Wells Fargo: Warren Buffett Doesn't Want It - And You Shouldn't, Either

Wells Fargo is bucking trends in the financial sector, where many of the market’s recent earnings results have shown signs of encouragement.

Wells Fargo’s recent reports show critical weaknesses in areas like net interest income and it looks as though the bank might not be well-prepared for the macro-environment of low rates.

Warren Buffett’s Berkshire Hathaway has slashed its stake in the bank, reducing its long-held to position just 3.3% after several rounds of stock sales in 2020.

Based on the balance of the evidence, we think that Warren Buffett is probably right and that it’s time for income investors to sell WFC.

For the most part, earnings results from the financial sector during the third-quarter reporting period have shown signs of encouragement. However, this does not appear to be the case at Wells Fargo (NYSE: WFC) and the bank has made it clear that this low-interest rate environment is weighing on its performance results in net interest income. Unfortunately, this appears to be just another excuse (following a long line of excuses in the past) and we expect the stock to see a sustained downside break of support levels near $22 per share.

Source: NPR.org

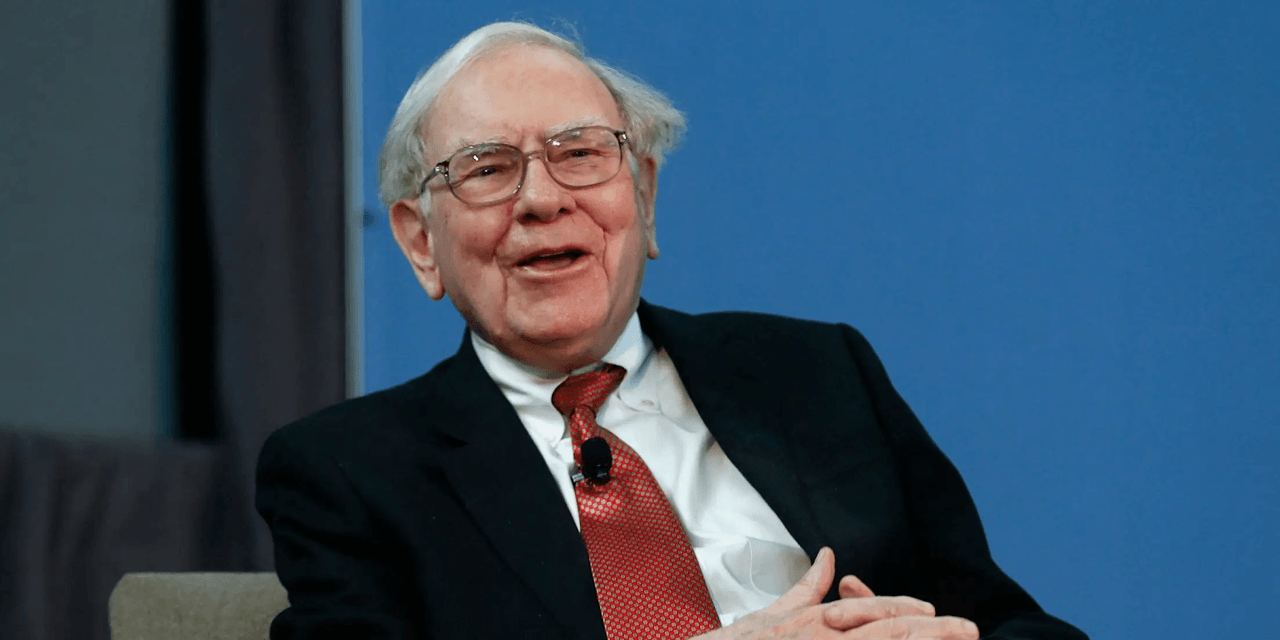

During the bank's most recent reporting period, Wells Fargo generated earnings of $0.42 per share and this failed to meet the market's consensus estimates (at $0.45 per share). Revenues were a bit more encouraging, as the bank beat analyst forecasts of $17.98 billion (with Well Fargo's quarterly results coming in at $18.9 billion):

Source: Wells Fargo

In describing the tumultuous economic trends Wells Fargo faced during the period, CEO Charles Scharf explained:

Our third quarter results reflect the impact of aggressive monetary and fiscal stimulus on the US economy. Strong mortgage banking fees, higher equity markets, and declining sequential charge-offs positively impacted our results, while historically low interest rates reduced our net interest income and our expenses continued to remain elevated. We continue to provide support for our customers having helped more than 3.2 million consumers and small businesses by deferring payments and waiving fees.

