Ally Financial: Strong Past Performance, Current Trend To Normalization, And A Low Valuation

Ally Financial has had steady growth over the past five years.

The COVID-19 pandemic hit the bank over the first two quarters, but a trend toward normalization is apparent.

The low price-to-tangible book value of 0.84x makes the bank a very attractive buy.

Introduction

Ally Financial (ALLY) is a leader in the digital financial services industry. The bank offers products ranging from deposit banking, insurance, mortgages, auto loans, and investment services. Ally Financial has seen its stock price decline this year along, with many other banks. Although the bank has seen some headwinds as a result of the COVID-19 pandemic, the overall financial well being and performance are still good. This is unlike many other financial institutions that have seen heavy losses over the same period. I am thinking about starting a position in Ally Financial because of the solid financials, positive industry trends, and a low price-to-tangible book value of 0.84x.

Long-Term Overview

Company Overview

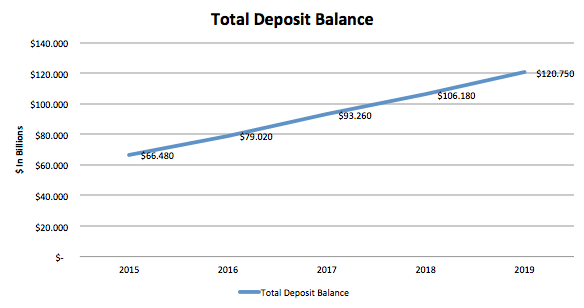

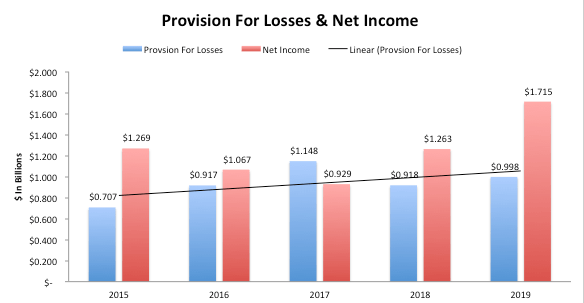

Source: SEC 10-K's

Before getting into the financial performance of Ally Financial, I wanted to explain what I like about the business model. Ally Financial has a strong focus on being consumer-centric with exceptional customer service and product innovation directed for the customer. The bank has a motto of "doing it right" and a six-point strategic overview on how to achieve this goal. These strategic points of focus are to differentiate around the customer, optimize auto, and insurance business lines, grow total customers and deposits, expand product offerings, deploy capital efficiently with proper risk management, and ensure the culture is aligned for the customer. Strategic points two through five are commonplace business goals, but I like how the company purposely wrapped them around the customer goals. This focus on the customer has helped and will continue to help grow the deposit base, therefore, helping the bank grow revenue over the long term.

Financial Overview

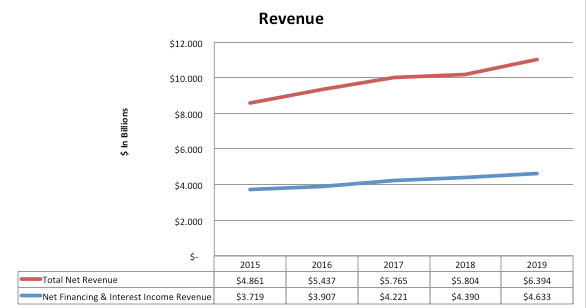

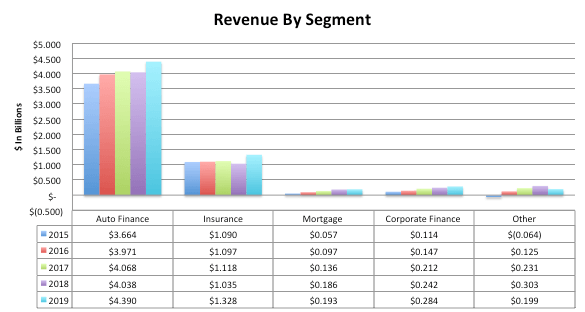

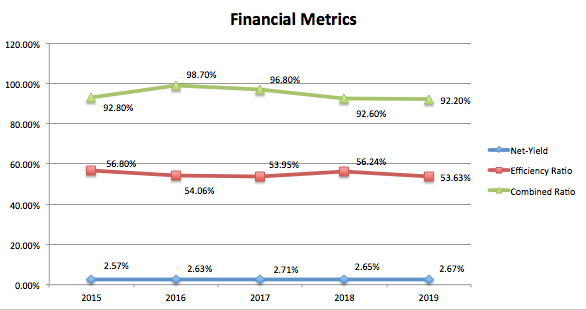

Source: SEC 10-K's

Ally Financial has seen a total revenue growth rate of 5.64% over the past five years. As can be seen, this growth was powered by net financing and interest income, which grew at a rate of 4.49%. Other revenue has grown in recent years due to improved underwriting within the insurance division that has added to this total revenue growth. While revenue has grown over time, the provision for losses has stayed relatively flat, showing that Ally Financial holds a healthy loan book. Altogether, this has benefited the bottom line, which was at $1.715 billion in 2019.

