Pioneer Natural Resources Makes A Reasonable Purchase With Parsley Energy Acquisition

The management team at Pioneer Natural Resources decided to acquire Parsley Energy in an all-stock transaction.

The premium paid for Parsley is small, but that is because the company is already pricey for a firm in its space, though a cheap company compared to non-energy opportunities.

With synergies, the transaction does make a good deal of sense, but even without it's not a bad transaction.

So far, October has been a pretty busy time for oil and gas firms looking to merge. The latest example here is the decision of Pioneer Natural Resources (PXD) to acquire, in an all-stock transaction, Parsley Energy (PE). This multi-billion-dollar deal will help to create a real power-player in the Permian Basin and is slated to net the combined company (and its shareholders) some significant synergies. In all, the price being paid by Pioneer is toward the higher end of the range of what many players in the space are currently going for, but it’s not such a high amount that the transaction is necessarily bad. If anything, it should be considered a decent transaction for the parties involved.

A look at the deal

The deal between Pioneer and Parsley is fairly straightforward. According to the terms of the transaction, shareholders of Parsley will receive a fixed number of shares in Pioneer for each share of Parsley they already own. This figure is 0.1252. Based on the data provided, this works out to a premium for Parsley’s stock, over the closing price for the business on October 19th, of 7.9%. This isn’t a large premium, but it’s important to keep in mind that as a larger, more stable E&P (exploration and production) operator, shares of the business are trading higher than many other, smaller players.

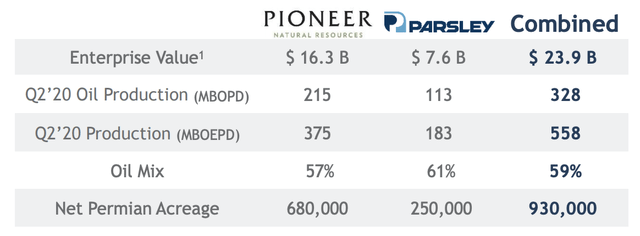

In all, Parsley is seeing its equity (as of the time of the announcement) valued at $4.5 billion. Its total EV (enterprise value) is about $7.6 billion. When combined, Pioneer will see the benefit of its proved reserves rising to the tune of 65%. That’s quite a significant increase when you consider that Pioneer’s shareholders today will retain 76% of the equity in the combined business. The remaining 24% will belong to Parsley’s shareholders. This point is further strengthened by the fact that 65.5% of the combined firm’s output of 328 thousand boe (barrels of oil equivalent) per day comes from Pioneer, while the remaining 34.5% comes from Parsley.

*Taken from Pioneer Natural Resources

*Taken from Pioneer Natural Resources

Merging the two entities into one will have a major impact on the business. Based on the data provided, the company will have around 930,000 Permian Basin acres to its name. Its net leverage ratio will be moving down to 0.75 and it will also see its reinvestment rate reduced to between 65% and 75%. The latter here is the percent of cash flow from the firm that must be put into operations to meet management’s expectations. This flexibility will permit the company to set a base dividend of $2.20 per share, with a variable component to it starting in 2021. With shares of Pioneer currently trading for $83 apiece, this implies a yield of at least 2.65%. This is not particularly high, but in space where few of the players can afford to pay out anything, it is noteworthy.

Growing its physical footprint is reason enough to make Pioneer want to make this deal happen, but there’s a different angle to the transaction as well. By merging with Parsley, management believes that it is capable of generating significant synergies. In all, management anticipates annual run-rate synergies of $325 million. $150 million of these are tied to planned operational synergies, while another $100 million will relate to savings associated with general and administrative costs. The latter here will likely come from reducing duplicative costs at corporate headquarters. In addition to these savings, $250 million in all, management believes it can generate a further $75 million per year associated with interest expense. This comes from the fact that the average interest rate currently paid by Pioneer is about 2%, while for Parsley it is 5%. Refinancing debt under the larger umbrella of the combined entity should allow the firm to push interest rates on its debts down by some.

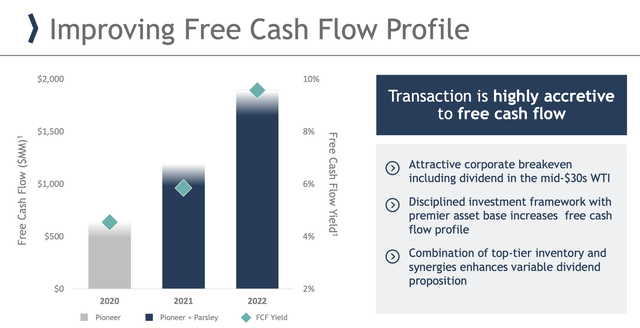

Using a 10% annual discount rate, the present value of these savings over a period of 10 years is worth some $2 billion. In addition to this, management has high hopes that cash flow for the business will improve materially in the next two years. You can see this illustrated in the image below. In all, by 2022, the expectation is for the combined firm to generate nearly $2 billion in free cash flow, implying a free cash flow yield approaching 10%. This is vastly superior to Pioneer as it stands today.

*Taken from Pioneer Natural Resources

*Taken from Pioneer Natural Resources

I do believe it’s worth mentioning that while this transaction makes a lot of sense conceptually, the value of the deal really does boil down to whether these synergies are realized or not. Or at least a lot of its value does. Consider how performance has been in the trailing twelve months ending in the second quarter this year. Based on the data available, Parsley’s operating cash flow has been $1.20 billion. With the $4.5 billion equity value of the transaction, the firm is being acquired by Pioneer at a multiple of 3.74.

That’s actually not bad, especially compared to companies outside of the energy space. For those in the oil and gas market, however, particularly on the E&P side, it is definitely toward the high end of the scale. Its EBITDA, meanwhile, looks to be $1.42 billion. An EV, then, of $7.6 billion works out to an EV/EBITDA multiple of 5.35. Once again, this is not bad for a company in general, but it is at the higher end of what many players are trading for. If we assume no taxes at all, the $325 million in annual synergies changes this picture to some degree. The implied price/operating cash flow multiple looks to be just 2.94, which is getting close to what many other players are trading around, while its EV/EBITDA multiple dips to a slightly better 4.55.

There is another dimension to this transaction. Since the deal is all-stock in nature, it’s worth comparing Parsley’s valuation to Pioneer’s. On a price/operating cash flow basis, Pioneer is trading for a multiple today of 4.48. This premium means that the company is paying for a cheaper business with its (relatively-speaking) higher-priced stock. On an EV/EBITDA multiple, the disparity is a little different at 4.91. On that basis, Pioneer is cheaper. Investors should reflect on how these disparities affect the value proposition between the two entities.

Takeaway

Right now, there’s a flurry of activity in the energy space and for good reason. Most of the players in the market are trading at pretty low multiples and the benefit of merging with others is obvious. In the event that synergies are not realized from this transaction, it does appear a bit pricey for Pioneer, but it’s not bad in the grand scheme of things. With synergies, the transaction certainly looks better, but only time will tell what the end picture will look like.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.