The mortgage market has surprised many "experts" and has remained extremely strong.

New data indicates that most mortgages coming off of forbearance are going back to making on-time payments.

The market has been treating forbearances as the equivalent of defaults.

The market is wrong, and here's how you can profit from it.

Co-produced with Beyond Saving

At High Dividend Opportunities, we have been discussing the opportunities we have been seeing in residential real estate. In March, everyone "knew" that COVID-19 was going to kill the housing market and we were heading for the next huge mortgage crisis. Everyone was wrong as the housing market remained extraordinarily strong, lifted by crashing mortgage rates.

In August, the world was going to end because delinquencies were rising at the fastest pace since 2009! News stories dug up the horrors of 2009 all over again. After all, nothing gets clicks like fear.

The reality is that the housing market was not in a bubble like it was in the early 2000s. Homeowners have a lot of equity in their homes and home values were rising at a reasonable and sustainable pace. When COVID-19 hit, homeowners were very well positioned financially.

True, for many there have been cash flow issues and the US government was quick to respond along with most major banks, offering forbearance programs and allowing homeowners to defer mortgage payments. These plans have been a huge success, providing the majority of homeowners the time they needed to regain enough cash flow to comfortably pay their mortgage again.

Earlier this month we saw the largest weekly decline in active forbearance plans.

Source: Black Knight

Source: Black Knight

Active forbearance plans declined from nearly 5 million mortgages in forbearance plans to under 3 million. If every home still in forbearance were to become delinquent today, it would not hold a candle to the impact of the mortgage crisis.

The bottom line is that we are not seeing a repeat of the mortgage crisis, yet the market's fear has impacted the prices of several companies exposed to the mortgage markets. Today we look at PennyMac Mortgage Investment Trust (PMT).

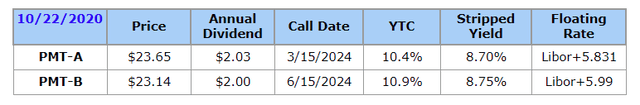

While we believe the 9.8% yielding common shares are interesting, the best opportunity is in the preferred shares:

- PennyMac Mortgage Investment Trust, 8.125% Series A Fix/Float Cumulative Redeemable Preferred Shares (PMT.PA)

- PennyMac Mortgage Investment Trust, 8.00% Series B Fix/Float Cumulative Redeemable Preferred Shares (PMT.PB)

Both currently yield over 8.5%.

Strong Mortgage Market

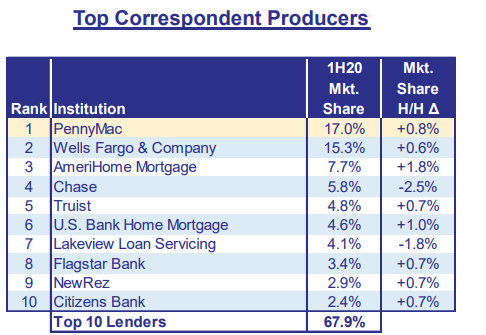

PMT is related to PennyMac Financial (PFSI), the largest correspondent producer in the country. In other words, PennyMac originates the mortgages and provides its own money, as opposed to many mortgage originators that sign the agreement with a borrower and then sell it to investors.

Source: PMT Conference Presentation Sept. 15

PMT plays the role of investor, providing capital, while PFSI is the company that holds all the infrastructure. This provides tax benefits as PMT is structured as a REIT and it also provides shareholders the opportunity to get a much higher yield investing directly in PMT.

PMT has a variety of strategies including Credit Risk Transfers (or CRTs), Mortgages Servicing Rights (or MSRs) and Agency Mortgage-Backed-Securities (or MBS). Generally speaking, PMT benefits when people pay their mortgages, so the spike in people not paying their mortgages is a potential risk to them.

