Brookfield Business Partners: Many Ways To Win, With The Price Below Liquidation Value

Efforts to build a more resilient profile, as well as the success of recent investments (public and private), are key positives for Brookfield Business Partners.

With the balance sheet well-funded, expect more of the same going forward.

Units currently trade below fee-adjusted liquidation value, offering investors a compelling entry point into a best-in-class investment vehicle.

Backed by its proven ability to compound capital for outsized returns, Brookfield Business Partners (BBU) offers investors a compelling path to surface value at current valuations. Relative to current prices, BBU’s potential embedded value of >$60/unit (solely from currently owned operations) and the added optionality from accretive M&A and capital recycling initiatives make the units a bargain, in my view. Plus, as units are currently well below the high water mark, investors get to reap the benefits without a drag from incentive distributions.

An Underestimated Shift Toward A Less Cyclical Profile

BBU’s investor day presentation made a point of highlighting its resilience in the current economic environment. To be clear, relative to the Brookfield complex, BBU’s portfolio is more sensitive to external shocks (as shown by the impact of the COVID-driven revenue declines and subsequent recovery).

But I do agree that the underlying rotation toward higher-quality, less-cyclical businesses remains underappreciated. The BBU today is significantly different from when it was carved out from Brookfield Asset Management (BAM) – not only is the portfolio more global, but it is also significantly more diversified given the increased breadth and scale.

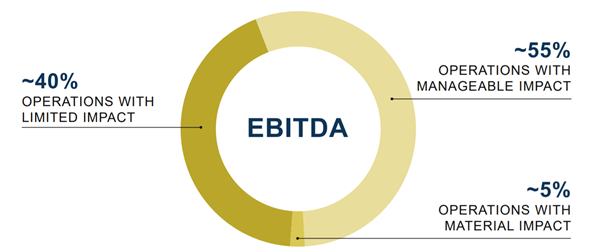

Per management, ~40% of EBITDA contributions come from operations which suffered a limited impact from the pandemic (e.g., Westinghouse and Altera Infrastructure). The majority of ~55% of EBITDA contributions were derived from businesses that suffered a manageable impact (e.g., Clarios, Healthscope, and Genworth). That leaves only ~5% of EBITDA from businesses such as Multiplex and Cardone, which experienced a material impact.

Source: Investor Presentation

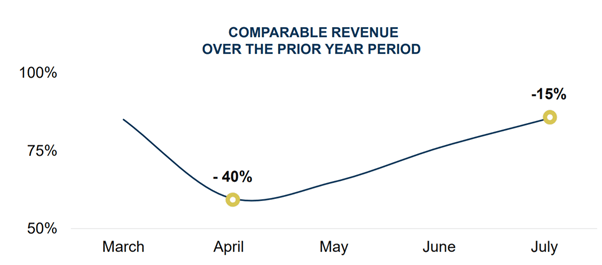

At this point, most of BBU’s businesses have recovered, and operations are now seeing YoY improvements across the portfolio. As of end-2Q, EBITDA has seen a YoY increase on successful cost-cutting initiatives, though we’re not entirely out of the woods yet, given revenues were still down ~15% YoY in July (vs. -40% YoY in April).

Source: Investor Presentation

Active Deal Pipeline

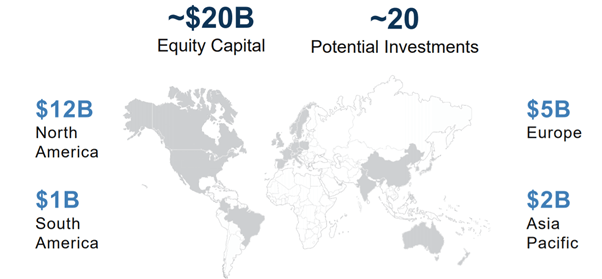

On a positive note, new investment activity is picking up – BBU is currently evaluating ~20 investments, representing equity commitments of ~$20bn. Most of the deals on the table are large-scale, high-quality businesses across a wide spectrum, from public to privatization and corporate carve-outs, to sponsor exits. BBU expects opportunities to arise over the next 6-12 months and, in the interim, will be evaluating a number of bolt-on targets for its portfolio companies.

Source: Investor Presentation

Given the backdrop, I wouldn’t be surprised to see some unconventional investments – BBU’s capital deployment YTD has featured several public investments amid market distress, all of which have significantly appreciated thus far. Specifically, BBU deployed ~$575m during the market sell-off, with these investments now marked at ~$1bn.

