Fund Spotlight: Simplicity US Equity PLUS Convexity (SPYC)

Simplify is a new ETF company that launched three similar but slightly different ETFs meant to hedge downside risk.

The fund sponsor is attempting to capitalize on this trend toward trying to capture most of the upside of the equity market while limiting the downside risk.

SPYC plays on the convexity of their strategy where the fund outperforms the S&P 500 during extreme market moves, both up and down.

SPD is another version of SPYC without the upside outperformance but simply the S&P 500 with a market crash downside hedge.

We will continue to watch these as they are too new to invest in today, but I'd like to get them on your radar screen.

(This report was issued to members of Yield Hunting on Oct. 9. All data herein is from that date.)

This is the next in a series of new exchange-traded funds that have come out recently that focus on minimizing downside risk while providing at least a majority of the upside in equities. The demand for this type of strategy is extremely high thanks to several large market declines in the last few years as well as sharp memories of the massive downturns in 2000-2002 and again in 2008.

In this report we will analyze a new fund from Simplify ETFs, a relatively new fund company. The company is run by Paul Kim, CFA, a former PIMCO SVP who helped launch ETFs for that firm including MINT, BOND, ZROZ, and HYS. He also was the head of ETF strategy at Principal.

They have three ETFs with small variants in their strategies. We will focus on Simplify US Equity Plus Convexity ETF (NYSEARCA:SPYC) but will make some references to the other funds as well - Simplify US Equity Plus Downside Convexity (NYSEARCA:SPD) and Simplify US Equity Plus Upside Convexity (NYSEARCA:SPUC).

Simplify US Equity Plus Convexity ETF (NYSEARCA:SPYC)

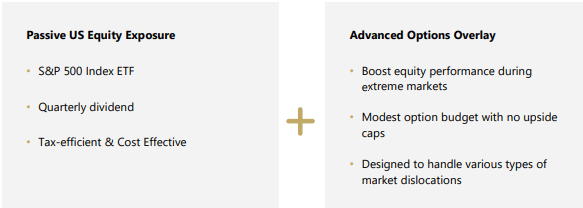

So what is this fund? Like the Aptus Defined Risk ETF (DRSK), the fund attempts to track the large-cap US equity market while not exposing the investor to the large downside exposure during a market crash. They do this with a systematic options overlay strategy.

What is convexity? The fund name has the word "convexity" in it. Typically, we see this word in relation to mortgage rates. Convexity is the measure of the curve in the relationship between bond prices and interest rates. When we think of bond prices and rates, we think of a perfect inverse relationship where as interest rates go down, bond prices go up.

(Source: IG.com)

However, some bonds do not experience this same sort of relationship. Due to the intricacies of the bond itself or the investment strategy altogether, the payoff on a bond is curved upward. In the case of SPYC, they are using an options overlay to benefit from extreme market moves. In this case, as the market moves up significantly or down significantly, the investment strategy (made up of options) pays off.

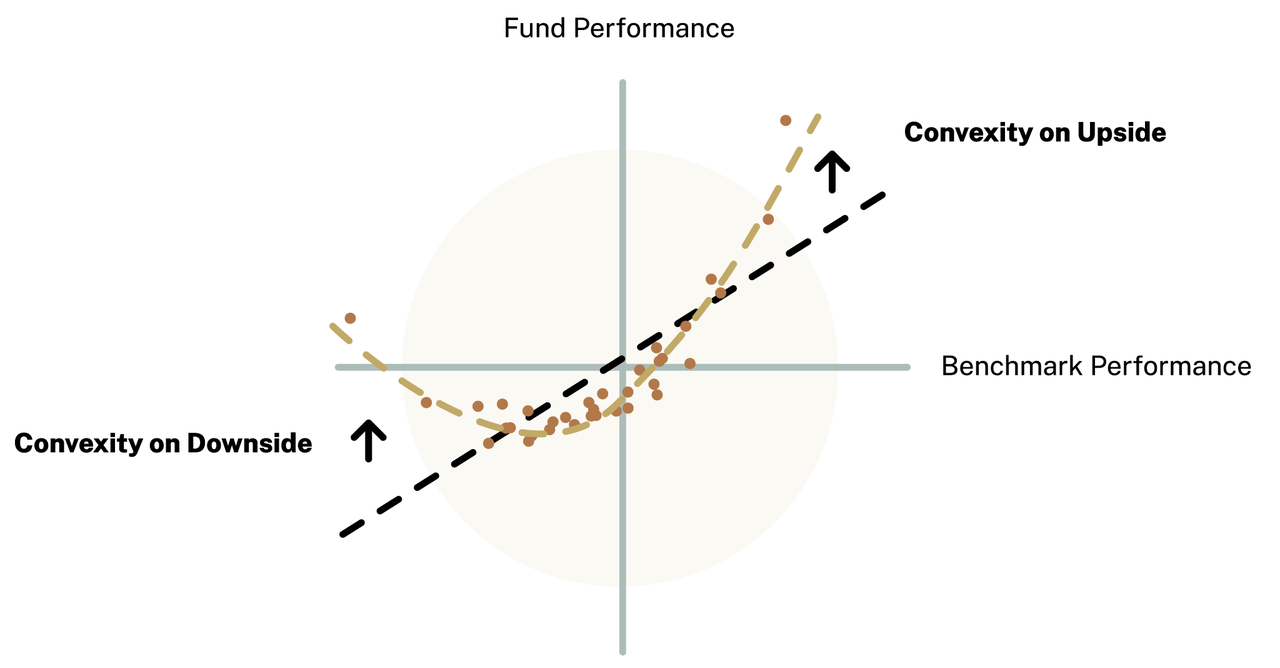

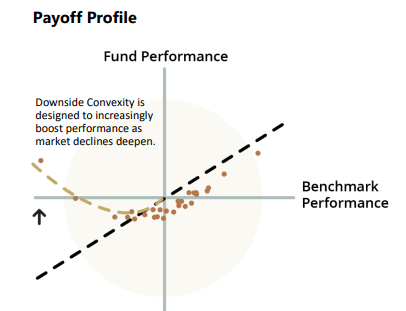

Here's a diagram below: Now, many of you may ask why wouldn't you do this? If I can get exposure to the S&P 500 and make money if the market crashes, why wouldn't I have all my money in something like this?