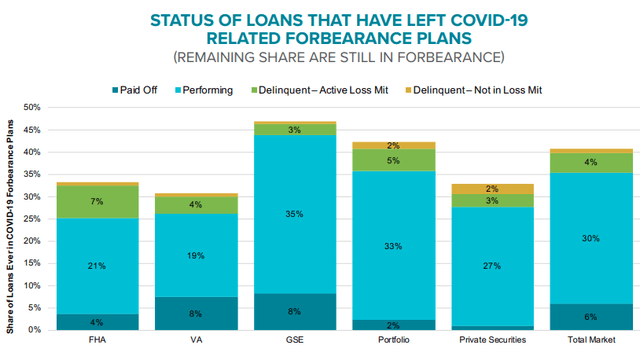

However, if we look at what happens when mortgages are removed from forbearance, we see that the vast majority are paying.

Source: Black Knight Mortgage Monitor

Of the 41% of mortgages that came off of forbearance as of Sept. 22, the vast majority are "performing," meaning they're paying on time. The next largest group are people who paid off their mortgages, either having refinanced or sold their house. In total, 267,000 are delinquent, though they are listed as "active loss mitigation," which means they are working with the servicer and have a plan in place to become current. Say they're 30-days behind and so the servicer agrees to let them pay 125% of the normal payment for four months to make up for the missed month.

The bottom line is that 90% of people who are coming off of forbearance plans are either resuming normal payments or have paid off the whole loan. The market has been treating forbearances as being the equivalent of delinquency and many mortgage monitors report mortgages in forbearance as delinquent, however for all practical purposes, that assumption is proving conservative.

Credit Risk

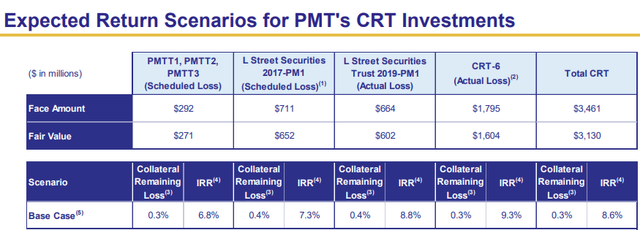

A CRT is a security that's sold by the "agencies" that guarantee agency MBS which we have discussed extensively in other articles. The agencies guarantee the principal to the "Mortgage Backed Security" ('MBS') investors, so when a mortgage defaults, the MBS investor gets their principal back.

One mechanism invented to protect Fannie and Freddie from absorbing massive losses is the Credit Risk Transfer. The CRT is sold to investors willing to take on the credit risk and will get a great return if the mortgage is paid as agreed. If the mortgage results in a loss, the owner of the CRT absorbs a portion of the loss.

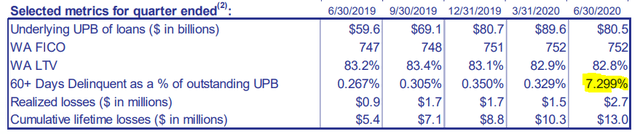

Here's a look at the CRTs that PMT currently holds:

Source: PMT 2Q 2020 Earnings Presentation

Source: PMT 2Q 2020 Earnings Presentation

Note that the credit score is fairly high and stable and realized losses have been fairly consistent with an uptick in Q2. Overall, PMT still expects to achieve 6.8%-9.3% IRRs on their CRT investments.

Source: PMT 2Q 2020 Earnings Presentation

Note that refinancing and house sales are a positive for CRT investments because they are carried below the face value. So when a mortgage prepays, that results in an immediate capital gain which helps offset losses from defaults.

High levels of refinancings due to record low mortgage rates, combined with lower losses than anticipated early on during the COVID-19 epidemic, should lead to continued recovery in the book value of CRTs.

Mortgage Servicing

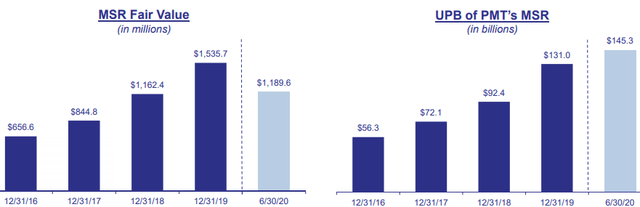

The other substantial segment for PMT is their "Mortgage Servicing Rights" (or MSRs). MSRs are the "right" to service mortgages. The servicer collects a fee in exchange for its work of actually collecting the checks. In this case, PMT owns the MSRs, while the company PFSI does the actual work.

