SLV is a strong ETF due to its liquidity and lack of exposure to roll yield.

When the VIX pops, silver tends to rally over the next year.

Given that SLV closely tracks silver, buying SLV at this time makes for a good trade.

As you can see in the following chart, the iShares Silver Trust ETF (SLV) has recovered from the lows set earlier this month and at the time of writing are trading higher in the pre-market.

It is my belief that SLV makes for an excellent addition to portfolios at this time. Not only do I view the ETF as one of the better silver investment funds, but also I believe the outright price of silver is going to rally in the coming months.

About SLV

When it comes to investing in silver, no ETF is more eponymous perhaps than the iShares Silver Trust ETF. With $14 billion in AUM holding more than 564 million ounces of the precious commodity, SLV consistently ranks at the top of the silver options available to investors. In my opinion, for pure exposure to silver price changes, SLV is perhaps the best option at this time. The reason why I primarily believe this is based on two things: liquidity and fund structure.

When it comes to investing or trading a commodity ETP, it is important to ensure that you have liquidity to enter and exit positions. It may seem slight, but even a single penny added to the bid-ask spread can result in impacts to performance through time.

To understand this concept, here’s a screenshot of the current bid-ask spread through my TD Ameritrade platform:

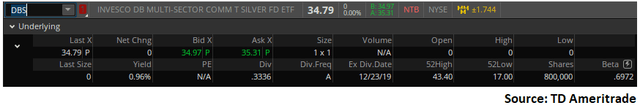

What this essentially shows is that if you needed to trade SLV and trade it in size, you could do so without moving the market to much of a degree at all. Compare this to the DBS ETF which is somewhat of a rival fund to SLV:

In the case of DBS, liquidity simply isn’t there, which means that if you wanted to transact the ETF and do so in size, then you would substantially move the market and lose value in the process.

The point here is this: if you are going to actively trade or trade silver in size, SLV really is the king ETF at this point in the evolution of metals ETPs. For this reason, I suggest that investors looking to trade silver on an outright basis do so through SLV. As an interesting aside, despite the fact that SLV commands the most market cap and there are very few viable alternatives for active investors, the ETF still only has an expense ratio of 0.5% which is quite low in my book.

All this said, there’s another important reason to trade SLV versus other funds and that is roll yield. Roll yield is the return you make or lose when you’re holding futures contracts and they converge towards the spot price. In the case of silver, at present the math basically works out to be losses for traders of silver futures to the tune of a little over 2% per year.

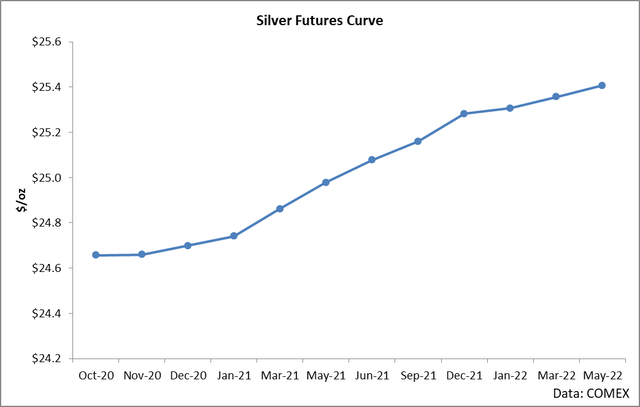

To understand this concept, here’s the current silver futures curve.

If you look closely at the chart and do the math, you’ll notice a very interesting trend: on average, each data point is equal to the spot price of silver compounded at an annualized rate of a little over 2% per year.

This 2% annualized figure essentially represents the difference between the cost of borrowing and any applicable fees for storage of silver. If any one of these prices steps out of line with this current figure, then arbitragers could borrow money and buy the physical commodity while entering into a futures contract to deliver at a later date. This process will result in profit and is what keeps the prices of silver along the futures curve in a fairly predictable pattern (as long as interest rates remain the same, that is).

This is important to understand for silver traders because this is a benefit to holding SLV. Since SLV is a physical commodity play, it isn’t exposed to this roll yield issue which futures traders experience. It may seem like a small amount, but that’s partly a product of the low interest rate environment we are in now – if interest rates rise, then roll yield will rise as well for futures traders.

All this said, I believe that holding SLV at this time is a sound play not only for its methodology and liquidity, but also because I believe that silver is poised to rally strongly in the coming year.

