Rand Capital: Shifting Focus To Debt After Failure In Equity Investment Strategies

Rand Capital is a BDC in transition. The company is shifting its focus from equity to debt investments, setting the groundwork for regular dividend payments.

RAND didn't share its plans for how it would look like after the transition.

A wait-and-see approach is advisable until the company shows its ability to succeed in its new endeavor.

Investment thesis

Rand Capital (NASDAQ:RAND) is shifting its focus from equity to debt investments, setting the groundwork for regular dividend payments. A wait-and-see approach is advisable until the company shows its ability to succeed in its new endeavor.

Warning: RAND is thinly traded and can be hard/expensive to buy and sell.

What you need to know

RAND has been trading publicly for a while now

RAND has been trading on the stock market since 1969. Allen (Pete) Grum, aged 62, the company's CEO has been holding the reins since 1996 (See Election of Directors section in the 1996 proxy statement).

RAND is not your typical BDC

The majority of RAND's assets are private equity investments. This might be one of the reasons it hasn't been popular among investors since these assets are riskier than debt investments. It is also one of the reasons RAND hasn't distributed regular dividends in the past.

Rand is transitioning

RAND continues its strategic shift to investing in income-generating assets. For example, the proportion of equity as a percentage of total investments decreased from 65% in Q2 2019 to 58% in Q2 2020. This year will be the first year the company files its tax returns as a registered investment company "RIC". RICs don't pay tax and distribute almost all their income to shareholders in the form of dividends. Below is an excerpt from the Q2 financial statement released in August.

Rand intends to shift to an investment strategy focused on higher-yielding debt investments and intends to elect U.S. federal tax treatment as a regulated investment company ("RIC") as of January 1, 2020, on its timely filed Federal tax return for the 2020 tax year

RAND didn't announce a detailed transition plan

RAND didn't share details on the transition plan. For example, investors and analysts don't know the composition or time frame of the transition. RAND isn't exactly known for its strong investors' relation. The company had its first earnings calls in 2017, which is scant in light of its 50+ years history.

Because of these uncertainties, RAND is unsuitable for risk-averse investors.

Historical performance

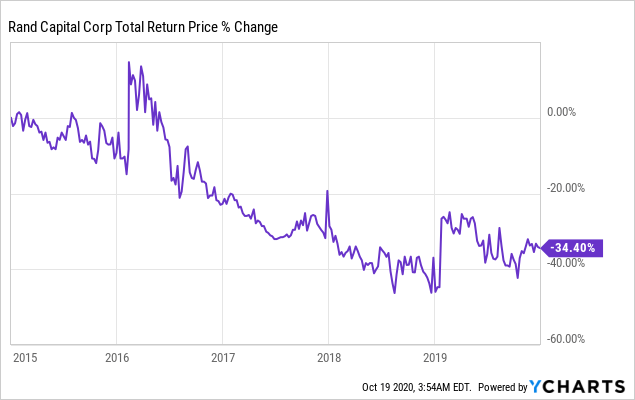

To factor out the effect of COVID-19 on performance, I measure pre and post COVID-19 stock price changes separately. The evidences point that RAND's performance is dismal before and after COVID-19. In the five years ending December 2019, RAND shareholders were 34% worst off than they would have, had they put their monies under the mattress.

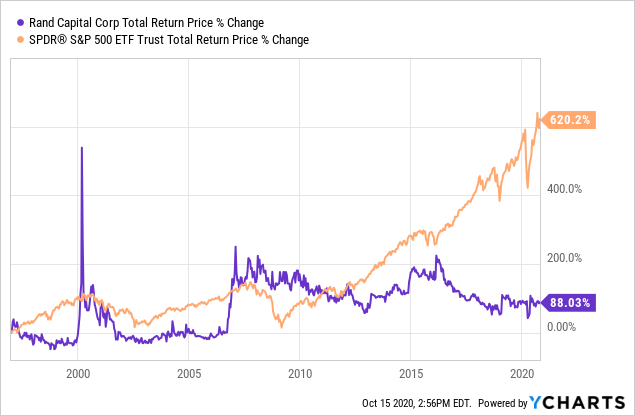

Under Pete Grum's 24 years of leadership, the total loss to investors is 12%, compared to a 370% increase in the S&P 500.

Data by YCharts

Data by YCharts Data by YCharts

Data by YCharts

Insiders' ownership

Poor performance disappointed investors. During RAND's first earnings call in 2017, an analyst/asset manager voiced these frustrations, as shown in the earnings call excerpt below. Mr. Grum expressed his understanding and said that they are on the same boat, pointing to recent management stock purchases.

