Infosys: Another Strong Quarter Highlights The Case For A Narrowing Valuation Gap

Infosys posts another strong quarter featuring broad-based outperformance across the top and bottom lines.

With a record deal pipeline in place, the near-term growth outlook appears bright.

A strong balance sheet allows the company to weather the cycles and support the dividend.

Clearing of the governance overhang should refocus investors toward the strong fundamentals.

Infosys (INFY) has run up significantly this year, but I still like the shares going forward. INFY remains a high-quality large-cap offering investors diversified exposure to the IT outsourcing space. Following a strong quarter, which saw record margins despite the COVID-19-led uncertainties, the company should continue to post steady organic growth in the upcoming quarters on the back of a record pipeline. Now that the growth gap with TCS (TTNQY) has narrowed, I see room for a re-rating as the valuation gap narrows as well.

Broad-Based Strength Across Growth, Margins, and Guidance

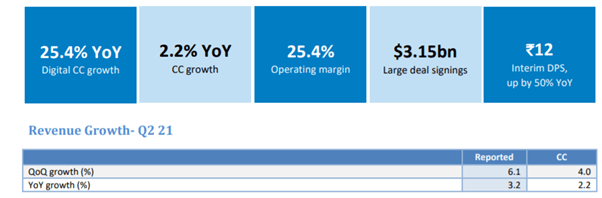

INFY posted revenue growth of 4% Q/Q on a constant currency basis, matching its closest peer TCS (4.8% Q/Q) on the back of strong traction in Banking, Financial Services, and Insurance (BFSI), Retail, and Hi-tech. The major surprise, however, was EBIT margins, which improved c. 270bps Q/Q, on higher revenue productivity, utilization, and offshoring.

(Source: FQ2 ’21 Fact Sheet)

The near-term outlook also looks strong, with deal wins at a historically high $3.1 billion, and with an impressive c. 86% net new contribution. The company also guided for c. 2-3% growth Y/Y (raised from the c. 0-2% Y/Y prior) in fiscal 2021 and raised EBIT margin guidance to 23-24% (up from the 21-23% prior). However, with wage hikes effective as of the start of the year, one-time incentives for junior employees in FQ3, and the reversal of temporary cost cuts, the company pointed out that 23-24% margins might not be sustainable as Infosys starts with its hike and promotion cycle.

As a result, I expect INFY to revise its margin band slightly lower to c. 22% after fiscal 2021, while retaining partial cost benefits from lower travel expenses and an increasing shift toward work-from-home. However, I see steady revenue growth ahead, with EBIT margins set to return to c. 23% in fiscal 2022/2023.

Outlining Future Demand Drivers

INFY sees strong demand ahead across digital transformation (especially cloud migration and software-as-a-service) and productivity (automation and IT infrastructure modernization). With the pace of modernization set to accelerate in the coming quarters as clients increasingly invest in technology, the ongoing vendor consolidation (as highlighted by INFY management) plays right into the hands of INFY and large-cap peers such as TCS.

Notably, INFY has also recently launched Cobalt, a product that brings together its capabilities in cloud with c. 14k cloud assets and c. 200 industry cloud solutions, while also leveraging partnerships with leading SaaS, IaaS, and PaaS companies. Although management did not provide guidance on the potential revenue contribution, I do expect the product to emerge as an incremental top line driver in the upcoming quarters.

Marginal Shift Offshore

At present, INFY does not expect a material shift offshore, even over the longer term, as demand is expected to increase for onsite resources (in-line with easing travel restrictions). However, COVID-19 has helped showcase INFY’s ability to implement a digital transformation, even from offshore locations, and I expect INFY to continue leveraging its flexibility in addressing client needs.

On a positive note, INFY is looking to reduce its exposure to regulatory changes overseas. INFY plans to add c. 12k employees in the US over the next two years, taking the total number of domestic hires to 25k, which should help offset any impact from changes in visa rules. As c. 37% of its employees in the US are currently on visas, this would imply a significant shift in the labor composition and potential margin implications.

Record Deal Pipeline

As of quarter end, INFY had a total contract value (TCV) of c. $3.15 billion - the highest ever for the company. INFY announced 16 deal wins in FQ2, of which 11 were in the US, 4 in Europe, and 1 in the rest of the world. By vertical, six deals were in BFSI, 3 in Retail, two each in Telecom and Hi-Tech, and one each in Energy, Manufacturing, and Others.

On balance, I think the strong contribution of net new deal wins in FQ2 at c. 86% (led by the Vanguard deal) is a major positive, as a higher % of net new should translate into improved revenue trends for the upcoming quarters.

Strong Cash Position

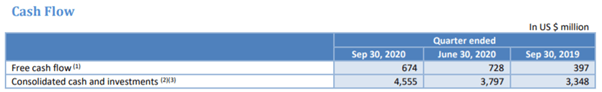

On the back of resilient working capital trends, operating cash flow was c. $793 million in FQ2, a c. 52% increase Y/Y. FCF of c. $674 million also grew by 70% Y/Y, reaching a record high, supported by robust collections.

(Source: FQ2 ’21 Fact Sheet)

Relative to net profit, this implies a c. 103% conversion, supporting a strong, cash-rich balance sheet with no debt. Not only does the balance sheet allow INFY to navigate the cycles unscathed, but it also ensures a sustainable dividend payout.

Closing the TCS Valuation Gap

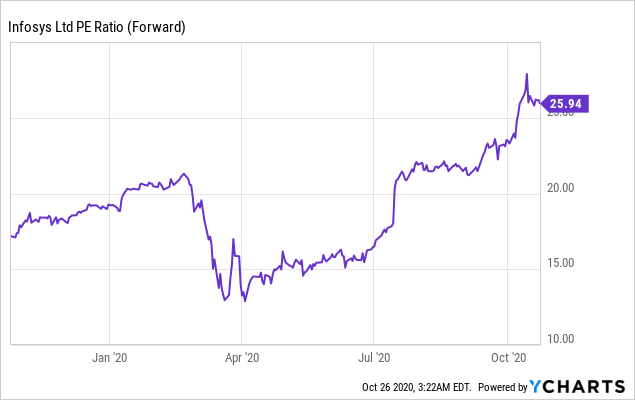

Following the controversy around the whistleblower issue, INFY has suffered from a governance overhang. As a result, the company’s sustained growth relative to its peers over the previous quarters has been underappreciated. As investors shift their focus back to the fundamentals, I think there is a compelling case for the INFY valuation gap to TCS to narrow from current levels (TCS trades at c. 31x P/E vs. INFY's c. 26x P/E).

Data by YCharts

Data by YCharts

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.