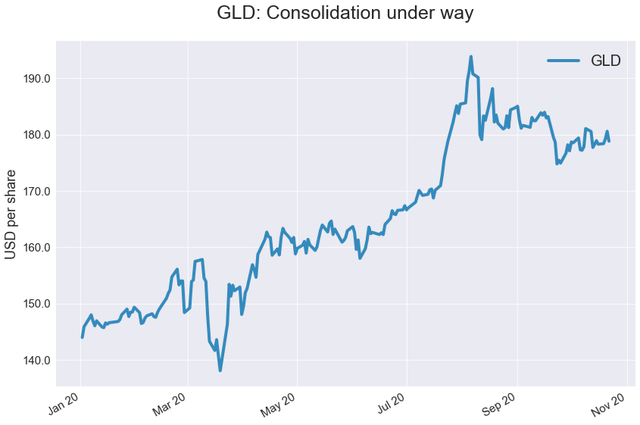

GLD has experienced a consolidation since hitting an all-time high this summer.

We analyze the positioning in the gold market to assess the sensitivity of gold prices to changes in behavior from specs, commercials, and ETF investors.

We find that ETF investors could easily push GLD back to its all-time high if they continue to accumulate the yellow metal at a strong pace.

However, speculators and commercials are unlikely to significantly impact GLD in the near term.

SPDR Gold Trust (GLD) has experienced a consolidation since August, on the back of renewed strength in the dollar and firmer US real interest rates.

Source: Orchid Research

In this note, we take a deep look at the positioning in the gold market in order to determine if and how fast GLD could come back to its all-time high.

Gold prices tend to be highly driven by changes in positioning from 1) speculators, 2) the commercial community, and 3) ETF holders. Although a significant share of gold price changes is driven by OTC activity, it is too opaque to estimate it and, therefore, quantify its impact on gold prices.

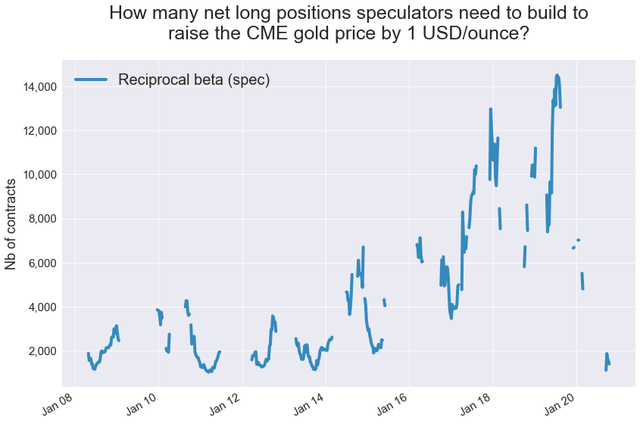

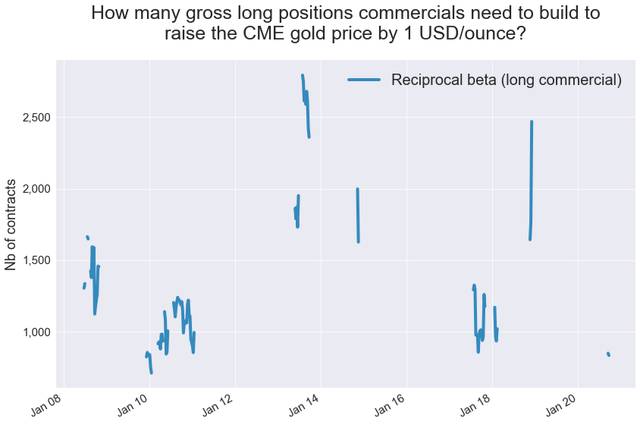

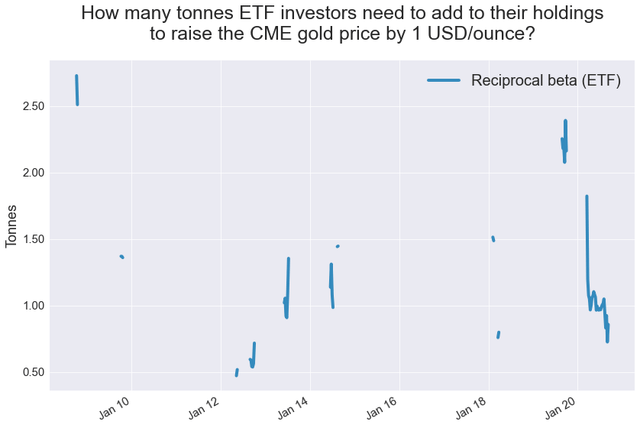

To understand the sensitivity of gold prices to changes in behavior from specs, commercials, and ETF investors, we run a 6-month rolling regression of weekly changes in the CME gold spot price on weekly changes in net long positions held by money managers (specs), gross long positions held by producers, merchants, processors, and users (long commercials), and gold holdings from ETF investors.

