Alibaba: As Compelling Now As Ever

Alibaba share price growth has seen strong growth in 2020, increasing 80% year to date and nearly 5x since the lows in early 2016.

BABA's core secular growth businesses in commerce, payments and cloud computing will continue propelling strong double-digit revenue growth for the next 5 years or more.

For patient investors, Alibaba still has a lot more growth to offer and could offer very attractive returns.

I’ve had a quite long association with Alibaba (BABA), having first invested in the business in early 2016 when irrational fears about the health of the Chinese economy sent the share price down into the mid $60 range. While I’ve subsequently averaged up the position for the Project $1M portfolio in the time since, I feel that the business is as good now as it ever was and I still see the promise for quite good future returns.

Alibaba now finds itself in a sweet spot as far as having market-leading positions in China in three secularly advantaged businesses across e-commerce, digital payments and cloud, each of which have received a substantial tailwind as a result of the pandemic and which now seem destined to propel Alibaba’s overall business growth for at least the next five years or more.

E-commerce business is in an upswing

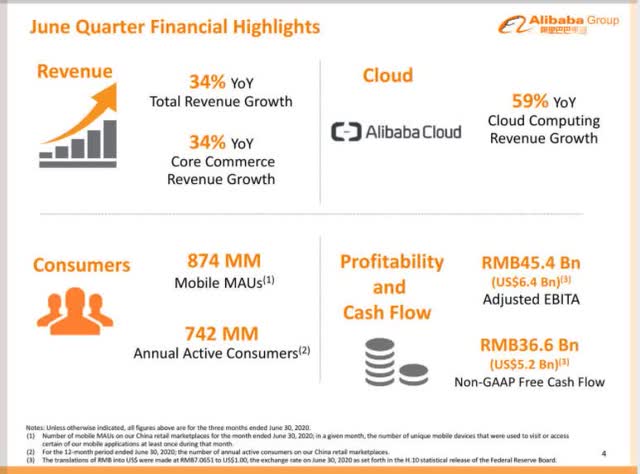

The pandemic has been a boon for Alibaba's e-commerce business as far as providing a tailwind which has elevated the near-term trajectory and rate of growth of the business. Alibaba’s core commerce platforms saw an increase in their rate of growth from 22% pre-pandemic to 34% most recently. This mirrors the impact that has been seen on other global e-commerce platforms such as Amazon, MercadoLibre (MELI) and Sea (SE).

While some of this e-commerce platform growth may moderate as pandemic-related restrictions are eased in China, my expectation is that e-commerce growth will be at an elevated level compared to that prior to the pandemic. Alibaba's e-commerce moat also continues to widen with the business further expanding monthly active users to 874M, a number which was up 20M sequentially compared to the March quarter and up almost 16% compared to the 755M monthly active users from the same period in 2019.

TaoBao and Tmall have a majority penetration of total Internet users in China, something which speaks to the dominance of both market places. Alibaba continues to innovate across both of these commerce market places. The recently introduced Taobao Pass program yielding an increase of 30% in ARPU for those users who joined. Gross merchandise volume growth across both properties has strongly recovered after the initial dip caused by reduced consumer spending in the midst of the pandemic.

Alibaba believes there is significant growth ahead of the business and has set a long-term target of serving more than 1B consumers in China and achieving more than $1.4T in gross merchandise volume over its commerce platforms within the next five years. In order to achieve this growth, Alibaba is making a more proactive effort to attract users in tier 3 and tier 4 regional centers. To this end it has also been tailoring its product offerings through programs such as Taobao deals, a more price sensitive offering to value-conscious consumers.

Also it’s not just Alibaba‘s China commerce market places which have been seeing strong growth. Alibaba has a considerable presence in the Southeast Asian e-commerce market via its ownership of Lazada. Lazada arguably has even more potential growth compared to e-commerce in China, given penetration rates of low single-digit percentages across many of the markets in Southeast Asia such as Vietnam, Thailand and Indonesia. Lazada also recently recorded revenue growth in excess of 100% in this market year over year, with the business remaining engaged in a very tight tussle with Tencent (OTCPK:TCEHY) backed Sea Limited.

Cloud computing dominance is the works

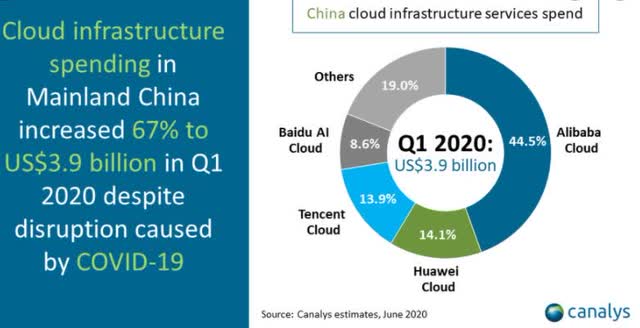

Alibaba Cloud has a dominant market leadership in the Chinese market. The business has consistently held a market share between 40% and 50%, for cloud computing, with analysts estimates suggesting that Alibaba’s cloud market share is currently close to 45%.

Consistent with global trends, the pandemic has provided an acceleration for the deployment of cloud-related services by enterprises to ensure business continuity. In the June quarter, Alibaba‘s Cloud computing revenue grew close to 60% year-over-year. While other players have been making marginal inroads, the business still retains a very sizable lead over other competitors.

