NetEase: Gaming Pure-Play With Plenty Of Growth Opportunities

NetEase is the second-largest mobile gaming company in the world and has demonstrated the ability to generate consistent revenue from existing games and develop a robust pipeline.

We see international expansion to be an increasingly important initiative for the company, and it has gained some initial success in Japan.

We believe NetEase can capture additional growth opportunities through its online education offering, Youdao and music streaming services.

NetEase is trading at a discount to its closest peers, which we believe is not justified given its competitive advantages and technology capabilities. Our sum-of-the-parts valuation suggests a 30% upside.

Overview

Often overshadowed by its larger rival, NetEase (NASDAQ:NTES) is the second-largest mobile gaming company in the world after Tencent (OTCPK:TCEHY). We believe the focus on R&D and content quality remains a competitive strength for NetEase, which enables the company to leverage its existing gaming IP and continue to grow its customer base. In addition, we see an attractive gaming pipeline including the partnership with Warner Bros to develop "Harry Potter: Magic Awakened" and "The Lord of the Rings: Rise to War". NetEase is also turning its focus globally after some achieving initial success in Japan which we believe will offer future growth opportunities. We expect overseas investments and expansion to be an increasingly important strategic focus as the company has earmarked 45% of the proceeds from its secondary listing in Hong Kong for globalisation strategies and opportunities.

In addition, there are pockets of opportunities in online education and music streaming which are still at an early stage of development. Although online education is a very competitive market, we see a path for Youdao (NYSE:DAO) to capture market share by leveraging its technology and the Youdao Dictionary brand. With a number of differentiating factors, recent success in signing direct licensing deals with major overseas studios, and forming a strategic alliance with Alibaba (NYSE:BABA), we believe NetEase Cloud Music is able to compete in the music streaming market, which is largely dominated by Tencent Music (NYSE:TME).

We see the current valuation as attractive as the stock is trading below a number of its closest peers. Using a sum-of-the-parts approach, our target price suggests a 30% upside. We believe this is a good opportunity to invest in a well-established company with plenty of growth opportunities as consumers continue to shift towards digital media and online gaming.

Company introduction

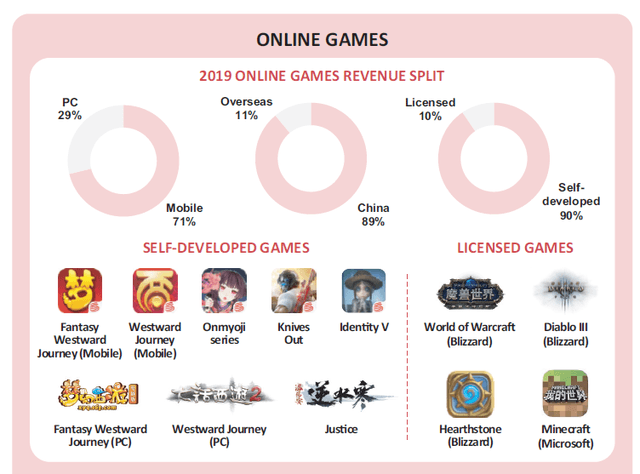

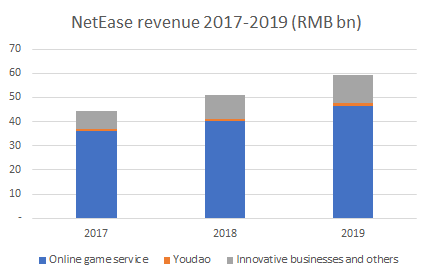

Founded in 1997, NetEase is a China-based internet company with 78% of its revenue generated from online game services in 2019. Self-developed games account for 90% of the gaming revenue while the company also license games from developers such as Blizzard (NASDAQ:ATVI) and Microsoft (NASDAQ:MSFT). In addition, it offers online education services through its majority-controlled subsidiary, Youdao, which was separately listed on the New York Stock Exchange in 2019. Under the Innovative Businesses and Others division, NetEase also offers music streaming through NetEase Cloud Music, e-commerce through Yanxuan, internet media and e-mail services.

Source: NetEase Annual Report

Online gaming: Strong development capabilities remain a competitive strength

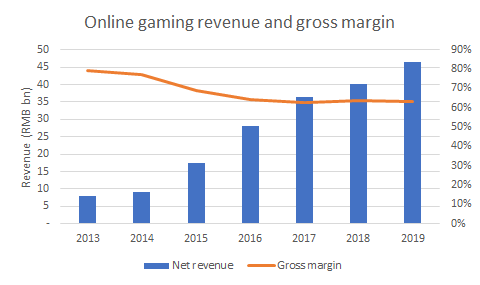

NetEase is the second-largest mobile gaming company in the world in terms of combined iOS and Google Play revenue in 2019, according to App Annie. Revenue is generated primarily from the sale of in-game virtual items, which means that customer retention and innovative contents are crucial. Although Tencent dominates the Chinese and international gaming markets, we believe R&D capabilities remain a competitive strength for NetEase which enables the company to continue to increase its user base.

