Essential Properties Trust Yields Nearly 5% With An Underleveraged Balance Sheet

Rent collection has bounced back to 90%, even before accounting for deferrals.

EPRT’s tenants have financially strong with 3.0 times rent coverage.

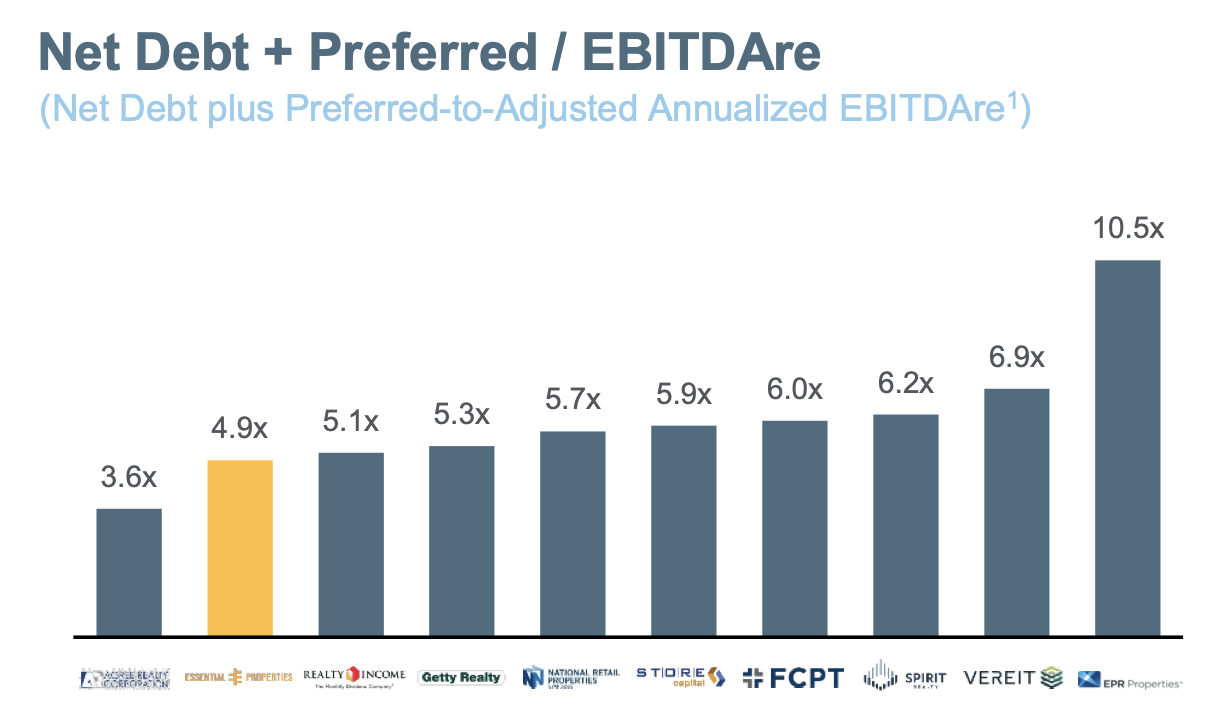

The balance sheet is underleveraged at 4.9 times debt to EBITDA.

I rate shares a buy with over 30% total return upside.

Essential Properties Trust (EPRT) has proven the skeptics wrong, and its shareholders have been rewarded for their conviction. As rent collection breaks into the 90% threshold, EPRT has returned over 80% since the retail real estate bloodbath in March and April. EPRT remains underleveraged, which should enable it to report significantly stronger bottom-line growth as compared to peers due to leverage ramp up. I rate shares a buy.

