Ardelyx Is An Even Bigger Value After Recent Sell-Off

I last wrote about Ardelyx as the company was close to submitting its tenapanor NDA and the stock was trading for over $8.

Since that time, Ardelyx had gotten its NDA accepted with an April 29, 2021 PDUFA date, yet the stock has dropped to about $5.

Nothing has changed fundamentally with the company, meaning that current price levels could present a good long-term opportunity for patient investors.

Ardelyx (ARDX) (pronounced ar-dell-ix) is a small clinical-stage biopharma that I first wrote about at the end of May. Since then, Ardelyx’s stock has taken a nose-dive, reducing its market cap from about $650 million down to nearly $450 million.

Figure 1: Ardelyx Stock Chart (source: finviz)

I decided to write this update to probe whether there is a fundamental reason underlying this decline or if it's just the ordinary volatility that so often creates good buying opportunities in biotech stocks.

Recap of My Prior Article on Ardelyx

In my prior article, I first discussed tenapanor for hyperphosphatemia’s benefits and the big potential upside for the company. I noted how hyperphosphatemia is a significant, negative predictor of patient outcomes for those on dialysis and how the current standard-of-care phosphate binder therapies do not adequately control serum phosphate levels. I also discussed how tenapanor offered a substantial improvement in quality of life and therapeutic adherence due to a large gap in the number of pills required between it and phosphate binders.

Figure 2: Chart Showing the Reduction in Pills for Patients on Tenapanor (source: Ardelyx’s September 2020 Investor Presentation)

At the time, Ardelyx said it was on track to get the NDA submitted in this indication mid-2020 which would likely lead to a mid-2021 launch.

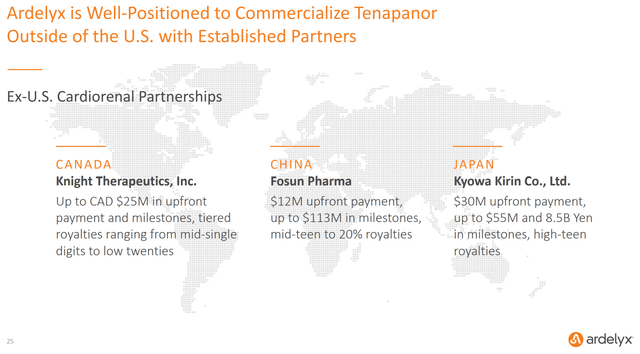

I then talked about Ardelyx’s multiple partnerships to develop its products worldwide. Ardelyx already had deals in place in Canada, China, and Japan to commercialize tenapanor that provided over $40 million upfront and the potential for substantial milestone payments and royalties down the road.

Figure 3: Chart Showing Ardelyx’s Partnerships (source: Ardelyx’s September 2020 Investor Presentation)

Lastly, I discussed Ardelyx’s valuation and how I thought Ardelyx looked somewhat undervalued on the US hyperphosphatemia opportunity alone. To me at the time, all of Ardelyx’s partnerships and the RDX013 opportunity represented essentially a free call option on additional potential upside.

Ardelyx has Continued to Execute on Getting Tenapanor Approved

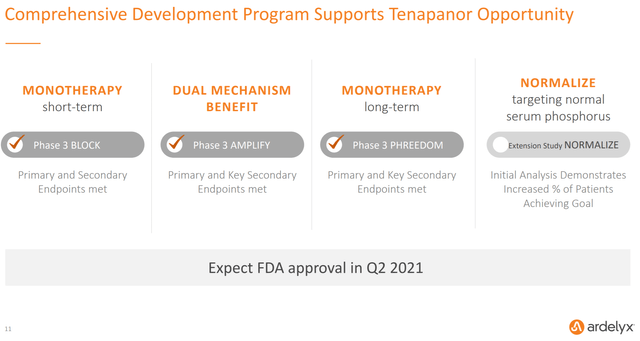

Ardelyx’s clear priority as a company is to get tenapanor approved and on the market in the hyperphosphatemia indication. To that end, Ardelyx announced that it filed the NDA for tenapanor in hyperphosphatemia on June 30, setting up an April 29, 2021 PDUFA date.