PMT owns MSRs on $145 billion in unpaid mortgages. While that's up, the value of their MSRs is lower.

Source: PMT 2Q 2020 Earnings Presentation

This is because the MSR's collect payments based on the amount of interest collected. When prepayments increase, the result is less overall interest is collected over the life of the MSR. MSRs are investments you usually want to own when mortgage rates are going up, which clearly they are not right now.

The good news is that mortgage rates are likely as low as they are going to get. So the negative impact of declining rates has already been experienced in PMT's book value.

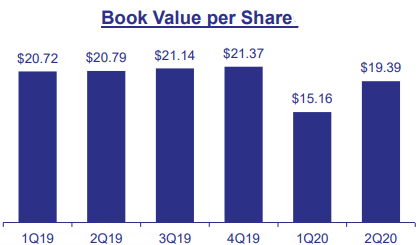

Book Value

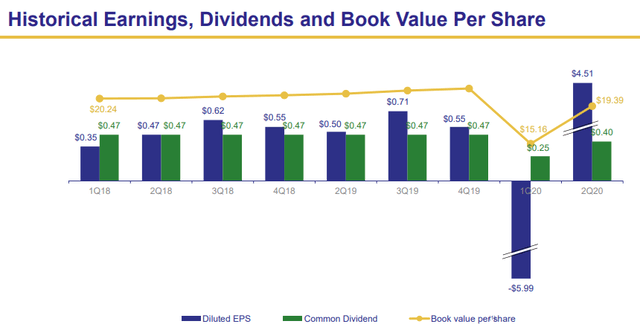

PMT, like most mREITs, experienced a dramatic swing in book value in March.

Source: PMT Conference Presentation Sept. 15

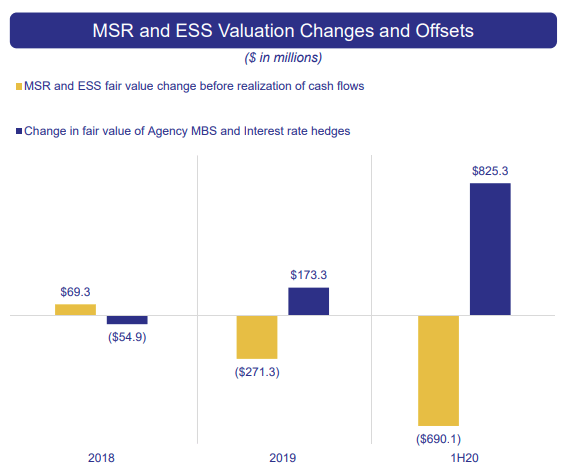

Fortunately, it recovered a very large portion in just a single quarter. The main reason is that PMT invests in agency MBS to offset the swings in their MSR holdings:

- Remember, we stated above that MSRs increase in value when interest rates are going up and decrease when they are going down.

- Agency MBS usually does the opposite – it goes up in value with interest rates go down and down in value when they go up.

For PMT, this proved to be an effective hedge, even if it was one that didn't work immediately when everything sold off in March:

Source: PMT Conference Presentation Sept. 15

The end result is that PMT's book value took a hit due to their exposure to credit risk at a time when many investors are leery of credit risk, but is only down about 10% in the first half of the year.

Preferred Shares

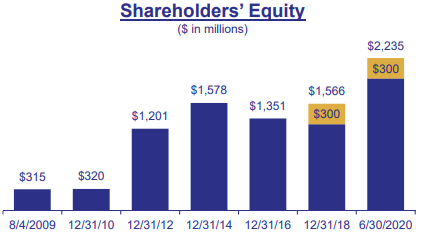

PMT's preferred shares enjoy the benefit of being well insulated. With a book value of $19.39/share, PMT's preferred shares are covered by equity over 7.4x (or 740% coverage).