Source: Fortune Magazine

On the topic of looking forward into the Wells Fargo's future prospects, Mr. Scharf went on to say:

As we look forward, the trajectory of the economic recovery remains unclear as the negative impact of COVID continues and further fiscal stimulus is uncertain, but we remain strong with our capital and liquidity levels well above regulatory minimums.

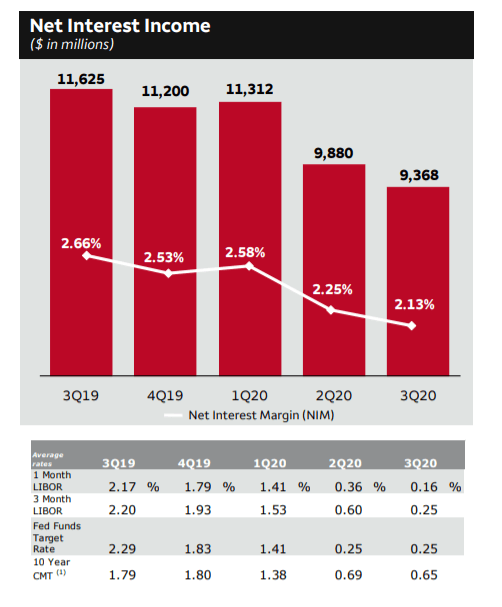

In our view, income investors should be focused on the ways the current macroeconomic climate is likely to impact the bank going forward. Specifically, Wells Fargo's net interest income figure dropped to $9.37 billion, which indicates a decline of -19.4% on an annualized basis:

Source: Wells Fargo

Unfortunately, these are the types of metrics that will need to turn around before shares of Wells Fargo stock can be reconsidered for buy positions. But if investors wish to look beyond the well-understood macroeconomic disruptions that have been encountered as a result of the coronavirus pandemic, we can simply look at Wells Fargo's comments in their own regard.

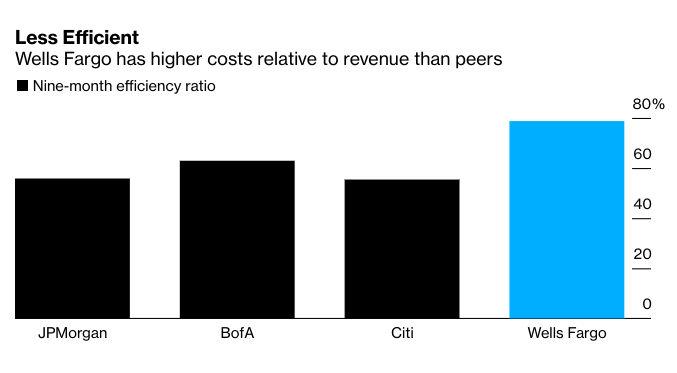

Source: Bloomberg

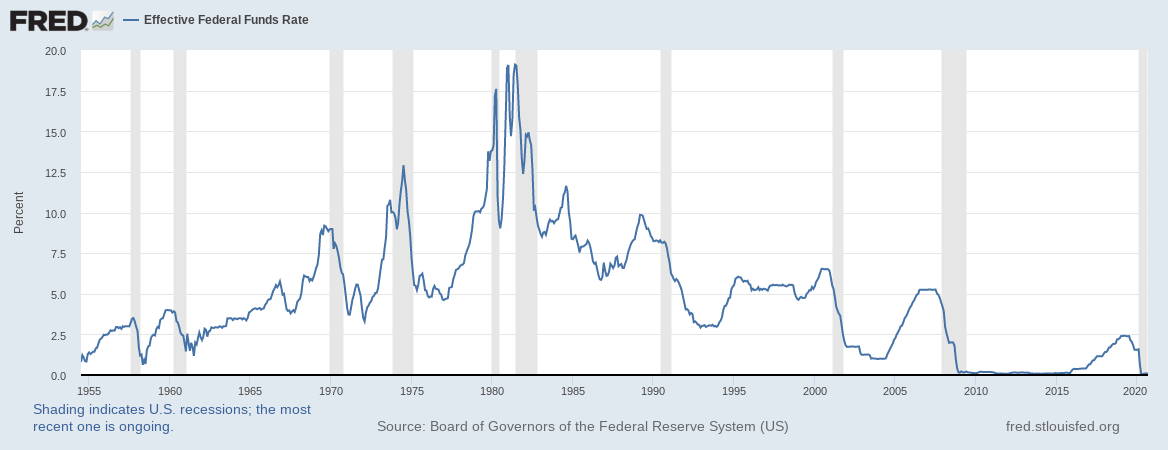

As Mr. Scharf explained in his comments following Wells Fargo's earnings release, bearish trends in the bank's operational performances were negatively influenced by prior decisions by the Federal Reserve to cut interest rates to historic lows as a strategic response to the reduce negative economic effects stemming from the COVID-19 pandemic:

Source: Federal Reserve

Declines of $2.3 billion in Wells Fargo's net interest income figure show that the market environment for interest rates was capable of impacting the bank's quarterly performance by nearly -20%. Essentially, this means that it could be quite some time before bullish WFC investors encounter a meaningful turnaround in the stock's share price activity.

