Plenty More Upside To See In Alexion Pharmaceuticals In 2020

The market has shown strong support for Alexion YTD, where shareholders have enjoyed +64.28% since the selloff in March.

Strong revenue growth on healthy margins paints the picture for periods to come, with equally as satisfying FCF positioning and capital structure.

New level of support has been realised recently, with the stock bouncing off the new support line twice to today's trading.

Upgrade to relative strength supports this bullish outlook, and investors may benefit from 5-15% upside in a dislocation in valuation to price.

We are bullish on Alexion setting a price target of $142 and are eager to provide full coverage after their third quarter earnings release.

Investment Thesis

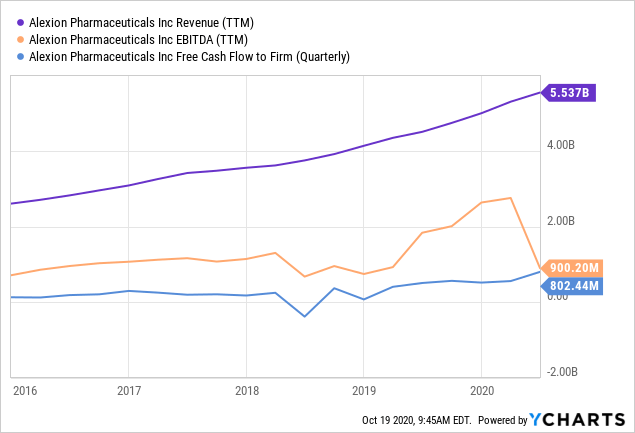

Alexion Pharmaceuticals (NASDAQ:ALXN) has rewarded shareholders nicely YTD, up +64.28% since the market selloff in March. Fundamentally, the company has shown resilience and demonstrated the capacity for ongoing revenue growth over the coming years, alongside consistent value growth for shareholders. Over the 5-year period to date, revenues have grown at a CAGR of 16.3%, alongside EBITDA growth of just over 25% over this same time frame. One can view these on top of excellent margins of 91.6%, 52.58%, and just over 30%, for gross profit, EBITDA, and FCF, respectively. Exiting Q2, total revenues of $1.44 billion were observed, representing around a 20% increase YoY from the same time last year. However, due to the large, hopefully one-off impacts from the pandemic, there was a substantial loss on the bottom from Q1-Q2 of around $1.5 billion. The loss undoubtedly will place margin pressures on revenues into the remainder of the year, and we will be eager to observe ALXN's performance coming out of the 3rd quarter, to identify their resilience in dealing with these black swan-type events.

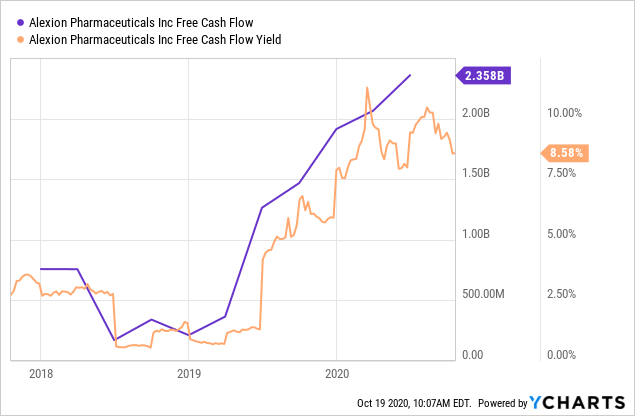

Data by YCharts

Data by YCharts

What did help in this situation was the strength on the balance sheet until today. Debt has been well managed to date, with a long-term debt to capital figure of 19.88%, alongside total debt to equity of just over 26%. From a short-term solvency perspective, the company has 4.79x coverage from its liquid assets, and whilst inventory holdings have increased over the years, in the event the company cannot liquidate its inventory quickly, still has 3.77x coverage over shorter term liabilities. Furthermore, debt as a function of free cash flow is at 1.41x, as a reflection of the superior FCF growth over the last 2 years. In fact, we've witnessed stellar growth in free cash on the back of fantastic debt and liquidity management from leadership. Since 2018, we've observed FCF growth at a CAGR of 76.19% to $2.35 billion, alongside FCF yield reaching 8.56%, demonstrating satisfactory value creation for shareholders.