During Alibaba‘s recent investor day, BABA indicated an expectation that its cloud computing business will achieve cash flow break-even at some point in 2021, which marks a significant turning point for the business from one of significant investment into product maturity.

Alibaba cloud capabilities score consistently well on independent external analyst services such as Gartner, where the business has been part of Gartner’s magic quadrant for 4 consecutive years with strong ratings across network, security and database. At Alibaba‘s 2020 investor day, the business estimated that cloud growth amongst large, premium customers was increasing at a rate of over 40% over the last two years.

Source: Alibaba 2020 Investor Day

Source: Alibaba 2020 Investor Day

Alibaba’s growth in the cloud computing market in China will be decades-long. It’s currently estimated that only 3.4% of total IT spending of $402B is currently directed to the public cloud in China, a market which is estimated to grow at a nearly 40% annualized rate over the next five years.

Ant may be Alibaba's hidden jewel in financial services

Alibaba has a 33% ownership stake in Ant Financial, the leading digital payments business in China which is now set to go public. Ant has over 700M monthly active users on its Alipay payments platform. Ant is an integral part of the finance landscape in China, and is involved much more broadly beyond just payments within the financial ecosystem in China.

Source: Alibaba 2019 Investor Day

Source: Alibaba 2019 Investor Day

Ant has a basic health plan product Xiang Hu Bao which has helped insurers upsell health insurance on the AliPay platform. Ant's commercial lending platform, MyBank provides commercial loans to micro-merchants. More recently Ant has partnered with Vanguard to deliver wealth management services to AliPay users. In many of these initiatives, Ant merely acts as the technology interface or enabler with traditional insurers, lenders and wealth management firms who execute the loan origination, take the insurance risk or deliver the wealth management services.

This has led to a particularly attractive financial profile for Ant. In documentation for its upcoming IPO, Ant disclosed a business generating $10.5B in the 1st half 2020 revenues growing at over 30% year over year, delivering a profit of close to $3B in the same time period. Valuation estimates for Ant’s business suggest a valuation near $300B. This has provided a nice tailwind for Alibaba’s share price over the last few months.

However, Ant is not only important to Alibaba merely due to just the increasing value of the equity stake and in unlocking additional value realization for Alibaba. There is also a fairly tight interchange of data between the businesses, with Ant‘s IPO disclosure highlighting the data sharing that occurs between Alipay and the other Alibaba businesses, assisting with offers and recommendations to users on BABA’s e-commerce and other properties based on Ant user data. Ant arguably has a long runway of growth ahead, which will lead to additional opportunities for further monetization by Alibaba.

Source: Alibaba Investor Day 2019

Source: Alibaba Investor Day 2019

Valuation and long-term growth

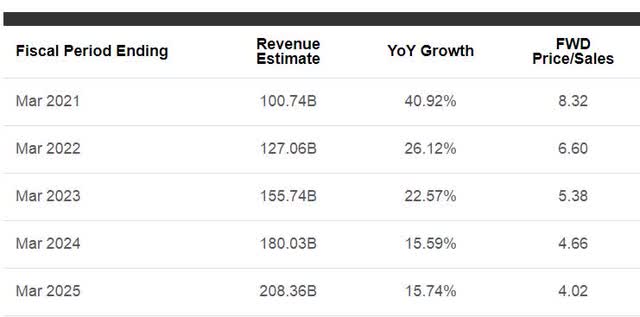

Consensus estimates suggest that Alibaba should at least double its revenue over the next five years, with earnings likely to grow at a rate closer to the mid 20% range over the next 5 years. This can be rationalized in that Alibaba has dominant market positions in three secularly growing markets in China of e-commerce, cloud computing and digital payments.

For all this growth Alibaba trades at a relatively undemanding Price to Sales multiple of 10 times sales and a P/E multiple of approximately 30 times earnings, both within the ranges that it has traded at within the last 5 years. On this basis, I believe that Alibaba should at least double in price over the next five years, If not more.

Risks

Even though Alibaba has a relatively protected position in the landscape of Chinese commerce, the risk of regulatory intervention as a result of this position and the vast data that it has on the Chinese consumer always remains a constant threat for the business. Alibaba also faces an equally determined and aggressive competitor in Tencent who has ambition, if not dominant market positions in many of the areas that Alibaba is going after.

Alibaba has shown its intentions to be particularly acquisitive and invest significant capital to chase new growth opportunities, something which could lead to write-offs if investments aren’t pursued in a disciplined fashion, and more as a result of competition with Tencent.

Concluding thoughts

While Alibaba has had a strong run in 2020, with its share price rising almost 80% and though it has more than quadrupled since its low point in early 2016, I believe that Alibaba still has a very bright and promising outlook and should reward patient investors well over the long term.

If you are interested in uncovering other sustainable high growth prospects please consider a Free Trial of Sustainable Growth.

- Methodology based on the publicly tracked Project $1M, which has nearly doubled S&P 500 returns over the last 4 years, delivering 23% pa.

- Emerging Leader, Venture Portfolios which have returned over 100%+ p.a. since inception

- Dynamic, engaged chat room with other like-minded investors

- Exclusive ideas on potential 'Wealth Creators of tomorrow'

Disclosure: I am/we are long BABA, TCEHY, SE, MELI. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.