Evofem's Major Sell-Off Undervalues The Company's Long-Term Potential

Evofem vaginal pH modulation technology is a differentiated product being used to target unmet needs in women’s health.

Currently-approved Phexxi will likely have peak sales higher than Evofem’s current market cap.

Evofem is likely a big long-term bargain after its recent large sell-off.

Evofem Biosciences (EVFM) is a small biopharma company focused on unmet needs in women’s health. Evofem has proprietary technology that modulates vaginal pH levels, and this technology already is in use in just released Phexxi, an as-needed, hormone-free birth control. The company has experienced a major sell-off that seems to have been triggered by the CEO selling off about 25% of her large holdings of the company’s stock, but as I will discuss in this article, I think this has left the stock very undervalued compared to its potential. I originally posted this article more than a month ago on my Marketplace service, Biotech Value Investing, and since then, Evofem traded over 25% higher and still remains more than 10% above the level when this article was originally released. I've updated pertinent facts here, and despite the rally, I still believe the thesis holds.

Evofem’s pH Modulator Technology is Clinically Validated and Holds Substantial Promise

Vaginal pH has long been known to have a role in women’s health through preventing infection. Healthy vaginal pH is typically acidic, ranging from about 3.5 to 4.5. This promotes the environment that a healthy microflora needs to thrive. Evofem’s technology relates to using a proprietary gel to ensure that vaginal pH stays in this optimal range which the company suggests can prevent pregnancy and several sexually transmitted infections.

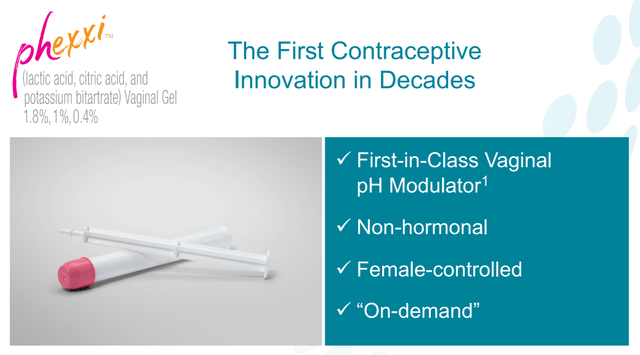

Evofem’s first use of its vaginal pH modulation technology is in the on-demand birth control Phexxi which just went on sale last month in September 2020. Semen typically has a pH of 7.1-8 and relies on being able to raise the acidic pH of the vagina in order to have any sperm survive for fertilization. By maintaining the acidic environment, Phexxi is creating conditions that usually do not allow for fertilization.

One benefit of the fact that Phexxi is just maintaining vaginal pH in a normal, healthy range is that so far is seems very safe. For the most part, only mild adverse events like vaginal itching or burning are being reported, as would be expected given that it should help promote optimal vaginal conditions.

Evofem markets Phexxi as quick and easy to use on demand within one hour of expected vaginal intercourse. It's inserted like a tampon, and the plunger is depressed as a woman pulls the product out. Phexxi’s effectiveness seems somewhat low at first glance at just 87.3%, but this is really statistically more effective than condoms, which are thought to be only 85% effective in real-life conditions. Just to put these numbers in context, this means that if 100 women used Evofem as their only birth control method for a whole year, just under 13 of those women would be expected to get pregnant during that time.

Figure 1: Phexxi Basic Facts (source: Evofem’s September Investor Presentation)

Evofem’s sales pitch is that current forms of contraceptives have lots of drawbacks. Hormonal contraceptives have a host of rare but serious risks including blood clots and strokes. The hormones in these pills can also affect the way a woman feels, and they are thought to potentially make it more difficult, at least temporarily, for a woman to get pregnant after stopping use. IUDs also have lots of drawbacks. Some are hormonal and carry the same issues just described with oral hormonal contraceptives. Even the non-hormonal ones can cause discomfort and have a risk of migrating and embedding in tissue. IUDs also have to be implanted and removed by a doctor, so they aren’t as convenient as a prescription one can use at home.