Data by YCharts

Data by YCharts

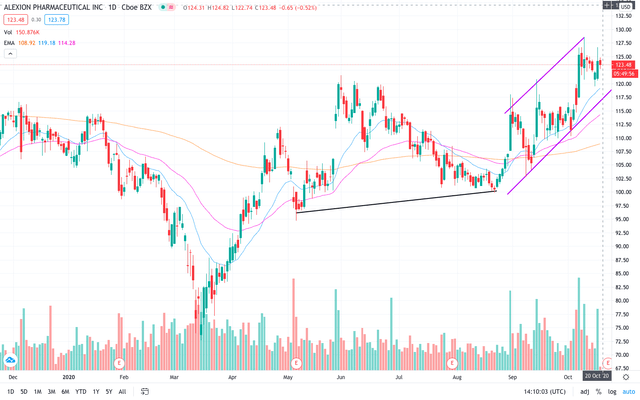

On the charts, YTD, we've seen the market's view of ALXN remain bullish, alongside the returns shareholders have enjoyed to date. Since the selloff, the stock has regained confidence, reversing a small down step in June/July, to form new support towards the end of August. An ascending channel has been observed from then up until today's trading. During that time, the stock has bounced from the support line nicely 2 times, with the new level surpassing the previous high back in June. Notice on the chart below, ALXN breaking away from the downtrend, forming new support at around $100, rallying up to today's trading of $123.

Data Source: Trading View ALXN

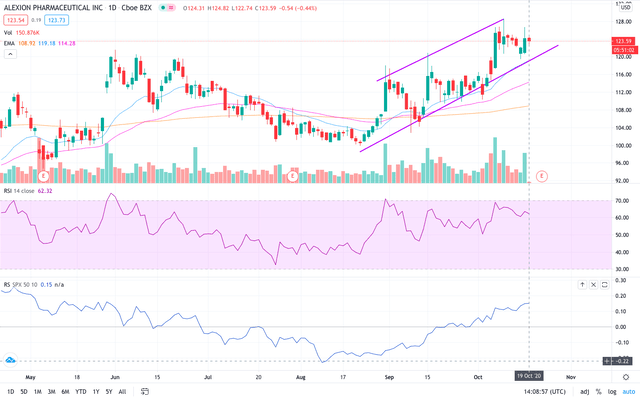

We've observed evidence the bullish sentiment of late, with a recent upgrade to ALXN's relative strength, and shares remaining below the RSI 70 line, away from an overbought territory in spite of the strength of the upward trend. The floor of the support line has been breached twice; however, it has bounced away nicely both times, as mentioned previously. What is important to note is that with ALXN, we've observed a strong correlation in movement with the RSI numbers and the movement of the stock price this year. Almost a mirror image is formed when looking at the 2. Therefore, we would advocate this as a good metric to keep an eye on for longer term investors, in order to understand more medium-term price movements, alongside potential entry and reallocation points. With the observed trend, a small pullback of around 2%-3% would reach support, providing an exciting entry point.

Data Source: Trading View ALXN

Valuation

In light of earnings season approaching, we have opted to hold on excluding explicit revenue, EBITDA, and valuation forecasts. It would be more appropriate to share these models with investors following Q3 earnings results, to provide the best framework moving forward, rather than complete the modelling and then have to re-update these almost immediately. Thus, we are eager to update our modelling following Q3 earnings, and share these with investors, as a complement to this analysis.