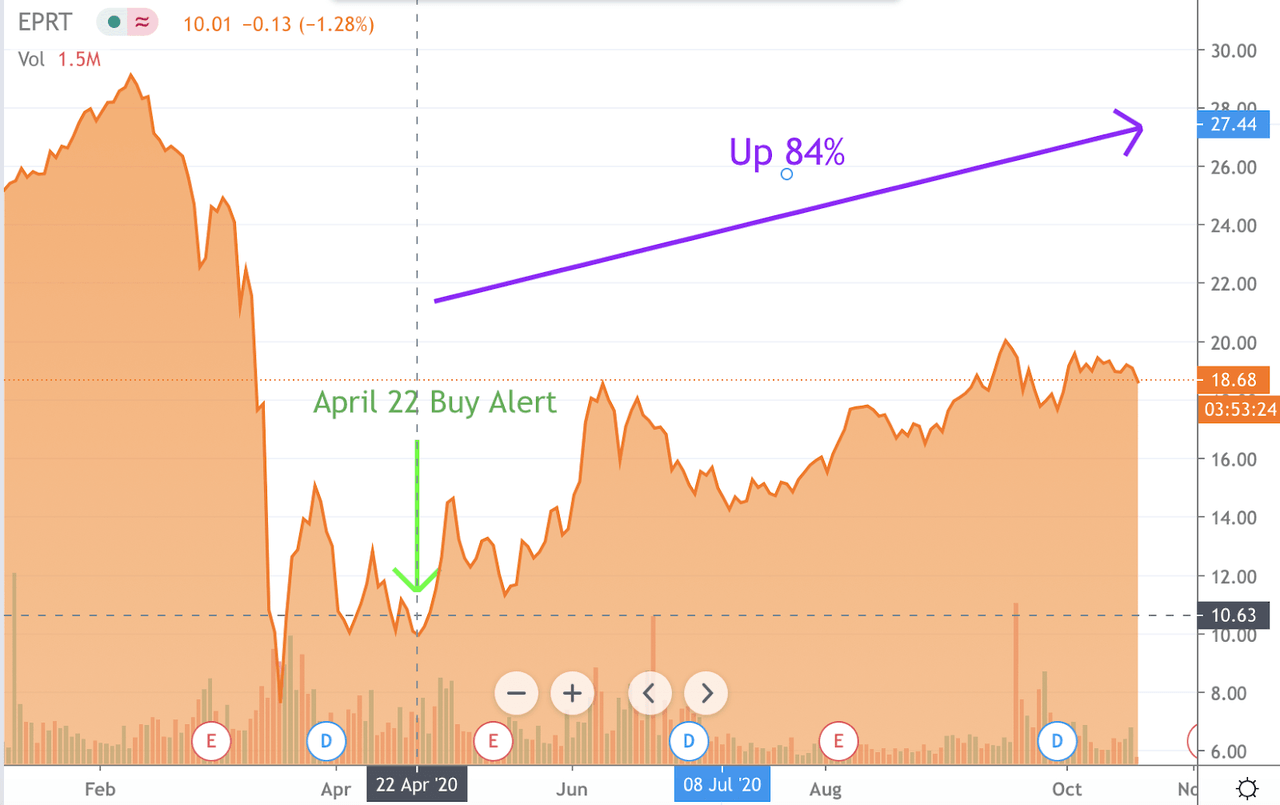

Up 80% With More Upside To Come

It wasn’t easy to be bullish on retail real estate in the months of March and April, as it seemed that no one on Wall Street was buying. At the time, the general consensus seemed to be the financial collapse of the entire brick and mortar economy. Value investors that ignored the overly pessimistic outlook considered the steep price declines buying opportunities instead of reasons to run away. Since my April buy alert, EPRT has returned over 80% in 6 months:

