I Have A Bad Feeling About This

Many major markets appear to be on the edge of a cliff right now.

Markets need stimulus, and it does not look like they are going to get it any time soon.

Hope is no investment strategy that I'm aware of, however, hedging is.

Some ideas on how to protect your portfolio going forward.

Major Markets are in a Very Dangerous Spot Here

Not much seems to be getting done on the fiscal stimulus front, coronavirus cases continue to explode around the globe, there's great uncertainty regarding the presidential election and what will follow. In addition, while we are in the midst of an earnings season that seems to be "relatively strong," much of the forward guidance is not, or is extremely uncertain. Therefore, there appears to be a strong likelihood that markets could stumble along for a while, or possibly even cascade lower in the near term.

Look at Some Key Markets Right Now

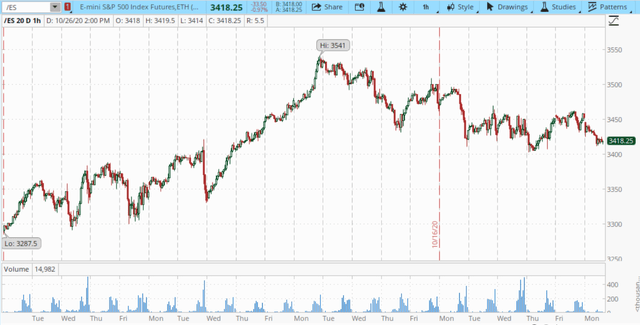

SPX futures

Source: Think or Swim, Ameritrade

Source: Think or Swim, Ameritrade

The S&P 500/SPX (SP500) futures are down by around 1% in the pre-market session. Moreover, we see that SPX is dangerously close to its crucial support area at 3,400. If this level breaks down we could see selling accelerate. First major support area from here is 3,300, but the market could fall through this point and cascade lower to 3,200 support, and possibly even down to the 3,000 level after that.

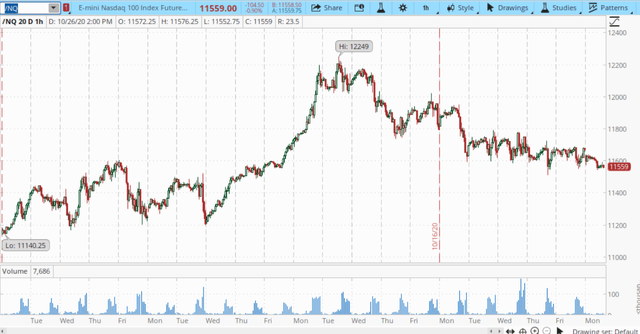

Nasdaq futures

We see a very similar image with the Nasdaq (futures). The Nasdaq is down by roughly 1% as well and is dangerously close to breaching the 11,550-11,500 support level. If this level gives out, I expect a move lower to the 11,200 level, and possibly lower after that.

We see a very similar image with the Nasdaq (futures). The Nasdaq is down by roughly 1% as well and is dangerously close to breaching the 11,550-11,500 support level. If this level gives out, I expect a move lower to the 11,200 level, and possibly lower after that.

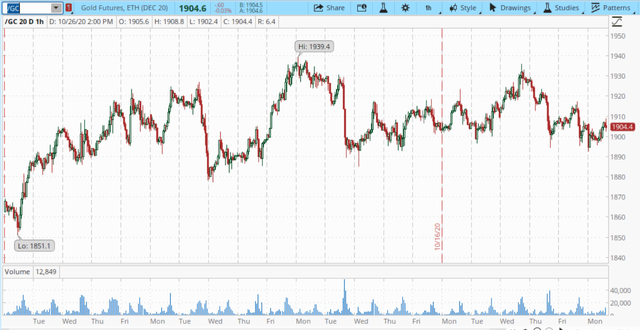

Gold futures

Gold looks better, as it's around flat for the session right now. Yet, gold also is close to breaching $1,900 support after which it's likely to test $1,880, and possibly re-test the $1,850 level after that. I'm not as concerned about gold in the intermediate and longer term as I'm about major stock market averages, but if volatility picks up significantly across the board in equity markets, gold and GSMs in general will likely be impacted negatively in the short term as well. To the upside, gold needs to get back above the $1,940 level for a positive momentum shift to occur.

