United Airlines: There Are Easier Ways To Make Money

United Airlines misses the mark in 3Q, but 4Q commentary indicates it remains on the right track.

I think United is not entirely out of the woods on funding though, as the liquidity runway may not be as extensive as it appears.

The pace of corporate travel recovery also remains a big unknown, as the disparate DAL/UAL commentary showed.

I think UAL could still bounce from here, but the easy money has likely already been made.

With the capital base now firmed up, United (NASDAQ:UAL) should have sufficient liquidity to withstand any challenges into FY21, but the runway may not stretch too far beyond that, in my view. UAL also remains exposed to a great deal of uncertainty around an international and corporate travel recovery post-COVID, which makes this a rather risky name to own. I like the management team (see my prior bull thesis), but I think the easy money has already been made at this point.

3Q Misses the Mark

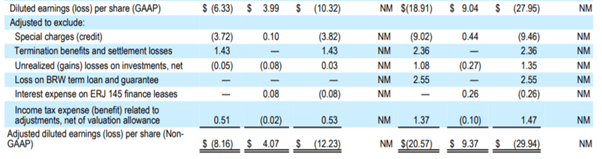

United posted 3Q20 adjusted EPS of -$8.16, well below consensus expectations, after accounting for COVID-related adjustments (e.g., ~$415m termination benefits and settlement losses, as well as >$1bn from the CARES Act grant) and other one-offs.

Source: Earnings Release

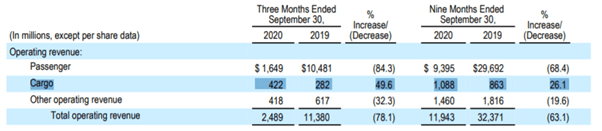

Driving the EPS miss were revenues down 78% YoY on lower capacity, of which passenger revenues were ~84% lower YoY. Domestic yields were weaker across geographies, down ~12.7% YoY, as United continues to price toward volume. From here, United's loads likely need to improve significantly from the current ~47.8% (-38.3%pts) before airfares can be normalized. Opex was also down ~36% on an adjusted basis, though much of this was down to lower capacity (and fuel).

3Q wasn't all bad though - cargo continues to be a resounding success, with sales rising ~49.6% YoY. Management deserves a tip of the hat here - post-COVID, UAL has been the most active US airline in driving cargo revenue, with >6,500 all-cargo flights now in operation. Now, this won't fully offset passenger revenue declines, but it's a clear step in the right direction.

Source: Earnings Release

4Q Guideposts Look Positive

Looking to 4Q, management offered the following guide - total revenues and passenger revenues down ~67% and 72%, respectively, on ~55% lower capacity. Opex is also guided at down 42%, driving daily cash burn in the $15-20m range (vs. ~$25m in 3Q).

I thought it was interesting that UAL is guiding toward breakeven cash burn ahead of Delta (NYSE:DAL) (recall DAL only expects to breakeven in spring 2021). But given UAL's higher 4Q burn level, this would seem counterintuitive and likely indicates a more optimistic view on the 2021 improvement at UAL (management still expects demand to remain below ~50% of pre-COVID levels pending a vaccine, though). That said, I would not read too closely into these numbers, given the differing cash burn definitions between the airlines.

Liquidity Runway - Not as Extensive as It Appears

For 3Q, daily cash burn was in line with company expectations at $25m, driving a >$19bn liquidity position as of quarter-end. UAL expects to end the year with ~$16-19bn (depending on the CARES Act loan). That all seems good, but I think the United liquidity runway is a lot less extensive than it appears. Given UAL has a ~$2bn bridge maturing in early 2021 (secured by older aircraft), which needs to be repaid, that brings the liquidity position to $15-17bn using end-FY20 guidance. Assuming minimum liquidity is ~$8bn, that leaves an ~$7-9bn cushion relative to the guided $15-20m/day cash burn (i.e., a ~350-day runway in a bear-case scenario).

The Pace of the Corporate Travel Recovery is a Concern

As I outlined in my DAL piece, the outlook for business travel is a concern. Yet, UAL continues to pin its long-term hopes on corporate travel as its "bread & butter" (similar to pre-COVID). The disparity in views around a corporate recovery is telling - UAL believes corporate travel can recover with minimal structural impairment, which compares to DAL guiding toward an ~10-20% impairment. Both companies also differ on the timing - DAL is guiding toward recovery in spring 2021, with a full recovery two years out. This contrasts with UAL's call for a recovery in late 2021 or early 2022, with a return to normalcy by 2024.

On a more positive note though, UAL has been flexible in the interim. Case in point - the company's network is markedly different from its pre-COVID capacity allocation. For instance, UAL continues to add capacity at hubs like Denver and Houston, given the interior hubs are outperforming coastal hubs, as well as point-to-point flying to warm-weather destinations.

Easier Ways to Make Money

Airline stocks are one big unknown (as the contrasting DAL/UAL commentary showed), and post-COVID bounce, I think the risk-reward is a lot less favorable. To be clear, airlines could still bounce along with the industry tide and reopening prospects - in such a scenario, UAL should outperform. That said, UAL's exposure to international and corporate travel puts it at a relative disadvantage to the low-/ultra-low-cost carriers, while its liquidity runway could come under pressure should things take a turn for the worse. Net-net, I am moving to neutral on UAL. Additional risks include competitive pressures, the Boeing (NYSE:BA) 737 MAX re-certification, and a COVID resurgence.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.