Sprout Social: Key Winner In Social Media Software

Sprout Social is one of the leading providers of social media management software with strong revenue growth and customer traction.

As more traffic and customer engagement modalities shift to social media, solutions by vendors like Sprout Social will become increasingly important.

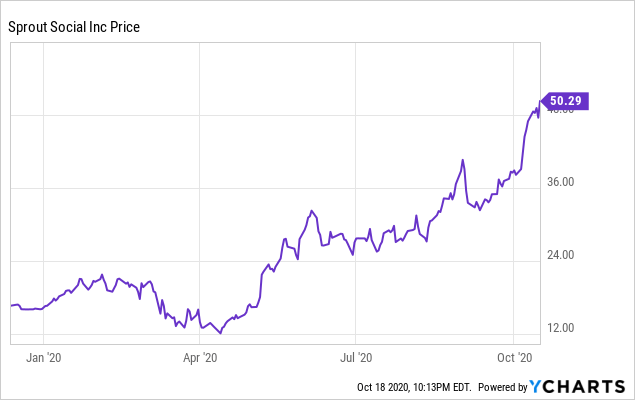

The current valuation is undemanding, and I see significant upside from current levels.

Investment Thesis

Sprout Social (NASDAQ:SPT) is a platform used to manage social media accounts across a variety of different services including Twitter, Instagram, Pinterest, and Google. This platform provides an all-in-one solution that covers many core use cases including user engagement, content publishing, analytics, and collaboration. The company has performed well even through COVID as social media engagement became more important as offline consumer interactions became more restricted.

From a pure product perspective, the company goes to market with the following key product features:

- Engagement - This feature set allows customers and their clients to communicate across multiple social media channels in a central location.

- Publishing & Scheduling - This feature allows customers to schedule various multimedia posts across a variety of social media accounts

- Analytics - The company's analytics features allow customers to understand usage and performance of the platform and of their social media activities.

- Listening - The listening feature set allows the company to gather data across social media channels to drive insights on the customer base.

Social media has become an increasingly important part of both digitally-native and non-digitally-native companies' go-to market strategy as e-commerce and overall consumer behavior has migrated to digital channels. Additionally, beyond just transactional sales, much of the historical customer interaction whether it is general marketing or customer service has also moved to social media channels. This has driven the increasing importance of social media to enterprises. However, the adoption of tools to manage social media channels is still relatively light. According to the company's analysis, only 5% of the 90 million businesses that have a social media presence actually have dedicated software to manage it. Thus, there is significant room for Sprout Social to grow. It is also why I believe that Sprout Social is a good way to get a call option on the overall enterprise shift towards social media channels.