Source: SEC 10-K's

Looking at the above chart shows that the majority of revenue comes from the Auto Finance segment. Auto Finance has grown at a rate of 3.88% per year, due to a yield that has grown in each automotive category. Along with this increased rate, there has been a little variance in the average credit score. The Insurance segment is the second-largest and has also performed well over the past five years. Insurance has grown at a clip of 4.03%, and the combined ratio, which was above 100% in 2015, has decreased to around 92%. This is great as it shows improvement in the underwriting Ally Financial is doing. Auto Finance and Insurance are the main focus of this segment as these two businesses make up almost 90% of total revenue. With that being said, the Mortgage segment has grown at a rate of 27.63% per year while Corporate Finance has grown 20.03% per year. The last thing to look at is the efficiency ratio, which shows the bank's operational efficiency. Over the past five years, Ally Financial has seen a stable efficiency ratio, meaning that it is not costing exponentially more to acquire and retain customers. Overall, Ally Financial has seen great growth across all segments, within total deposits, and on the top line.

The Fiscal Year 2020 And The COVID-19 Pandemic

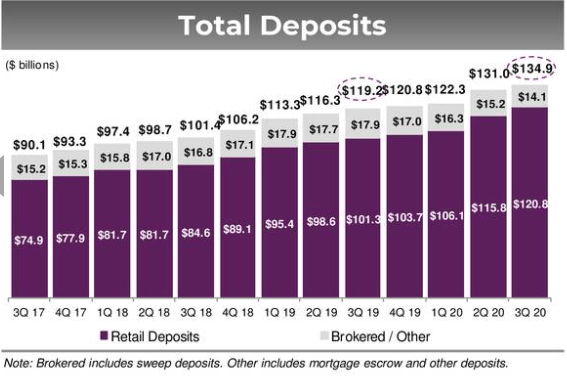

Source: Ally Financial 2020 Q3 Earnings Call Presentation

As with many financial institutions, Ally Financial has seen a large impact on financial performance due to the COVID-19 pandemic. In Q1, net financing and interest income was flat, while total net revenue was down 11.6% due to unrealized losses on the fair value of securities. The provision for losses increased by 220% to $903 million. The result was a net loss of $319 million or a 185% decrease. The results in Q2 were much better. In Q2, financing and interest income decreased by 8.9%, but total net revenue increased by 3.8% and was due to an increase in unrealized gain on securities. Provision for losses was down significantly from Q1 to $287 million but was still 62% higher than last year. This lower provision for losses allowed for the bank to post a net income of $241 million in the second quarter.

As of writing this article, Ally Financial released the Q3 results. Q3 showed the trend back to normal is materializing. Financing and interest income was up 1%, and the total net revenue was up 5.2%. Much of this was due to the dramatic drop in provision for losses to $147 million, which is a 44% decrease from the prior year. Therefore, net income increased by 24.9% to $476 million for the quarter.

For the total nine months, top-line results were not bad at all. Finance and interest income was down 2.2% and totaled $3.4 billion. On the other hand, total net revenue increased by about 1%, at $4.705 billion. Not too bad considering the economic environment. The provision for losses is what has hurt Ally Financial. Provision for losses totaled $1.337 billion for an 85% increase. The result was a decrease in net income of 70% to $398 million. The efficiency ratio so far has increased to 59.7%, which isn't awful. On a positive note, the graphic at the top of this segment shows that Ally Financial managed to continue to grow the deposit base to $134.9 billion. The combined ratio for the Insurance segment has decreased back below 100%, and the net interest margin has stayed flat around 2.65%. Overall, this performance is good when we consider the economic environment surrounding the bank.