Now, many of you may ask why wouldn't you do this? If I can get exposure to the S&P 500 and make money if the market crashes, why wouldn't I have all my money in something like this?

The answer is that the options overlay doesn't come free. Thus, in periods of calm and slowly-rising markets, this ETF will underperform. In the prospectus, they note that they have about 3% opportunity cost. Like I've discussed in many of my monthly letters to members, we think of this as an insurance cost. Paying 3% of your portfolios value each year to protect against a crash. It's a drag to performance but, like life or homeowners insurance, you pay it to protect yourself but hope you never use it.

In the case of SPYC, the extreme market move can actually be a benefit to the fund's performance.

If you look at the image above, the curved dashed line (in gold) deviates from the dashed line which would be a passive investment in an index. It's above that line on the tails or at the extreme ends - when the market moves up or down 30% or more. But in the middle, you can see that the gold line drops below the black line. This indicates it's underperforming the index. That's the ~3% opportunity cost that we described above.

The Investment Strategy / Portfolio

The portfolio uses a core allocation to the iShares Core S&P 500 ETF (IVV) which costs them 3 bps or 0.03%. The current holdings are a mix of SPX call and put options. But 98.21% of the holdings are in the IVV. That means they are using 1.79% of the portfolio's assets to purchase options.

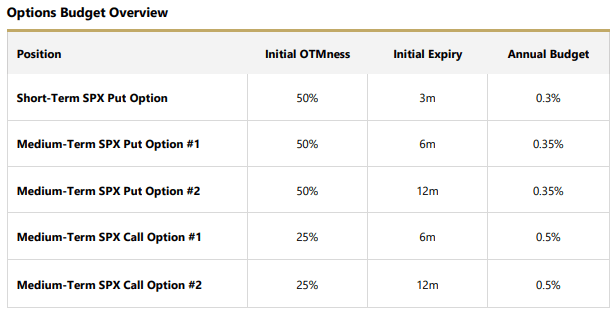

The call options are bullish bets on the market giving them the right but not the obligation to buy the S&P 500 index at a certain level by a certain date. An example. If I buy the SPX March 2021 4400 call option for $0.10, then I can exercise the option at any point between when I bought it to March 2021 but it's only worth something if the S&P reaches 4400. That requires a return of 31%.

A put options works like a mirror image. For instance, one of the holdings in SPYC is the December 2020 1800 put. This options gives the holding the right but not obligation to sell their S&P 500 position at 1800 at any time up to expiration. This protects against a market crash.

The chart below shows how they think about their options strategy and the blend of expiration.

Characteristics:

- Inception: 9/3/2020

- Core Exposure: S&P 500

- Net assets: $2.5M

- Management Fees: 0.50% (0.25% waived currently) plus 0.03% of acquired fund fees for a total expense ratio of 0.28%. This is until at least 08/31/2021

Concluding Thoughts

Risk management is becoming more and more important in the portfolio construction. As rates get closer to zero and income investors are forced to take more risk, they want to be able to offset that added risk from other areas of the portfolio.

The addition of options strategies to equity portfolios can help offset some of the volatility - a role that bonds have typically played in the past. With interest rates where they are, investors need to adapt to the new environment by shifting strategies.

It's a very simple strategy, but in my opinion, the chances of the call options being executed are almost nil, especially on the upside. In the example we used prior with the 4400 call option- the chances of a 31% increase in the market over a six-month period is extremely low. In my mind, they should be selling those call options to fund the purchase of the put options. While that would cap the upside of the fund, they also could move up the strikes of the put options to help protect earlier from a fall in the market.

This is why the Simplify US Equity Plus Downside Convexity ETF (SPD) may be more interesting. This fund simply buys the far-out-of-the-money put options to protect against a large negative event. By looking at their top holdings, they own 1800 strike puts from December, March and September. The drag on this ETF will be less than SPYC since they only buying half the number of options.

These tools are too new to be investable just yet. But we will be tracking them to see how they perform in certain markets. My guess is that the options are just too far out of the money, for both the puts and the calls, to be useful. The "moneyness," or how far the underlying index must drop before the option has intrinsic value, is very large - upwards of 50% for SPD. 50% market crashes in short periods of time don't happen very often (thought I understand the index doesn't need to fall the full 50% to make money on the option).

The number of these risk management ETFs are likely to expand significantly in the next few years. We hope to analyze and find the best few for the objectives we hold.

Our Yield Hunting marketplace service is currently offering, for a limited time only, free trials and 20% off the introductory rate.

Our member community is fairly unique focused primarily on constructing portfolios geared towards income. The Core Income Portfolio currently yields over 8% comprised of closed-end funds. If you are interested in learning about closed-end funds and want guidance on generating income, check out our service today. We also have expert guidance on individual preferred stocks, ETFs, and mutual funds.

Check out our Five-Star member reviews.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.