Since we initiated a Buy rating on Safehold, shares have returned 99% annualized.

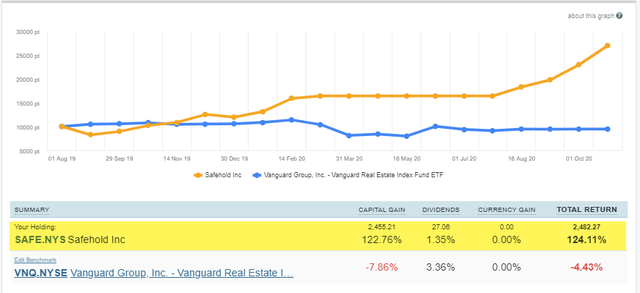

I am glad that I jumped on the Safehold train when we did, as shares have returned 124% annually since we made the initial investment back in August 2019.

If there’s one REIT to own during a global pandemic, it has to be Safehold!

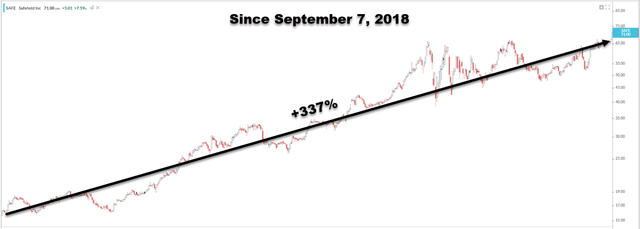

We first began touting Safehold Inc. (SAFE) back in February 2018, when I explained in an article titled "Crack Open The SAFE":

“After speaking with Jay Sugarman (SAFE’s CEO) and taking a closer look at SAFE we are initiating a BUY rating. We believe this REIT is trading at a modest discount and we consider $16.50 a reasonable Fair Value Target. We will include SAFE in the “Other” classification within the Intelligent REIT Lab.”

(Source: Koyfin)

To be clear, since we initiated a Buy rating on SAFE, shares have returned 99% annualized. And in October 2019, in an article titled "Safehold: The Ultimate Sleep Well At Night REIT," I explained:

“Although the dividend yield of 1.84% appears paltry for a REIT, the growth potential is compelling. It’s forecasted for 25% in 2020 and 20% in 2021.

The economics of the business model are driven by the most durable income generators in the real estate sector – with rent growth of 2x inflation. And at some point, the residual value will provide icing on the cake. Just remember: You’re buying an AAA bond in a REIT wrapper. Here’s to sleeping well at night!”

(Source: Koyfin)

As I reflect on the success of our Small Cap REIT portfolio, that has returned an average of 28% per year since April 2016, I am glad that I jumped on the Safehold train when we did, as shares have returned 124% annually since we made the initial investment back in August 2019.

(Source: Sharesight)

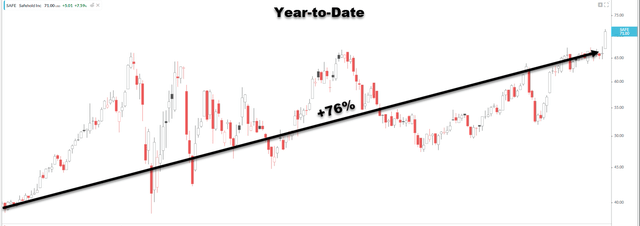

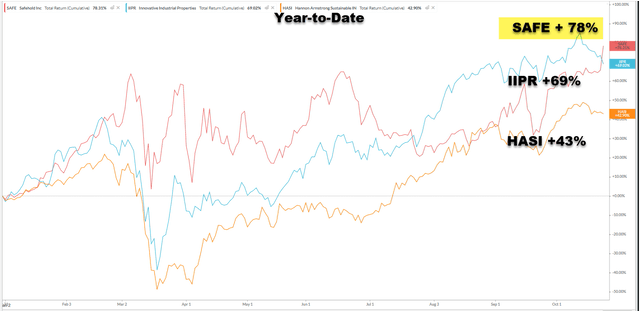

When you look at the company’s year-to-date performance (below), you would not even know that we’re living in the midst of a global pandemic:

(Source: Koyfin)

And the more I ponder Safehold and its uniquely positioned business model, I began to realize that this misunderstood REIT could be the only pandemic-proof REIT in the world.

