Demystify Citigroup: Perception Versus Reality

Citi is priced as if it is the same cowboy-style bank prior to the financial crisis.

I break it down by business lines to demystify the poor perception Citi often received, and show its true strength.

Citi is a strong buy at its current price with positive asymmetrical risk/rewards.

Background

Citigroup (C) needs no introduction. A household name with its origin dated back 200 years ago, initially charted as City Bank of New York.

Unfortunately, Citi has often been perceived as a highly volatile, lower caliber bank among majors. Its reputation was severely damaged by its near-death 2007 subprime mortgage crisis. It took joint efforts from Treasury/Fed/FDIC, and a total of $300+ billion bailouts to bring it back to life.

Investment Thesis

My thesis builds upon one theme - the perception about Citi is far distant from the reality as I break them down.

After near one-decade continuous improvement on operational efficiency and over 60 divestiture transactions that reduced $800 billion non-core assets, the remaining businesses in Citi, especially those contribute to the majority of its revenue/net income, are top-tier businesses, and compete favorably among its peers.

My conservative model values Citi at $113 billion with a 24% potential upside to its current price.

Perception vs. Reality

Citi earned a terrible reputation (rightfully so) with its heavy exposure to troubled mortgage in the form of CDO during the financial crisis. It was saved by joint efforts of Treasury, Fed Reserve, and FDIC when over 90% of shareholders' values were wiped out.

Since then, Citi has divested over 800 billion non-core assets in over 60 transactions, including:

- Sold its hedge fund business to SkyBridge in 2012,

- Sold stakes in Indian Mortgage Lender in 2012,

- Sold Consumer Bank and Diner's Club card operation in Greece in 2014,

- Sold Alternative Investment Business in 2015,

- Sold Fixed Income Analytics unit in 2017.

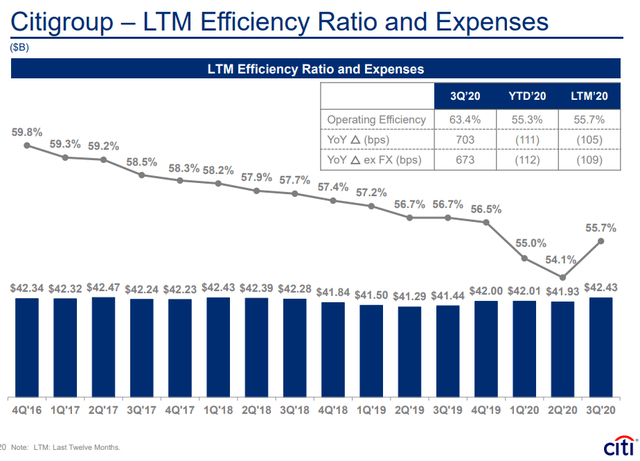

Its efforts to curb operating expenses can be best demonstrated by its continued efficiency ratio improvement over time and compared favorably to JPM (59%), BOA (71%), and WFC (80.7%), as of 3Q20.

Source: 3rd qtr 2000 earning presentation

In terms of solvency, while JPM's 13% CET1 ratio leads the pack, Citi's 11.8% is on par with BAC (11.9%) and WFC (11.4%).

Citi is often perceived in public as a lower caliber player when compared to investment banks such as Goldman Sachs (GS), Morgan Stanley (MS), or other global banks such as JPMorgan (JPM) or Bank of America (BAC).

On the contrary, 3 key businesses that contribute to the lion's share of Citi's revenue and profit are all world-class business units with a commanding market share. Let us examine them.

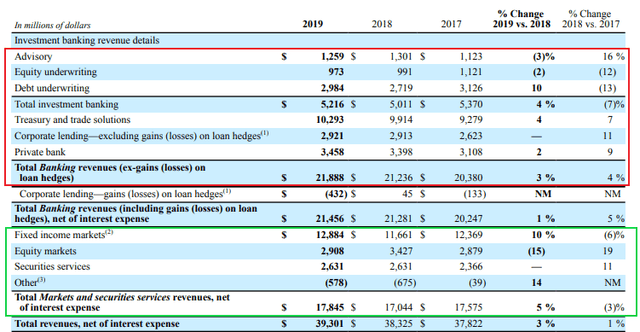

Treasury and Trade Service: It provides large/international corporations and governments treasury services, and cash/liquidity management solutions. This is where a bank builds its close relationship with the senior management of large corporations. According to Global Finance 2020 award, it ranked Citi No.1 globally for liquidity management and No.1 for overall treasury and cash management solutions in the US. Treasury/Trade Service (TTS) alone generates about $9 billion in annual revenue. Citi's corporate lending and underwriting units (both within ICG group) leveraged its treasury relationship to bring in about another $7 billion revenue. The other $5 billion CB/IB annual revenue comes from IB advisory and private banking.