Source: NetEase IPO prospectus 2020

NetEase is known for its self-developed games which account for 90% of its revenue in 2019. One of its strengths is the ability to extend the lifecycle of legacy games through extension packs and content updates, which is demonstrated by the continued success of the Westward Journey series. The franchise has been in operation since 2004 and remains popular today, ranking second in China and seventh globally in terms of user spending in 2019, according to App Annie.

Apart from generating consistent revenue from legacy games, the company has also been able to roll out native blockbuster titles each year including Onmyoji (2016), Knives Out (2017), Identity V (2018) and Fantasy Westward Journey 3D (2019). It is also partnering with major global brands such as Blizzard, Microsoft and Warner Bros for game licensing and co-development. The partnership with Warner Bros on "Harry Potter: Magic Awakened" and "The Lord of the Rings: Rise to War" are in advance stages of development, which are expected to be a major hit when they are released.

Expanding geographical reach will become an increasingly important initiative for the company, in our view, as it has earmarked 45% of the proceeds from the secondary listing in Hong Kong for globalisation strategies and opportunities. Overseas currently accounts for 11% of its online games revenue and company management previously mentioned its target to reach 30% in the medium term. The company has achieved some initial success in Japan, with Knives Out and Identity V topping Japan's iOS grossing chart multiple times in 2019. It has already invested in a number of game studios globally in recent years, which is an initiative we believe will accelerate further after additional fundings from the secondary listing.

Source: NetEase Annual Report

Online education: Monetisation is the key to reach profitability

The online education market was already growing rapidly pre-COVID, which was accelerated further by COVID-19. According to Youdao's IPO prospectus, the Chinese intelligent learning market is expected to grow at a CAGR of 48% between 2018 and 2023. The industry has become increasingly competitive with both the incumbent players, TAL Education (NYSE:TAL) and New Oriental (NYSE:EDU), and start-ups offering online classes. Achieving profitability seems to be a common problem that companies face in the online education industry, as some of them are spending a huge amount on sales and marketing to gain customers while offering discounted prices.

| Online education company | Market cap ($m) | Revenue ($m) | Gross margin | Net income margin |

| GSX Techedu (NYSE:GSX) | 2,401 | 628 | 78% | 8% |

| Koolearn Technology (New Oriental Education) | 3,730 | 151 | 46% | -69% |

| China Distance Education (NYSE:DL) | 311 | 213 | 54% | 9% |

| China Online Education (NYSE:COE) | 531 | 253 | 71% | 4% |

| LAIX (NYSE:LAIX) | 107 | 140 | 69% | -72% |

| Sunlands Technology Group (NYSE:STG) | 267 | 305 | 81% | -21% |

Source: Seeking Alpha

However, we believe Youdao has several competitive advantages that enable the company to attract and retain customers. Firstly, the company has developed some proprietary technologies such as automatic speech recognition (ASR), text-to-speech (TTS) and AI-powered applications. One example that management gave recently was the "Intelligent Memorisation Plan" which uses ASR technology for students to practise in their own time, which has contributed to a double-digit increase in retention in high school Chinese classes. Secondly, Youdao Dictionary is a well-known product and language tool founded with 51.9 million MAUs in 2019. The company can leverage this platform and cross-sell its online courses. Gross billings of new paid enrollments from internal traffic increased by 127% year over year in Q2 2020.

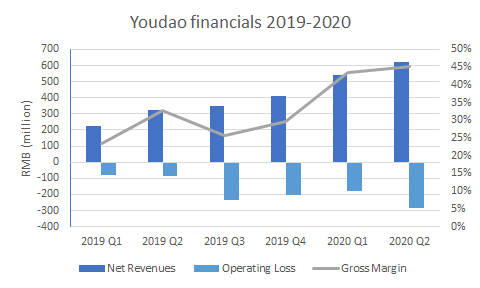

Youdao has achieved rapid top-line growth in recent quarters but at the expense of higher sales and marketing costs. It is promising to see an increase in gross margins and positive cash flow in Q1 and Q2 2020. However, we would not expect the business to be profitable in the immediate future as management is planning to increase spending on sales and marketing to capture the market, which arguably is the right strategy in a highly competitive market yet young and fragmented market, where the potential benefit of being the market leader is huge.