Figure 4: Chart Showing Ardelyx’s Tenapanor Opportunity (source: Ardelyx’s September 2020 Investor Presentation)

Clinical trial results, including from all three of Ardelyx’s Phase 3 trials, have been overwhelmingly positive, so it’s pretty hard to see tenapanor not getting approved in this indication. Patient reported diarrhea is the only real issue of potential concern, but as I discussed more in depth in the prior article, it seems to have been mostly mild-to-moderate in severity and usually transient. This is also a known side effect of the phosphate binders already in use. Additionally, the fact that tenapanor already got approval in the IBS-C indication is a strong indicator that the safety profile is acceptable.

Figure 5: Slide on Presenters from Recent Physician Panel (source: Ardelyx’s Virtual Physician Panel Slide Deck)

Ardelyx also hosted a recent physician panel on tenapanor on October 22. All three of these physicians discussed how significant the clinical results for tenapanor are in hyperphosphatemia. One of the physicians described tenapanor as a first-line, foundational therapy for the patient population at issue. Two other things they said about tenapanor stuck out in particular to me. One was that the standard-of-care phosphate binders have shown significantly higher levels of FGF23 versus tenapanor which is associated with cardiovascular problems like cardiomyopathy. This underscores the importance of getting serum phosphate levels under better control than what is currently happening in most patients.

The second is that they view tenapanor as an opportunity to actually achieve not just lower phosphate levels but also truly ideal phosphate levels which are virtually unachievable on phosphate binders alone. Currently, the goal for patients on phosphate binders is to maintain serum phosphate levels below a target level of 5.5 mg/dL, and the physicians on the panel said that this target is actually higher than ideal but more a reflection of what is even semi-realistic for binder therapy. Even still, 77% of patients on binder therapy don't stay below that mark over a six-month period. Tenapanor is helping people get well below that level and stay there.

These comments strongly suggest to me that tenapanor should be the new standard-of-care, whether used as a monotherapy or in conjunction with binder therapy.

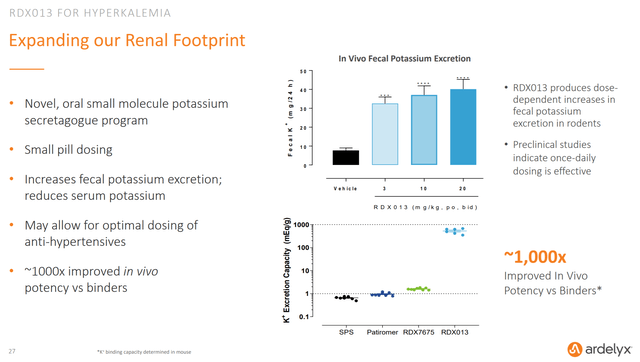

RDX013 for hyperkalemia is still in the pipeline, but there doesn’t appear to have been much tangible progress of late. The company seems solely focused on tenapanor right now which is fine by me given how important getting it approved and launched obviously is for Ardelyx.

Figure 6: Chart Showing RDX013 Facts (source: Ardelyx’s September 2020 Investor Presentation)

Just as a reminder, tenapanor already received FDA approval in IBS-C back in 2019, but the drug was never launched. I must say the lack of an IBS-C partnership or launch spooks me a bit. Back in 2018, the company was describing this as a $500 million+ opportunity. It’s really hard to understand why a once-promising, already approved drug is still just sitting unused and unpartnered over a year after garnering FDA approval. I would definitely be encouraged to see this either partnered out or launched alongside the hyperphosphatemia indication early next year.

It’s also worth explicitly noting that there is a risk that Ardelyx might not get tenapanor approved and successfully commercialized for hyperphosphatemia. Given that this is the company’s primary indication at present, this type of failure could result in huge and permanent losses of capital for investors.

