Sage Therapeutics May Have The Juice That's Worth The Speculative Squeeze

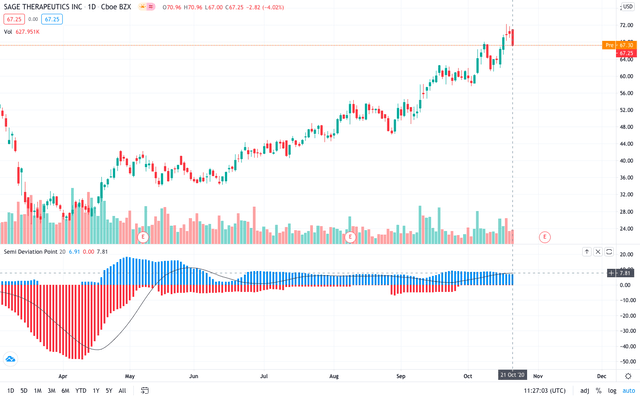

Sage Therapeutics has shown impressive results on the charts YTD, where shareholders have enjoyed +169% gains since the selloff.

The stock has bounced away from support nicely 5 times since then, with new support formed in August, where it has moved away another 2 times.

SAGE has several key developments in its pipeline, mainly pertaining to clinical depressive disorders, with Zulresso set to expand commercial reach from this year.

Other compounds have shown impressive data thus far, and if all continues to evolve as planned, share trajectory may continue north.

We believe that the company is a higher risk play, for those with a higher risk appetite, and assign a blue-sky target range of $70-$75.

Investment Thesis

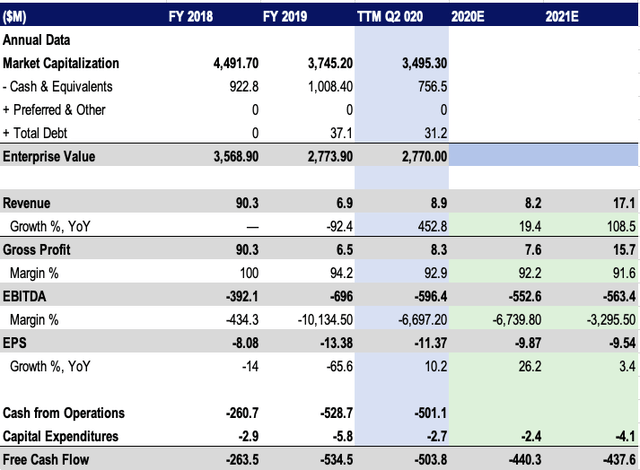

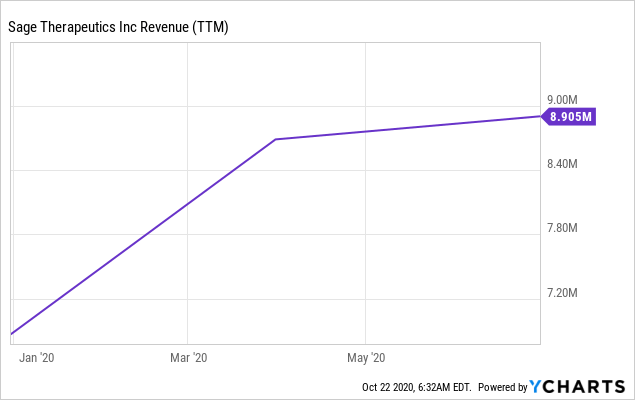

Sage Therapeutics (SAGE) has had an interesting year, both on the charts and from developments in the pipeline. From the Q2 exit, TTM revenues amounted to $8.9 million, alongside an EPS surprise of $0.06 above the Street's estimates. More positively, they ended the quarter with around $760 million in cash on the balance sheet, with no additional debt, meaning they were adequately capitalised for the remainder of FY 2020. Shareholders have realised 168.89% in gains since the March selloff, with low volatility and adequate compensation to the downside, with a smoothed Sortino ratio of around 0.35 since that period. The Sortino ratio is an excellent measure to identify the amount of compensation an investor has received for the level of downside risk/volatility that has occurred over a defined period.

