Lufax Proposes Terms For $2.2 Billion U.S. IPO

Lufax has filed to raise $2.2 billion in a U.S. IPO.

The firm has developed an online portal that provides credit facilitation and wealth management services in China.

LU has performed admirably during the Covid-19 pandemic and the IPO is worth a close look.

Quick Take

Lufax (LU) has filed to raise $2.2 billion in an IPO of its American Depositary Shares representing underlying ordinary shares, according to an F-1 registration statement.

The firm has developed an online personal financial services platform for persons in China.

LU enjoys a significant strategic relationship with the Ping An Group, a major source of prospective clients and appears to be weathering the Covid-19 pandemic well, so the IPO is worth considering.

Company & Technology

Shanghai, China-based Lufax was founded to create the ability for consumers in China to obtain loans and wealth management services via an online portal.

Management is headed by Chief Executive Officer Mr. Gregory Dean Gibb, who has been with the firm since 2016 and is Chairman and CEO of Chong Qing Financial Assets Exchange.

Below is a brief overview video of Lufax (in Mandarin):

Source: Lufax

The company’s primary offerings include:

Retail credit facilitation

Wealth management

Lufax has received at least $2.1 billion from investors including Ping An Group and Tun Kung Company

Customer/User Acquisition

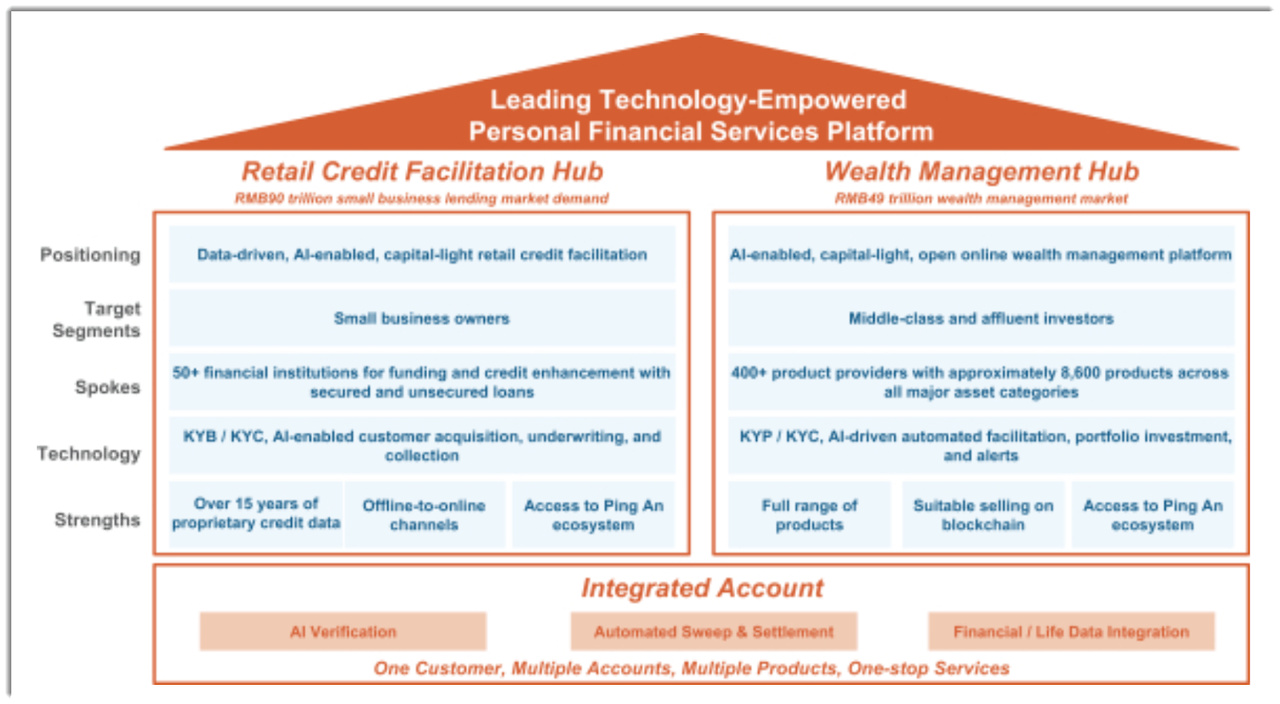

The firm operates a 'capital light, hub and spoke' business model around its credit facilitation and wealth management hubs.

LU's relationship to the Ping An Group provides access to that company's 210 million financial services customers, some of which are small business owners and middle class and affluent investors.

The chart below shows the firm's two-hub approach:

Sales and Marketing expenses as a percentage of total revenue have been rising as revenues have increased, as the figures below indicate:

Sales and Marketing | Expenses vs. Revenue |

Period | Percentage |

Six Mos. Ended June 30, 2020 | 33.6% |

2019 | 31.2% |

2018 | 26.6% |

Source: Company registration statement

The Sales and Marketing efficiency rate, defined as how many dollars of additional new revenue are generated by each dollar of Sales and Marketing spend, dropped by half in the most recent reporting period, as shown in the table below:

Sales and Marketing | Efficiency Rate |

Period | Multiple |

Six Mos. Ended June 30, 2020 | 0.2 |

2019 | 0.4 |

Source: Company registration statement

Market & Competition

According to a 2018 market research report by China Daily, the consumer finance market in China is projected to reach $1.6 trillion by the end of 2020.

