Ares Capital: A Blue Chip To Bank On The U.S. Economy With An 11% Yield

BDCs allow investors to invest in the middle-market businesses that make up the bulk of the American economy.

With BDCs the quality of management is exceptionally important.

This BDC has high-quality management and the resources to back it up.

We are betting on the resilience of the American economy with this pick.

Co-produced with Beyond Saving

Business Development Companies were created in 1980 through amendments to the Investment Company Act of 1940. Being publicly traded, BDCs can access equity in the public markets and use their scale to access relatively cheap capital, which they then invest into small or medium businesses (worth under $250 million) that are not publicly traded.

BDCs can invest at any level of the capital structure, senior debt, junior debt, preferred equity, equity or warrants. Their willingness and flexibility to accept equity provides the unique ability to be the bank of small businesses. BDCs will not only lend to these private companies, they also have a stake in the company having a good future, and in the event of a default on a loan, are often more willing to work out a deal with the company rather than just cut their losses like a traditional bank might.

For retail investors, BDCs provide a platform to invest in the heart of the American economy. The small to medium-sized businesses that fuel substantial economic activity are generally not available for purchase by the average investor. The wealthy might join or set up a venture capital fund or a private-equity fund. For those retail investors like us who wish to invest in small business and in the power of the American economy, BDCs are the solution. BDCs are a very liquid and easily accessible investment that allows the average investor to participate in this great sub-sector of the economy.

Additionally, BDCs are taxed as "regulated investment companies" ('RICs') under the Internal Revenue Code. This means that they have a "pass-through" tax structure and do not pay taxes at the corporate level as long as they distribute the majority of their taxable income. Like REITs, BDCs will pay out a relatively high amount of dividends due to these requirements.

This makes them a great vehicle for investors looking to develop a substantial stream of dividend income.

However, we need to be careful in this sector because even as small- to medium-sized businesses support the economy, they do fail and we want to make sure we are invested in a BDC that has a high-quality team capable of determining what businesses are worth investing in, which are worth supporting through hard times and when to pull the plug and move on.

However, we need to be careful in this sector because even as small- to medium-sized businesses support the economy, they do fail and we want to make sure we are invested in a BDC that has a high-quality team capable of determining what businesses are worth investing in, which are worth supporting through hard times and when to pull the plug and move on.

With their unique ability to be very involved in their portfolio companies and to make several decisions along the course of the investment, the BDC sector is one where management quality is paramount and will make a huge difference between success and failure.

Today we look at one of the top-tier BDCs that has a stellar history, navigating through the Great Financial Crisis and is in an excellent position to navigate through the current crisis while providing strong shareholder returns.

Ares Capital (ARCC) is a BDC that survived the Great Financial Crisis, arguably one of the hardest times in history for small to medium businesses, and came out the other side thriving.

Ares Capital (ARCC) is a BDC that survived the Great Financial Crisis, arguably one of the hardest times in history for small to medium businesses, and came out the other side thriving.

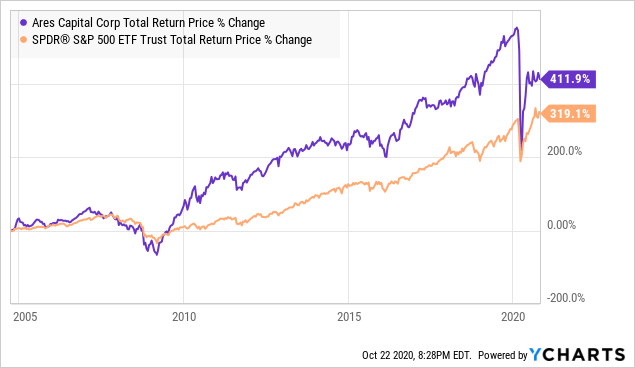

Data by YCharts

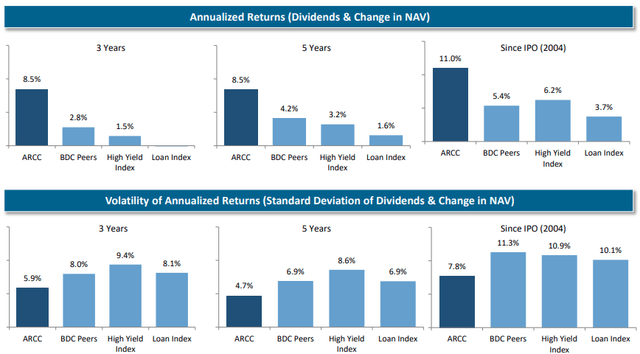

Data by YChartsARCC has outperformed the S&P 500 in total returns, with the bulk of those returns coming as cash dividends. ARCC has not only outperformed the S&P, they also outperformed their BDC peers, high-yield bonds and leveraged loans having above average returns, and below average volatility on a NAV basis.

