United Bankshares: Confident In The Q3 Results But Exposure To Commercial Loans Remains

UBSI's loan loss provision now exceeds 1.2% of the total loan book, and I expect the quarterly loan loss provisions to decrease.

Whereas $3B of the loan portfolio requested deferrals at the end of June, this dropped to $1.2B in early September.

I expect the current portion of the portfolio that has a deferred payment status to drop below $1B.

I'm still reluctant due to the high exposure to commercial loans, but I may decide to write some out of the money put options.

Introduction

United Bankshares (UBSI) still needs to report its Q3 results and ahead of the release (next week), I noticed the option premiums have reached interesting levels as market makers are bracing for the uncertainty surrounding the Q3 results. An excellent cue for me to have a look at how the bank performed in the first half of the year and how the bank’s risk management department has been dealing with the balance sheet.

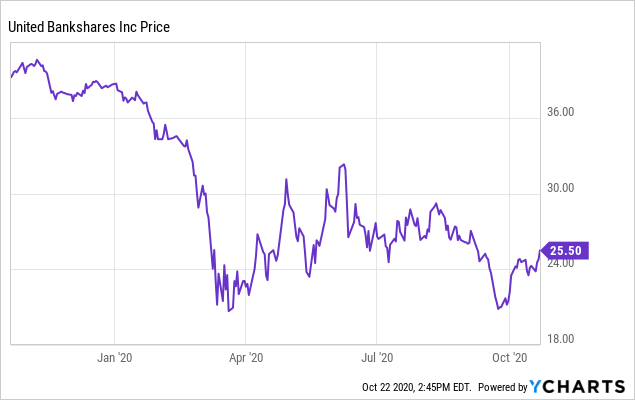

Data by YCharts

Data by YCharts

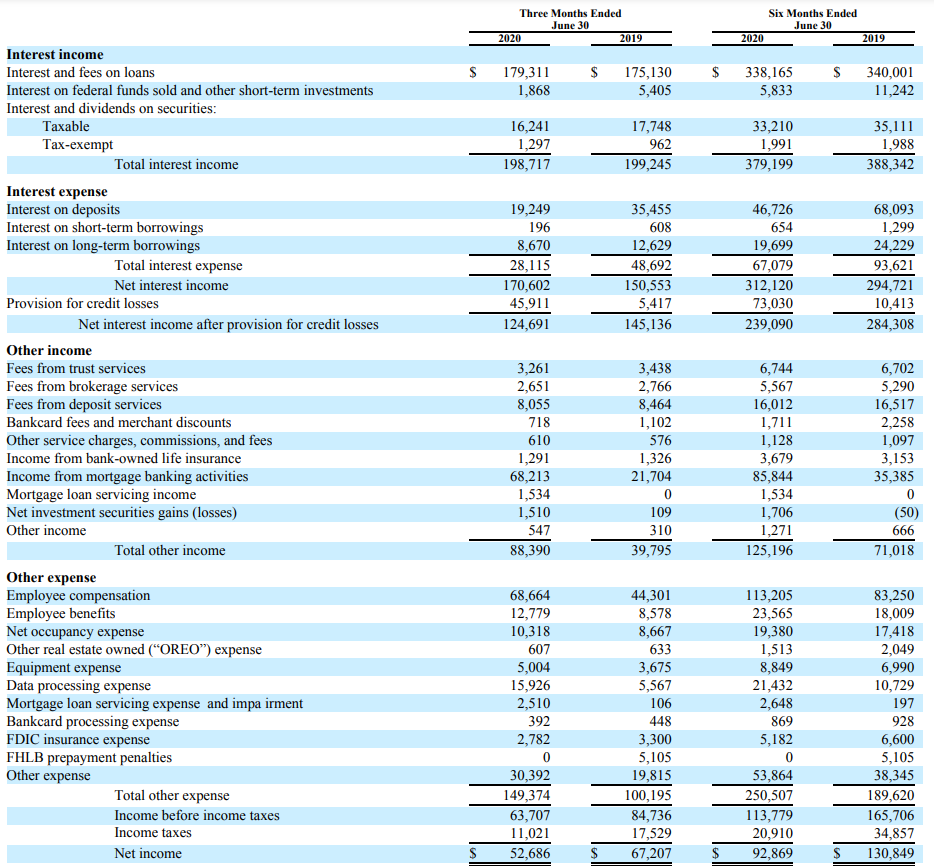

The H1 results indicate a strong profitability

In the first half of the year, United Bankshares saw its net interest income increase as the interest expenses decreased at a much faster pace than the interest income. This even accelerated in the second quarter as although the interest income decreased by a little bit less than 0.5%, the interest expenses decreased by more than 40% resulting in a $20M expansion of the net interest income to $170.6M.

The total net non-interest expenses were approximately $61M which means United Bankshares recorded a $109M pre-tax and pre loan loss provision income. A total of $45.9M was earmarked as a provision for credit losses in the second quarter, resulting in a pre-tax income of $63.7M and a net income of just less than $53M or $0.44/share.

Source: SEC filings

Note, the EPS is based on the average share count. If we would have used the expanded share count of 134M shares after the recent acquisition, the EPS would have been just over $0.40. Still sufficient to cover the current quarterly dividend of 35 cents per share. Assuming the loan loss provisions will decrease to around $30M (I’ll explain in the next section of this article why I’m assuming this), the EPS will likely come in at around $0.50.

The balance sheet: a strong focus on commercial lending

I prefer banks with a relatively high exposure to residential lending. Sure, the interest income on residential mortgages will be lower than on commercial loans, but I like the additional layer of safety.