Gold looks better, as it's around flat for the session right now. Yet, gold also is close to breaching $1,900 support after which it's likely to test $1,880, and possibly re-test the $1,850 level after that. I'm not as concerned about gold in the intermediate and longer term as I'm about major stock market averages, but if volatility picks up significantly across the board in equity markets, gold and GSMs in general will likely be impacted negatively in the short term as well. To the upside, gold needs to get back above the $1,940 level for a positive momentum shift to occur.

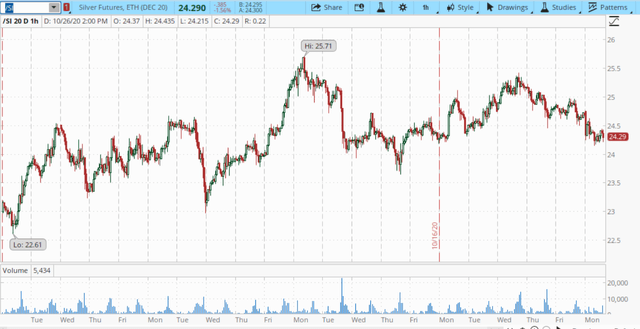

Silver futures

Silver appears to be in the same boat with gold technically speaking, but is leading the way lower, down by roughly 1.5% so far in the session. Silver is typically more volatile than gold, but its lead to the downside is troublesome, in my view. We can see that silver is extremely close to breaching $24.20-$24 support, after which it could cascade lower to $23, then $22, and possibly down to the $20 support level after that (worst case scenario in my view).

Silver appears to be in the same boat with gold technically speaking, but is leading the way lower, down by roughly 1.5% so far in the session. Silver is typically more volatile than gold, but its lead to the downside is troublesome, in my view. We can see that silver is extremely close to breaching $24.20-$24 support, after which it could cascade lower to $23, then $22, and possibly down to the $20 support level after that (worst case scenario in my view).

Markets Need Stimulus, Period

The markets need more stimulus, and it doesn't look like they are going to get it. Nancy Pelosi and the Democratic-controlled Congress seem to be stalling regarding pre-election stimulus, and time is running out. With just about a week until the election I don't think anything is going to get passed.

So, What Happens Then?

Some market participants may think that the "blue wave" will come to the rescue right after the election if Joe Biden wins. However, this is unlikely as the lame duck session and the transfer of power in the White House takes time. So, in such a scenario we may not see a fiscal stimulus package pass until early 2021. Unfortunately, by this time it may be too late, and markets are likely to decline into this kind of uncertain atmosphere.

On the other hand, if President Trump retains power, we will likely see a fiscal package pass sooner but it will not be as large. In my view, sooner is better for stocks, and for markets in general, even if the stimulus is not as large. Unfortunately, due to the political theater down in Washington uncertainty is likely to persist not only going into the election, but following it as well.

Bitcoin The Safe Haven?

Source: Binance.com

Source: Binance.com

Bitcoin continues to illustrate its decoupling from stocks and other major asset classes as it continues to move relentlessly higher despite weakness in most major markets. How long this phenomenon will last is difficult to predict, but the technical image continues to look bullish for now.

Key support levels to watch here are $13,000, and then around $12,700. If $12,700 starts to collapse, BTC could retest the $12K area, and possibly break through to lower levels if volatility picks up substantially across the board. To the upside, we want to form a base above $13K and proceed to $13,500, and then to $14,000.

The Bottom Line

We have about 45% of our assets allocated to Bitcoin/blockchain enterprise and GSMs. Bitcoin and "Alts" we are watching closely, and will likely begin to lock in some more profits if BTC starts to reverse sharply lower. GSMs we are not as concerned about at the moment as they are not likely going to be as volatile as the digital asset segment, and we are looking to buy more gold and silver miners on the dips.

