Coca-Cola Is About To Break Out

KO is on the verge of a break out.

With its fundamentals pointing to higher earnings, I think it is a buy.

The stock is pricing in historical growth levels, but I believe it will do much better than that.

Drinks maker Coca-Cola (KO) has been performing quite well of late. The stock took a fair bit of punishment earlier this year, and while that was certainly warranted given the conditions, it appears to me the recovery is visible enough to support the buying we’ve seen of late.

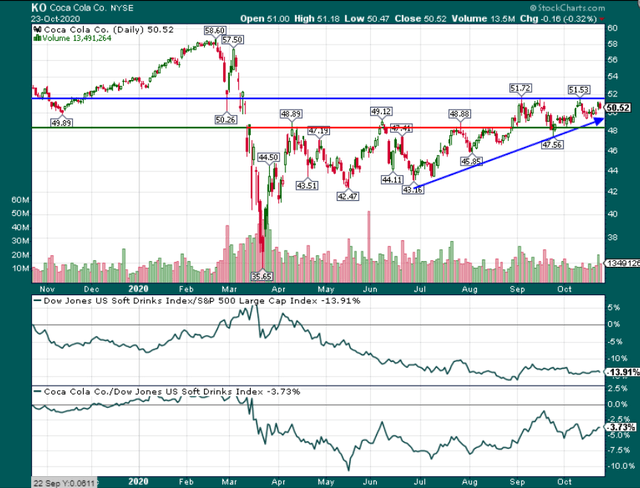

I’ve annotated this chart much more than I normally do because I firmly believe we’re seeing a breakout forming.

If we look at the period of June to late August, we can see that the stock formed an ascending triangle, with the top of it being around $48/$49. The breakout occurred in late August and shares ran up to ~$52. There’s been a period of consolidation since then, but if we look at the very right side of the chart, we can see another ascending triangle forming.

There is trendline support (blue arrow) that has been holding since the late June bottom, and higher lows have been made in recent weeks. While there may be one or two more connect points with the trendline, I firmly believe we’re about to see Coca-Cola break out above the $52 level and make a run at pre-pandemic highs.

The good news is that if the ascending triangle pattern fails, there is strong support at the former breakout level of ~$48, which is also annotated above. Therefore, I think you’ve got some pretty clearly defined parameters for this one and you’ll know fairly soon if the break out is occurring or not.

Earnings support the bulls

Coca-Cola reported Q3 earnings just a few days ago, and results were weak compared to last year. That, of course, is expected given the fact that away-from-home venues remain incredibly weak for Coca-Cola. This segment includes things like movie theaters, sports stadiums, and other places where people would normally congregate in large groups, but aren’t allowed to. It is, of course, anyone’s guess as to when this segment will return to normal, but Coca-Cola is proving its immense diversification can help it thrive in just about any environment, including one with a pandemic.

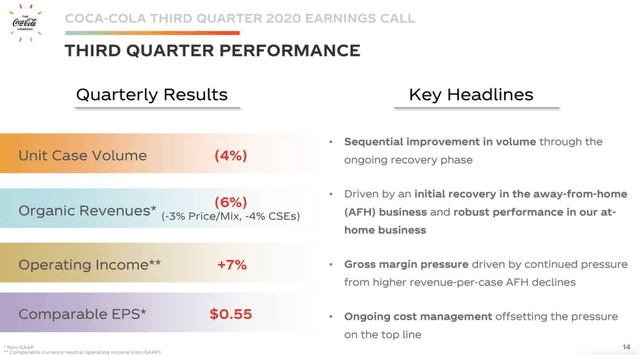

Source: Q3 earnings presentation

What I think is most telling about the company’s results is not that case volumes are down or that pricing and mix were a headwind in Q3; neither of those things is a positive by any means. However, we knew Q3 would be ugly given pandemic conditions haven’t lifted.

I think the impressive thing about Coca-Cola’s performance is that it managed a 7% boost in adjusted operating income while organic revenue was down 6%. Generally, if organic revenue is performing poorly, margins tend to follow suit due to deleveraging of fixed and operating costs. Coca-Cola’s intense focus on margin improvement in recent years is bearing fruit in a tremendous way in 2020, and the extension of that is that when revenue does eventually recover, the operating leverage from that revenue should be sizable.

It is pretty easy to believe that Q4 will be bumpy as well given that management stated that October was off to a rough start. But as we look forward to 2021, and away-from-home channels begin to reopen in earnest, Coca-Cola stands to benefit immensely.

When you couple the improvement in organic revenue that should be coming in 2021 with Coca-Cola’s never-ending push for innovation, I think the future looks quite bright. Coca-Cola’s strategy has long centered around extensions of current products, such as flavored Coke and Diet Coke lines. In recent years, however, it is has moved into coffee with its Costa acquisition, and into selling alcoholic beverages in the US for the first time ever with its Topo Chico brand. Coca-Cola is late to the hard seltzer party, but its marketing and supply chain might collectively give it a huge advantage over the other players in the space.

To be fair, management has been very forthcoming about the fact that the recovery is likely to see stops and starts. Given the enormous geographical reach of Coca-Cola’s revenue globally, that makes sense. Different countries are still in initial lockdowns, while others are coming out of them into a new normal. Indeed, we are seeing the same thing in the US in different cities and states are in different modes of recovery.

This will lead to uneven performance for Coca-Cola, so do not expect a straight-line recovery back to the top. This will be a process, but the important thing is that the pieces are in place for recovery, and initial signs are quite good.

The bottom line

I’m obviously bullish on Coca-Cola these days for all the reasons I’ve mentioned above. The good news is that you get the opportunity to own Coca-Cola for what I believe is a fairly compelling valuation as well. Permit me to explain.

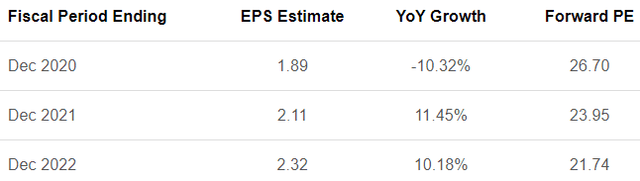

Source: Seeking Alpha

Shares trade today at 24 times next year’s earnings, which should be normalized, more or less. The good news is that the stock’s five-year average forward PE ratio happens to be 24, so Coca-Cola is trading for essentially what is a normal valuation.

The thing that makes it compelling is that in the past few years, earnings haven’t moved much. Coca-Cola has struggled to move the needle on EPS, but traded at 24 times earnings anyway. Today, if we look at the growth numbers above, the company is in a much better spot from a growth perspective, so it should trade for a higher valuation to account for improved growth prospects. Indeed, shares traded near 30 times earnings prior to the pandemic selloff, so this sort of thing isn’t without precedent.

With Coca-Cola’s focus on operating margin gains, constant product innovation, and a recovery in away-from-home on the horizon, I see plenty of reasons to be bullish. In addition, the stock is set up very bullishly from a technical perspective, so I think it is a buy.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in KO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.