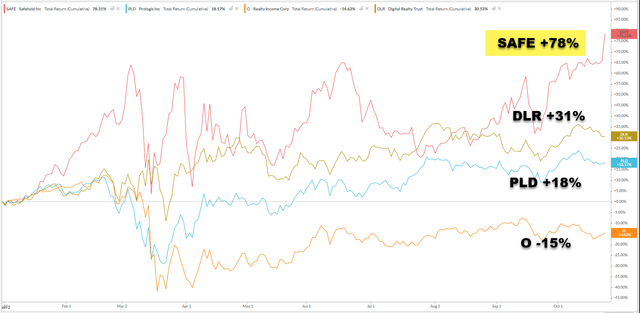

Just take a look at its year-to-date performance, compared with other well-known stalwarts such as Realty Income (O), Digital Realty (DLR) and Prologis (PLD).

(Source: Koyfin)

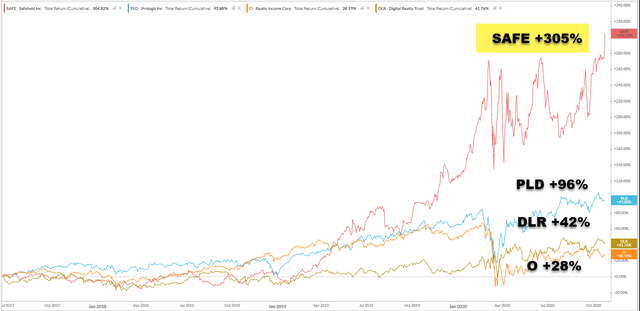

And over the last 5 years, the performance is simply stunning (see below)!

(Source: Koyfin)

I was curious as to whether Safehold had outperformed two other iREIT recommendations - Innovative Industrial (IIPR) and Hannon Armstrong (HASI) - and as can be seen below, this pandemic-proof player once again demonstrates that it deserves that (pandemic-proof) title. SAFE has outperformed IIP and HASI year to date.

(Source: Koyfin)

So now that my curiosity is increasing (and hopefully yours too), it’s time to take a deeper dive and determine whether or not Safehold is the quintessential pandemic-proof pick.

(Source)

The Business Model

I spotted this very interesting quote by Charles Pryor (published in 1928) on the SAFE website:

The lessor desires to see his property improved, and yet he makes it as easy as possible for the lessee to make the improvement, for the success of the one means the success of the other as well.”

That, my friends, is the value proposition of the ground lease. As I pointed out in my article from February 2018:

“there are good reasons why a ground lease is advantageous to all parties involved.

Perhaps the biggest advantage for tenants is that a ground lease provides access to well-located land that otherwise could not be bought. This is why ground leases are widely used by many big retail tenants such as McDonald’s, Chick-fil-a, and Starbucks.

Another advantage of a ground lease is that the tenant does not have to come up with the upfront cash required to purchase the land in a deal. This lowers the upfront equity required in an investment, freeing up cash for other uses, and also improving the yield.”

As a developer, I have constructed numerous buildings on ground lease contracts, and I have found them to be extremely useful. But there are also benefits for the landowner, as the “ground lease provides a stable income stream typically from a creditworthy tenant, while still allowing the landlord to retain ownership of land.”

One extremely important benefit for the landowner, and SAFE as I will address in this article, is the fact that “ground leases normally have a reversionary clause, which transfers ownership of the improvements to the landlord at the end of the lease.”

The Most Powerful Benefit

As a REIT, SAFE makes real estate ownership more efficient, as the unique vehicle provides three distinct advantages to building owners:

- Better capital efficiency

- Better cost efficiency

- Material risk reduction

These three ingredients enable building owners to generate higher returns, avoid unnecessary transaction costs and significantly reduce maturity risk in their capital structures.

SAFE has provided ground leases during the development phase, at the point of refinancing/recapitalization and during the purchase or sale of a property.

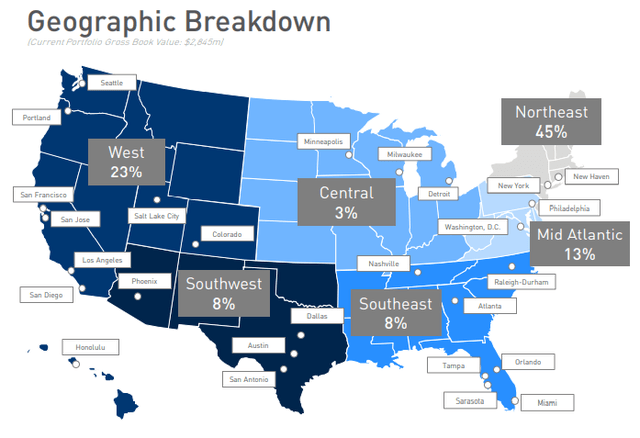

While one ground lease can offer up to 99 years of increasing and compounding cash flows, Safehold is building a portfolio of ground leases around the country underneath some of the highest-quality office buildings, apartment buildings and hotels.