Source: Youdao quarterly financial reports

Music Streaming: A promising growth engine

We see NetEase Cloud Music as a promising growth driver for the business, which saw revenue grow by triple digits in Q2 2020. Although the Chinese music streaming industry is dominated by Tencent Music, which owns KuGou Music, QQ Music and Kuwo Music, we believe there are opportunities for NetEase Cloud Music (no.2 player with 12% market share) to increase its market share.

Firstly, compared to Tencent, NetEase focuses on discovering and promoting emerging musicians and has attracted over 100,000 independent musicians. It also has social networking features that enable users to share comments and resonances, which seem to be able to attract a younger audience as more than 84% of its users are below 25.

Secondly, the music industry is starting to open up in China, partly due to government pressure, as NetEase is able to sign a direct license deal with major studios such as Universal Music which used to be exclusive to Tencent. In addition, the strategic partnership with Alibaba, which has acquired a minority stake in the business as part of the $700m deal in 2019, would allow both companies to pool resources together to offer greater music repertoire and content.

Financial projections and Valuations

We see the current valuation as attractive, as NetEase is currently trading at 4.9x forward EV/revenue and 20.7 forward P/E which are lower than its closest peer, Tencent (at ~35% discount).

To derive our target price, we use a sum-of-the-parts approach which divided the company into three businesses:

- Online gaming: Peers are trading at 6.8x forward EV/revenue on average. Given NetEase's established market position and its track record in generating consistent revenue growing pipeline, we assume the gaming division to trade at a 10% premium at 7.5x.

- Peers are trading at 9.7x forward EV/revenue on average. As Youdao is at an early stage of development with a lower historical gross margin, we assume the business to trade at a 20% discount at 7.7x.

- Innovative businesses and others: Peers are trading at 3.5x forward EV/revenue on average. The division includes NetEase Cloud Music and Yanxuan which are in their early stage of development and has historically achieved a lower gross margin. We assume the business to trade at a 20% discount at 2.8x.

By using different multiples on the respective division, we derive a share price of $117, which represents ~30% upside from the current share price.

Online gaming

| Company | Market cap ($ bn) | EV/revenue (FY1) | P/E (FY1) | Gross margins | Revenue growth (FY1) |

| Tencent | 689 | 7.8 | 30.7 | 46% | 22% |

| Activision Blizzard | 62 | 7.6 | 24.0 | 70% | 3% |

| EA (NASDAQ:EA) | 38 | 6.1 | 22.3 | 75% | 7% |

| Nintendo (OTCPK:NTDOY) | 66 | 5.7 | 19.4 | 52% | 7% |

| Average | 6.8 | 24.1 | 61% | 10% |

Education

| Company | Market cap ($bn) | EV/revenue (FY1) | P/E (FY1) | Gross margins | Revenue growth (FY1) |

| New Oriental | 26 | 5.3 | 36.5 | 54% | 27% |

| TAL Education | 48 | 7.9 | 62.4 | 54% | 42% |

| GSX Techedu | 24 | 12.7 | n.a | 78% | 76% |

| Koolearn Technology | 4 | 12.8 | n.a | 46% | 64% |

| Average | 9.7 | 49.5 | 54% | 34% |

Ecommerce/ Music Streaming

| Company | Market cap ($bn) | EV/revenue (FY1) | P/E (FY1) | Gross margins | Revenue growth (FY1) |

| Alibaba | 826 | 6.9 | 27.0 | 45% | 30% |

| JD (NASDAQ:JD) | 126 | 1.0 | 36.3 | 8% | 21% |

| Vipshop Holdings (NYSE:VIPS) | 13 | 0.8 | 12.5 | 22% | 13% |

| Tencent Music | 24 | 4.4 | 25.7 | 33% | 24% |

| Spotify (NYSE:SPOT) | 49 | 4.3 | n.a | 25% | 22% |

| Average | 3.5 | 25.4 | 26% | 22% |

Source: Seeking Alpha

Risks

Government regulations remain a risk for the online gaming sector. After an eight-month freeze on new game releases in 2018, the government has announced new regulations for publishing video games. This has led to a decline in the number of games that received approvals in 2019 compared to previous years. There is a risk that NetEase might not receive approvals for its games which will negatively impact its revenue.

Competition is also another major risk, particularly for the online education and e-commerce business. Youdao and Yanxuan are in their early stage of development, which requires significant investments and sales and marketing to grow their customer base. The increase in costs might affect the timing when the businesses can reach profitability and drag down the profit margins on the group level.

Bottom line

We believe NetEase offers a unique opportunity to invest directly in the growing online gaming and digital media industry in China, which is a trend that has accelerated further since COVID-19. NetEase has a solid position in online gaming with a track record of being able to leverage its existing gaming IP and develop new games. Youdao and NetEase Music offer additional growth opportunities and we see a path for NetEase to become a significant market player in these two industries with its focus on technology to create differentiated offerings.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.