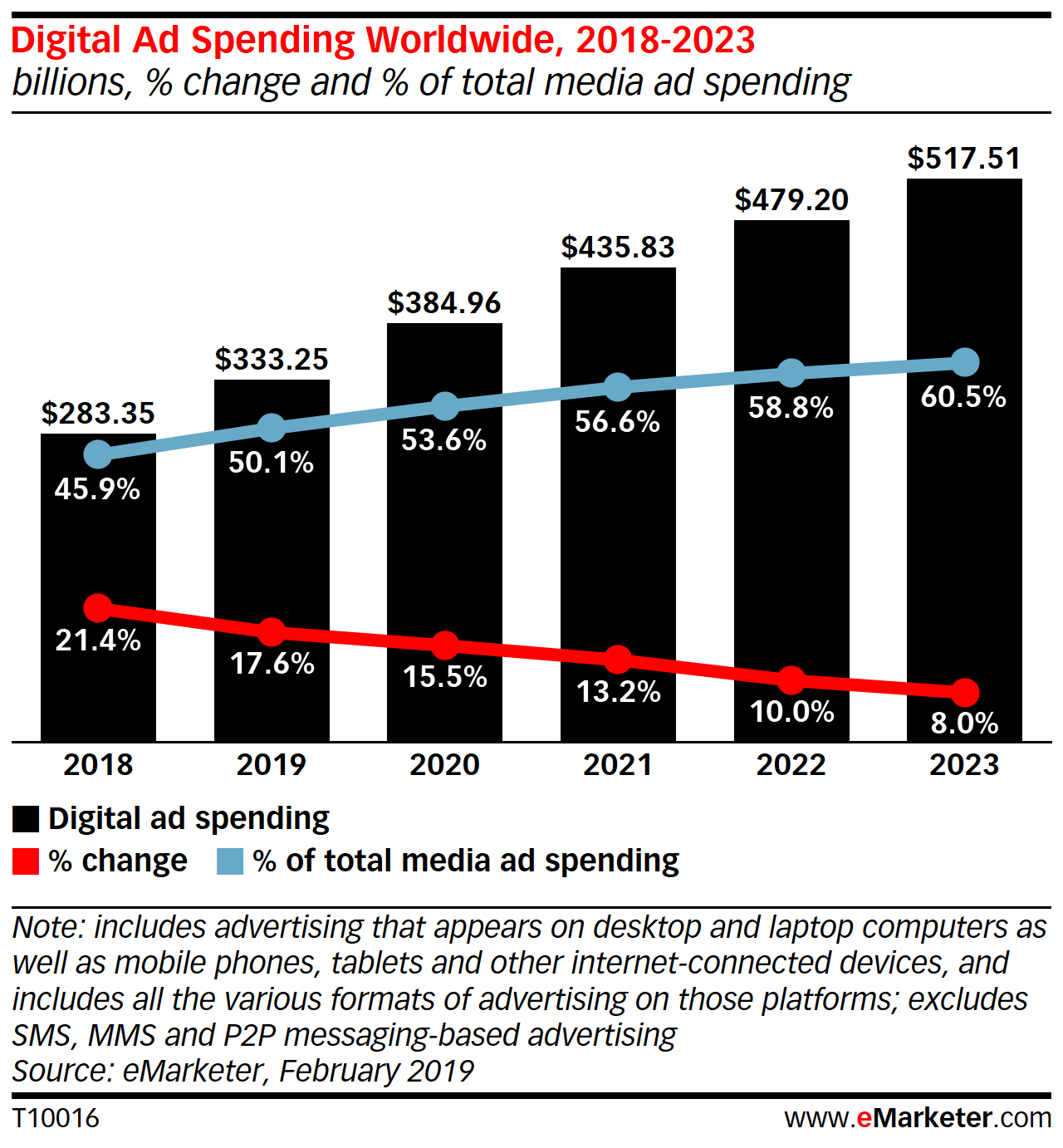

Additionally just looking at digital advertising spend in general, this has been a massive growth area as advertisers move their focus and spend away from online channels to online channels where many consumers have migrated their attention to. Given Sprout Social's focus on the digital channel, I believe it has significant runway for growth in this macro shift from offline to online across all industries. This is true even for non-digitally-native brands as they realize the importance of having a digital presence and even more importantly, engaging with customers with a modality that is most comfortable for them. In this case, the digital modality oftentimes through social media.

In the social media management tools space specifically, Sprout Social is the clear leader with over 23,000 companies in over 100 countries on the platform. The company has a strong presence across SMB, Enterprise, and Mid-Market, which provides for a strong land and expand strategy as the customer grows. Customer satisfaction and upsell within the platform are also high with the company reporting net retention >100%. This strong upsell alongside organic demand for the platform has helped drive strong YoY revenue growth of 27% to a ~$126MM run-rate in Q2'20. This revenue is largely high-margin subscription software which provides a degree of stickiness to the company's revenue base.