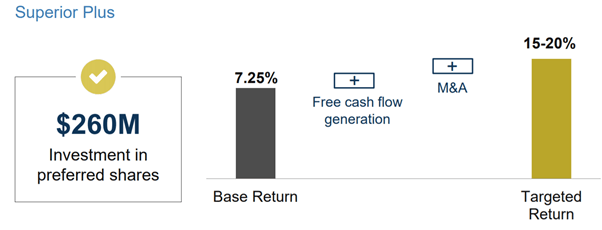

BBU has also indicated it could eventually enter into transactions with its public holdings, which points toward an interesting new approach – taking positions that can provide toehold positions for future M&A, and affords BBU the option to be the capital provider of choice. One case study presented at the Investor Day event was Superior Plus, which (like a number of similar past investments) offers both future returns and strategic optionality.

Source: Investor Presentation

Well-Capitalized and Ready for Accretive M&A

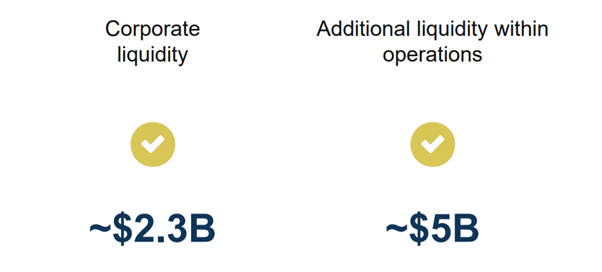

The strong balance sheet is a key advantage as management looks to take advantage of new investment opportunities. The liquidity position is currently at ~$2.3bn, with further funding to be unlocked from capital recycling as BBU looks to sell off mature businesses and potentially, minority interests in larger, developing investments.

Source: Investor Presentation

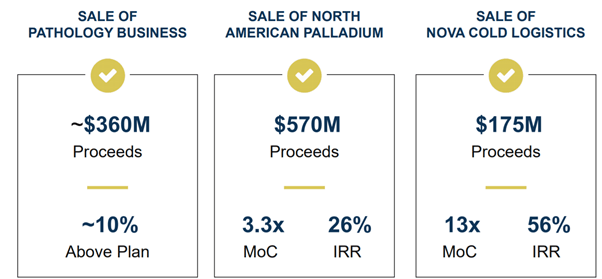

The strength of monetization over the past year should give investors much comfort – the disposal of North American Palladium generated ~26% IRR, while Nova Cold Logistics was disposed at ~56% IRR (equivalent to a very impressive 13x multiple on capital). And I expect more of the same from here – incremental capital deployment into new opportunities, execution of value creation strategies, and share buybacks all serve as key catalysts for BBU going forward.

Source: Investor Presentation

Many Ways to Win, with the Price Below Liquidation Value

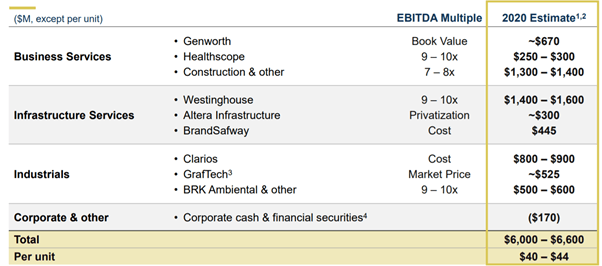

Relative to the current $32 trading price, BBU pegs the value of its existing portfolio at $40-44/unit, with potential embedded value even higher at ~$60 per unit. This estimate is based on a somewhat conservative view (because it excludes the value from additional investments) of the company’s liquidation value. I see NAV closer to ~$34-38/unit though, after accounting for the management services contract with BAM and applying an NAV discount.

Source: Investor Presentation

That said, valuing BBU using this approach neglects the long-term return potential of existing capital and any added optionality. Using a more realistic long-term oriented valuation approach yields an "embedded value" of >$60/unit, though this only accounts for current operations and does not assign any value to upside from M&A or capital recycling initiatives. In this context, BBU’s decision to buy back units this year makes a lot of sense, in my view.

Overall, BBU offers investors a compelling entry point into a best-in-class investment vehicle well-positioned to compound capital for the long term. As units are also well below the high water mark, investors get to reap the benefits without a drag from incentive distributions. Downside risks include investment performance, personnel departures, and adverse macro shifts.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.