that reason, SNGX is a buy at the current price, particularly with the company’s other late-stage asset, SGX942 for oral mucositis (“OM”) anticipated to read out Phase 3 results before year-end, plus the potential for additional non-dilutive grant funding for SNGX’s vaccine programs in the coming months.

Phase 3 FLASH trial demonstrates better response rates over time and exceptional safety and tolerability profiles. The main purpose of Cycle 3 was to demonstrate safety and tolerability, and based on the recently reported results, SGX301 continued to be extremely well-tolerated due to the lack of absorption and circulation of hypericin, the active compound, in the bloodstream. Cycle 3 also enabled physicians and patients to treat full body lesions, not just the isolated lesions designated in Cycles 1 and 2. Despite more widespread use on patients’ bodies and longer duration of use, SGX301 still showed an exceptional safety and tolerability profile.

On the efficacy side, the Cycle 3 data demonstrated that for patients who elected to continue on treatment for 18 weeks, 49% of lesions treated in Cycles 1 and 2 saw a 50% or greater reduction in their lesion score (CAILS). This compares favorably to the 40% reduction observed after 12 weeks of treatment (Cycle 2), and 16% reduction observed after 6 weeks of treatment (Cycle 1). Additionally, SGX301 showed a rapid onset of action and proved equally effective on both patch and plaque lesions of CTCL, which underscores the benefits of SGX301’s more deeply penetrating visible light therapy, compared to limited penetration capability with UV light therapy.

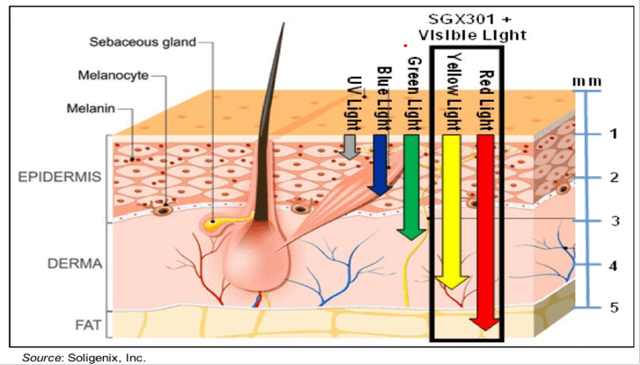

Deep penetration has favorable implications including new potential indications for SGX301. SGX301 and its use of visible light to drive penetration of the active ingredient, hypericin, up to 4 to 5 millimeters deep into the skin demonstrated clinical benefits throughout the FLASH trial, particularly the ability to treat both patch lesions and plaque lesions, which can be up to 2 millimeters deeper than patches on the skin. This is important in the treatment of deep CTCL lesions, and also may have implications for treating other deep-lesion skin conditions such as psoriasis. As seen in the graphic below, UV light does not have the ability to drive therapeutic penetration into deeper layers of the skin.

Dr. Brian Poligone, lead investigator of the FLASH study noted that "Along with SGX301's rapid response time and safety profile, the patch and plaque data from the study are extremely compelling. Current treatments for CTCL are generally less effective against plaques and deeper lesions, very similar to the problem observed in psoriasis. The ability of SGX301 to target both patches and thicker plaques in CTCL is an important feature for this therapy and, if approved, will be of benefit to patients, regardless of their presentation.”

Dr. Poligone also noted a case study presented in February 2020 at the 4th World Congress of Cutaneous Lymphoma, whereby a patient with folliculotropic mycosis fungoides, a hard to treat variant of CTCL characterized by deep lesions on hair follicles, was successfully treated with SGX301. This case study and Dr. Poligone’s mention of psoriasis suggest that SGX301 has potential to be used in other conditions that manifest in deep skin lesions.

With the completion of this Phase 3 trial, Soligenix is planning on having a pre-NDA meeting with the FDA as soon as possible, with the goal of commencing a rolling NDA submission in the first half of 2021. Additionally, the company is assessing commercialization strategies, including partnerships for SGX301 domestically and in international territories.

Phase 3 results approaching for SGX942 offers significant upside potential. Oral mucositis, or OM, is a complication of cancer treatment, whereby the mucosal lining of the mouth breaks down, causing painful ulcers to form. With OM, patients can experience pain, develop nutritional problems from an inability to eat, and are at risk of serious infection. OM is one of the most common complications from cancer radiation and chemotherapy, and there are currently no approved treatments for OM in patients with solid tumors.

Soligenix’s second key asset, SGX942, is an IV formulation of dusquetide, an innate defense regulator ("IDR"). IDRs are a class of compound that makes the innate immune system more effective by decreasing inflammation, increasing anti-infective action, and increasing tissue healing properties. This is particularly helpful for OM as the condition is exacerbated by the innate immune system response.

Clinical results so far have been promising. In Soligenix's Phase 2 trial, SGX942 was shown to be safe, well-tolerated, and effective at reducing the duration of severe OM. Overall, patients saw a 50% reduction in median duration of severe OM, and even greater benefits among patients receiving the most aggressive chemotherapy. Mortality and infection rates also were lower in the SGX942-treated arm, suggesting that the treatment may also aid in overall patient survival. For more details on the clinical trial, please see our prior article on SNGX.