From a competitive point of view, I believe that the company has strong differentiation and will allow it to gain share in excess of the rest of the market. Although large platform plays such as Adobe (NASDAQ:ADBE) and Salesforce (NYSE:CRM) are entering the market and have offerings that do bits and pieces of what the pure plays do, product leadership is still in the hands of pure plays ranging from Sprout Social to Hootsuite and Sprinklr. Additionally, those platforms are geared more for their own ecosystem vs. being platform agnostic like many of the pure-play vendors. In terms of pure plays, Hootsuite plays largely in the SMB space so isn't the greatest comp in terms of just customer target vs. the more mid-market/enterprise lean that Sprout Social has. Sprinklr on the other hand, with a much higher enterprise/mid-market mix, is a key competitor to Sprout Social as it has very similar feature sets. However, given the market size, I believe that there is significant room for multiple players to win here.

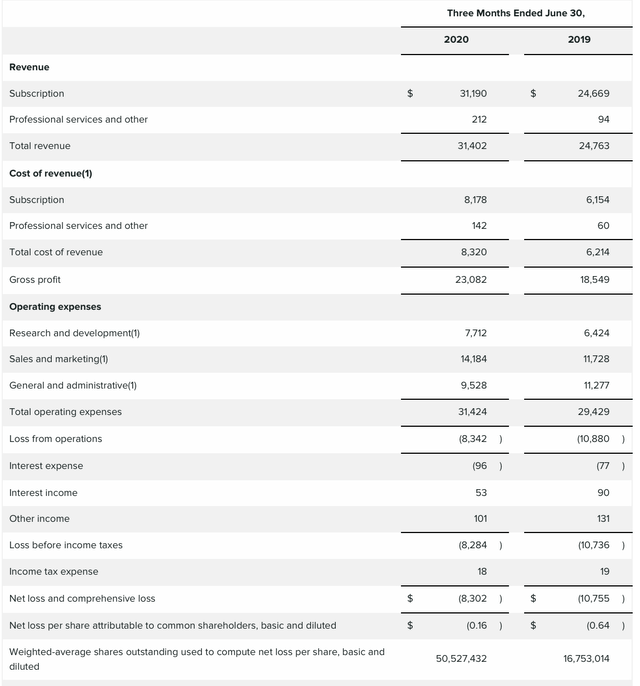

Financials

The company continues to perform very well, with growth up 27% YoY in Q2 with burn decreasing as well. On the burn front, operating margins have improved from -44% to -27%, which is a significant YoY improvement and puts the company closer to break-even. Much of the expansion in OpEx YoY was in S&M, which can be pulled back to moderate burn if COVID-related disruptions cause significant macro headwinds that cause sales to soften. R&D and G&A either shrunk or grew slower YoY, which illustrates the increasing operating leverage that the company is achieving. With ~$80MM of cash, the company still has a significant cash runway without the need to raise dilutive capital.

Risks

Competition is heating up in the space with many major platforms whether it be Adobe or Salesforce putting additional emphasis on this market. Additionally, pure-play competitors such as Sprinklr which have close feature parity to Sprout Social are an increasing threat. However, given the fact that the market is still relatively unpenetrated and the growing emphasis on social media management, I believe that there are multiple players that can win here. I firmly believe that just given Sprout Social's strong traction and product leadership that it will be one of the winners.

The overall burn is still relatively high, and although liquidity is fine for now, there is always a risk of another dilutive equity raise if additional capital is needed.

An additional risk here that is worth highlighting is the company's exposure to coronavirus-related headwinds. Although as of now, the company is likely to be a beneficiary of the mix shift towards digital channels, but a massive depressionary cycle driven by the pandemic may depress spend across forms of software including this company.

Valuation and Conclusion

The company currently trades at a EV/revenue of ~19x. This is based on FY 2020 revenue estimate of $129MM and an enterprise value of $2.45B. There are a few companies with a similar growth range that trade in the 10-20x range e.g. Wix (NASDAQ:WIX) and ServiceNow (NYSE:NOW). The company is definitely on the higher end of the range, but I think it is warranted given the company's product leadership, relatively uncrowded competitive landscape, and large underpenetrated TAM with large opportunities for growth. This drives my bullish rating on the company. In terms of price target, I believe a 12-month price target of ~$62/share is fair (28% upside) and is based on maintaining the same EV/revenue multiple and utilizing the median FY21 revenue of $165MM.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.