Source: ARCC Presentation - September 2020

There's little doubt that ARCC has earned their reputation as the blue chip of the BDC sector. It's due to their performance and reputation that ARCC usually trades at a premium to the net asset value. Today, they are trading at +10% discount to NAV, while they were trading at a premium before the COVID-19 crisis. Buyers today will have the benefit of upside from ARCC's NAV recovering, but also from the current discount being reduced. One of the great parts of investing in ARCC is that you can collect an 11% yield while you wait for the recovery to take place.

Investments

BDCs make their cash flow from the regular interest payments from their portfolio companies. Since they are invested in middle-market businesses, it's a reality that loans are going to default from time to time, especially when you have macro events like the Great Financial Crisis or COVID-19.

The strength of BDCs is that they are very flexible and have numerous options to work out deals with defaulting companies to maximize their total return. The goal is that realized gains from such equity deals will meet or exceed the losses from the debt defaulting.

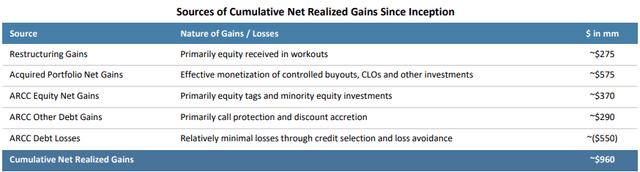

In ARCC's history, they have done an exceptional job.

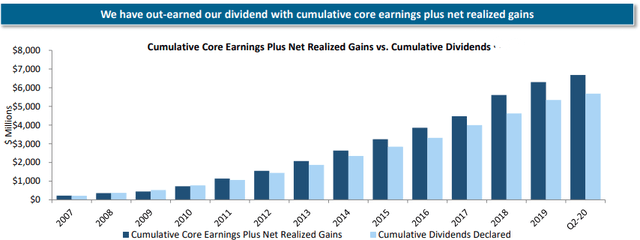

Source: ARCC Presentation

In short, while ARCC has written off $550 million in debt losses from defaulting borrowers, they have realized more than $1.5 billion in gains from their equity and restructuring gains. ARCC has achieved this by making good debt investments with low default levels, and when defaults do happen, they have the expertise to make lemons into lemonade. CEO Kipp Deveer discussed Singer Sewing in the Q2 earnings call:

So this is a company that we - that had struggled, people probably know it then excelling machines. And was private equity owned, and we now own the company, didn't choose to, but sort of had to, and that's a couple of years back. And look, this is testament to the portfolio management team. We've gone in. We've literally re-engineered the entire business running it in terms of its board, its management team, its strategy and all of that. And the markup is simply reflection of the profits are up, and we think the value is higher than it was last quarter. And we think the prospects for the business are much, much better. So this is just going in and doing what we actually tell people that we do, which is roll up our sleeves and get involved in the underperformers and create value. So hopefully, we're on a path down the line to a realization, but I don't think there's anything happening tomorrow.

This is a great example of what ARCC does. They made a debt investment, it didn't work out so they ended up taking ownership of the company and using their expertise and connections, were able to get it to a point where they believe they will eventually exit the position with a gain.

Diversity

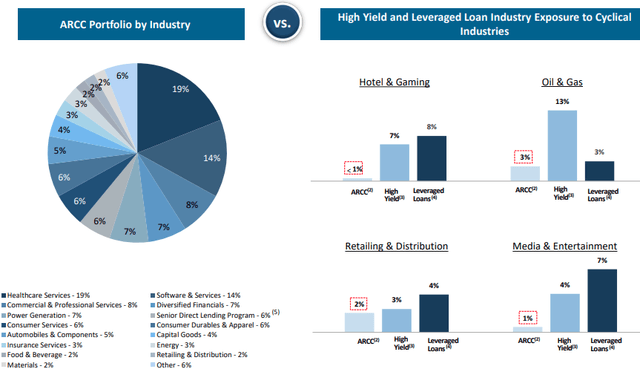

ARCC is extremely well diversified with no single loan exceeding 3% of their assets and their average position size is just 0.3%. Additionally, they are well diversified by industry.

Source: ARCC Presentation

Note that ARCC's largest industry exposures are industries that are currently very strong like healthcare and software, while their exposure to some of the most distressed sectors is limited.

There's no doubt that COVID-19 is going to impact many of ARCC's portfolio companies, however the limited exposure to the most distressed sectors will help keep such problems to a manageable level.

ARCC will have the time and the resources to be highly involved with the companies that have issues and position themselves to have a positive outcome.