Our Non-GSM segment is more concerning at the moment, as many equities we hold could decline substantially if crucial support levels begin to collapse. Therefore, we will likely take more profits in some areas in the short term if support levels give out and we will look to buy back into select names on the dips once markets stabilize. Our cash position is at a healthy 30%, but it will likely increase in upcoming sessions if markets continue to show more weakness.

Good Time for a Hedging Plan

Hedging can be extremely important in various instances, especially when the market is in an uncertain phase, or looks like it's getting ready for a major decline. In fact, we may be at such an inflection point right now.

Let Us Talk About Some Various Hedging Methods

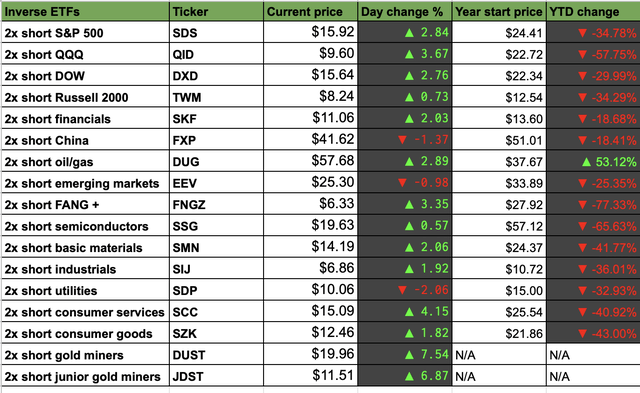

Inverse ETNs

Inverse ETNs are likely the most popular and most convenient way to hedge positions in a portfolio. Typically, we look at technical levels for when to open/close positions. Some of our favorite choices concerning the underlying inverse ETNs include (SZK), (SCC), (FNGZ), (DUG), as well as major market average inverse ETNs such as (TWM), (SDS), and (QID).

Futures Contracts

In my view, futures contracts are the most optimal way to short/hedge, as they don't degrade like inverse ETNs.

Say SPX futures break down below 3,400, then this would be a good time to sell (go short SPX futures). Same thing with the Nasdaq futures if they break below 11,550-11,500. The same applies to gold if it starts to fall below $1,880, etc.

Thus, the best way to hedge/short in my view is through the futures market. But timing is very important here, and futures contracts are relatively large in dollar terms, even the mini contracts. So, this strategy may not be applicable for everyone.

The VIX Option

Another way to protect your portfolio in an uncertain or downward market is to "play the VIX." For instance, buying VIX futures may be a good strategy here, and I certainly believe it's better than using instruments like (VXX), etc., as VXX and other similar trading instruments tend to decay extremely quickly.

More Conservative Options

More conservative hedging options include selling covered call options and picking up nice premiums for owning shares. Also, implementing a sell call/buy put strategy, where you sell a covered call option on a stock and use the premium to buy put options on the same position.

Hope is no investment strategy that I am aware of, hedging is...

Want the whole picture? If you would like full articles that include technical analysis, trade triggers, portfolio strategies, options insight, and much more, consider joining Albright Investment Group!

- Subscribe now and obtain the best of both worlds, deep value insight, coupled with top-performing growth strategies.

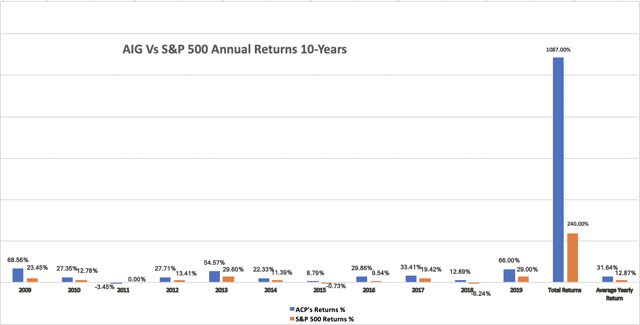

- Receive access to our top-performing real-time portfolio that returned 38.5% in H1 2019, as well as 66% in our stock and ETF segment for the full year.

- Don’t hesitate, click here to find out more, become a member of our investment community, and start beating the market today!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article expresses solely my opinions, is produced for informational purposes only and is not a recommendation to buy or sell any securities. Please always conduct your own research before making any investment decisions.