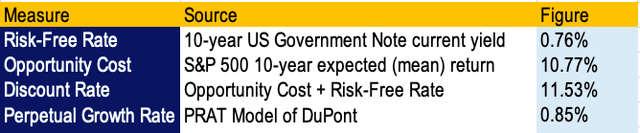

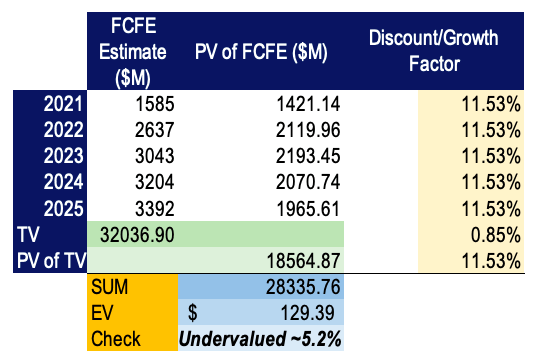

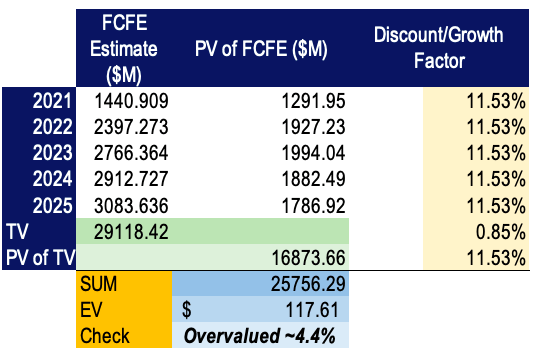

On a valuation front, it would, however, be appropriate to share our DCF valuation model, the snapshot of which can be observed below. We are accustomed to assigning a terminal growth rate using the PRAT model of DuPont. We do this alongside utilising the opportunity cost of holding a risk-free asset in the 10-year Treasury yield, alongside the S&P 500 average return, as a proxy for the discount rate. It has been commented on previous analyses about the discount rate we use not pertaining to the company. However, we do not view the discount rate as something that should pertain to a specific company. This limits its usefulness as a comparative tool for one, but also doesn't reflect the true reasoning behind using a discount rate. Discount rates, required rates of return, hurdle rates, whatever the investor may choose to label them, are and should be a reflection of the opportunity cost of forgoing investment into a 'safer' asset class, particularly the treasury security. It is akin to yield spread measures in fixed income analysis, where the investor must be compensated for the additional credit risk, liquidity risk, volatility and uncertainty that surrounds investing in equities, over these other instruments. Alas, kindly view the snapshot of our DCF model below.

Base Case:

Data Source: Author's Calculations

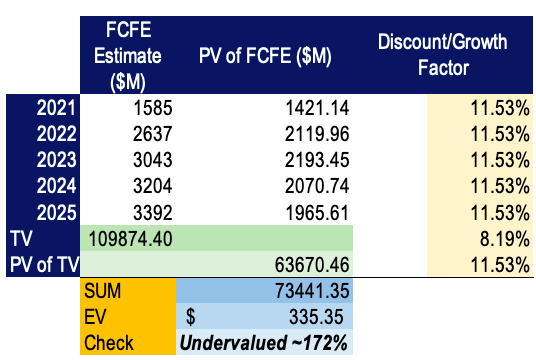

We've observed the terminal growth rate to be questionably low, considering relatively ALXN's high equity multiplier. Therefore, we have performed the same DCF, albeit this time with a sustainable growth rate formula using the company's ROE, observed below. This results in a wide gap in calculations, where the value gap increases to over 170%. Depending on which metric investors prefer, there is still a deep value play in this stock, in our humble opinion.

DCF using sustainable growth rate incorporating ROE vs PRAT model:

Data Source: Author's Calculations

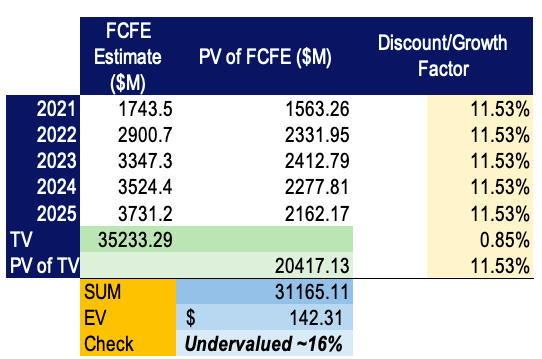

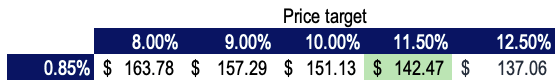

In the interests of remaining conservative, we have used the PRAT model in our terminal value calculations for both blue-sky and grey-sky scenarios. In our blue-sky scenario, where we observe revenues around 12% above the base and FCF around 10% above the base, the stock widens its value gap to around 16%. Whereas in the grey-sky picture, where we view the worst case scenario, there is a potential value gap of -4.4% to the downside.

Blue-Sky

Data Source: Author's Calculations

Grey-Sky, worst case scenario

Data Source: Author's Calculations

Data Source: Author's Calculations

In the brighter picture, using the base and upside case, we see upside potential in the ranges of 5.2% to 15.45%, and upwards of 172% if including ROE in the sustainable growth formulae. The market may be missing the opportunities in ALXN as well, with P/E of 32.59x lower than the median, alongside FWD PEG of 0.88x. Looking forwards, however, FWD P/E balloons to 84x, illustrating the market's expectations of the stock's performance in periods to come. Further evidence of the potential mispricing is observed in relatively low EV/EBITDA of 9.33x, P/Sales of only 4.79 and P/CF of 11.98 at current time of writing. Offsetting these figures is that ALXN is currently trading at over 11.5x FCF, with FCF forecasted to take a hit over the coming periods in our modelling. Earnings from the exit of Q3 will provide better insight into these figures. What we are also extremely pleased to observe is a high return on capital and over the asset base. Return on total capital is recorded at 12.18%, and return on capital employed is over 16%, both of which have displayed growth over the 3-year period to date. Return on assets is also high at 5.07%, whilst the company generates $0.35 for every dollar invested into the asset base. We are adamant that high return on capital alongside growth in these figures is ubiquitous with high valuation, and ALXN's valuation is certainly justified, in our opinion, based on these metrics. A company that can allocate its capital effectively, alongside generating sufficient return over the capital deployment, is a superior company, in our view.