According to Evofem, 17 million women self identify as either not wanting to use hormonal forms of contraception or as at least being open to trying non-hormonal alternatives. While condoms don’t share a lot of the problems described with other forms of birth control, they are male controlled, and by contrast, Phexxi is a completely female-controlled solution.

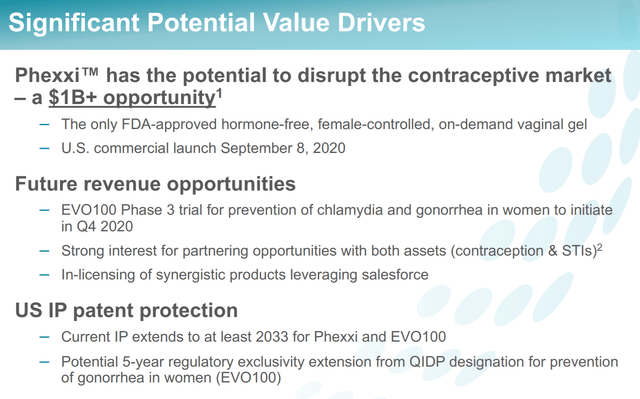

Phexxi is one of the only good female-controlled, on-demand options, and Evofem is confident that there's a substantial market for such a product. Evofem’s market research among healthcare providers has suggested that Phexxi could take up to 15% of the contraceptive market. This seems probably overly optimistic, but given that the US contraceptive market was worth approximately $7 billion in 2019 and is estimated to keep growing at 4.2% per year over the next few years, Evofem doesn’t need anywhere even close to 10% of the US market alone to more than justify its current value.

Figure 2: Evofem’s Potential Long-Term Value Drivers (source: Evofem’s September Investor Presentation)

I love the chart shown in Figure 2. Not only does it succinctly show the company’s perceived opportunity in Phexxi, but it's also clearly demonstrates that the company is thinking ahead toward how to build future value for shareholders. Management knows they can’t rest on Phexxi revenues alone and need a plan to reinvest the eventual retained earnings it will generate.

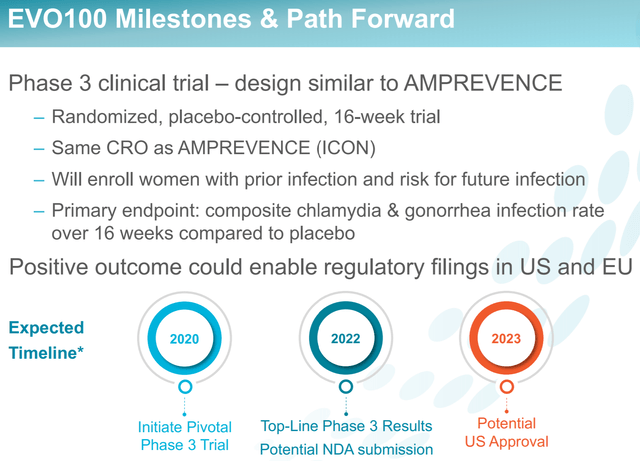

Evofem’s second indication, or EVO100 as it is still called in the pipeline, is to prevent the STI’s chlamydia and gonorrhea, and it might have even more potential than the birth control indication. The chlamydia indication has already received the FDA’s Fast Track Designation, and the gonorrhea one is now considered a Qualified Infectious Disease Product.

Figure 3: Evofem’s Plan for Advancing EVO100 (source: Evofem’s September Investor Presentation)

While still several years away, EVO100 could have a substantial market impact. There are currently no FDA-approved therapies for prevention of both gonorrhea and chlamydia. STI treatment in the US only was a $35 billion market in 2018 and is growing rapidly, so it certainly seems likely that, if EVO100 is approved to prevent two common STIs and is the only available option, sales could be very meaningful to a company like Evofem with a $200 million market cap.