Silver Markets

To help me understand where silver is likely to travel, I have created a number of studies and backtest methodologies. I’ve delved into several different correlations and price drivers and I believe that the data is strongly suggestive of higher prices of silver over the next year.

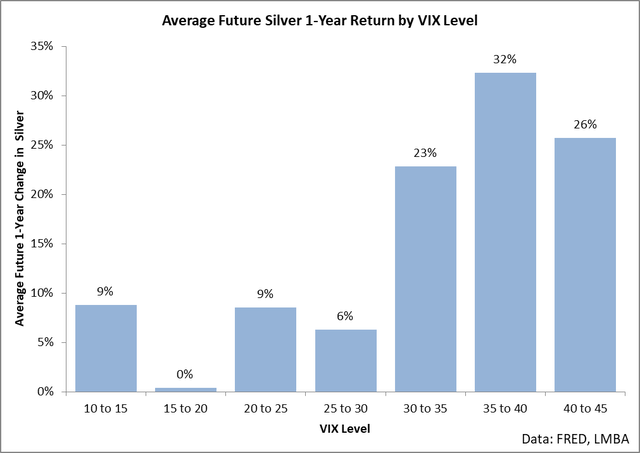

One primary study is that between the VIX and future prices of silver.

The relationship above is fairly consistent: when the VIX rallies, it tends to lead to strong rallies in the price of silver. If you’re unfamiliar with the VIX, it is in essence the market’s “fear gauge.” It is calculated through prices on options on the S&P 500 – since investors tend to buy options during market downturns, this leads to the VIX popping when the market is dropping. The tie-in to silver here is that when investors are fearful, they seek yield in alternative assets, thus propping up the price of silver.

At present, the VIX is only sitting around 29, which actually isn’t that strong of a signal on the above chart. However, in September we witnessed the VIX trade up to around 38 which means that we’re currently sitting in the immediate wake of a strong signal generated. The data would suggest that on average we can expect silver to rally by 32% over the next year (from September levels). Given that silver is actually somewhat lower from this initial signal, this could be considered a buying opportunity in a trend which is yet to unfold.

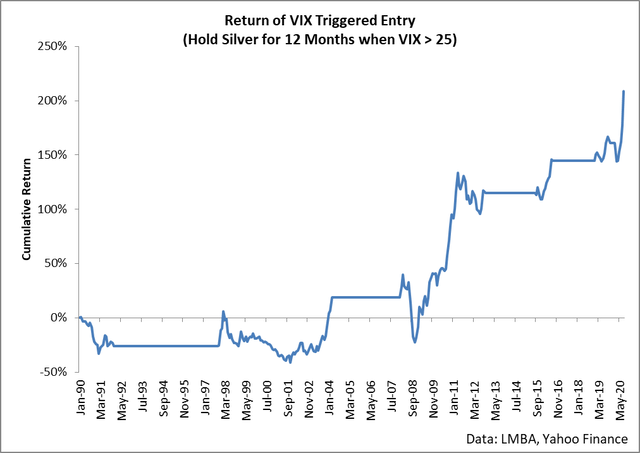

This said, however, we can look at the data in another format: as a standalone investing signal. Here’s a simple strategy: every time the VIX hits 25, buy and hold silver for the next year.

At present, this signal is triggered which would mean that this would say to buy and hold silver for one year. It is hard to see the performance of this strategy from a chart, but here’s a comparison:

- In my data, the buy and hold average monthly return of silver is 0.72% with a standard deviation of 8.19%.

- This strategy increases the average monthly return to 1.84% while reducing the monthly standard deviation of returns to 6.03%.

In other words, if you buy and hold silver for the next year based on the above VIX signal, you are substantially increasing the average monthly return as compared to buy and hold while reducing the variability of monthly returns. In risk-adjusted terms, this strategy is much stronger than the buy-and-hold approach.

To trade this strategy using SLV, all you would need to do would be to purchase the ETF and hold for 1 year. After the year, you would then look at the current VIX level: if it’s above 25, hold SLV for another year. You could potentially enhance the strategy through active trading and other studies; but as it stands, there is a clear tendency and correlation between rising market fear and future gains in silver. Since SLV is exposed to the commodity with good liquidity and is not subject to roll yield, this means that returns will closely track the results of the above test (net the small 0.5% expense ratio of course). I believe that now is a strong time to buy SLV.

Conclusion

SLV is a strong ETF due to its liquidity and lack of exposure to roll yield. When the VIX pops, silver tends to rally over the next year. Given that SLV closely tracks silver, buying SLV at this time makes for a good trade.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.