Data by YCharts

Data by YCharts

The company was founded in 2010, and following its IPO in 2014, shares skyrocketed to highs of around $190. Investor sentiment turned sour in 2019, however, after the company failed in its SAGE-217 phase 3 study, where it failed to meet its primary endpoint, as indicated for use in clinical depressive disorders. Investors immediately gave away over -60% in returns on the back of the bad news.

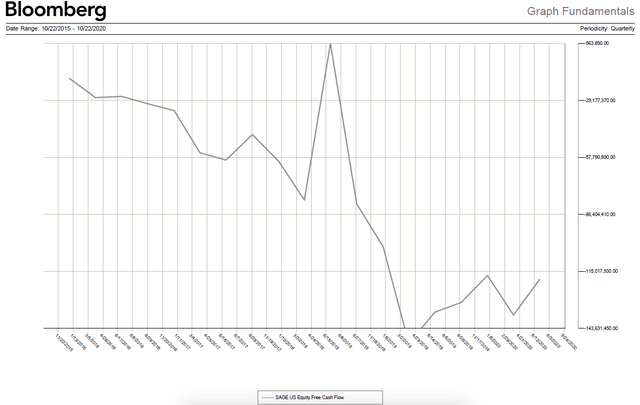

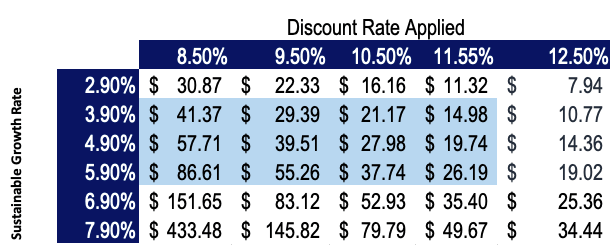

Fundamentally, the picture hasn't been as sweet for SAGE up until this point either. We've seen questionable financials over recent periods, with revenues in decline over the last 2 years to date, alongside an EBITDA loss and negative EPS growth over this same term. FCF has remained sub-zero within this time period also, however, this is not uncommon for early-stage companies such as SAGE, who are constantly reinvesting cash back into their development pipeline, or to increase R&D expenditure. Forecasts aren't exactly exciting either. We foresee slow revenue growth to $17.1 million by the end of FY 2021, with EBITDA and FCF remaining negative over this period, although regaining momentum back towards profitability over this time period. Forecasts beyond 2021 would not be of great value right now, in our opinion, without the guidance of the Q3 earnings release. Having these numbers will paint a far clearer picture for all involved and allow for far more beneficial modelling.

Data Source: Value Line SAGE; Author's modelling

SAGE Free Cash Flow, courtesy of Bloomberg:

Data Source: Bloomberg Terminal

What does shine for the company, is their strength on the balance sheet. From a short-term solvency perspective, the company has over 9.2x coverage from liquid assets, and in the event that inventory cannot be liquidated quickly, coverage is still around 9x over short-term obligations. Therefore, the company should be able to meet its obligations in the short term, as they fall due. Total debt to equity is currently at 4.22, alongside a favourable debt ratio on the lower end of 3.78. The company also remains well capitalised with almost $760 million in cash on the balance sheet from the Q2 exit. These are figures we are eager to review and compare with following the Q3 earnings release. Unfortunately, ROA and ROIC are quite poor at this stage, at -57% and -62% respectively, as the company is currently unprofitable. We feel this will show in the valuation, as we believe companies that don't exhibit high ROIC cannot form a high valuation, or justify one anyway.

On the charts, there has been a strong ascending channel formed since the selloff in March, where the stock has bounced from the support line nicely 5 times since this time. From August, it has broken away from that level of support, forming a new floor, where it has rebounded 2 times up until today's trading. The ascending channel up until this point has been relatively narrow, indicating low volatility over returns. Furthermore, the RSI ranges have remained below the RSI 70 line, despite the consistent upward movement, having breached that line only twice in the period since March. Thankfully, the direction of the trend has remained positive, and with Q3 earnings approaching, several catalysts are likely to benefit the stock further should they come to fruition, which are discussed later.