While the data about positioning from the speculative community and commercials is from the CFTC, the data about ETF holdings is estimated by us, using public websites.

Our model explains around 40% of the gold price variance over the past two years. What is not explained by the model is changes in OTC activity, other trader categories (e.g. swap dealers), and intraday trading activity.

Source: CFTC, Bloomberg, Orchid Research

Once we have quantified the sensitivity of gold price to changes in positioning from specs, commercials, and ETF holdings, we seek to estimate the potential change in positioning from these different market participants warranted to push the CME gold spot price to a certain level.

To do so, we compute the reciprocal rolling betas and capture only the ones that are statistically significant (i.e. p_value<=5%).

By doing so, we are able to see how many contracts speculators and commercials need to buy to push the COMEX gold spot price by $1/ounce and how many tonnes ETF investors need to add to push the COMEX gold spot price by $1/ounce.

Source: Orchid Research

The last significant reciprocal rolling betas are:

- 1,398 (speculators)

- 834 (commercials)

- 0.86 (ETF holders)

Interpretations

The CME gold spot price is currently trading at $1,890/ounce, which is $184 below its all-time nominal high of $2,074/ounce established on August 3.

Our analysis suggests that the CME gold spot price could come back to its all-time high, if

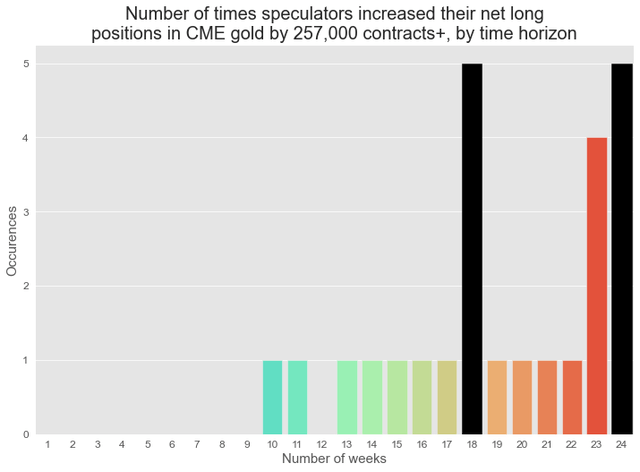

1) The speculative community increases by 257,000 contracts its net long position in CME gold, or

2) Commercials increase by 153,450 contracts their gross long position in CME gold, or

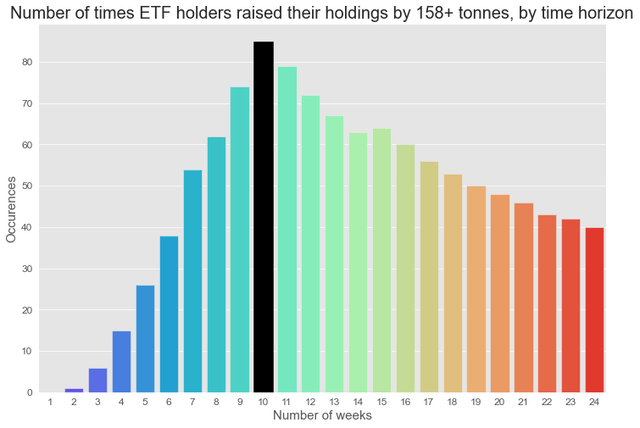

3) ETF investors raise by 158 tonnes their gold holdings.

What is the likelihood of such a scenario? We shed more light by analyzing the frequency of these plausible events.

Source: Orchid Research

Note: The bars in black correspond to the highest frequency. Since 2010, specs have increased their net long positions by at least 257,000 contracts in CME gold in an 18-week period 5 times since 2006. The fastest period was 10 weeks although it happened only once.

Source: Orchid Research

Note: Commercials have never increased their gross long positions by 153,000 contracts+ in less than a 50-week period.

Source: Orchid Research

Note: The bar in black corresponds to the highest frequency. Since 2006, ETF holders have added by at least 158 tonnes to their holdings in a 10-week period 85 times since 2010. The fastest period during which ETF investors added 158+ tonnes was only two weeks although it happened only once.

Conclusion

Our analysis suggests that GLD could come back to its all-time high by year-end if ETF investors continue to buy the yellow metal at a vivid pace. However, we find that the sensitivity of gold prices to changes in positioning from speculators and commercials is relatively weak, leading us to conclude that specs and producers are unlikely to significantly move GLD in the near term.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Our research has not been prepared in accordance with the legal requirements designed to promote the independence of investment research. Therefore, this material cannot be considered as investment research, a research recommendation, nor a personal recommendation or advice, for regulatory purposes.