737 Max gets some key votes of confidence.

Revenue bottom is likely in rear view mirror.

We are closer to a coronavirus vaccine now.

It's been a tough couple of years for aerospace giant Boeing (BA). Troubles with the 737 Max plane and the coronavirus have led to historic losses and cash burn for the company. That has resulted in a dividend and buyback suspension, a mountain of debt piling up, and a stock that has cratered. Fortunately, it looks like we can now see the light at the end of the tunnel, and investors might want to consider getting in now before things really start turning.

There have been a couple pieces of good news for the company in recent days, which has helped the stock get back towards the $170 level. The 737 Max got a key vote of confidence from Europe's top aviation regulator late last week, and that could easily pave the way for the FAA to add its blessing rather soon. Over the weekend, American Airlines (AAL) announced it would operate a daily 737 Max flight in the US right before year's end. Once a major carrier makes a move like this, others are soon to follow.

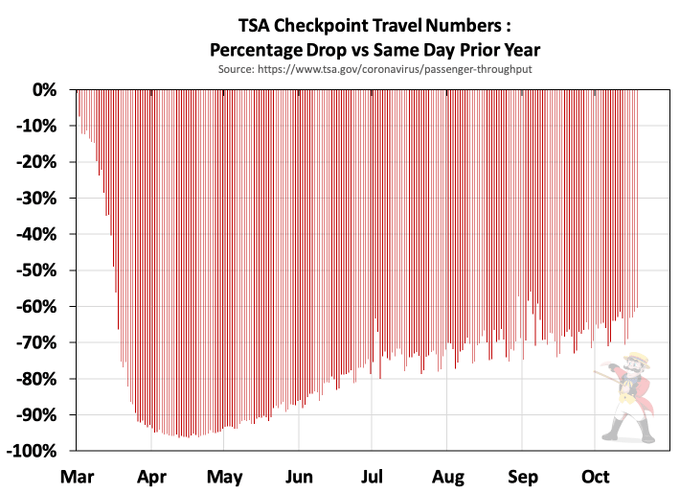

Beyond the issue with the Max, the coronavirus has disrupted air traffic around the globe and also impacted other areas of Boeing's business. However, things have been improving over time, as Sunday marked the first day where the US passenger count topped 1 million since March. As the graphic below shows, year over year declines are improving, even if they aren't coming back as quickly as some had hoped.

(Source: TeslaCharts Twitter, seen here)

Everyone is looking for good news on the coronavirus front. Earlier this week, the CEO of Moderna (MRNA) said that we could see emergency approval for its vaccine candidate in December. Multiple clinical trials are in the advanced stages currently, so, hopefully, we'll get some positive news soon. As a point of reference, holiday travel searches this year were down 43% this summer as compared to 2019. As one associate professor at Adelphia University said, "having a vaccine will be a sign for many travelers that they can travel freely again".

As a result of the items mentioned above, Boeing has seen a major decline in deliveries as well as net orders. The company has slowed down production across a number of lines, but customer deferrals have led inventory to jump by more than $15 billion for the twelve-month period ending in Q2 2020. Between that rise and huge losses, Boeing has burned through billions in cash, requiring a lot of new funding.

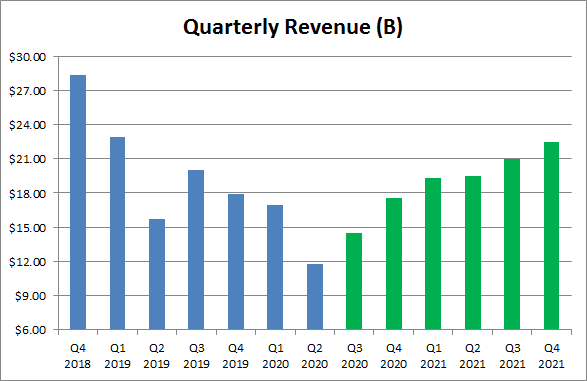

However, it appears that the worst is now behind us. The company is expected to report its Q3 results on October 28th. As the chart below shows, Boeing is expected to report its first sequential revenue increase in a year, with the Q2 2020 figure expected to mark the bottom. By the end of 2021, revenues are forecast to be up more than 90% from their quarterly low, which would put them back near Q1 2019 levels.

(Source: Seeking Alpha Boeing earnings page, seen here)

As the revenue situation starts to turn, so does the rest of the financial picture. The company is expected to return to non-GAAP profitability next quarter, and once meaningful deliveries start, free cash flow will become positive again. This will allow the company to start reducing the large debt pile it has needed to sustain operations, which will help improve the bottom line and cash flow even more. As a point of reference, the latest 10-Q filing showed Q2 2020 interest and debt expense was $815 million compared to $277 million in the year-ago period. Interest costs will likely be even worse in Q3 as all of the debts raised in Q2 see a full quarter of expense.

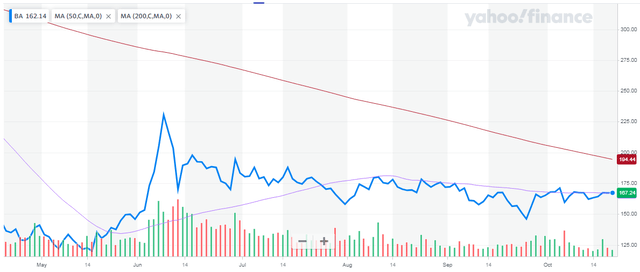

Beyond the financial picture starting to turn, I like where Boeing shares are currently. The stock is more than $22 below the average Street price target, which represents more than 13% upside from here. As the chart below shows, we're also getting closer to the point where the 50-day moving average crosses above its longer term counterpart. This key technical event, known as the golden cross, is considered a bullish event. If Boeing shares do start to rise, a rising 50-day moving average should also form a level of support.

(Source: Yahoo! Finance)

In the end, I think it's time that investors start to look at Boeing again. We've seen some positive news in recent days regarding air travel and the 737 Max, so we're closer to that plane flying again and the coronavirus ending. With the company likely to report next week that Q2 2020 was the revenue bottom, the financial picture should be turning rather soon. This sets up 2021 to be a nice rebound year for the company, and with an improving technical setup for the stock, now looks to be a good time to consider the name.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.