Notice on the chart below, SAGE bouncing from the support line nicely 5 times, where it formed new support in early September, again moving away from support to today.

Data Source: Author's Bloomberg Terminal, SAGE

Since August, new support has formed, resulting in an uptick in price of around 46.2% to today's trading. We've seen strength in this trend, alongside decent momentum along the way, which has begun to revert back towards the mean. Considering the timing, in that Q3 earnings are just around the corner, a sharp pullback towards support would provide a compelling entry point for longer-term investors, alongside a point of reallocation of capital for existing shareholders. We are in favour of reallocating 0.1-0.5% of NAV in this fashion, where we view the strength of the trend as high, a reversal of momentum back to previous highs, and the stock moving away again from support. Combined with a strong earnings surprise, which may come to fruition, as discussed below, the outlook for SAGE for the remainder of FY 2020 and into 2021 is bullish, in our view.

Data Source: Author's Bloomberg Terminal

Below, we can see SAGE's relative strength index performance YTD, which is essential to view for longer term investors to view the more medium-term outlook. Combined with several tailwinds, discussed below, we firmly believe that the current investor sentiment is bullish, also evidenced by the pricing activity mentioned. We believe that SAGE has the legs to continue this movement upwards, particularly should the market view the benefit in SAGE's pipeline commerciality.

Data Source: Author's Bloomberg Terminal, SAGE

Further to the above points, investors have been rewarded returns YTD with relatively low volatility to the downside. We are certainly pleased to view this, especially with the current shape of the yield curve, and with treasury yields as low as they are. In this view, investors will continue to seek yield away from treasuries and other fixed income classes, instead turning to equities that are displaying the growth characteristics with low volatility one would hope to see in other asset classes. We can see evidence of this low downside risk to date on the chart below, where the blue bars capture the upside, whereas the semideviation, or downside volatility, is captured in the red bars. Of great benefit to investors to date has been this reward they have seen for exposure to the downside, which has been minimal, as evidenced below.

Data Source: Trading View SAGE

Therefore, in light of these points, we are of the firm belief that the current investor sentiment remains bullish, and with a small to sharp pullback towards the support line, to around to $63-$64, may provide a compelling entry point for longer-term investors.

Growth Catalysts

Considering the timing around earnings, it is imperative to have some insight into advancements in SAGE's story, for reference and to enable the most accurate forecasting possible. Furthermore, on earnings release, investors would benefit to see how the company is (or isn't) able to commercialise its pipeline, amongst other factors.

Investors have poured their attention for Sage into their brexanolone (Zulresson) and Zuranolone drugs, which are indicated for usage in clinical depressive disorders. In particular, Zulresson is indicated in post-partum depression. From Q2, revenues for Zulresson surmounted to ~$1.1 million, above street expectations. Revenues from this product are expected to catapult at a CAGR of 71.3% over the next 6 quarters into 2024. Additionally, the company expects Zuranolone available for commercial status by 2023, where analysts estimate around $204 million in its first year of sales. Most recently, dosage at the 50mg level has shown exciting results, meaning a once-a-day outcome may be likely in the treatment protocol. The significance of these developments in Zuranolone pertains to investor sentiment, which, in our view, is skewed to the upside in terms of risk/reward, for phase 3 completion in 2021.

Furthermore, potential new works in the pipeline include the NMDA modulator known as SAGE-718. The benefits of this compound are claimed in patients with Huntington's disease, a progressive neurodegenerative disorder that affects gross motor skills, and the ability to function in general. Patients will demonstrate motor deficiencies similar to Parkinson's disease and even multiple sclerosis, and for those diagnosed with Huntington's, they will eventually succumb to the condition. SAGE 718 has available for licensing as of 29th June of this year, representing a large commercial opportunity once the company finalises its market strategy, and the potential to change many lives.