Q: Brett Reece: Right, right. I appreciate that and if I could just leave you with just some empirical data. I bought the stock personally in for clients back in the fall of 2013 and I'm happy with all of the progress you guys have made. But at that time, the NAV was around 440 and we're going on pushing four years this coming fall and the NAV are five and the stock price is $2.80. So, the extent you can pull out the tool chest to try to narrow that in the foreseeable future, I would appreciate that.

A: Pete Grum: Thank you. And I appreciate that, we internally feel that is personally management and the board have been the big buyers of the stock, at the end of the year we made substantial purchases personally and the board members, but I think your feedback is more warranted.

I don't think that the two are in the same boat. While Mr. Grum is paid +$300,000 per year, excluding income from attending board of director meetings, the poor asset manager most likely lost his job.

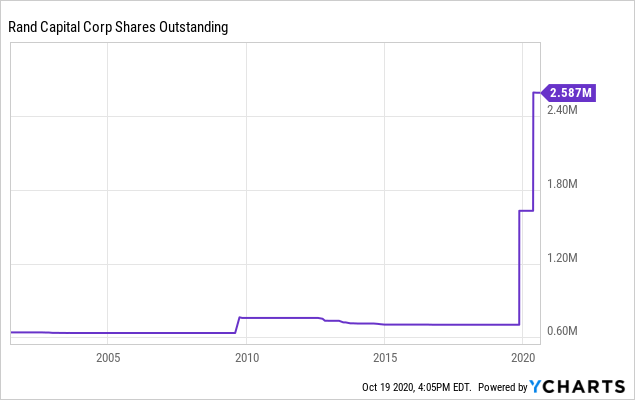

Since December 2016, the CEO hasn't bought any shares. His shares are stuck at 173,000 shares (before adjusting for 9 to 1 reverse stock split). After the reverse stock split in May, Mr. Grum's ownership is 19,294 shares and worth $214,544 as of Monday's market close.

Financial position

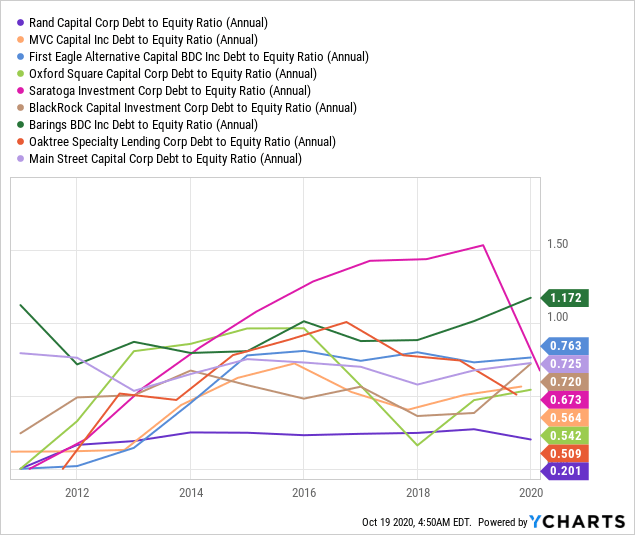

RAND has one of the lowest debt ratios, if not the lowest, among its peers.

The company has $61,127,860 in assets, about two-thirds of which are deployed in investments, and the rest in cash, cash equivalents, and a small portion in other liquid assets, rendering the company small and nimble, both good qualities for a company in transition.

Data by YCharts

Data by YCharts

Dividends

In the six months ending June 30, 2020, RAND generated $737,160 in taxable income. Under the RIC rules, RAND is required to distribute at least 90% of this amount.

As of August 7th, RAND had 2,587,500 shares outstanding. This translates to a potential $0.26 or 2.3% (based on a share price of $11.12) dividend distributions to shareholders in the first half of the year. That's 4.6% annualized.

The final dividend distribution yields will depend on the shape of the portfolio after the transformation. Variables such as weighted average yield, leverage, and portfolio composition will determine yields to shareholders.

Assuming the company channels all its assets into debt investments, and the average yield on these debt instruments is 12%, net investment income would be $4.4 million, based on $2.7 million annual expense and 2,587,500 shares outstanding. This would translate to a 13.6% yield, based on Monday's market close price of $11.12 per share. This is a high yield, especially given the company's low leverage.