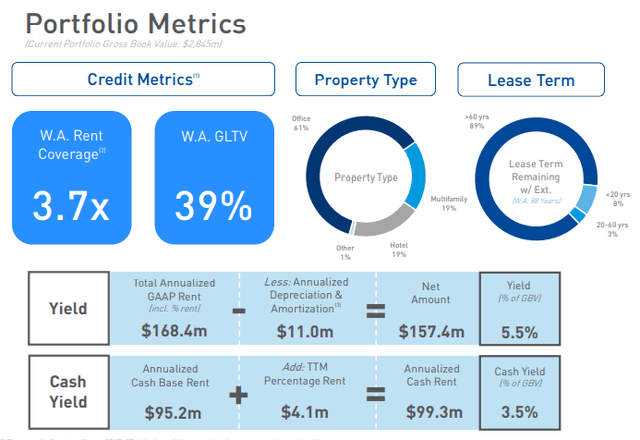

As you can see below, SAFE’s portfolio is well-diversified with a total of $1.9 billion of investment value (was just $138 million in June 2018).

(Source: Investor Presentation)

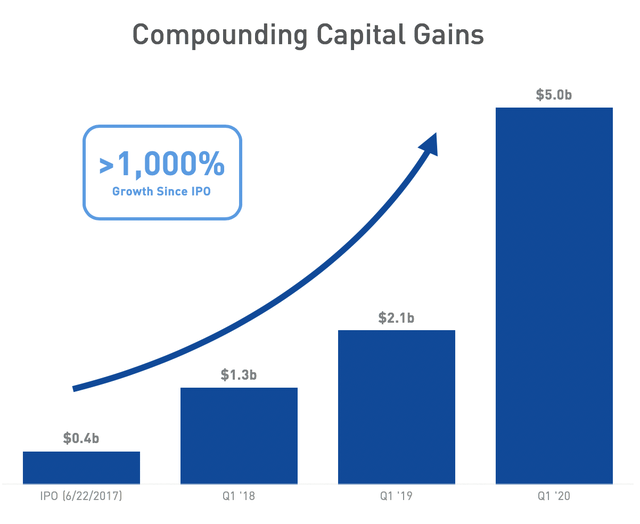

The portfolio has grown 12x since June 2018, and as viewed below, the company’s unrealized gain (reversionary benefits referenced above) is now over $5.0 billion in value.

Because the buildings on top of SAFE’s land transfer at the end of the lease term, the company is also building a growing pool of future ownership interests in those buildings, “effectively creating a trackable capital gains account that is compounding.”

(Source: Investor Presentation)

The Balance Sheet

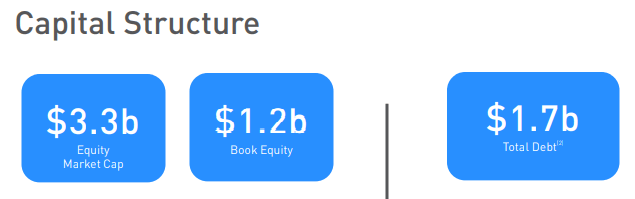

SAFE’s equity market cap is around $3.3 billion, and as of Q2-20, the company had roughly $239 million of cash and revolver availability. It maintains conservative leverage (0.5x debt-to-equity market capitalization and 1.4x debt-to-book equity).

(Source: Investor Presentation)

The company has around $1.7 billion of total debt, and the weighted average interest rate is 4.0%, which is a 150-basis point spread to the 5.5% portfolio yield (cash yield is 3.5%, as seen below). Also, the debt has a 31-year weighted average maturity.

(Source: Investor Presentation)

Before Q3-20 end, SAFE received an additional $32.5 million commitment to its revolving credit facility from a new banking relationship, bringing the total capacity on the revolver to $557.5 million. Also, as referenced earlier, the company’s unrealized capital appreciation stood at $5.1 billion (at the end of Q3-20), representing 12x growth since the IPO.

Note: SAFE has each asset appraised on an annual basis after it is acquired, and there was a modest decline (from $5.2 billion to $5.1 billion) due to COVID-19.

What Pandemic?