In light of this, what is of great benefit with this compound, is its potential commerciality and applicability within the Parkinson's disease arena, alongside those markets including Alzheimer's and dementia. These facts present compelling advancements for SAGE on a commercial level. Expanding from these interventions, SAGE hopes to see positive results in their current and ongoing double-blinded, placebo-controlled, randomised study for their SAGE-324 compound. This is currently undergoing observation for efficacy and safety in patients who present with essential tremor. This is exciting news for SAGE, in an otherwise underdeveloped segment, where there have been limited advancements made over more recent years. We can anticipate results from this phase of the study in December of this year.

Valuation

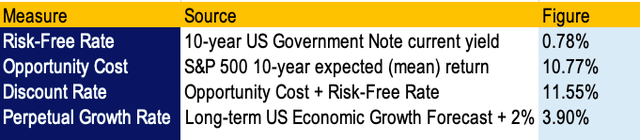

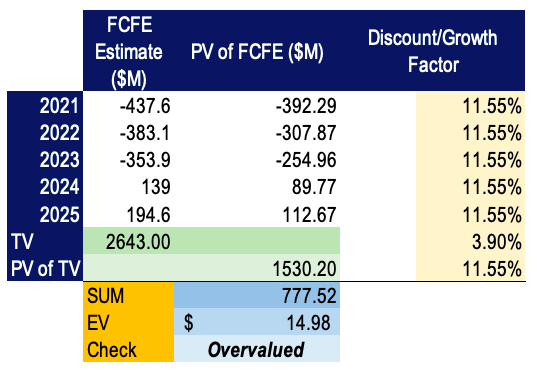

The company has remained unprofitable to date, therefore, many traditional metrics are of little use in this valuation. However, we are happy to perform our DCF analysis on the company and the stock. We've done so by using implied inputs related to the long-term economic outlook of the US economy, alongside a discount rate reflective of the additional risks in investing in this equity over a risk-free treasury, and holding the index directly. We have coupled this with FCFE estimates from our own modelling, which is slightly more bearish than the Street's. The snapshot of this valuation can be seen below.

Base Case:

Data Source: Author's Calculation

What's difficult to ascertain is SAGE's terminal growth rate. Being unprofitable, but, on the other hand, having large potential should their pipeline become successful, there is great variance in the growth rate (and discount rate, therefore) that can be assigned to the company. Manipulating these implied inputs somewhat gives a greater indication of the range of valuations that should be placed on the company. With this in mind, we feel that the potential range of fair value lies within the blue ranges shown below.

Sensitivity to DCF inputs for SAGE valuation:

We feel the inputs are sensible, considering the risks that are at play in SAGE's case. These are discussed below, and this valuation of fair value, in our opinion, is fair based on these assumptions. We must price in the risks that can pan out, the history of the company, its lack of profitability and potential for failure along its pipeline. In that view, other opportunities with less risk (although lower potential yield) such as the 10-year treasury note, alongside the market index, would be a safer play, and therefore, this is why their returns are chosen as the hurdle rate. Furthermore, with a lack of usable data for comparative analysis, and in a ratio format, the picture remains blurry with valuation and must be considered also. Therefore, as mentioned, we believe the stock is overvalued and also appreciate the current momentum and price trajectory on the charts. Coupled with scenario's in the pipeline panning out, alongside high relative strength, remaining out of overbought territory, and the strength and direction of current support, we would firmly believe that the stock will continue its run up. Using an appropriate multiple for the industry, combined with a sum-of-the-parts type analysis, we assign a price target of $75 in our utmost blue-sky scenario over the next 6-12 months.