Based on these figures, we assign a price target of $142, reflective of our blue-sky scenario, which we feel that ALXN has the propensity to match, given a strong 3rd quarter.

Data Source: Author's Calculations

Growth Catalysts

ALXN has been busy over previous months in adding mobility to its operational flywheel. The formulation of Ultomiris has been given the green light in three key regions; firstly, by the FDA in the US, and then also in Japan and Europe. These are big milestones by the company, where the markets for Ultomiris' candidate population is large. Ultomiris is a long-acting C5 inhibitor for atypical hemolytic uremic microangiopathy syndrome, or "aHUS" for short, but also has indication for use in haemoglobinuria. The advantages of this formulation are the applications to both the paediatric and adult domains, where it can be administered every other month for both population groups. The 100mg/ML intravenous solution has been dubbed the hero, with this particular formulation claiming to reduce annual infusion times by around 60%, compared to the lower volume 10mg/ML solution, with similar efficacy and safety parameters.

With acceptance into these markets, ALXN gains clinical access to an otherwise complex set of conditions for prescription, and with the reduction in infusion times, will be seen as a huge incentive from prescribing clinicians to aid in patient comfort. Not to mention the efficacy standard.

Furthermore, earlier this year, ALXN indicated its progression to Phase 3 trials to evaluate their amyloid fibril targeted therapy compound, known as CAEL-101. ALXN is completing the study program along with Fortress Biotech (NASDAQ:FBIO) through Caelum Biosciences. The Phase 3 progression will see the CAEL-101 therapy initiate a standard of care or "best practice" guideline development for indication and usage. The population that ALXN intends to reach with this type of therapy is those suffering with AL amyloidosis, which is a systemic condition that results from plasma cell pathology within an individual's bone marrow, thus leading to kidney damage, alongside heart pathology.

ALXN has also been busy with acquisition activity, acquiring Portola Pharma via a tender bid offer, through subsidiary Odyssey. The move sees ALXN add Andexxa to its commercial portfolio, which is indicated in use for conditions requiring Factor Xa inhibitor reversal, to alleviate uncontrolled bleeding and anticoagulant interactions from other medications. Andexxa is marketed as Ondexxya in Europe, where a large population subset of conditions within this domain lie within the Mediterranean zones, where Beta Thalassemia is disproportionately present. Beta Thalassemia is a haemoglobin disorder, so reversal of uncontrolled bleeding is essential in the treatment of these patients undergoing surgery, trauma, and so on.

These catalysts have begun to be priced in, but may not be fully priced into the stock's movement as of yet. We've begun to see the upward trend on the charts come to fruition. However, there is still room to go, given the valuation and potential upside on this stock.

Conclusion

We feel the market is yet to view the full upside of ALXN in 2020. Pending a strong 3rd quarter exit, empirical evidence will show that trading will benefit the stock price further, causing a further run-up from today's price. We've seen strong support up until this point, with new support gathering as we approach earnings, where the market may be catching up to remove the dislocation in valuation to trading price. Therefore, we advocate investors to have a serious consideration about entry at the current price, considering the valuation and the potential trajectory of the stock movement, in light of this dislocation in value and price. To manage risk, especially in light of the timing, consider keeping the position size smaller than usual, and aiming to take profits earlier than usual also. Investors who have followed this philosophy this year have done quite well, by all accounts. Further, consider any hedging strategies that may be of benefit to the investor also, albeit keeping in mind the ceiling and floor that would be placed on the upside and limit to the downside, in a basic options setup.

Furthermore, there are several drivers that have been added to ALXN's flywheel, which may yet to be fully priced in. We believe ALXN will continue to see an uptake of these drivers as utilisation of medical services continues to expand with the reopening of the large economies ALXN operates in. We'd anticipate ALXN to adhere more to our blue-sky modelling, and we are eager to view the Q3 reports to gain full insight into the mid-term future of the company. We are anticipating a strong Q3 exit, but are prepared to trim the position should the company disappoint on this front.

Disclosure: I am/we are long ALXN. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.