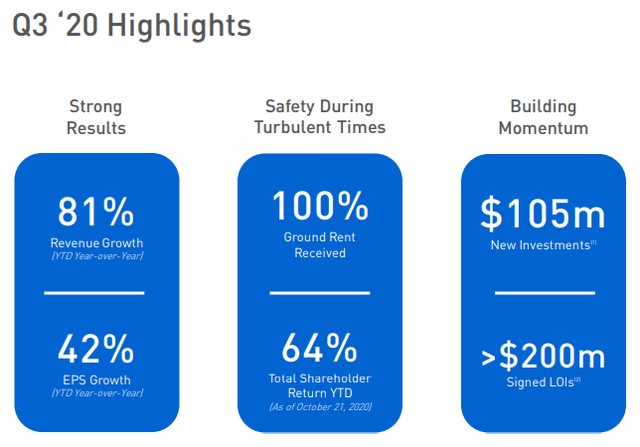

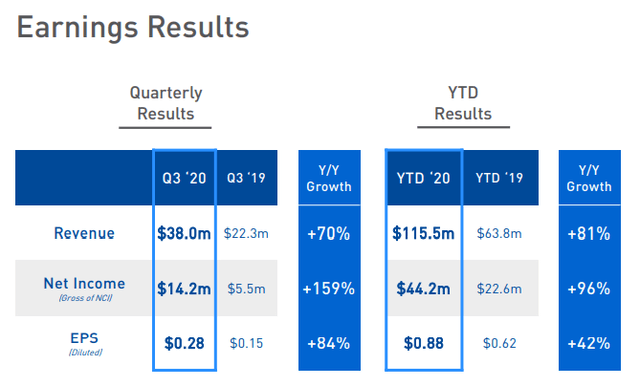

SAFE reported Q3-20 EPS of $.28 per share, ahead of consensus of $.26 per share. Unlike many REITs that are still collecting rent, SAFE collected 100% of rents:

(Source: Investor Presentation)

When you think about it, I’m not surprised that the company collected 100% of its rent. Even though 80% of the rent is derived from hotel and office buildings, the building owner has a strong incentive to stay current because a default could trigger a transfer of ownership to SAFE.

So, SAFE’s business model is just what the ticker describes: S.A.F.E.

Thus, even a global pandemic has not made a dent in the ground lease platform, and SAFE’s rents would have to fall by 75% to put the company at risk. As viewed in a previous chart, rent coverage stands at 3.7x, which provides SAFE with an identifiable margin of safety against asset-level cash flow declines.

(Source: Investor Presentation)

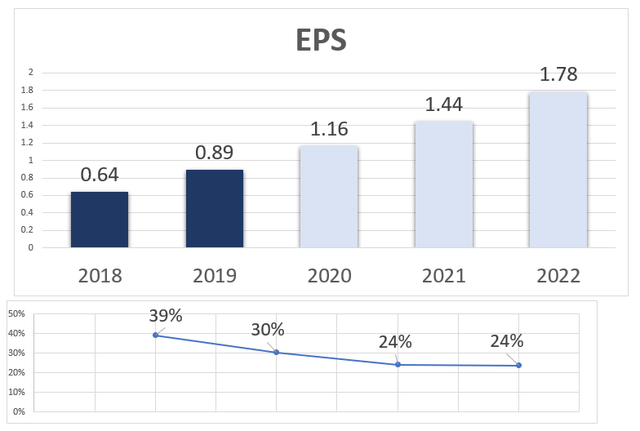

Consensus numbers suggest SAFE could grow EPS by 30% in 2020, 24% in 2021 and 24% in 2022. Note that this forecast consists of 6 analysts in 2020 and 2021 and 4 analysts in 2022.

(Source: Wide Moat Research)

In terms of growth, SAFE has closed $234 million of new deals so far in 2020 and has around $200 million in “signed LOIs.” Keep in mind that the company added $1.9 billion in new assets in 2019, but the consensus growth numbers have to be the very best in the entire REIT sector.

Correction (I just checked): IIPR consensus FFO/share in 2021 is 52%, and VICI Properties (VICI) is showing 37% (and I own both).

Nonetheless, SAFE was the best-performing public REIT in 2019, delivering a 118% total return. Earnings grew 38% year over year (in 2019), and the high fragmentation should lead to elevated acquisition volumes in the years ahead.

Risks are Relevant

SAFE is externally managed by iSTAR (STAR), a leading player in the sale-leaseback market, which means the company has deep experience in crafting capital markets solutions. Because of this relationship, SAFE is able to source new deals thanks to the “wide net” business model in which STAR aggregates customers.