Balance Sheet

One of the reasons BDCs work is that they are able to use their scale to access capital at cheaper prices than the companies they lend to are capable of. When a crisis like COVID-19 hits, many businesses have experienced interruptions in their revenues that are not related to the quality of the company itself. Many businesses are fundamentally strong, but being forced to shut down by government and/or having demand dissipate overnight is the kind of shock that really can't be prepared for.

For ARCC, this is an opportunity to invest more in the businesses they know are going to be great long-term investments. Just like in our portfolios, March presented us with opportunities to increase positions at much cheaper prices than before. So in scenarios like this, it's crucial that ARCC has access to capital themselves so that they have the flexibility to do what is best for ARCC whether that is to extend an additional loan, convert a loan to an equity investment or even buy out the entire company. Those are decisions that need to be made on a case by case basis, and it's crucial that ARCC has the financial resources to do what is best and not to let a company fail that could have been successful.

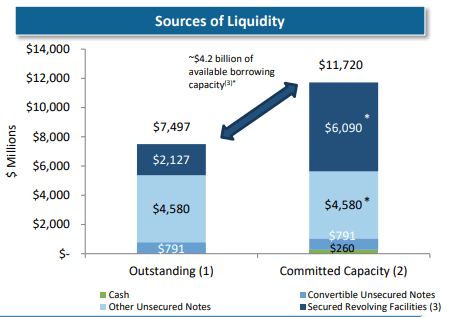

ARCC has an investment grade balance sheet, with plenty of excess liquidity.

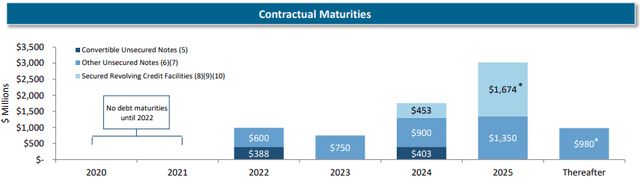

Source: ARCC Presentation

Source: ARCC Presentation

ARCC's debt is at an average interest rate of only 3.372% and they have no maturities until 2022.

Source: ARCC Presentation

This puts ARCC in a comfortable position to be able to make investments that the situation calls for and not worry about being constrained by their own lack of funds or having to worry about their own debt maturities.

Dividend

ARCC has been paying out a quarterly dividend of $0.40/share, resulting in a current yield of 11.5%. As we discussed at the beginning, BDCs are required to distribute the bulk of their taxable income. ARCC has been quite conservative with their dividend payments and has easily out-earned their dividend over time.

Source: ARCC Presentation

As a result, ARCC had "spill over" income of $0.96/share at the end of 2019. This is taxable income that has not yet been distributed. This helps provide ARCC with a cushion to help sustain the dividend in exactly this kind of event. We believe that ARCC's dividend is sustainable and will be sustained throughout the duration of the current crisis.

Conclusion

While the giant corporations are the most recognizable, it's middle America that drives the economic engine of the country. BDCs are one way that average investors can invest in this engine. When investing in BDCs, looking for the best management is key, and it's a very large portion of what predicts success.

ARCC has a stellar track record, having survived and thrived through prior cycles, and has outperformed the S&P 500 index. In the face of the COVID-19 crisis, ARCC came in better positioned than they have been in the past. They have a stronger balance sheet and a very skilled team with the resources and expertise to navigate a rocky economy.

With the prospects of a COVID-19 vaccine coming as soon as the end of 2020 and very likely in 2021, the businesses in ARCCs portfolio will find their way in the new normal. It's out of difficult times like these that the futures winners will rise gaining market share and expanding their operations.

ARCC proved in 2009's financial crisis that they could come out the other side in a better position. We believe they will do so again. This the blue chip of the BDC sector with an investment grade balance sheet. It's not going to be trading at a 10%-plus discount for a long time, and investors should bank on this opportunity. The American economy is nothing short of being resilient. Never bet against the American economy. This is why we are betting on ARCC.

Thanks for reading! If you liked this article, please scroll up and click "Follow" next to my name to receive our future updates.

Which Dividend Stocks We Are Buying?

High Dividend Opportunities is the largest community of income investors on Seeking Alpha for the 5th year in a row, with over 4400 members. Our best dividend picks are shared on a weekly basis. Our Immediate Income Method generates strong returns, regardless of market volatility, making retirement investing less stressful – simple and straightforward.

Join us to get instant-access to our model portfolio targeting 9-10% yield, our preferred stock portfolio, bond portfolio, and income tracking tools. Don't miss out on the Power of Dividends! Start your free two-week trial today!

Disclosure: I am/we are long ARCC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Treading Softly, Beyond Saving, PendragonY, and Preferred Stock Trader all are supporting contributors for High Dividend Opportunities.