Ardelyx’s Balance Sheet Should Get it to 2022

Ardelyx reported having $204.8 million in cash and equivalents at the end of Q2. With the company’s current $25 million per quarter burn rate, one would expect Ardelyx to make it to early-to-mid 2022 on its current cash resources.

Ardelyx also has a $50 million loan that matures in 2022. That is not a particularly high debt load, though, so Ardelyx could possibly raise a bit more capital that way. Hopefully, Ardelyx will be able to string together sufficient funding between debt or royalty financing and maybe a partnership in IBS-C to keep dilution to a minimum.

While the balance sheet looks good now, Ardelyx could obviously have to raise large amounts of dilutive capital if there was trouble getting the tenapanor hyperphosphatemia indication approved or if sales are slow. This is another big risk to consider when investing in a company like Ardelyx.

Ardelyx’s Valuation has Gotten More Attractive

Ardelyx has taken a substantial haircut in valuation since my last article, losing over 30% despite the fact that nothing has really changed from a fundamental standpoint. Ardelyx’s current market cap is now well under the low-end of the estimated peak sales range I’ve seen for tenapanor in the US alone which is around $500 million to $750 million.

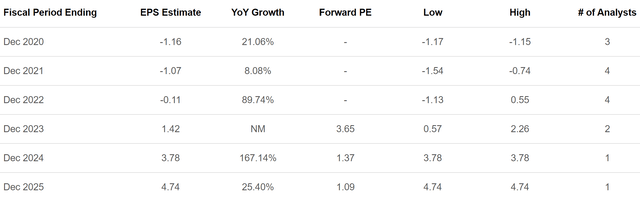

Figure 7: Ardelyx Earnings Estimates (source: Seeking Alpha)

As you can see from Figure 7, Ardelyx is also trading for just over 1x expected 2025 per share earnings and is expected to be cash flow positive after just two more years. All this together suggests Ardelyx could offer strong long-term value from present levels. Certainly nothing has happened on a fundamental level to decrease the outlook over the last few months as the stock has sold off.

The bottom line is that Ardelyx is now closer than ever to getting its key therapy to market, and yet the stock is hitting recent lows. Ardelyx's entire market cap is well under likely tenapanor peak sales, and with around $200 million in cash and equivalents, the market appears to value the tenapanor opportunity at just $250 million. Ardelyx thus presents a set-up that could lead to outsized long-term returns for the patient investor.

Ardelyx is a good example of the type of company I cover in my Marketplace Service, Biotech Value Investing, and in fact, subscribers are getting access to my discounted cash flow model and strategies for taking a potential position in Ardelyx. Biotech Value Investing provides coverage of my approach to finding high-quality, value-oriented companies in the biotech sector and using options to help generate a high compounded return while ensuring optimal entry and exit points. Check us out today with a free trial.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I’m not a registered investment adviser. Please do not mistake this article, or anything else that I write or publish online, as any type of investment advice. This article and anything else that I post online are for entertainment purposes only and are solely designed to facilitate a discussion about investment strategy. I reserve the right to make any investment decision for myself without notification except where required by law. The thesis that I presented may change anytime due to the changing nature of information itself. Despite the fact that I strive to provide only accurate information, I neither guarantee the accuracy nor the timeliness of anything that I post. Past performance does NOT guarantee future results. Investment in stocks and options can result in a loss of capital. The information presented should NOT be construed as a recommendation to buy or sell any form of security. Any buy or sell price that I may present is intended for educational and discussion purposes only. Please think of my articles as learning and thinking frameworks--they are not intended as investment advice. My articles should only be utilized as educational and informational materials to assist investors in your own due diligence process. You are expected to perform your own due diligence and take responsibility for your actions. You should consult with your own financial adviser for any financial or investment guidance, as again my writing is not investment advice and financial circumstances are individualized.