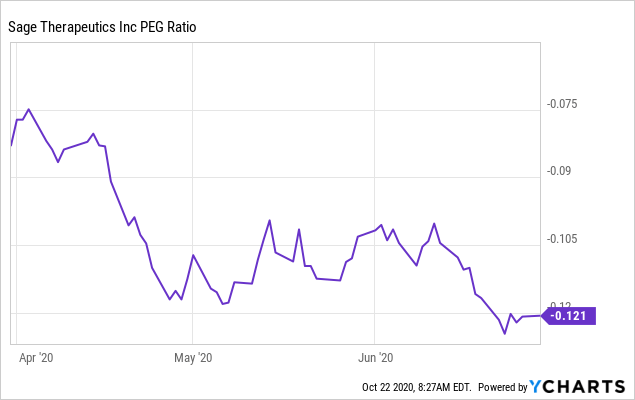

Data by YCharts

Data by YCharts

Data by YCharts

Data by YCharts

Risks

There are several risks that come with investing in a company of SAGE's lifecycle and development framework. Firstly, these types of investments are largely speculative, as many of the growth catalysts and market activity are contingent on success of clinical trials and commercial ability of management to sell product. Those with a higher risk appetite, alongside higher tolerance to risk and volatility are the best candidates as investors for a company such as SAGE. Nonetheless, it is beneficial to remain on top of the story, for longer-term investors will benefit from early insights into the company.

Firstly, there are execution and pipeline risks that SAGE faces. With the positive sentiment around the recent development in their clinical trials, this has been reflected in the charts also. What investors may likely be bullish on is the expectations around Zuranolone and its application in clinical depressive disorders. Therefore, any failure to successfully complete phase trials of this compound will provide a negative turn for the company, leading to higher downside exposure for investors. On these execution risks, should the company fail to continue growth in the Zulresso regime, then investors would certainly view this as a negative for the company also. Other works in the pipeline, alongside successful preliminary data and successful commercial scale of Zulresso to date, offset these points. Therefore, should any setbacks from efficacy or safety data arise, investors will likely turn sour, meaning more downside for current shareholders, similar to the end of 2019. Continued upward trajectory is contingent on these factors, as much as any.

Furthermore, although the company left the second quarter well capitalised, there is risk for shareholder dilution through equity raises, should the company need to finance operations, facility build outs or R&D expenditures at a greater scale. Lenders are unlikely to cooperate for a debt issue, secondary to the high credit risk involved, poor profitability standing of the company and lack of cash flow from key projects to date. Therefore, this leaves shareholders at risk, as the company may execute the option by assigning additional equity warrants and dilute existing shareholders.

Finally, longer-term investors should keep a very close eye on the political situation around drug pricing, policy and route to market. Although unlikely to impact SAGE in the shorter term, over a longer time frame, investors may see more downside should political risks surrounding SAGE's key markets begin to impact pricing power and prescription power for key stakeholders within the anti-depressive segment. With an election just around the corner also, we will be keeping a close eye on the trajectory of these policies moving forwards.

Conclusion

SAGE remains a risky play in light of its current status as a company. The direction of stock price offsets these risks partially, however, this play is more suited to investors with a higher risk appetite, alongside greater risk tolerance. If considering an entry in the near future, we would advocate to wait for a sharp pullback towards the support line shown, to around $64 or slightly below, and enter with a small position, ready to take profits earlier than expected. Doing so allows for greater reallocation scale also, should the price continue its run up. A strong Q3 earnings release following robust sales in their key product Zulresso will also be a key driver in the near term for investors. We will be eagerly awaiting to view these results, alongside management's performance in improving EBITDA and FCF totals. Long-term investors should also consider the risks outlined above, as these are key to company performance. From the charts, however, the current investor sentiment is bullish and looks to remain so for the foreseeable future. Combined with positive data from phase studies, we would anticipate that any further good news will likely be priced in as the stock moves higher. We are firm on a price target of $75 in the most blue-sky scenario that is contingent on the pipeline becoming successful and with no setbacks in efficacy and safety data. Should these risks pan out, we would be looking at a range of $45-$75 in our target ranges. More analysis to follow, as more time passes for this company.

Disclosure: I am/we are long SAGE. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.