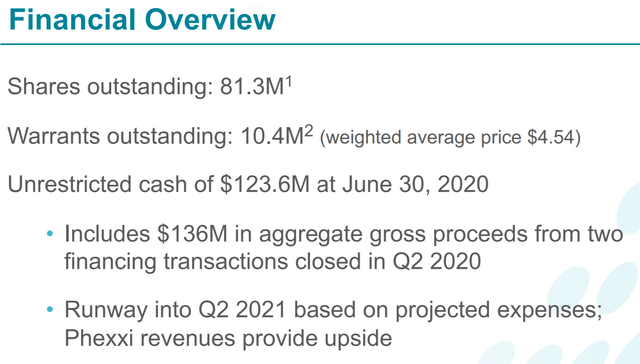

Evofem’s Balance Sheet Looks OK But More Cash Will be Needed

Evofem has completed 2 transactions this year aimed at shoring up the balance sheet. First Evofem struck a deal with Baker Bros., a well-respected biotech fund, for some funding. Baker Bros. already has a 1.4 million share position in Evofem, but now the company agreed to pay Evofem $15 million upfront in exchange for a senior promissory note and warrants on an additional $10 million worth of shares. Although these warrants will be somewhat dilutive to current shareholders if executed, I like the implied validation of Evofem that this implies coming from a fund like Baker Bros.

Next Evofem sold 28.5 million shares at a price of $3.50 per share in June, raising about $100 million. All together, Evofem had $123.6 million in cash at the end of Q2, providing a financial runway into Q2 next year or later if Phexxi revenues pick up substantially.

Figure 4: Evofem’s Financial Overview (source: Evofem’s September Investor Presentation)

Evofem’s cash burn is a little concerning, running at about $90 million per year right now. I would expect Evofem to need to raise at least another $100 million based on its current trajectory. It would be nice to see at least some of this come from non-dilutive means, but either way, Evofem still looks like a value even with another $100 million raised completely dilutively. Something to watch in coming quarters with the Phexxi launch though will be if Evofem can start getting the burn rate down. Slow sales and thus more than expected dilution are the biggest risk I see to long-term shareholder returns.

Evofem’s Recent Sell-Off has Created an Attractive Valuation with a Wide Margin of Safety

Evofem has traded significantly down since a brief spike around the time Phexxi was approved early this summer, but it really took a nose dive last month in September.

Figure 5: Evofem Stock Chart (source: finviz)

At $2.55 per share, Evofem has a market cap around $200 million. This is hugely undervalued given that Phexxi would still hit a higher level of peak sales than that if it captured less than 3% of the overall US contraceptive market using the market size estimate described above. If Evofem achieved $200 million in revenue, well below analyst estimates I've seen of more than $500 million, Evofem could be expected to trade at 4x to 5x that number in market cap given typical industry ratios. This provides a good margin of safety in the stock at present.

This is a delayed release article from my Marketplace Service, Biotech Value Investing. The original article was posted on my service over 30 days ago, and it also included the results of my discounted cash flow analysis and potential strategies for taking a position in Evofem. Even though the stock has rallied since the initial post, I believe the research is still applicable today. Biotech Value Investing provides in-depth coverage of my approach to finding high-quality, value-oriented companies in the biotech sector. Check us out today with a free trial.

Disclosure: I am/we are long EVFM. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I’m not a registered investment adviser. Please do not mistake this article, or anything else that I write or publish online, as any type of investment advice. This article and anything else that I post online are for entertainment purposes only and are solely designed to facilitate a discussion about investment strategy. I reserve the right to make any investment decision for myself without notification except where required by law. The thesis that I presented may change anytime due to the changing nature of information itself. Despite the fact that I strive to provide only accurate information, I neither guarantee the accuracy nor the timeliness of anything that I post. Past performance does NOT guarantee future results. Investment in stocks and options can result in a loss of capital. The information presented should NOT be construed as a recommendation to buy or sell any form of security. Any buy or sell price that I may present is intended for educational and discussion purposes only. Please think of my articles as learning and thinking frameworks--they are not intended as investment advice. My articles should only be utilized as educational and informational materials to assist investors in your own due diligence process. You are expected to perform your own due diligence and take responsibility for your actions. You should consult with your own financial adviser for any financial or investment guidance, as again my writing is not investment advice and financial circumstances are individualized.