Source: Business Insider

Mostly, these trends help us to understand that bounces remain unlikely for this stock and a downside break through important support levels near $22 per share could accelerate losses quite quickly. Of course, this type of selling pressure could be exacerbated if certain large-name investors decide to exit prior large positions.

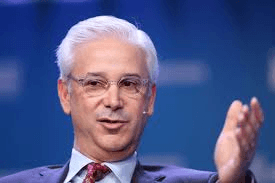

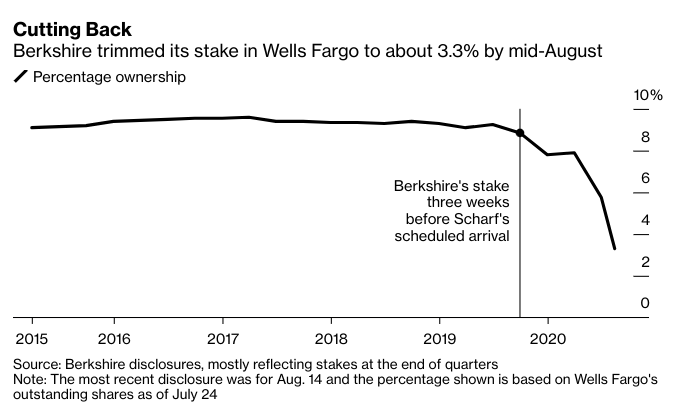

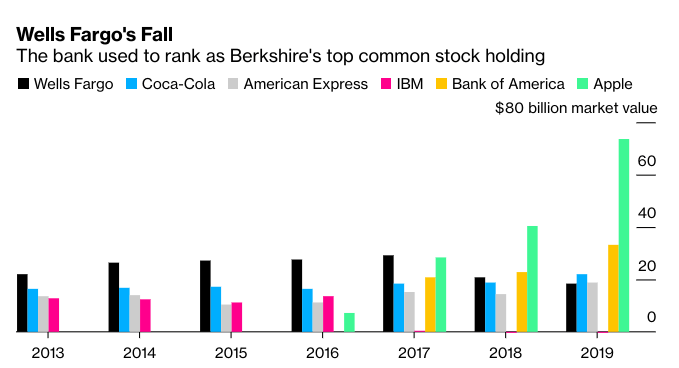

As a case in point, legendary investor Warren Buffett appears to be giving up on his long standing bullish position on the bank. Specifically, Buffett's investment firm Berkshire Hathaway (BRK.A)(BRK.B) has slashed its stake in the bank and we believe this will add to the negative sentiment.

Source: Bloomberg

Since the middle of August, Berkshire Hathaway's stake in the bank has actually been reduced to just 3.3% through several rounds of stock sales in 2020. Unfortunately, it might be difficult to ignore the fact that many of these WFC stock sales were conducted in close time proximity to Scharf's scheduled arrival as CEO of the bank.

Source: Bloomberg

Can this be described as the "end of an era" for the financial industry? If we look at Berkshire Hathaway's historical tendencies, we can see (in the chart above) that this just might be the case because the firm's exposure to the financial sector has changed somewhat dramatically over the last five years.

Source: Macrotrends

Of course, this five-year period would include the aftermath of Wells Fargo's various account scandals. However, the short-term trading picture does not look much better. On a YTD basis, shares of WFC are trading lower by -57.7% and these declines go far beyond what has been experienced in most of the financial sector.

Source: Author via Tradingview

As a comparative example, the KBW NASDAQ Bank Index (BKX) is trading lower by -31.16%. Of course, these performances indicate clear weakness because the S&P 500 is currently trading higher by 7.42% over the same period. All of the momentum is currently focused on the downside and we believe that the stock could be in serious trouble if support levels at $22 are removed in a decisive fashion.

For WFC, the next major low can be found at $7.80 (which is the price low from March 2009) and this is why it's likely that a break of near-term support levels could accelerate losses quite quickly. Ultimately, this tells us that Warren Buffett is probably right and there is very little reason to maintain long positions in this stock. We think it's time to sell WFC.

Thank you for reading. Now, it's time to make your voice heard.

Reader interaction is the most important part of the investment learning process. Comments are highly encouraged! We look forward to reading your viewpoints.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.