Sales/Trading Desk: Citi ranked No.2 globally in 2019 for FICC (Fixed Income, interest rate, Currency, and Commodity) trading, with 17% market share, right behind JPM (19%). Citi also has a 7% global market share in equity trading. The top 3 are MS (18%), GS (17%), and JPM (14%), according to KBW.

Overall, JPM has a lead in the sales/trading desk business. Citi is a serious contender to the No.2 spot among its peers including BAC, GS, and MS with a very strong position in FICC trading.

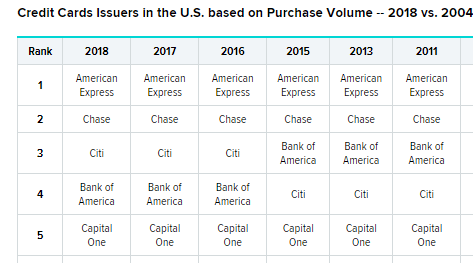

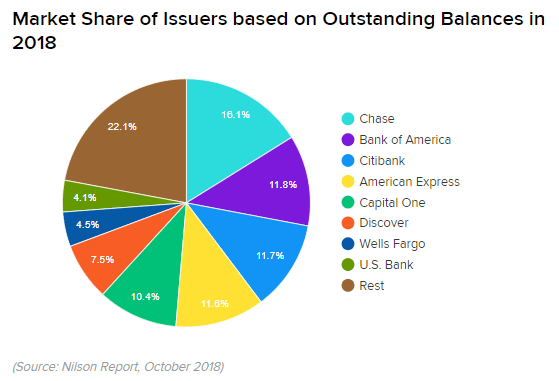

Credit Card: Among all card issuers (excluding Visa/Master), Citi ranks No.1 in account numbers (95million), No.3 by total purchase volume (behind AmExp, and JPM), and No.3 by outstanding balance (behind JPM and BAC).

Source: Ranking by Purchase Volume, data from Nilson Report 2017/2019

Source: Ranking by outstanding balance, from Nilson Report 2018

3 businesses above account for over 80% of total revenue. All of them are top-tier players in their own field.

Sum-of-all-parts Valuation

Corporate/Investment Banking: As discussed above, TTS is Citi's anchor business within CB/IB unit. It builds relationships with corporate senior management and further cements other lucrative CB/IB businesses. It has relatively stable revenue in the last 3 years, roughly $21 billion annual revenue, $6.5 billion net income (detailed number inside the red box below).

I don't expect explosive future growth in this business but expect it maintains market share leadership and a similar profit margin. A modest 6x P/E ratio values that business at 39B.

Source: Citi 2019 annual report

Sell-side sales/trading desk is another crown jewel Citi owns, generating $17+ billion revenue, close to $6 billion net profit (details in the green box in the above chart). A modest 6x P/E ratio values its trading desks business at 35B.

CB/IB and trading desks are businesses with high margin (its efficiency ratio is 57%, and net margin around 33% for Y2019). They are also asset-light and relatively low exposure to market volatility.

Credit Card: with 95 million account holders (No 1 bank issuer), 400 billion annual purchase volume (No 2), Citi's credit card operation generates 17 billion revenue, and 3 billion net profit annually in the last 3 years. An 8x P/E ratio values its business at 24B.

As a benchmark comparison to Capital One (COF), COF's credit card is roughly 65% of its revenue, and 70% of net profit. With its $35 billion market cap, its card business is roughly valued between $22.5 - $24.5 billion. Citi is about 20-40% larger, similar growth, lower profit margin, and slightly bigger net income. Thus, $24 billion valuations of Citi's credit card business seem reasonably conservative.