This represents a forecast CAGR of 18% from 2018 to 2020.

Despite the demand, only 28% of consumers in China possess credit ratings of any kind, as compared to 86% of the US.

Also, according to another market research report by the Boston Consulting Group and Lufax, China had around $2 trillion in online wealth management [OWM] in 2017 while the Chinese OWM market had reached $6 trillion with an online sales penetration rate of 34.6%, as of the end of Q1 2018.

The major factor driving market growth is the use of technology by fintech companies in OWM services.

The independent third-party internet wealth management segment has a penetration rate of only 10%, as compared to 35% in the US.

Major competitive or other industry participants include:

Ant Financial

Tencent Licaitong

Domestic commercial banks

Wealth management firms

Financial Performance

Lufax’s recent financial results can be summarized as follows:

Growing topline revenue

Increasing operating profit but decreasing operating margin

A swing to cash used in operations

Below are relevant financial results derived from the firm’s registration statement:

Total Revenue | ||

Period | Total Revenue | % Variance vs. Prior |

Six Mos. Ended June 30, 2020 | $ 3,635,000,000 | 5.4% |

2019 | $ 6,770,000,000 | 13.7% |

2018 | $ 5,955,882,353 | |

Operating Profit (Loss) | ||

Period | Operating Profit (Loss) | Operating Margin |

Six Mos. Ended June 30, 2020 | $ 1,439,000,000 | 39.6% |

2019 | $ 2,751,000,000 | 40.6% |

2018 | $ 2,742,500,000 | 46.0% |

Net Income (Loss) | ||

Period | Net Income (Loss) | |

Six Mos. Ended June 30, 2020 | $ 1,029,000,000 | |

2019 | $ 1,885,000,000 | |

2018 | $ 1,996,470,588 | |

Cash Flow From Operations | ||

Period | Cash Flow From Operations | |

Six Mos. Ended June 30, 2020 | $ (54,275,147) | |

2019 | $ 322,337,353 | |

2018 | $ (213,583,382) | |

Source: Company registration statement

As of June 30, 2020, Lufax had $5.5 billion in cash and $19.9 billion in total liabilities.

Free cash flow during the twelve months ended June 30, 2020, was negative ($8.4 million).

IPO Details

Lufax intends to raise $2.2 billion in gross proceeds from an IPO of 175 million its American Depositary Shares representing underlying ordinary shares, offered at a proposed midpoint price of $12.50 per ADS..

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $26.1 billion, excluding the effects of underwriter over-allotment options.

Excluding effects of underwriter options and private placement shares or restricted stock, if any, the float to outstanding shares ratio will be approximately 7.17%.

Management says it will use the net proceeds from the IPO as follows:

We plan to use the net proceeds of this offering primarily for general corporate purposes, which may include investment in product development, sales and marketing activities, technology infrastructure, capital expenditures, global expansions and other general and administrative matters. We may also use a portion of these proceeds for the acquisition of, or investment in, technologies, solutions or businesses that complement our business, although we have no present commitments or agreements to enter into any acquisitions or investments.

Management’s presentation of the company roadshow is available here.

Listed bookrunners of the IPO are Goldman Sachs [Asia], BofA Securities, UBS Investment Bank, HSBC, China PA Securities, Morgan Stanley, CLSA, Jefferies, J.P. Morgan, BOCI, Haitong International, Stifel, China Renaissance and KeyBanc Capital Markets.

Commentary

Lufax is seeking to go public in the U.S. as industry giant Ant Financial is finalizing its monster $35 billion IPO on the Hong Kong Stock Exchange.

The company’s financials show continued topline revenue growth despite the Covid-19 pandemic, an impressive result.

However, operating cash flow has taken a hit and turned negative in the most recent reporting period.

Sales and Marketing expenses as a percentage of total revenue have also risen; its Sales and Marketing efficiency rate has been cut in half. Neither trend is positive.

The market opportunity for providing credit facilitation and wealth management services in China is in a long upswing as consumers seek online platforms to achieve better returns on their increasing discretionary income and to obtain credit.

Like many Chinese firms seeking to tap U.S. markets, the firm operates within a structure where U.S. investors would only have an interest in an offshore firm with uncertain rights to the firm’s operational results.

This is a legal gray area that brings the risk of management changing the terms of the relationship or the Chinese government altering the legality of such arrangements. Prospective investors in the IPO would need to factor in this important structural uncertainty.

As to valuation, it’s difficult to find a direct comparison for the firm’s combination of services and scale of operations.

However, much smaller 9F provides many of the same functions but has performed poorly in the current year

Given Lufax’s strategic relationship with Ping An and solid revenue growth and earnings, its proposed EV/Revenue multiple of 3.75x appears reasonable.

LU may be a company that is able to weather the remaining Covid-19 pandemic effects better than most, so the IPO is worth considering.

Expected IPO Pricing Date: October 29, 2020

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis. Get started with a free trial!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.