Slack: Overpriced Work From Home Trade

Slack is less impressive an investment than its fanbase of shareholders believe it to be.

Investors have been paying absurd multiples for growth rates that are failing to materialize.

Slack's upside potential is already fully priced and leaves no margin of safety.

Investment Thesis

Slack (WORK) carries a large valuation based on the idea that Slack is rapidly growing and will be highly profitable. However, the facts contradict this rhetoric.

Paying more than 19x forward sales for a company growing at sub-30% is not a rewarding investment. I question whether the work from home trade is now fully priced.

Revenue Growth Rates Fading, Maybe Not So Disruptive

How fast things move in the market? Up to a month ago, the work from home and ''new era'' stocks were still in vogue.

Right now, there are ever so small cracks starting to emerge where investors are starting to question whether it's truly worthwhile paying such large multiples for these SaaS stocks as we (myself included) have been paying.

Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, and one by one.

-- Charles Mackay (Madness of Crowds)

Presently, admittedly, I have little to truly substantiate my claims -- as many companies are still to report their all-important Q3 results. What I have is a gut feeling (system 1), backed by years of experience (system 2) -- somewhere between Daniel Kahneman and Gary Klein.

The very few meaningful companies, to this hypothesis, that have so far reported their updated results, Fastly (FSLY) (preliminary only), IBM (IBM), and Netflix (NFLX), have for one reason or another reported lackluster results.

What's more, their outlooks are unimpressive. Thus, how does this bode for Slack? I suspect that we may witness a re-rating of this stock. Bear with me, as I lay out my rationale.

What we have seen during 2020 was a dramatic pull forward of technological acceleration, and for that, investors have been paying absurd multiples for participation (again, myself included).

Put simply, the pull forward we witnessed during March-June may have been hugely significant, but it may not justify paying several years into the future growth, for companies that are evidently not growing anywhere near commiserate with the narrative of digital acceleration.

Furthermore, back at the start of September, when Slack reported its guidance, investors were still too euphoric to pay the necessary attention heed to the facts.

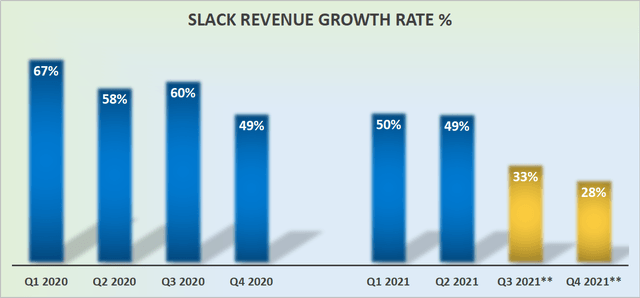

Source: author's work

Now, on a second appraisal, I suspect investors may be willing to to be slightly more attentive. Slack's guidance firmly implies that it is not seeing the growth rates that it was seeing last year.

What's more, if, during fiscal H1 2021 (calendar 2020), Slack was growing at 50%, right now, as Slack looks out to fiscal H2 2021, its guidance simply does not see the strong growth many bullish shareholders expect.

As a brief aside, I should mention, that it makes absolutely no difference (forgive me, for I take poetic liberties here), just how compelling or attractive Slack's collaboration software is. If Slack does not have the distribution, going against Microsoft (MSFT), will not be a successful venture.

Furthermore, Microsoft is a company with such a long history of antitrust suits against it, that investors have been willing to fully disregard in their thesis.

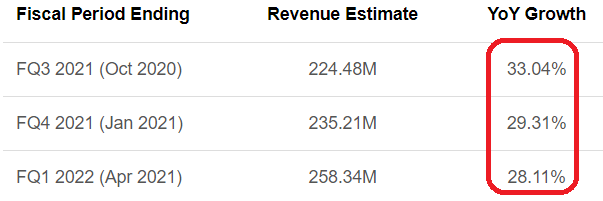

Moving on, there are nearly 20 analysts following the stock, and the consensus points towards a steady deceleration in Slack's revenue growth rates over the coming few quarters.

Source: SA Premium Tools

However we appraise Slack's prospects, either through my gut feeling or through Slack's own guidance, all road lead to Rome: Slack is not the high growth disruptive collaborative platform we were lead to believe.

Two Further Details Reinforce Slowing Prospects Ahead

Slack's billings in Q2 2021 were up 25% y/y. Even if billings can be a noisy metric, with some quarters stronger than others, it's still a key forward-looking indicator.

And whether bulls like it or not, at sub 30% billings growth, Slack will struggle to maintain plus 30% growth rates.

Next, on a Rule of 40 metric, Slack is likely to finish fiscal 2021 at sub 30%. This is metric demonstrates how well a company is balancing growth and profitability.

Either of these two metrics taken in isolation could be easily dismissed. However, taken together with everything else, I believe this becomes irrefutable evidence.

Valuation -- Why Investors Will Struggle to Find Upside Potential

For now, investors are still willing to pay 19x forward sales for a company evidently growing at sub 30%.

During Summer 2020, any company in the SaaS world was getting a blanket 20x forward multiple irrespective of its long-term potential.

And while I am quite happy to pay more than 20x forward sales, this sort of valuation has to be for stocks which are truly exceptional, with little competition, and backed with very strong visibility -- Slack maybe truly exceptional but fails badly on the other two criteria.

The Bottom Line

The facts, painful as they are to absorb, reflect that Slack is not the high growth collaborative platform investors believe it to be.

As investors start to take stock and re-evaluate just how much of an impact COVID had on technology, investors may get a rude awakening. There are many better investment opportunities elsewhere.

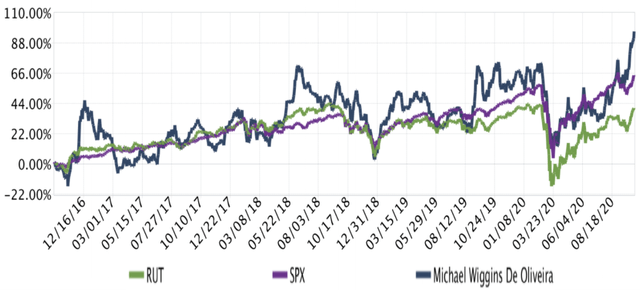

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive and profitable businesses.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Honest and reliable service.

- Hand-holding service provided.

- Very simply explained stock picks. Helping you get the most out of investing.

- Helpful advice together with videos.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.