STAR is SAFE’s largest shareholder and owns approximately 65.2% of the common stock, and two directors of STAR serve on SAFE’s board of directors, including Jay Sugarman, who is the CEO of STAR. SAFE’s manager is a wholly owned subsidiary of STAR, and as a result, STAR has significant influence over SAFE.

Some of SAFE’s tenants operate hotels. As of Q4-19, the company had 19.6% of total revenues from hotel properties. That’s certainly a risk to consider, but it appears the company plans to invest in the multifamily sector in the future, in order to create a more diversified platform. On the Q3-20 earnings call, Marcos Alvarado, president and CIO, said:

“... in the quarter and subsequent to the quarter end, we closed on 3 brand-new Class A multifamily transactions, 1 in Seattle, 1 in Philadelphia and 1 in San Jose that was closed in the quarter, all consistent with our methodology and investment thesis.

Post quarter, and I have to be frank, really since Labor Day, we've seen a dramatic pickup. So when you think about the letters of intent that are $200 million plus. 80% of those are multifamily transactions, all in major markets across 8 transactions in total. And we feel optimistic about the next wave behind that.”

Valuation Matters

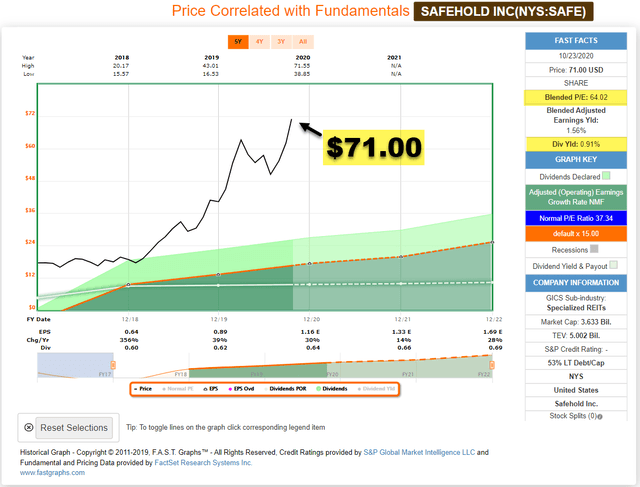

As my regular readers know, I rely on F.A.S.T. Graphs to obtain quick fundamental analysis, and as the graph below suggests, SAFE is not trading at a wide margin of safety whatsoever.

(Source: F.A.S.T. Graphs)

A dividend yield below 1% is not very enticing, as I would prefer to invest in ground leases directly in order to achieve an attractive source of sleep well at night ground lease income.

However, I can see why institutional investors (and family offices) have gravitated to SAFE. The company is now included in the RMZ, and Fitch recently upgraded SAFE.

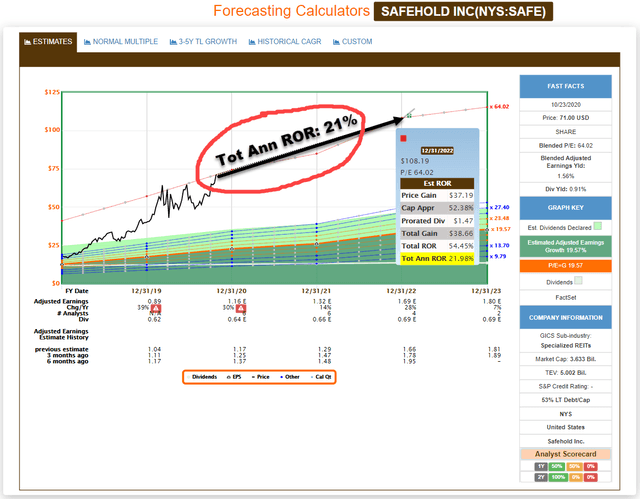

We recommend waiting on a pullback (FV target is $61.00/share), and I’m quite happy to hang onto existing shares (that should generate 20% annualized TR’s going forward). If there’s one REIT to own during a global pandemic, it has to be SAFE!

(Source: F.A.S.T. Graphs)

Author's note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Join the iREIT Revolution! (2-Week FREE Trial)

At iREIT, we're committed to assisting investors navigate the REIT sector. As part of this commitment, we recently launched our newest quality scoring tool called iREIT IQ. This automated model can be used for comparing the "moats" for over 150 equity REITs and screening based upon all traditional valuation metrics.

Join iREIT NOW and get 10% off and get Brad's book for FREE!

* Listen to our Ground Up Podcast * 2-week free trial * free REIT book *

Disclosure: I am/we are long SAFE. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.