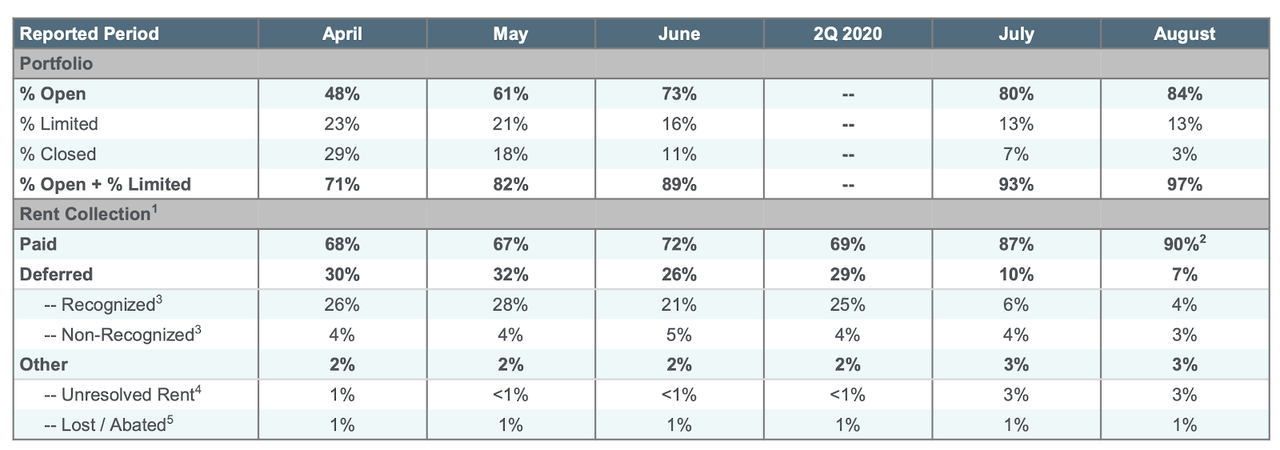

The strong price run-up was not undeserved, as EPRT has seen rent collection steadily improve from 68% in April to 90% August rent collection:

Overall, second-quarter AFFO was flat at $0.27 per share, as writeoffs of uncollectible rent weighed on results, even if the writeoffs were significantly better than much of the rest of the retail REIT sector.

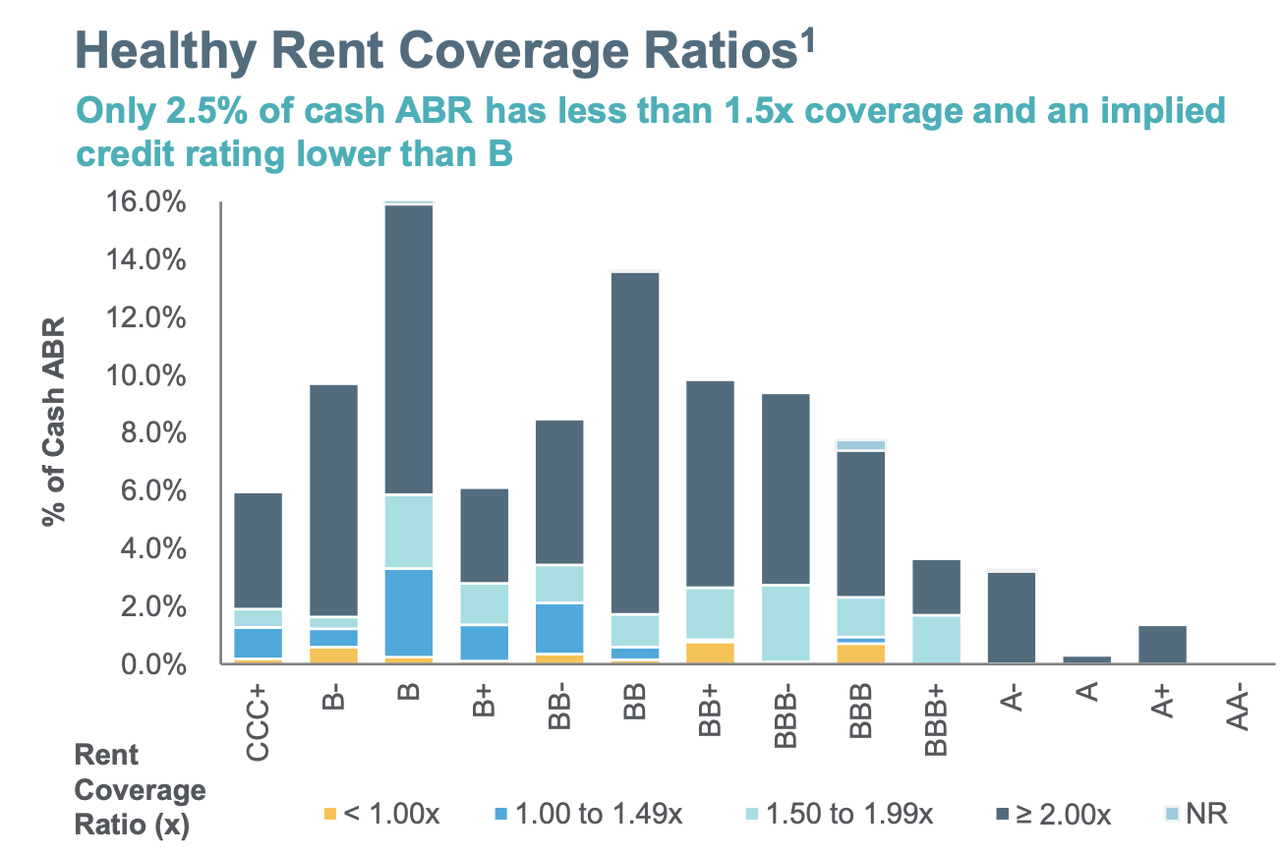

There’s reason for optimism regarding the forward outlook of EPRT’s portfolio. Overall unit-level rent coverage is 3.0 times and more critically, only 2.5% of rent is from tenants with less than 1.5 times coverage:

