China Life Insurance: Embarking On A Revitalization Strategy

The strategy seems to pay off as LFC’s written premiums for the six months ended June 30, 2020, grew by 13.1% year on year despite the current crisis.

LFC’s current dividend yield is at 4.6%, which is above the 3.4% industry average.

The current share price is estimated to be undervalued by 45%.

Analysts are issuing a strong buy for China's largest state-owned financial insurance corporation, China Life Insurance (LFC), and investors should be in the know. With a total reported year-to-date revenue of $131 million as of August 2020 and over 170,000 employees, LFC ranks 45th in the Fortune 500 list. The company offers individual and group insurance products covering life, critical illness, medical, savings and retirement, accident and juvenile protection. LFC manages an extensive network of distribution channels composed of exclusive agents, direct sales representatives, and dedicated and non-dedicated agencies. In the investment side, the company is one of the largest institutional investors in China. It is also one of the largest asset management companies through its subsidiary China Life Asset Management Company Limited.

Figure 1. LFC 12-month Share Price

Financial Performance

The company maintained its strategic focus on developing long-term regular business and continuously increasing business value. It also adhered to the diversified product and vigorous product development strategy. The strategy seems to pay off as LFC's written premiums for the six months ended June 30, 2020, grew by 13.1% year on year despite the current crisis. Gross investment income increased by 8.1% from the same period last year as a result of the company's continued asset-liability management enhancements. In 2019, annual gross investment income jumped by 77.7%. Net income for the first half of 2020, however, decreased by 18.8%. The company attributes the decrease to updated discount rate assumptions, pre-tax adjustment for underwriting and policy acquisition costs. It can also be attributed to a higher base as the company saw a 58% spike in earnings for 2019.

Dividends, Valuation, Forecasts

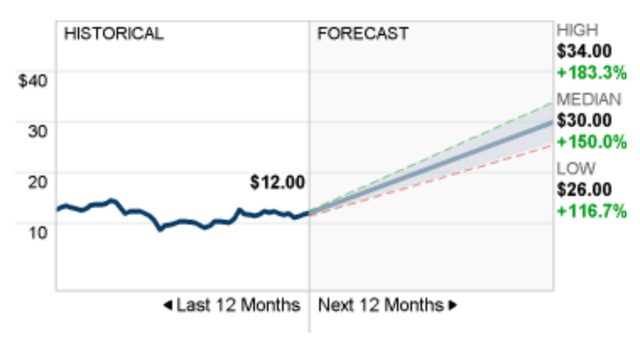

LFC's current dividend yield is at 4.6%, which is above the 3.4% industry average. Dividend payments grew over the past ten years but have also been volatile. For investors who are considering buying the stock for its dividends, EPS has been growing at a credible rate and provides reasonable protection to the dividends or potentially increase it. The current share price is estimated to be undervalued by 45%. P/E ratio is at 8.9x. Analysts have an extremely optimistic 12-month price forecast. The lower end of the forecast range projects a 117% increase from the current price.

Figure 2. LFC 12-month price forecast

Source: CNN Money

Growth and Transformation

LFC was recently awarded as one of the "Most Honored Companies" from the Institutional Investor's 2020 All-Asia Executive Team. It is also recognized in six other categories, including the Best IR Program and the Best IR team. This is the first time that LFC was awarded in all seven categories since its 2003 dual-listing in New York and Hong Kong. This recognition is a result of LFC's company-wide revitalization aimed at promoting market-oriented reform and transforming the company's operations and significantly improving its fundamentals. The new management has improved the communication channels with domestic and overseas investors to establish an open, transparent, and healthy corporate image within the capital market. LFC remains dedicated to its implementation of the "China Life Revitalization" strategy despite the current uncertainties and instabilities in the external environment. It is navigating the turbulent times by seizing new development opportunities, carrying out regular pandemic control, speeding up digital transformation, and strengthening asset-liability management.

Summary

Adequate dividend, undervalued shares, strong financial position, and promising growth forecast are indeed ingredients for a strong buy rating. However, LFC's share price has been volatile in the last three months. It still pays to tread with caution or to buy the dips even for strong buy stocks.

*Like this article? Don't forget to click the Follow button above!

Subscribers told of melt-up March 31. Now what?

Subscribers told of melt-up March 31. Now what?

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you'll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.