Soligenix expects topline results from its Phase 3 trial, DOM-INNATE, in 4Q20. Given the potential size of the market, the high unmet need, and the promising safety and efficacy demonstrated in prior trials, these upcoming clinical results have the potential to be a key catalyst for the stock in the coming months.

Scenario Analysis: Capitalizing SGX301 to commercialization is key. Dominating the stock, we believe are two key factors: 1. the approaching binary risk of the Phase 3 outcome for SGX942 and 2. the expectation that the company may raise additional capital with a large equity offering. Given the current extremely low valuation for SNGX with an NDA-ready drug and a Phase 3 trial outcome approaching, we believe the risk/reward of owning the stock here is favorable. On the one hand, a positive outcome for SGX942 would be extremely favorable and should take the stock to a much higher valuation. We estimate that SGX942 could produce peak sales of $500M, derived by the following:

The incidence of Americans diagnosed with head and neck cancer is approximately 65,000 annually, and 23,000 hematopoietic stem cell transplant ("HSCT") procedures are performed each year in the U.S. with similar numbers in Europe. With severe OM occurring in approximately 80-90% of these patients, we estimate the total addressable market for SGX942 is 150,000 patients per year in both the U.S. and Europe.

Assuming that the company can penetrate 40% of the potential market in both head and neck cancer and HSCT procedures, and with pricing of $7,000 per patient per course of treatment, we estimate peak sales of SGX942 at $500 million for these indications alone. The sales potential for SGX942 could be even larger if the product is approved and becomes adopted across other cancer types where radiation is typically used, as 40% of patients receiving cancer treatment experience some degree of OM.

As a result, if Phase 3 results for SGX942 are successful, this product candidate could be worth $1-2 billion on its own. This means that if both SGX301 and SGX942 are de-risked by successful Phase 3 results, SNGX shares have the potential to deliver a 10x return or more once the company is fully capitalized. On the other hand, should the OM trial for SGX942 fail, the market will be left to value SNGX primarily on SGX301 plus the company’s vaccine programs. While it wouldn’t be surprising to see the stock trade down initially on a failed trial for SGX942, the floor valuation under this scenario will likely depend on the market’s view of the company’s need for additional capital to successfully commercialize SGX301.

Company has creatively financed two Phase 3 assets; funding SGX301 with non-dilutive or less dilutive capital could be a key positive. On the financial front, Soligenix has done a good job managing its burn rate, with the company stating during corporate presentations that net of non-dilutive government funding, cash use has averaged approximately $1.7 million per quarter to date over the past couple of years. Also, the at-the-market (“ATM”) facility used by Soligenix thus far has helped to keep the company funded by opportunistically taking advantage of strong trading days of price and liquidity.

While this is not the preferred way for a biotech company to be financed long term, it has given SNGX enough capital to get to two meaningful Phase 3 read outs. Now that SGX301 has proven to be an NDA-ready asset, the company may move to fully capitalize this drug’s commercialization or perhaps secure a late-stage commercial partnership. We believe that if management can secure the resources to back the future of SGX301 prior to the Phase 3 readout for SGX942, the stock should trade higher, as the market will be able to fully appreciate the CTCL opportunity. At that point, the approaching Phase 3 readout for SGX942 would truly become a “free call option”.

Of course, if SGX942 has a positive Phase 3 outcome later this year, the company should not have any trouble raising additional capital at higher prices, given the likelihood of significant institutional interest in the OM opportunity. If this scenario plays out, we believe SNGX will be at an entirely new level.

Company has been executing; still lots of shots on goal. At the current valuation, Soligenix appears extremely cheap relative to the SGX301 opportunity for CTCL, which is now de-risked given the positive efficacy and safety results generated in all three treatment cycles in the Phase 3 FLASH trial. We believe that any move by the company to solidify SGX301’s future by capitalizing the program whether by non-dilutive, dilutive, or other creative means would represent upside to the stock given the low valuation and opportunity for CTCL.

Further, the upcoming Phase 3 results for SGX942 represent a key catalyst that could transform the profile of the company. Additional government funding for the company’s vaccine programs is incremental and could also send the shares higher, and if the company can monetize its biodefense priority review voucher for its ricin vaccine program, that could also provide significant non-dilutive financing and should take the stock higher. Soligenix has proven to be capable at advancing its clinical programs and achieving key milestones, and there are a number of ways for investors to win on the stock in the near-term.

The Illumination Capital Marketplace is coming soon! We are dedicated to helping our future subscribers realize a strong return on investment by working with seasoned healthcare and finance professionals. We plan to provide subscribers with the following research tools and techniques to help them construct a winning portfolio of healthcare stocks:

- Advanced access to our stock reports

- Live daily chat with our analysts

- Real-time market commentary

- Expert opinions and interviews

- Weekly recap and newsletter

- Portfolio management tips and tools

- Model portfolio

- Real-time technical analysis

- Options strategies

Disclosure: I am/we are long SNGX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.