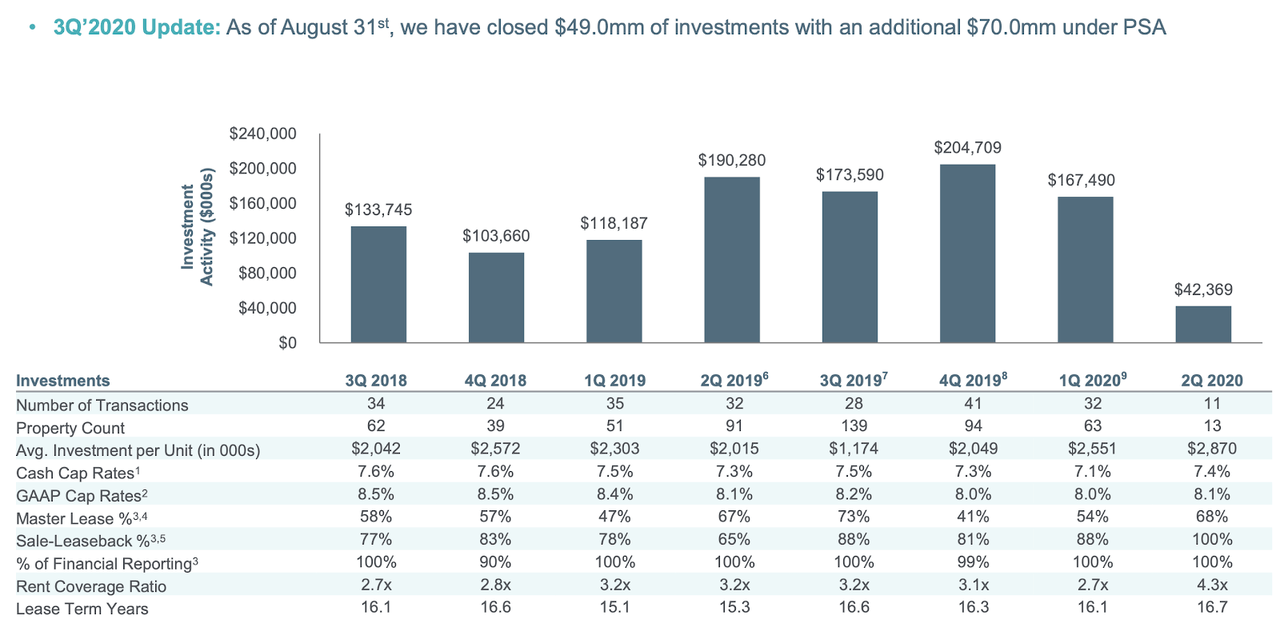

The strong unit-level financials suggest that EPRT’s tenants have a strong chance of making it through this pandemic. EPRT’s recent acquisitions have been from tenants with high rent coverage - totaling 4.3 times in the past quarter (albeit at a depressed amount):

EPRT’s commitment to financially strong tenants may also help it achieve a high collection of deferred rents, which would help improve rent collection rates for prior months. With rent collection even prior to deferred rents already reaching the 90% range, EPRT look set to continue capitalizing on its growth story.