Investing in other BDCs

This year, RAND bought shares in the following BDCs.

| Company | Symbol | Cost | Fair value | % Net assets |

| Apollo Investment | (OTC:AINV) | $ 364,084 | $ 291,725 | 0.6% |

| Ares Capital | (NASDAQ:ARCC) | $ 343,460 | $ 381,375 | 0.8% |

| FS KKR Capital | (NYSE:FSK) | $ 338,980 | $ 396,250 | 0.8% |

| Golub Capital | (NASDAQ:GBDC) | $ 403,910 | $ 418,750 | 0.8% |

| Owl Rock Capital | (NYSE:ORCC) | $ 347,067 | $ 360,000 | 0.7% |

Source: Table created by the author. Fair value as of October 15, 2020, share price.

Investors are paying a considerable amount of fees (base fees, incentive fees, corporate expenses) for RAND and end up with assets that they could have bought themselves through online brokers with minimum or no fees. The company's move to buy publicly-traded BDCs is a reminder that RAND might not be able to originate loans itself, at least at favorable terms. The company has been focusing on equity for decades, and it is just too risky for investors to bet on the success of the company shift to the new business model at this stage.

Valuation

Rand is trading at a significant discount to NAV. Years of disappointing performance, combined with recent uncertainties about the transition, are putting off investors.

As of June 30, 2020, RAND's net assets were valued at $49,711,314. Based on current shares outstanding, that translates to NAV $19.21. The current share price is $11.41 at the time of writing this sentence, which translates to a 40% discount to NAV.

Proxy fight

If you are torn between giving Mr. Grum another chance and buying a poor company for a discount, or you're not quite convinced it is worth the risk, then you're not alone.

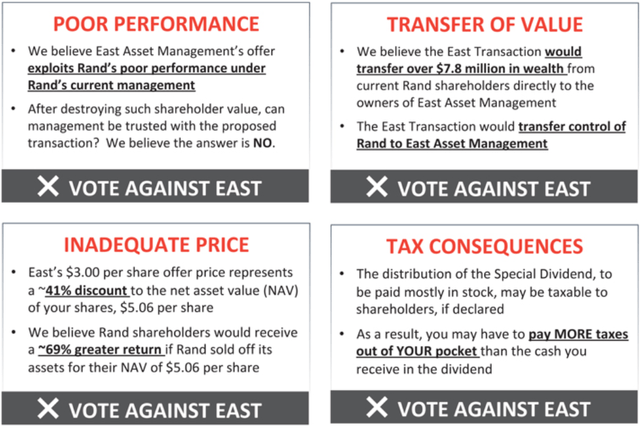

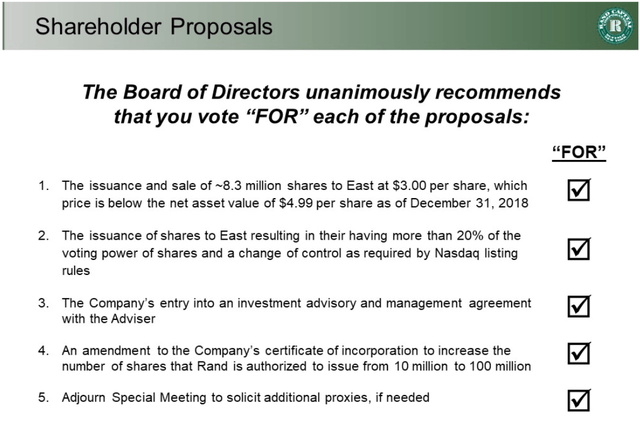

In 2019, a big proxy fight erupted between User-Friendly Phone Book, LLC on one hand, and management and East Asset Management on the other. Shareholders were bombarded by pamphlets like the ones below.

Source: A snippet of an anti-proposal pamphlet distributed by User-Friendly Phone Book, LLC

Source: A snippet of a pro-proposal pamphlet supporting the East Asset Management's deal

The proxy fight was related to the recent transition, in which dilution of shares occurred.

Data by YCharts

Data by YCharts

Summary

Rand Capital is a BDC in transition. The company is shifting its focus from equity to debt investments, setting the groundwork for regular dividend payments.

RAND has great potential, but its success will depend on the management's ability to adjust its operations to the new strategy. A wait-and-see approach is advisable until the company shows its ability to succeed in its new endeavor.

Thanks for reading. If you'd like to receive real-time notification of updates on RAND, scroll up and click the "follow" button.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.