Looking at the asset side of the balance sheet, as of the end of June, United Bankshares had a total of $26.2B on the balance sheet, of which just over $2B consisted of cash and cash equivalents. There also is about $2.5B of owned premises and equipment while there is a $1.8B value attached to the goodwill. The value of the goodwill has increased since UBSI closed an acquisition earlier this year. This also creates a big difference between the book value per share ($32.3) and the tangible book value per share ($18.50), so while the stock is trading at a discount to book, it’s also trading at a 40% premium to its tangible book value.

But back to the assets side of the balance sheet:

Source: SEC filings

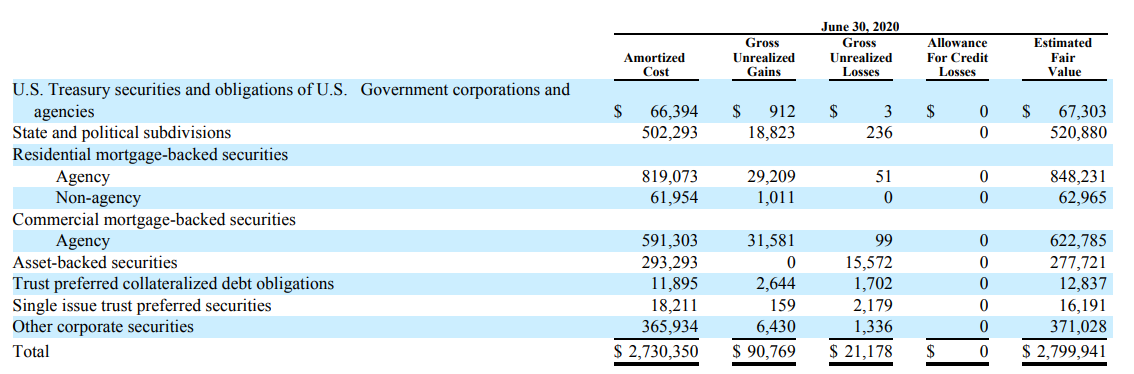

We see the bank had approximately $2.8B in securities available for sale and according to the footnotes, a large portion of this $2.8B investment consists of agency-issued securities:

Source: SEC filings

Given the high ratio of agency securities, local debt and asset-backed securities, this part of the portfolio is relatively ‘safe,’ so I shifted my attention to the $18B loan portfolio.

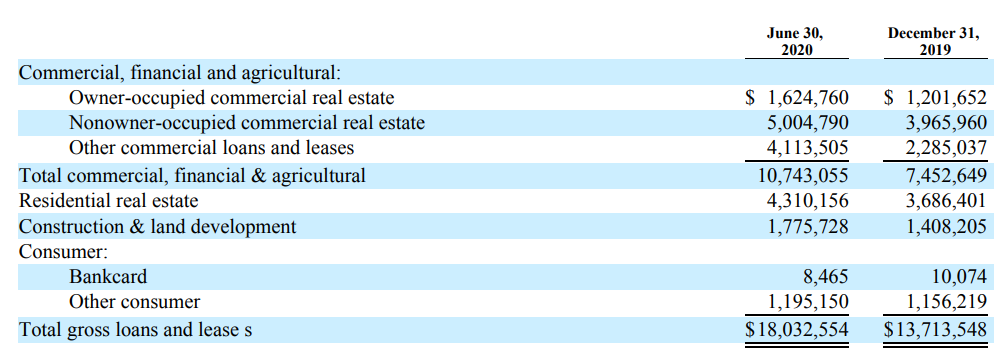

Source: SEC filings

As you can see in the image above, residential real estate makes up less than a quarter of the total loan book, which is predominantly focusing on commercial funding. About $6.6B of the loan book consists of commercial real estate lending while an additional $4.1B consists of commercial loans.

It was interesting to see United Bankshares reported about $3B of the loan book requested and was granted approval to defer some of its payments:

Source: company presentation

That was a significant portion of the loan book, but in the corporate presentation (published in September), we can see the situation has definitely developed in United’s favor. About $1.8B of the $3B in loans with deferred payments exited the deferral period, and as of September 4th, only $1.2B of the loans were in a deferred payment status.

We’re now almost 7 weeks later and I hope to see in the Q3 update the total amount of loans with a deferred payment status has dropped below $1B. That’s still a high amount in absolute numbers, but it would indicate that in the course of just over four months over 2/3rd of the loans in the deferred payment status have exited that status and payments have resumed.

I’m also encouraged by the relatively low LTV ratios in the commercial real estate and hotel loan portfolio:

Source: company presentation

Investment thesis

Thanks to the updated situation as of September 4th, I’m not expecting any significant surprises when United Bankshares reports its financial results. I expect the dividend to be fully covered by the EPS as I expect the loan loss provision to decrease considering the total allowance for loan losses already exceeded $200M as of the end of June and the risks seem to have decreased a little bit. While we will still see elevated loan loss allowances compared to Q3 last year, I expect the Q3 loan loss provision to be more in line with the Q1 provision ($28M) than the $45M recorded in Q2.

Despite the high exposure to commercial (real estate) loans, I am planning to write an out of the money put option as the December P20 option has an option premium of $0.35 while the P22.5 can be written for an option premium of $0.75 the same date.

Source: Interactive Brokers, author screenshot

I haven’t made a final decision yet, but I don’t expect UBSI to report any surprises when it reports its Q3 results.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

NEW at ESCI: A dedicated EUROPEAN REIT PORTFOLIO!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I may write one or several out of the money put options on UBSI.