AT&T: Surprisingly Strong Quarter Is Misleading

AT&T easily beat lowered Q3 analyst estimates.

The company now forecasts FCF reaching $26 billion providing a 57% payout ratio on a strong 7.4% dividend yield.

The lack of capital investment growth is part of the reason for capped upside in the stock.

AT&T is now good for a large dividend and limited capital returns.

After hitting my $26 price target before earnings, AT&T (T) had a misleadingly strong quarter. Or at the least, the media and wireless company had a quarter that easily beat lowered analyst expectations turning the market more bullish on the stock. My investment thesis is more bullish AT&T after hitting the lows of March, but the long-term potential isn't suddenly better.

Better Than Weak Expectations

For the quarter, AT&T reported revenues that beat analyst estimates by $750 million. Yet, the wireless company still reported revenues fell by 5.1% YoY continuing a trend of negative sales.

AT&T faced a tough business climate in the quarter due to the COVID-19 hits, especially in the media business. WarnerMedia saw sales fall by 10% in the quarter to only $7.5 billion. More importantly, operating income plunged by 38% to only $1.8 billion. In the process, HBO income is down to nearly $0 as the company ramped up programming costs while not obtaining a substantial boost in revenues.

The stock is up 5% today because of the better than expected wireless sub adds and increased HBO subs. CEO John Stankey really summed up the positive news in the Q3 earnings release:

Wireless postpaid growth was the strongest that it’s been in years with one million net additions, including 645,000 phones. We added more than 350,000 fiber broadband customers and are on track to grow our fiber base by more than 25% this year. And we continue to grow and scale HBO Max, with total domestic HBO and HBO Max subscribers topping 38 million — well ahead of our expectations for the full year. Our strong cash flow in the quarter positions us to continue investing in our growth areas and pay down debt. We now expect 2020 free cash flow of $26 billion or higher with a full-year dividend payout ratio in the high 50s%

Despite these strong subscriber numbers, AT&T still didn't generate impressive financials. Not only did the wireless company add the 645,000 postpaid phones, but also another 4.2 million connected devices. In total, the company had 5.5 million net adds to reach 176.7 million subscribers.

The key mobility service revenues actually declined 0.3% YoY to $13.9 billion. The only real bright spot in the mobility division was the 6.4% boost in equipment revenues due to sales of data devices that aren't likely to repeat in 2021. The inability to grow wireless service revenue in an environment where data usage was strong is a big negative for the future of the business.

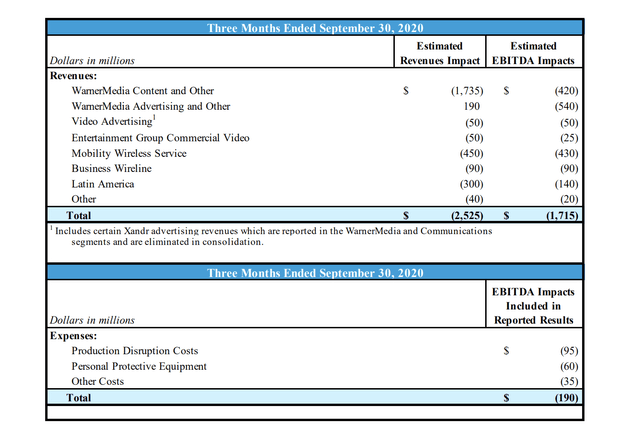

While saying this, the COVID-19 impacts were real. AT&T provided this guidance of a Q3 estimated revenue impact of $2.5 billion hitting EBITDA by $1.7 billion. Last Q3, the company reported revenues of $44.6 billion suggesting slight revenue growth with revenues of $44.8 billion without the COVID-19 impact.

Source: AT&T Q3'20 investor briefing

AT&T has a history of underwhelming results so the stock isn't going to hold a rally on better than expected results where revenues actually fell 5.1%. The company needs to print a quarter where the strong subscriber growth metrics deliver actual wireless service revenue growth, especially considering some concerns regarding pricing pressure in the current quarter surrounding the iPhone 12 release.

Cash Flow Is King

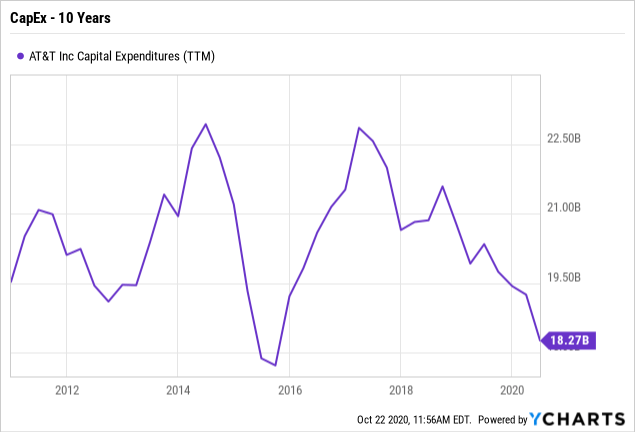

The one solid metric during 2020 has been the free cash flows. AT&T now predicts FCFs jumping back up to $26 billion for the year. The company has already generated $18.9 billion in FCFs to date, though part of the big boost in Q3 comes from only spending $3.9 billion on capex during the quarter. AT&T spent $1.3 billion less than last Q3 providing the majority of the boost to FCFs.

The company now forecasts full-year capex spending of $20 billion. While the amount sounds impressive, AT&T has kept the FCFs artificially higher due to holding investments down. The company bought both DirecTV and Time Warner during the last decade, yet capex spending is down from the higher levels seen in 2014 and 2017. The company not willing to invest in the new businesses has likely contributed to the failed business models.

Data by YCharts

Data by YCharts

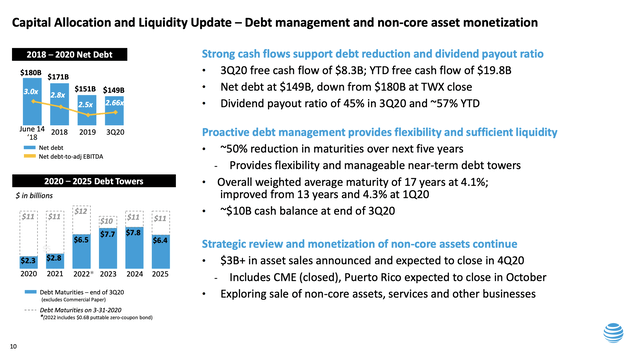

For investors loving the dividend, AT&T has the net debt down to a more manageable $149 billion after reaching $180 billion with the Time Warner acquisition. Though, the company has made limited progress in debt reduction this year after completing share buybacks right prior to the virus shutdown.

Source: AT&T Q3'20 presentation

With the debt under control and the solid FCFs at $26 billion in this difficult year and the potential to rebound to the $29 billion levels from 2019, the dividend remains secure. AT&T spends $15 billion annually on dividends for a forecasted payout ratio of only 57% even during a difficult time.

Even after the little rally, the stock still offers a 7.4% dividend yield. The history of disappointing results, the tricky business environment and the lack of growing investments, investors shouldn't expect the stock to offer much in returns beyond the dividend yield.

Takeaway

The key investor takeaway is that the stock will likely rally here on the back of improving market sentiment on AT&T following Q3 results. Investors should be cautioned that a revenue decline in excess of 5% and beating meager HBO Max targets aren't exactly impressive. The stock is good for a rally back into the low $30s, but investors shouldn't expect any lasting upside from COVID-19 adjusted results of 0% growth.

If you'd like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.