Retail/Asset Management: Citi's retail is the smallest among the big 4, with a $280 billion deposit, and $270 billion loans. Its Asset Management unit is also small in size, at around $200 billion AUM. Using a 5% deposit and 1% AUM values these 2 businesses at $15 Billion.

It sums up to $113 billion. As of writing, at $43.7, C has a market cap of $91 billion. This conservative valuation offers a 24% upside to its current price.

Just to show how conservative my valuation model is, its retail and asset management business is valued at a total of $15 billion, while Citi's Mexico business (Banamex and it was acquired in 2001 at $12.5 billion), was rumored to be approached for sales well over its initial acquisition price.

Recent Events

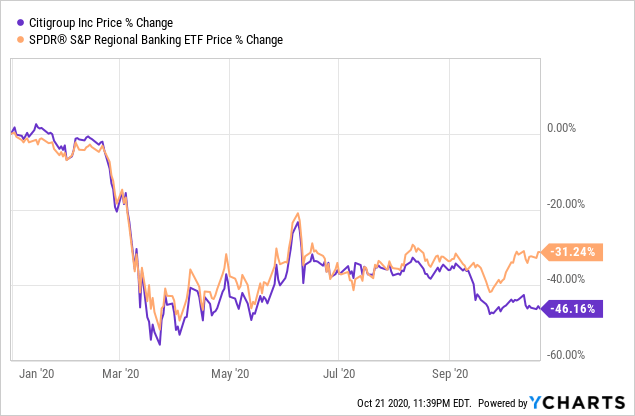

Citi's stock has been performing on par with KRE (S&P Regional Banking ETF) for most of 2020, till late August, when news came out that Citi filed suit to recoup $900 million it mistakenly sent to lenders. It was then followed by a $400 million fine, together with a consent order, which requires Citi to seek agency non-objection before making any new acquisition citing its risk mgt and internal control weakness. Its price went down more than 15% since, roughly 15 billion market cap.

Data by YCharts

Data by YCharts

In its latest quarterly report, Citi already hinted that it will beef up its internal control / IT system in the coming years. While no number was mentioned, I estimate a 2-3 billion annual spending for the next 18-24 months. It is not insignificant but very manageable for a 70+ billion annual revenue bank, and arguably money well spent. We shall expect its efficiency ratio goes up 2-3% for the next 2-3 years. If Citi can handle this in a forthcoming and decisive way, I think its damage could be well controlled, and a 15% price drop might be an overreaction.

Now let us examine a few potential issues.

Concerns and Opportunities

Outstanding Debts: its total debt increased from 210 billion to 248 billion in the last 4 years. Its Debt/Asset and Debt/EBITDA are high among its peers. I would prefer Citi to reduce share buyback (a total of $50+ billion spent in the last 5 years) and to pay back a portion of the long-term debt. However, at an average 3.5% interest rate of its debts, I can appreciate its current capital allocation choice as a way to maximize shareholder values.

CEO Early Departure: When Michael Corbat announced his abrupt retirement plan in early September to pave ways for Jane Fraser to become the first female CEO of a major US bank, the market didn't respond positively. However, as I read more about Jane Fraser, I am impressed by the choice.

Ms. Fraser is a hands-on problem solver - she was put into a couple of difficult situations, including appointed to CEO of Citigroup Latin America in 2015 amongst fraud charges in Banamex. She was able to stabilize and addressed the crisis quickly.

She is an insider - have experiences in many areas inside Citi including Private Bank, CitiMortgage, and Consumer Banking, as well as international exposure in Europe, North/South America.

I think this CEO assignment could be a significant event that improves shareholder value in long term. To be fair, I think Michael Corbat did a thankless yet solid job over the last 10 years as Citi CEO, even though the stock market didn't fully reflect that.

Concluding Thoughts

A conservative sum-of-all-parts values Citi at $113 billion market cap. At the current price of $44/share, it offers 24% upside potential.

The stock has been under headwinds in recent weeks, and I certainly don't know how long it would take the market to sort it out. I am taking a position at the current price while collecting a 4-5% dividend yield.

One More Thing

The latest addition to my Atlas portfolio H&R Block (HRB) was introduced in early October and went up 15% vs. 3.5% S&P since then. You might find the article here. I would appreciate you following me, and best of luck with your investments.

Disclosure: I am/we are long C. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.