Important Metric Trends

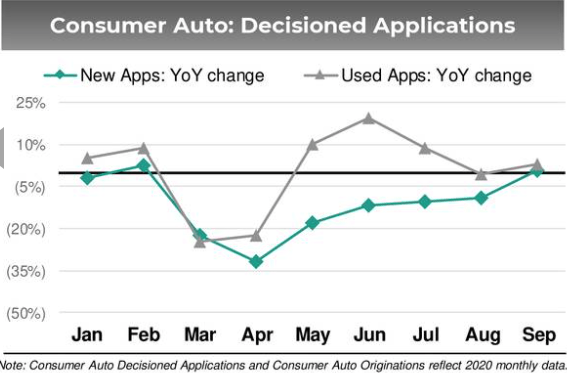

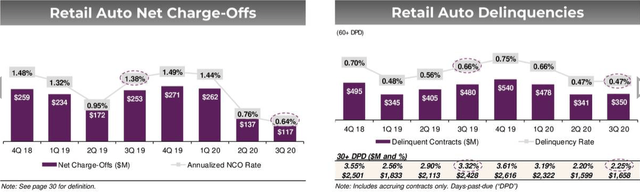

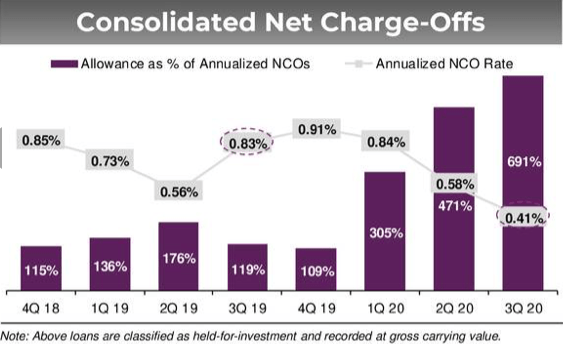

Source: Ally Financial 2020 Q3 Earnings Call Presentation

The chart above shows the charge-off rates for Ally Financial. What can be seen is that the charge-off rate has not seen a significant increase in 2020. This is attributable to the COVID-19 relief programs, which I will talk about below. Since Q1, the charge-off rate has fallen each quarter since, with just a 0.41% net charge-off rate in Q3.

Source: Ally Financial 2020 Q3 Earnings Call Presentation

Because Auto Finance is the largest revenue generator, it is key to looking into the metrics during 2020. The above graphics show that all the trends point to the positive. Both new and used auto applications saw a large dip at the end of February into April. This trend began to reverse in May, which is a great sign. Now, in September, it seems the normal is returning. The retail net charge-off rate has seen a similar trend, with a higher rate in Q1 that has decreased each quarter thereafter. Also, delinquencies have been steady, and just 2.25% are 30+ days-past-due. But as mentioned before, the COVID-19 relief program is attributable to these good rates.

Pandemic Relief Program

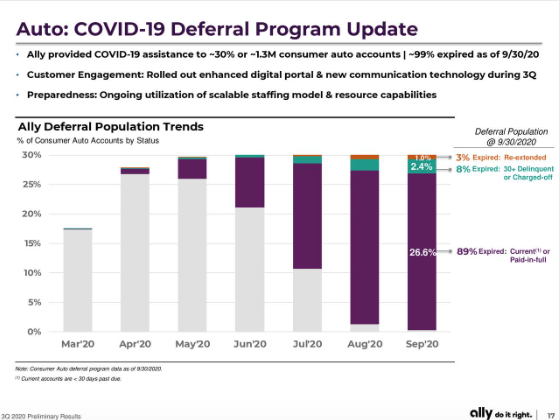

Source: Ally Financial 2020 Q3 Earnings Call Presentation

The pandemic relief program statistics are shown above. What we can see is that this program was a huge help in maintaining the Auto Finance segment as around 30% of consumer auto accounts were part of it. But 89% of those consumer auto accounts are now current or paid-in-full. Only 8% of the total are delinquent or charged-off, which shouldn't create a large impact on future charge-off and delinquency rates.

Valuation

This year, Ally Financial's stock is down around 6% to a price close to $29 per share. The 2020 projected EPS is currently at $2.38, which means the company has a forward P/E of 12.18x. Along with this, the net tangible book value is currently $34.60 per share; therefore, Ally Financial trades at 0.84x tangible book value. Overall, this seems undervalued when considering the growth pattern before COVID-19 and the current trend of the company's financials and metrics.

Conclusion

Ally Financial has always focused on the customer which has helped the bank grow its deposit base. This has allowed the bank to increase lending, which has increased total net revenue over the past few years. The bank has held very solid operating metrics in each segment and as a whole. As expected, the COVID-19 pandemic has hit Ally Financial, but the financial results have been trending upward. The recent Q3 results show a significantly lower provision for losses and higher net income. The credit metrics and pandemic relief program data show normalization in the Auto Finance segment. Taking this metric and financial performance together with the valuation of 0.84x tangible book value, Ally Financial looks like a company I want to buy.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in ALLY over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.