Balance Sheet Analysis

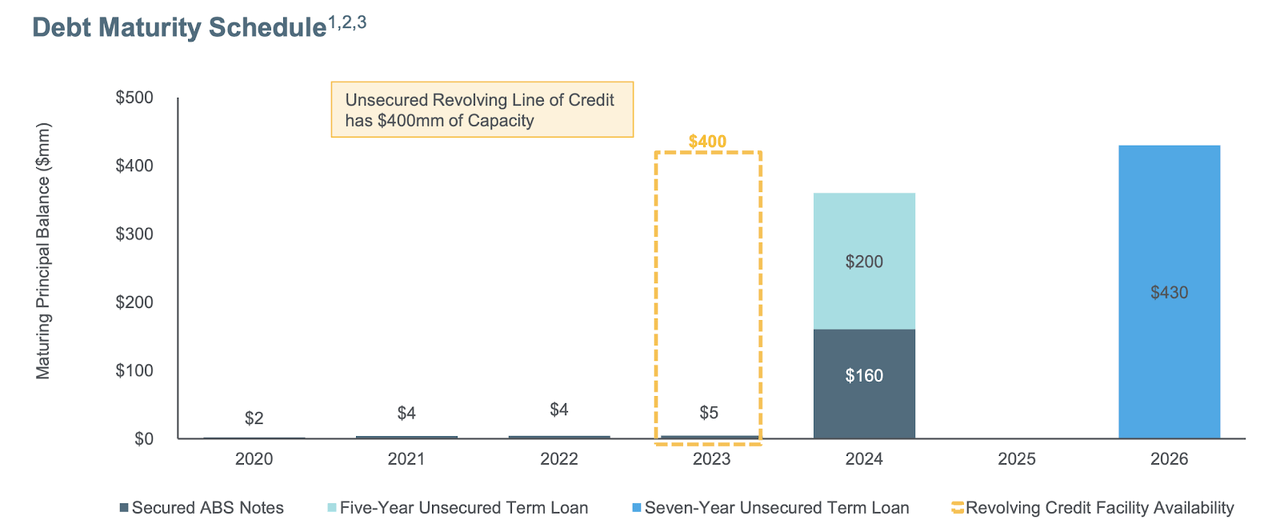

EPRT has a very strong balance sheet with no maturities until 2024:

In fact, EPRT’s balance sheet is arguably what differentiates it most from peers. Debt to EBITDA stood at 4.9 times, far lower than EPRT’s goal of 6.0 times debt to EBITDA:

EPRT can see a significant boost to the bottom line if it allowed leverage to reach its long term goal. Assuming acquisition cap rates are in-line with the 7.4% cap rate of recent quarters, EPRT can add approximately $280 million in additional assets, leading to an increase in NOI of $20.7 million, or 13.8%.

Valuation and Price Target

Annualizing the latest quarters’ results, EPRT earns an annualized $1.08 in AFFO per share and pays out an annualized dividend of $0.92 per share. Shares trade at 17.4 times AFFO and a 4.9% dividend yield. Assuming EPRT ramps up leverage to the 6.0 times range, then shares trade at 15 times AFFO, lower than the 18-21 times that of peers Realty Income (O), Four Corners Property Trust (FCPT), and Agree Realty (ADC). My 12-month fair value estimate is $25, representing 3.7% dividend yield (or 4.2% yield if the dividend increases in-line with AFFO after the ramp up in leverage). Shares have over 30% total return upside to that target.

Risks

EPRT might not ramp up leverage so quickly. While this would allow it to maintain one of the strongest balance sheets in the sector, it would also hold back shareholder returns. It remains to be seen if the current environment will lead to strong acquisition activity for EPRT.

It is possible that EPRT is unable to collect deferred rent. I don’t anticipate EPRT to face any covenant issues in such a scenario since it has already collected most of its billed rents. The biggest risk is if the inability to collect deferred rent is due to outright bankruptcies, as EPRT would need to find replacement tenants for those properties, or more likely, dispose of the properties at high cap rates. These transactions would be dilutive to the bottom line, pressuring cash flows until occupancy is stabilized.

While EPRT has been able to collect almost all of its billed rent in recent months, there is no guarantee that it can continue to do so in the future, especially if a second wave (or a prolonged first wave) hits the nation. Many states are stuck in a state of a “half-open” business environment, which isn’t optimal for in-person businesses. It is unclear how many of EPRT’s tenants are hanging on by a thread in the current business environment.

Conclusion

EPRT traded like junk in March and April, but its strong recent price performance seems to indicate otherwise. EPRT’s tenants have high unit-level rent coverage, which increases my optimism for their long term outlook moving beyond the pandemic. EPRT’s balance sheet is underleveraged, which should prove to be a source of low hanging fruit as EPRT ramps up leverage. Shares have over 30% total return upside to my fair value estimate.

Discover More High Conviction Ideas

NNN REITs are one of my 8 high conviction ideas. Subscribers to Best of Breed to get access to my top 10 holdings and full access to the Best of Breed portfolio. Exclusive Best of Breed content includes industry deep-dives, new compelling ideas, and high conviction picks.

Ignore the noise. Avoid bubbles. Stick to high quality and buy Best of Breed.

Become a Best of Breed Investor Today!

Disclosure: I am/we are long EPRT, O, ADC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.