Source: PMT Conference Presentation Sept. 15

It's important to remember that PMT owns assets that are quite liquid so there's not a lot of assumptions built into their values. Additionally, PMT has more than $600 million in cash and short-term investments. Meanwhile, PMT's only debt that's recourse to the company is $295 million in Exchangeable Senior Notes due 2024, which PMT can redeem for cash or stock. All other debt is non-recourse and tied to specific assets.

This provides the preferred with a very large asset cushion that wasn't even close to being threatened even in the midst of the March sell-off. Changes in CRT value are reflected on the income statement, so as a result earnings are going to be variable.

Over time, PMT has been able to out-earn its common dividend:

Source: PMT 2Q 2020 Earnings Presentation

The recent turbulence necessitated a dividend cut and a subsequent raise. At the new $0.40 level, the common dividend is approximately 6.5 times the size of the preferred dividend, meaning that the common dividend alone, if eliminated, would cover 650% of the preferred stock dividend. If credit defaults do become a problem, the common shares will feel it first and the preferred dividend cannot be suspended unless the common is eliminated – which would take something substantially worse than March.

Fixed-To-Floating

It's important to note that both of PMT's preferred shares are "fixed to floating." This means that the interest rate is going to change from a fixed rate to a floating rate. For both series, the floating rate is calculated as three-month LIBOR plus an adder and both will convert to floating on the Call Date in 2024, if they are not redeemed at that time.

It makes sense to buy whichever one has a higher yield at the time, however we have a preference for PMT-B. The reason being, if we assume LIBOR of 0.00%, after the coupons both convert to floating, the new dividend would be $1.458 for PMT-A and $1.497 for the PMT-B. As 2024 approaches the reality that PMT-B will yield more than the PMT-A should result in PMT-B being priced higher.

Note that at $23, the PMT preferred will still yield over 6.5% on capital when the rate converts to floating even if interest rates remain very low. If interest rates start rising (which we expect as explained in this report), then the preferred will pay more, creating a great hedge against both rising interest rates and inflation. Not only would the preferred coupon be rising, but PMT (as a company) would outperform in a rising-rate environment.

Conclusion

Before COVID-19, both PMT preferred shares were trading at above $26.50 per share because of the higher quality of this company. With mortgages coming out of forbearance generally going back to making regular payments or being refinanced, it's very possible that PMT preferred go back to trading above $26. The mortgage market is simply a lot stronger than the market has been projecting.

PMT preferred are a great vehicle to invest in a strong housing market because with substantial asset coverage and a huge equity cushion with the common equity, the preferred are very secure and will be able to continue paying dividends even if the mortgage market takes a turn for the worse.

The market has run away from mortgage REITs and PMT is one of the babies thrown out with the bathwater. You can get yields of 8.5% today in these preferreds, plus capital gains as they head back to their par value of $25.00/share. They also are a great hedge against rising interest rates and inflation in 2024 and beyond. PMT-A and PMT-B enjoy a high asset coverage of 7.4 times and a dividend coverage of 6.5 times. These would be the safer high-yield preferred in your high-yield portfolio!

Thanks for reading! If you liked this article, please scroll up and click "Follow" next to my name to receive our future updates.

Which Dividend Stocks We Are Buying?

High Dividend Opportunities is the largest community of income investors on Seeking Alpha for the 5th year in a row, with over 4400 members. Our best dividend picks are shared on a weekly basis. Our Immediate Income Method generates strong returns, regardless of market volatility, making retirement investing less stressful – simple and straightforward.

Join us to get instant-access to our model portfolio targeting 9-10% yield, our preferred stock portfolio, bond portfolio, and income tracking tools. Don't miss out on the Power of Dividends! Start your free two-week trial today!

Disclosure: I am/we are long PMT-B. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Treading Softly, Beyond Saving, PendragonY, and Preferred Stock Trader all are supporting contributors for High Dividend Opportunities.